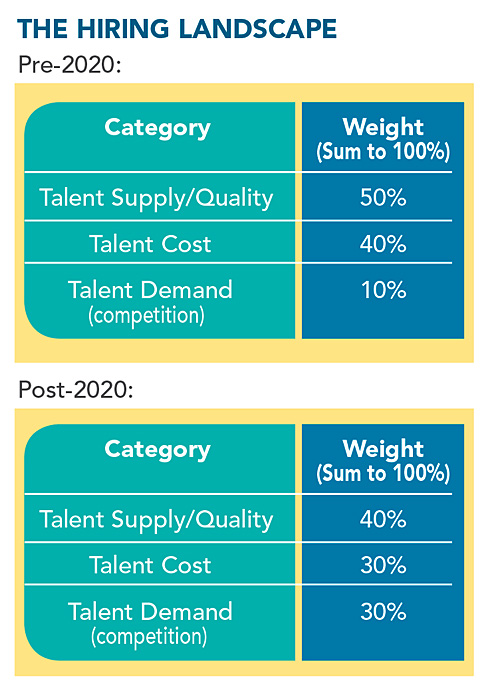

New hiring locations are typically assessed based on three broad categories: talent supply (including quality), talent cost, and talent demand. These factors still drive most talent-based location selections, but the priority placed on each has changed as a result of the constricted talent environment, accelerated by the pandemic, that has employees decidedly in the driver’s seat across most occupations and industry sectors.

Pre- and Post-Pandemic

Prior to the pandemic, companies focused mostly on the supply and cost of talent with demand (AKA the competitive environment) considered less, if at all, as part of a talent-based location strategy. Included is a representative sample of a typical company’s weighting around these three categories both before and since the pandemic.

The current hiring environment is characterized by slower supply growth in the face of a rapid escalation in demand. This reshuffling of priorities is largely a reaction to the current hiring environment, which is characterized by slower supply growth in the face of a rapid escalation in demand. Identifying locations with deep pools of cost-effective talent is no longer enough to guarantee a company can enter a new market as a preferred employer with a strong potential to attract and retain top talent over the longer term.

Ignoring a candidate market’s demand environment will significantly increase an employer’s near- and long-term risk. The COVID-19 pandemic accelerated the geographic distribution of hiring demand across the United States. Demand share decreased in larger, more established costal markets and shifted to a wider variety of locations dispersed throughout the country.

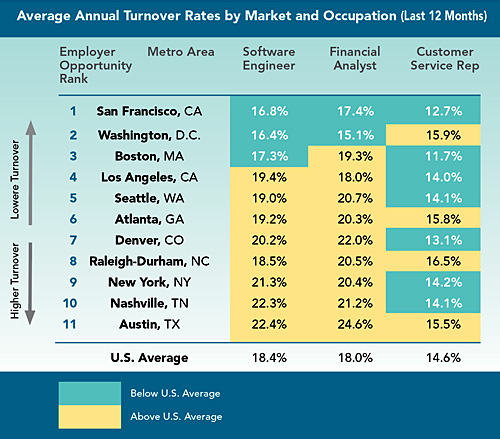

For example, many high growth “Tier 2” talent markets offering sizable pools of quality talent at a significant cost discount to more established costal markets have seen dramatic spikes in the demand for their talent. In most cases, this demand growth has significantly outpaced the supply growth occurring through in-migration and new talent creation within the local university pipeline. Because of this imbalance, many talent markets in metros like Nashville, Austin, Denver, Raleigh/Durham, and Atlanta are seeing higher rates of turnover and wage inflation than more traditionally competitive markets such as DC, Boston, Los Angeles, Seattle, and the San Francisco Bay area. This represents a major change in U.S. talent market fundamentals.

Even within the three evaluation categories of supply, cost, and demand, companies are realigning on what individual decision drivers are important to them in each of these buckets. The following section explores each category in more detail to explain the most common metrics evaluated and how their importance may have changed since 2020.

The new goal is to identify markets with growing pools of specialized talent that have fewer competitive pressures and a more stable and predictable cost environment. Evaluation Categories

Talent supply generally includes any indicators related to the size and specialization of a local area’s workforce. It also includes measures related to the quality of the workforce such as educational pipeline, language skills, and diversity.

The most common evaluation metrics within this category include:

- Existing talent count (by job title and/or skill set)

- Existing talent density per 10,000 workforce (indicating a market’s specialization)

- Talent pool and population growth rates

- Recruiting radii*

- Unionization rates

- Net migration by skill set and age*

- Educational attainment levels

- Size of annual graduate pipeline by degree program*

- Size and breadth of the local university system

- Size and breadth of local workforce training programs

- Workforce diversity (racial/ethnic, gender and age/professional experience)*

*Factors with increased importance since the onset of the COVID-19 pandemic

Talent supply generally includes any indicators related to the size and specialization of a local area’s workforce. DE&I is being actively considered by companies across industry sectors. This was accelerated in 2020 as a result of nationwide protests associated with racial inequality. Diversity is being measured in multiple ways including racial/ethnic identity, gender, and age. In some cases, companies are interested not only in the total diversity across a local population but are also keen to understand the “representation gap” between the overall local population compared to representation in the workforce for a particular industry sector or occupation group. For example, tech sector diversity in a given market may lag behind the local population overall. Some companies are seeking to take proactive roles in closing this gap by “fostering” greater diversity within their given industry by hiring a more diverse workforce more closely resembling the composition of the overall local population. Talent cost covers factors related not just to the cost an employer pays in salaries/wages but also a market’s macro cost environment, which impacts an employee’s quality of life. For example, cost of living and housing is an increasingly important consideration in hiring strategies, especially as it relates to overall affordability compared to average local market wages. Markets with greater housing affordability and a generally lower cost of living, and especially those with slower rates of growth in these categories, are viewed favorably in that employees will have more purchasing power in these locations and there will likely be less upward wage pressure and lower turnover risk.

- Current market wage/salary

- Local/state minimum wage policies (current and proposed)

- State/city taxes and fees (to be paid by employer)

- Wage inflation (1-, 3-, 5-year growth rates)*

- Housing cost as percent of average annual income*

- Cost of living*

- Change in cost of housing/living*

*Factors with increased importance since the onset of the COVID-19 pandemic

Talent demand is the third primary evaluation category. As previously mentioned, this is a critical evaluation category in today’s very tight talent environment, which gives candidates the upper-hand over employers. While talent supply addresses the total amount of talent, talent demand measures the volume of competition chasing that same talent pool as measured through unique active job postings. The comparison of supply versus demand helps determine a market’s likely saturation and thus the ability for a company to compete for talent in a given market.

The most common evaluation metrics within the talent demand category include:

- Total competitive job postings*

- Competitive job posting growth*

- Job postings vs. supply (hiring risk ratio)*

- Turnover rate*

- Wage inflation (cost and demand)*

- Company tenure*

- Time to fill job posts*

*Factors with increased importance since the onset of the COVID-19 pandemic

In Sum

The COVID-19 pandemic accelerated the trend of geographically dispersed hiring particularly for higher-skilled roles, such as tech and life sciences, that were historically highly clustered in a small number of mostly costal, gateway markets. This accelerated demand shift to a wider number of smaller markets has quickly changed the hiring landscape in these less established talent markets.

As a reaction to this, companies have become especially focused on the competitive environment for talent as they’re considering new locations. Luckily, there remains a wide variety of markets in the United States offering specialized talent pools that are both cost-effective and have relatively lower levels of competition that can help employers achieve the coveted “employer of choice” status that positions them to attract and retain the top talent in the market over the long term.