Bruce Rutherford, JLL's Global Energy Practice Lead, discusses the positive ripple effects of the $80 billion oil and gas industry's explosive infusion into the U.S. economy.

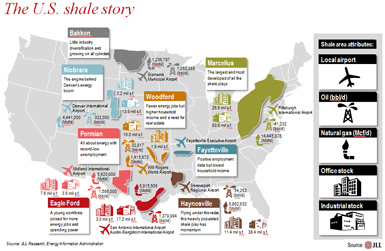

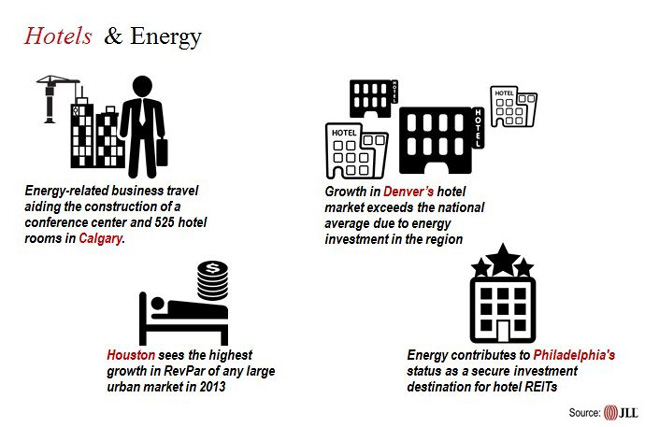

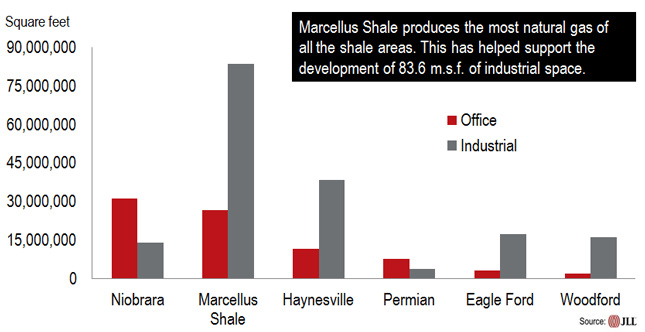

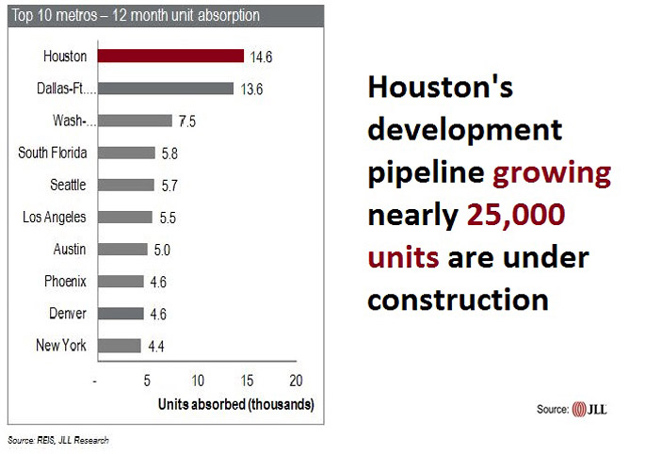

Today's thriving domestic energy industry is stimulating local economies across the map, from major cities like Denver and Houston, to small towns at the epicenter of shale plays like Williston, North Dakota.

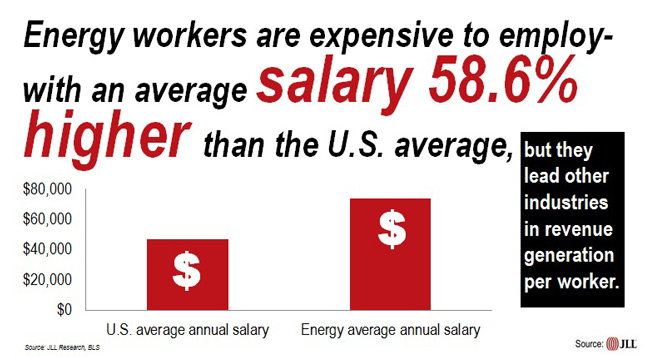

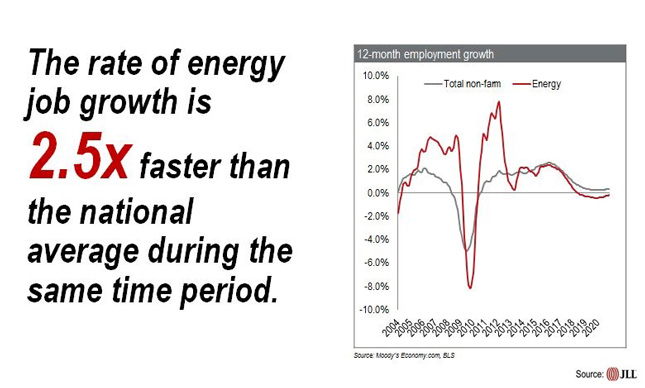

Furthermore, as shale production grows, it is adding 2-2.5 percent to the U.S. economic growth rate, adding jobs that generally pay double what other industries pay, and thus is creating a positive ripple effect through the entire economy, according to Bruce Rutherford, JLL's Global Energy Practice Lead.

Access to a bountiful supply of natural gas is providing U.S. manufacturers with a way to compete with their global counterparts. In fact, analysts say the U.S. has recently emerged as one of the lowest cost producers in the world, second only to China—and catching up quickly. The resulting "Manufacturing Renaissance" is expected to sustain for decades.

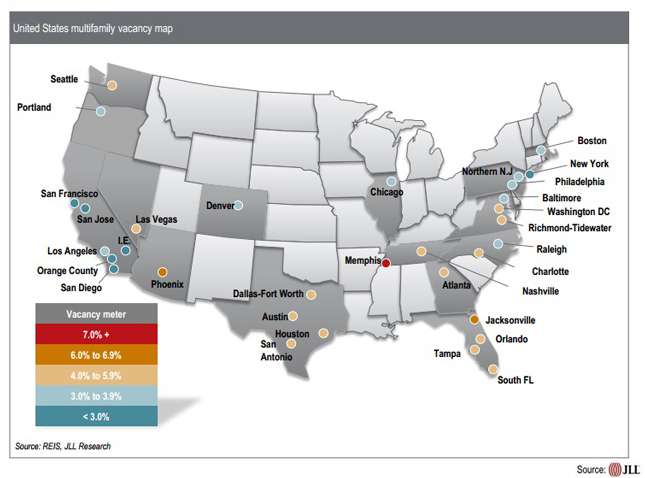

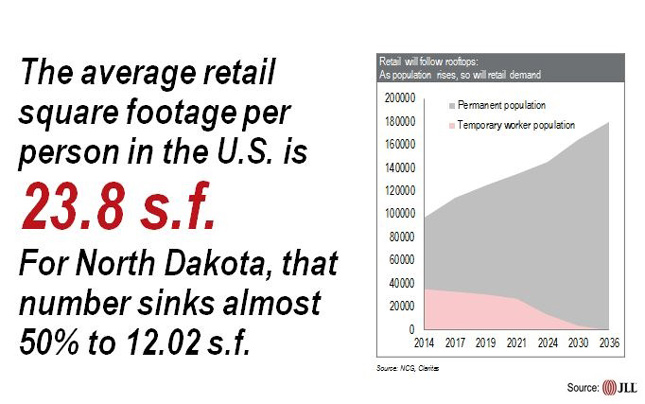

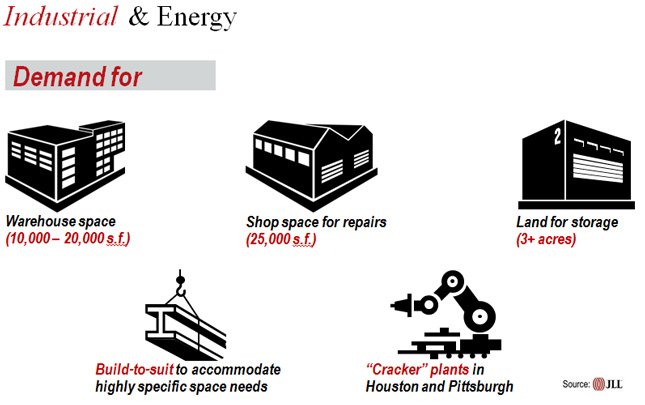

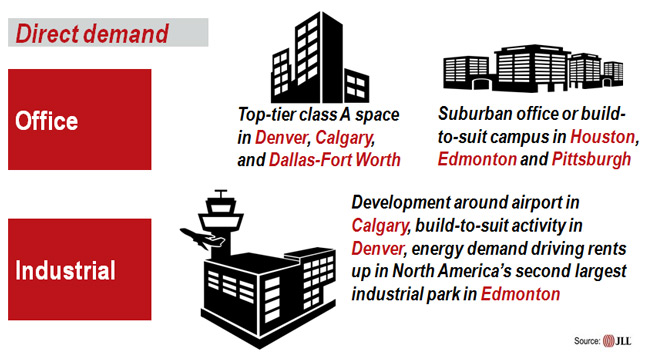

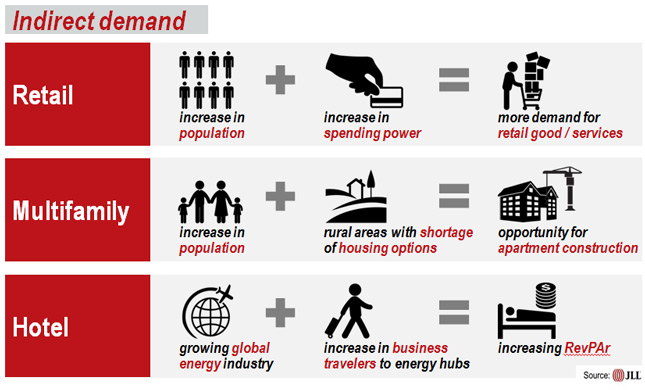

For real estate investors and developers, the opportunities are starting to be revealed as the industry matures. From creating residential opportunities that replace makeshift "man camps," to office and industrial development for the many diverse activities of this thriving industry—and for the communities that support them. In fact, small towns and major cities near shale plays are benefiting from roughly $80 billion in annual infrastructure investments as they evolve to accommodate more permanent living communities, where workers – and their families -- can live, play and work. For example: Fast economic growth coupled with supersonic population growth has sparked significant development activity in small towns like Williston, ND, with infrastructure construction underway on everything from roads to parks, and real estate development suddenly booming across residential, office, industrial, hotel, and retail sectors alike. Already this attention from private sector investment is paying off, as property values soar, and vacancies have emerged as the only ghosts around.