Know Your Industry — and Company

On the operational side, some expenses traditionally viewed as fixed costs may have more variation than you realize based on site location. For instance, utility costs vary significantly across the nation. The best rates can be negotiated directly with utility providers based on customer consumption, i.e., the more you consume, the better long-term rates you can negotiate.

Another big variable on the expense side of the ledger is labor. While skilled labor availability and wages vary greatly across the nation and the world, having access to a skilled and ready workforce at affordable wages is a key driver for success.

Even more important than understanding operational costs of a new project is understanding what the project needs to deliver within the competitive context of the industry. Perhaps the new project intends to replace an existing facility that has become too small or has technologically outdated equipment. Maybe regional demographics have changed, and you need to relocate an existing facility in order to tap into a less expensive, younger, or more skilled workforce. All of these factors represent what you need to accomplish with your site search in order to be more competitive or perhaps just stay alive in the industry.

Even more important than understanding operational costs of a new project is understanding what the project needs to deliver within the competitive context of the industry. Finally, understanding the market trends and how they can influence the success of your new facility is vital. Are you are competing in a declining market? (Can you imagine having the newest and best buggy-axle factory around the time when the automobile was invented?) If the market is declining, can you expect the new facility to maintain profitability or even be relevant? If not, perhaps just re-tooling your existing facility will bring a greater ROI. Is the market growing and expansion of capacity required to keep up with demand? How much extra capacity can the market absorb? Are your competitors planning facilities as well? Will the company over build the demand?

All these factors will play a tremendous part in guiding your site selection decision. Prime development-ready sites that are suitable candidates for an array of industries are everywhere, and EDOs spend vast amounts of time, money, and energy promoting the sites in their region. You must look beyond the site itself. Match your project needs to the site that can minimize costs and maximize results by leveraging company needs to what the site/region has to offer. Spending the time to identify and manage key project variables will unlock the hidden potential of the best site, which is essential in executing a winning site selection game plan.

Focus on Key Success Variables

Now that you have completed an exhaustive internal assessment of the company and project, key success themes have likely solidified through the course of the exercise. Identifying, defining, and measuring these key variables will point to site attributes that can maximize results.

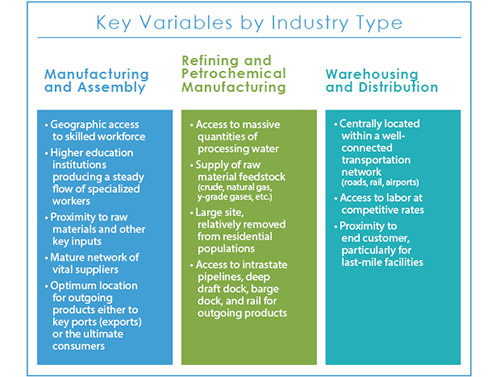

The cost of bringing in the right SMEs can pay dividends in returns over the lifespan of a successfully located project. Key success variables are not the same for any given project. It would be foolish to think that any site, even if certified and promoted heavily by an EDO, will be suitable for your project. Success lies in understanding which regions and sites match best with your immediate project needs and align with long-term company objectives. Key variables that ultimately make or break a project are sometimes not glaringly obvious and vary widely by industry and project type. Some of the key variables by industry type are listed in the accompanying chart.

Bring in the Right Subject Matter Experts

No one person or even firm is likely an expert on every topic you define as a key variable. Bringing in the best subject matter expert (SME) in each key area will ensure you find the best site. Some companies are reluctant to do this as they view it as inflating the cost of what they deem is a trivial exercise. While it may cost more in the short term to bring in experts from outside your company or particular department, the cost of bringing in the right SMEs can pay dividends in returns over the lifespan of a successfully located project. Adding a few key skill players on your site selection team will position your project for success. Some key skill players who can help to execute your site selection game plan may include:

- Workforce and training consultant — A good workforce consultant can analyze the supply of required workers and long-term regional trends to ensure the talent pool can meet the project’s current and future demand. Workforce consultants can also collaborate with local higher education institutions to design and align workforce training programs to meet the specific needs of the project workforce.

- Refining and petrochemical engineer — An in-depth knowledge of engineering is key for refining/petrochemical projects. Typically, siting these types of projects boils down to a handful of sites that have key features, such as massive amount of process water, bodies of water able to assimilate industrial process wastewater, and access to abundant, competitively priced feedstock.

- Logistics expert — Logistics usually plays a big role in siting a successful warehousing and distribution project. Logistics costs generally drive these projects to low-cost areas. Incentives can also play a significant role in siting a warehouse or distribution center. Typically, communities with existing infrastructure, or communities that can offer incentives to offset required infrastructure, are successful in attracting these project types.

Now that your team is in place, use them to your maximum advantage. The site selection SME team should begin their search wide, not to miss any potential site. The list of sites can be continually narrowed by aligning key project criteria to each site and eliminating sites that do not match. This iterative process should produce a handful of finalist sites where a more quantitative analysis can take place.

Weight Rating Criteria

Finalist sites should all be able to realistically host the project, but the difference in sites will be the cost to develop and operate. At this stage of the process, developing a detailed proforma for each site can shine a light on each site’s advantages and disadvantages. More importantly, site attributes that will maximize project success typically become obvious.

Developing a detailed proforma for each site can shine a light on each site’s advantages and disadvantages. During this stage, the slightest details are sometimes overlooked on sites. Applying a weighting factor can help amplify the key variables. For example, a weighting factor of 10 on a key variable such as feedstock supply versus a weighting factor for a financial incentive can help identify the best petrochemical site, as the availability and cost of a key feedstock is a primary driver for petrochemical manufacturing. Sometimes the cost of the feedstock over the life of the facility (typically 40 years) can swing by billions of dollars! No incentive offered by an EDO can ever make up that difference. Your SME team should build this type of quantitative analysis into you game plan to quickly eliminate sites and regions that are not a good fit.

Be Wary of Incentives Hiding Fundamental Site Weaknesses

Executing a well-designed site selection game plan should result in a handful of sites for final analysis. In order to avoid misrepresenting the true long-term competitiveness of each finalist site, incentives should not be factored in at this point. Sometimes incentives sunset after 10 or 15 years and can be misleading when considering the long-term competitiveness of the site. After one or two sites emerge as the clear leaders, incentives may be applied to demonstrate with which site to begin negotiations in earnest. Tailoring the incentives to mitigate site weaknesses or shift infrastructure cost off of the project’s balance sheet are ways to make a finalist site the winning site.

The most successful site searches result in a site with the best physical attributes for the project and a community that understands and rises to the challenges to mitigate the site’s weaknesses. Now that you have found your company’s project site, we will explore delivering the project on the site in a subsequent article.