Case in point: Warner Music Group recently announced that it will expand in Nashville over the next two years, bringing 175 additional jobs as the company moves its finance team into town. The music industry supports 56,000 jobs in the Nashville area.

Southern Region Demographics and Industries

-

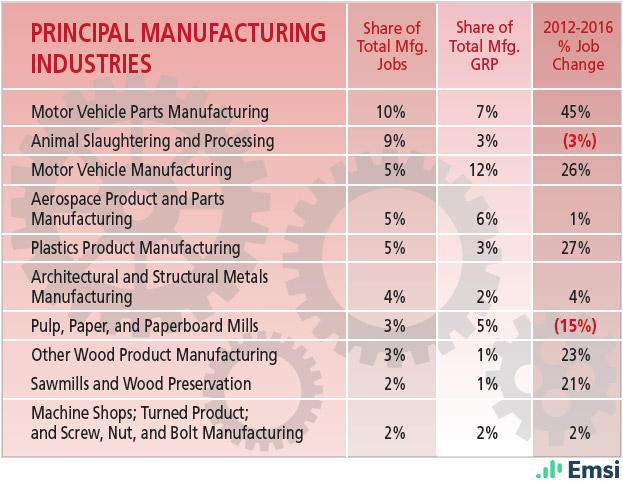

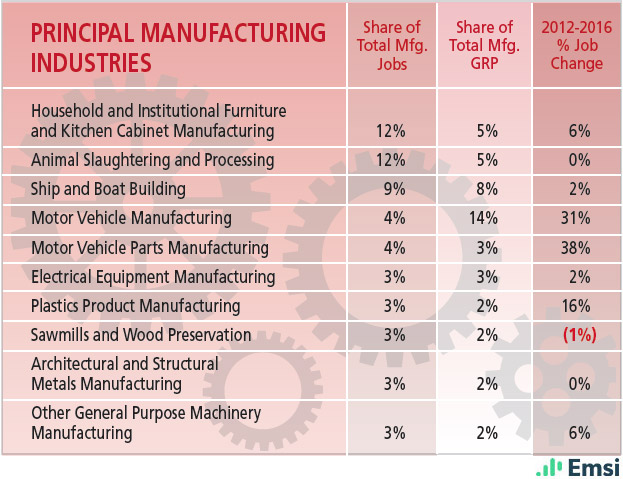

Alabama: Principal Manufacturing Industries

-

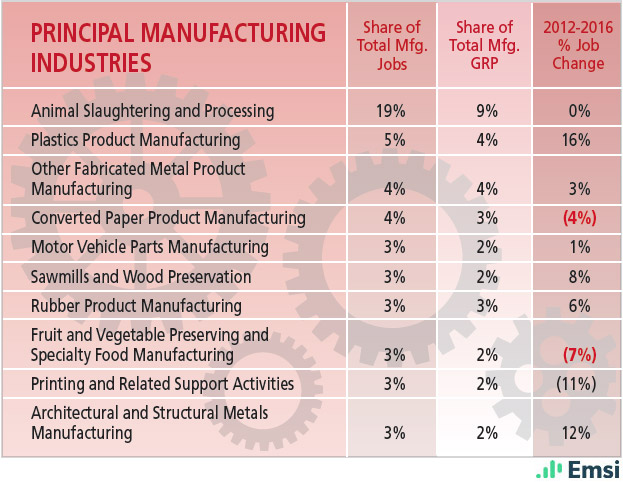

Arkansas: Principal Manufacturing Industries

-

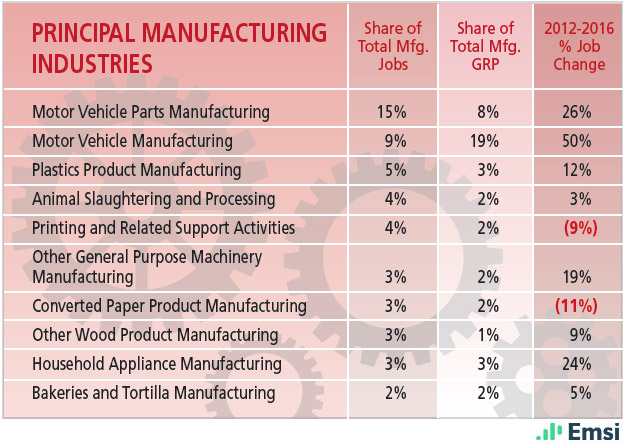

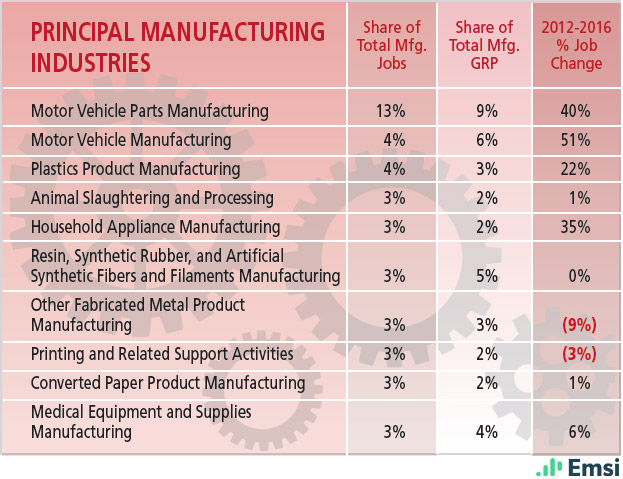

Kentucky: Principal Manufacturing Industries

-

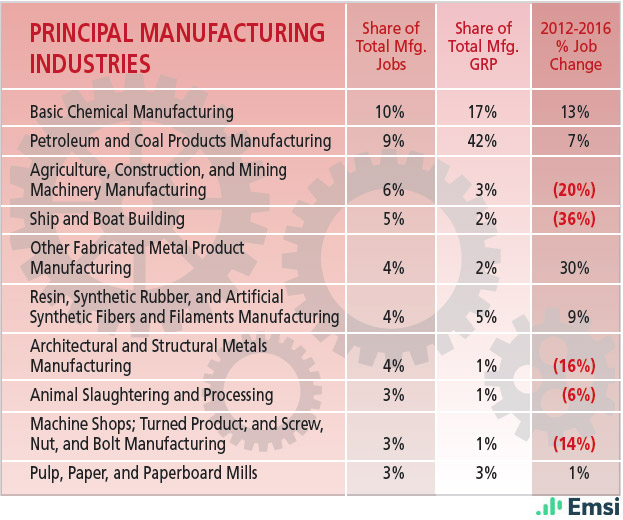

Louisiana: Principal Manufacturing Industries

-

Mississippi: Principal Manufacturing Industries

-

Tennessee: Principal Manufacturing Industries

-

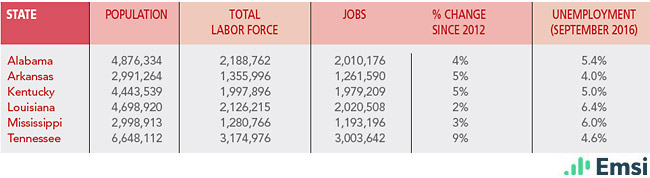

Southern Region: Demographics

-

Southern Region: Top Industry Clusters

For the rest of Tennessee and the other states of the South, the key for future economic growth is whether they collectively can replicate what’s happening in Nashville as well as in some other parts of the region and maintain or expand what has been a healthy share of the national increase in corporate locations and jobs.

The region’s inherent advantages include a vast and still-growing manufacturing base that rivals that of the Midwest in important and basic industries, including automotive and aerospace; a rising tide of employment in services and other professional pursuits; an expanding presence in the digital economy; more state-level policies to encourage business investment; and effective exploitation of the region’s inherent advantages of a temperate climate and geographic attributes. What’s more, with the exception of Kentucky, all of the region’s states are right-to-work.

Still, major states in the region have been hit hard over the last couple of years by tectonic shifts in America’s energy economy. The collapse in oil and gas prices has knocked Louisiana’s crucial petrochemical business for a loop, and the continuing decline in demand for Appalachian coal has become a huge drag on Kentucky’s progress. The Southern States overall still face some stiff obstacles in the years ahead as they continue to fill out their portfolios as complete economic engines.

“This area will face continued challenges in manufacturing and also economic diversity as time moves forward,” says Larry Gigerich, managing director at Ginovus, an Indianapolis-based economic development consultancy. “Not only will lower-skilled manufacturing jobs be at risk, but a large component of this region doesn’t have economic strength outside a few sectors. The lack of economic diversity creates more ups and downs as the economy shifts,” he notes. “So this region will be required to increase the skill levels of their residents, build economic development capacity in rural areas, and leverage assets to help diversify their economies.”

In fact, says King White, president of Site Selection Group in Dallas, while the South is “a desirable region” for call centers and data centers and similar types of facilities, “it is important to carefully evaluate site opportunities there at the county level. Labor conditions vary depending on what type of labor a company is needing.” For instance, White explains, Alabama, Mississippi, and Louisiana continue to win projects, but mostly manufacturing-related.

Manufacturing Success Stories

Manufacturing growth in those states and others in the region continues to rank as one of its biggest and most important success stories. Alabama, for instance, keeps adding to its status as America’s aerospace-manufacturing headquarters. American Airlines took delivery in May of its first Alabama-made A321 passenger jet from the Airbus factory in Mobile, a $600 million plant that now has around 350 employees and is expected to support 1,000 jobs once production reaches full tilt: delivery of four aircraft a month from the plant by the end of 2017.

Meanwhile, Boeing continues to deliver huge economic benefits to Alabama from its 2,750 employees in the state, with an overall economic impact on the economy of $2.3 billion a year, according to a new analysis by the University of Alabama. And the University of Alabama and Auburn University are partnering with NASA on future technologies that could aid space exploration, at the agency’s Marshall Space Flight Center in Huntsville.

Other states are getting in on the aerospace action as well. In Kentucky, for example, Meggitt Aircraft Braking Systems dedicated a $9 million expansion of its manufacturing and distribution campus in Danville in October, providing 66 additional jobs to the existing employment base of 185 people. And Raytheon plans to build its new proposed jet trainer for the U.S. Air Force in Meridian, Miss., where the company already builds array radars.

Tennessee’s huge network of technology-intensive auto plants — including major assembly complexes for Nissan and Volkswagen — helps ensure the steady creation of desirable jobs. In fact, Tennessee topped all states since 2013 with 4.6 percent annual growth in high-skilled jobs, according to a recent report by the Brookings Institution.

Another major boon for the state has been the investment of more than $2 billion over the last six years by food and beverage companies, creating more than 6,500 jobs. And Leclerc Foods recently announced that it would add to the total by establishing its U.S. headquarters in Kingsport, as well as additional capacity to manufacture its cookie and other snack products.

In Arkansas, Chinese manufacturers have begun creating a stream of new investments. Suzhou Tianyuan Garments agreed to create 400 jobs and invest $20 million in an operation in Little Rock; the company makes casual and sports wear for Adidas, Reebok, and Armani. Also, Sun Paper plans to invest $1 billion in a new bio-products paper plant in Arkadelphia, creating 2,150 jobs.

Across verticals, manufacturing locations and expansions keep popping up across the region. Georgia-Pacific completed a $40 million expansion at its lumber operations in Gurdon, Ark., adding 60 percent to capacity. And Nucor announced a $230 million investment and the addition of 100 jobs at its cold mill steel complex in Arkansas to help supply the growing appetite by U.S. auto manufacturers for high-strength and high-strength/low-alloy steels.

MACA Plastics, which supplies components to the medical and auto industries, plans to locate a 156-job plant in Maysville, Ky., with an $8 million investment. The company is based in Winchester, Ohio. And auto supplier Yokohama Industries America plans to invest $5 million and hire 134 employees for new equipment at its plant in Versailles, Ky. Germany’s Feuer Powertrain opened its first U.S. factory, in Jackson, Miss., as well as its U.S. headquarters, with 350 jobs and a 156,000-square-foot manufacturing facility. Continental Tire broke ground on a new manufacturing plant near Clinton, representing a $1.45 billion investment that is expected to create 2,500 jobs.

And in Alabama, new projects include a $200 million planned outlay by German chemical manufacturer BASF to expand its plastics-additives business in McIntosh, as well as the opening of a new Polaris Industries factory in Huntsville to produce Ranger off-road vehicles and Slingshot three-wheeled roadsters beginning in 2017 — a $140 million investment that now has around 500 workers and is expected to reach 1,700 employees or more.

Southern States Recent Industry Announcements

Companies that have announced new and/or expanded facilities in the Southern region.

-

Warner Music Group

Nashville, TNWarner Music Group recently announced that it will expand in Nashville over the next two years, bringing 175 additional jobs as the company moves its finance team into town.

-

Airbus

Mobile, ALAmerican Airlines took delivery in May of its first Alabama-made A321 passenger jet from the Airbus factory in Mobile, a $600 million plant that now has around 350 employees and is expected to support 1,000 jobs once production reaches full tilt by end of 2017.

-

Boeing

Huntsville, ALBoeing continues to deliver huge economic benefits to Alabama from its 2,750 employees in the state, with an overall economic impact on the economy of $2.3 billion a year.

-

Meggitt Aircraft Braking Systems

Danville, KYMeggitt Aircraft Braking Systems dedicated a $9 million expansion of its manufacturing and distribution campus in Danville in October, providing 66 additional jobs to the existing employment base of 185 people.

-

Raytheon

Forest, MSRaytheon plans to build its new proposed jet trainer for the U.S. Air Force in Meridian, Miss., where the company already builds array radars.

-

Nissan and Volkswagen

TNTennessee’s huge network of technology-intensive auto plants — including major assembly complexes for Nissan and Volkswagen — helps ensure the steady creation of desirable jobs.

-

Leclerc Foods

Kingsport, TNLeclerc Foods recently announced that it would establish its U.S. headquarters in Kingsport, as well as additional capacity to manufacture its cookie and other snack products.

-

Suzhou Tianyuan Garments

Little Rock, ARSuzhou Tianyuan Garments agreed to create 400 jobs and invest $20 million in an operation in Little Rock; the company makes casual and sports wear for Adidas, Reebok, and Armani.

-

Sun Paper

Arkadelphia, ARSun Paper plans to invest $1 billion in a new bio-products paper plant in Arkadelphia, creating 2,150 jobs.

-

Georgia-Pacific

Gurdon, ARGeorgia-Pacific completed a $40 million expansion at its lumber operations in Gurdon, Ark., adding 60 percent to capacity.

-

Nucor

Blytheville, ARNucor announced a $230 million investment and the addition of 100 jobs at its cold mill steel complex in Arkansas to help supply the growing appetite by U.S. auto manufacturers for high-strength and high-strength/low-alloy steels.

-

MACA Plastics

Maysville, KYMACA Plastics, which supplies components to the medical and auto industries, plans to locate a 156-job plant in Maysville, Ky., with an $8 million investment. The company is based in Winchester, Ohio.

-

Yokohama Industries America

Versailles, KYAuto supplier Yokohama Industries America plans to invest $5 million and hire 134 employees for new equipment at its plant in Versailles, Ky.

-

Feuer Powertrain

Jackson, MSGermany’s Feuer Powertrain opened its first U.S. factory, in Jackson, Miss., as well as its U.S. headquarters, with 350 jobs and a 156,000-square-foot manufacturing facility.

-

BASF

McIntosh, ALNew projects in Alabama include a $200 million planned outlay by German chemical manufacturer BASF to expand its plastics-additives business in McIntosh.

-

Polaris Industries

Huntsville, ALA new Polaris Industries factory in Huntsville will produce Ranger off-road vehicles and Slingshot three-wheeled roadsters beginning in 2017 — a $140 million investment that now has around 500 workers and is expected to reach 1,700 employees or more.

-

General Informatics

Baton Rouge, LAGeneral Informatics recently broke ground on a $20 million investment in a technology park in Baton Rouge.

The South is also attractive for call centers because of reasonable labor rates and the availability of American-English speakers. In Owensboro, Ky., for instance, Alorica announced that it would establish an 830-job customer-engagement center.

Digital-tech locations obviously are among the most coveted. And fortunately, the nature of digital technology is to allow programming, cloud-building, running server farms, and many other functions to occur anywhere in the country or the world, not just in legacy enclaves such as Silicon Valley and Austin, Texas. So the South is striving to get its share of that work, most of it clustered in a handful of cities with high populations of tech-savvy millennials. The benefits of information-technology development, of course, include the fact that it spans across many industry sectors, and the jobs typically pay above-average wages.

Louisiana has made a huge play for digital-era IT and electronic-media jobs for the last several years. For instance, General Informatics’ recently broke ground on a $20 million investment in a technology park in Baton Rouge. And, in Alabama, a program called the Innovate Birmingham Regional Workforce Partnership is deploying $6 million in federal funding to train young adults for 925 high-paying, technology-focused jobs. Also, the Mobile Chamber of Commerce has launched a new downtown incubator for tech outfits and a business-pitch competition.

Pro-business Initiatives

Alabama recently created a new system called Alabama Works that will seamlessly link employers looking for skilled workers with residents seeking job training. Also, the Alabama Renewal Act, which came into law in April, has created a “port credit” meant to stimulate cargo traffic at Alabama facilities such as the Port of Mobile, and at airports that handle cargo. The 4,000-acre Mobile seaport is one of the nation’s busiest.

And in a move that is clear to please CEOs who have produced a chorus of complaints about over-regulation at the federal and state levels, Kentucky Gov. Matt Bevin announced the first of what he expects to be many moves to cut administrative regulations since the launch of his Red Tape Reduction initiative. More than 500 of the state’s 4,700 such regulations had been reviewed as of October, resulting in the repeal of 30 of them and the targeting of another 129 for repeal. Another 52 regs were amended and 271 targeted for amendment.

The reduction in state tax revenues from lower natural-gas prices has crimped spending on financial incentives by the state of Louisiana under Gov. Edwards, Gigerich says, after Gov. Jindal had lowered tax rates and amped up economic development outlays. But Louisiana remains at the front of the pack nationwide with its workforce-training program. LED FastStart uses a nimble, collaborative approach that stretches from high-school classrooms to community colleges to research universities to employers themselves to recruit, screen, and train workers. The program has trained 24,000 people at more than 150 employers since 2008 and has heavily influenced companies’ decisions to site or expand in the state.