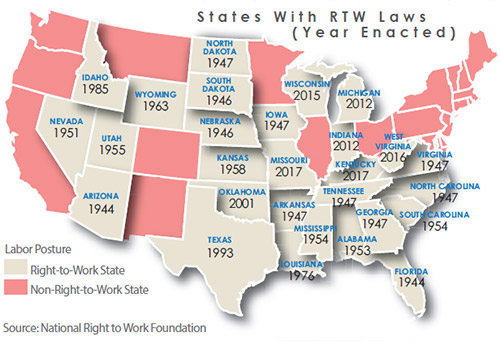

Right-to-work legislation establishes that employees do not have to join a union even if one is voted in by the facility workforce. This creates a difficult environment for unions to establish effective union organizations in such states. Many arguments have been presented on both sides of the issue over the years. Proponents of RTW cite the lack of freedom of choice of employees who may be forced to financially support a union that they did not seek to represent them. Those against RTW note that the net effect of RTW legislation is to create a block of “free riders” — employees who benefit from the collective bargaining of the union but who do not contribute to the union.

The surge of traditionally “rust belt” manufacturing states adopting RTW legislation has sent shock waves through the economic development world. This has many reasons behind it including the general decline in manufacturing employment, the trauma of major contractions in heavy industries that were partly blamed — rightly or wrongly — on union-related costs, and a generational move to a more conservative political environment and electorate.

Through the addition of Oklahoma in 2001, RTW states were generally politically conservative and not characterized by high union presence. As a result, RTW status was often used as a proxy for labor-management climate. It was not unusual for companies considering locations for new facilities to only consider RTW states. Even before the addition of new states in the past five years, this was always a very blunt instrument, eliminating entire states when the union risk varied greatly from one part of the state to another (e.g., eastern vs. western Michigan). As a result, our firm has typically discussed with clients an alternative approach whereby state RTW status is not a requirement for location consideration, but rather a weighted and scored business climate factor. This enables the client to maintain a broader search region that will meet its labor-management preferences, while accounting for both statewide union legal climate and local union presence and activity.

RTW in the Location Decision

So what does this mean for location decisions for expanding companies? First reaction is that RTW status is favorable for a state’s business climate and favorable for companies who prefer to operate in a nonunion environment. States with RTW legislation will see an increase in location projects from companies that are at least willing to consider their state for investment.

Companies seek the flexibility a nonunion workforce provides, and the cost of nonunion labor is generally less than union labor. However, companies should be more wary than ever about the use of RTW status as a location requirement.

As noted earlier, while there was a point when RTW status was strongly correlated to a low union risk environment on a statewide basis, this is no longer the case. Union risk can no longer be addressed solely by seeking out RTW states. Deeper dives into regional and local information are required more than ever. Such information would include union presence, union activity, and union election results. And it will be important to gauge what the union avoidance cost would be in a union-heavy area in a RTW state.

To further illustrate the complexity of using RTW solely as a measure of union activity, we examined election activity in the state of Michigan. Over the last 10 years, private-sector union election activity hasn’t changed much in Michigan, and there is no obvious reduction in the number of elections after 2013, which is when the RTW change was made. Election wins, as a percentage of elections, actually peaked in 2014, the first full year of RTW. This may reflect activities that were under way prior to the passage of RTW legislation, as well as a possible surge in union efforts and emotion in reaction to the passage.

Finally, part of this brave new world that is not well understood is the implication for the individual company in a RTW state that, in fact, has a union succeed in getting elected to represent the workforce. The “free-rider” argument would predict that many workers would vote for a union but then will not join and commit to paying dues. How divided will the workforce on the floor become with dues-paying members alongside non-dues-paying members, both of whom will be reaping the benefits of the union’s collective bargaining efforts? How severely will this impact cohesiveness and cooperation and teamwork? Such self-directed, team-organized work environments are the norm now and desired by most companies. Having a divided workforce would work directly against that operational goal.

In conclusion, companies will find a much broader potential search region when considering RTW states today, but RTW is no longer an effective proxy for union risk statewide. Understanding local conditions and trends will be critical in gaining a full understanding of labor-management relations in a particular location. And companies should be aware and plan for the implications of having union representation for a workforce with only a percentage of employees joining the union.