Out of the old Detroit 3, GM appears to be the most aggressive. It recently acquired Cruise Automation, a self-driving vehicle startup for $1 billion, to jump start its autonomous vehicle technology. Only a little beforehand, GM also invested $500 million in Lyft, a ride-sharing startup. GM President Dan Ammann believes that the timeline for autonomous vehicles is “probably faster than what you think.”

The large OEMs are not the only ones eyeing driverless technology. Rumors abound regarding technology companies seeking the next wave of disruptive technology, including reports of self-driving automobile initiatives at technology leaders Apple and Amazon. Google has already developed and piloted its initial driverless vehicles…with no steering wheel! Google plans to introduce a market-ready version in the next two to three years.

Automotive suppliers do not plan to be left out of the self-driving vehicle competition. They believe that they have deeper engineering and technology skills than most of their OEM customers. ZF, Continental, Denso, Bosch, Delphi, to name a few, have significant activities to aggressively develop autonomous vehicle technology to sell to OEMs who will need it to compete.

Technology has been introducing disruptive change to all industries at an increasingly rapid pace. The automotive industry is not immune to the impact of disruptive technology. The automobile has evolved enormously from the early days of a steam-powered vehicle resembling a horse and buggy without the horse. However, the evolution of smart phone technology that provides connectivity to the Internet, social media, and people at anytime and anywhere has brought a major challenge to automakers in the form of driver distraction.

Driver distraction has become one of the major causes of accidents leading to injuries and death in the U.S. The National Highway Traffic and Safety Administration (NHTSA) has reported a sharp rise in the number of accidents involving distraction, especially from cell phone use for those in their teens and 20s. As a result, many states and municipalities have attempted to regulate cell phone use while driving, with limited success in the reduction of accidents. The challenge for the automobile industry has now become how to provide the instantaneous connectivity to the world that is expected by individuals, while simultaneously protecting them for their own good.

It’s our fundamental belief that autonomous technology will lead to better safety on the roads. Dan Ammann, GM President Hence, the impetus for driverless technology will grow rapidly, by its ability to remove the human factor. GM’s Ammann supported this belief in a recent statement: “It’s our fundamental belief that autonomous technology will lead to better safety on the roads.” In the meantime, self-driving technology is receiving plenty of scrutiny by the media and regulators, especially in some recent reported accidents involving supposed self-driving vehicles. One of the most notable was the death of a Tesla Model S owner who crashed into a truck while using the vehicle’s Autopilot driver-assist system. This event was the first known traffic fatality involving an automated driving system, and will certainly affect the direction of discussions and decisions by both the regulators and industry. According to Christopher Hart, Chairman of the National Transportation Safety Board, “I think people are wildly underestimating the complexity of bringing automation into the system involving Joe Public.”

However, most regulators acknowledge that the momentum to build self-driving technology into cars will be unlikely to stop, only slow down as more standards and regulations come into place.

Levels of Self-Driving Technology

New technologies to improve driver safety have been around for a long time, beginning with “passive safety” in the 1970s, 80s, and 90s with the advent of seatbelts, airbags, and stability control. The next generation of “active safety” has taken on more relevance in recent years through the evolution of sensor technology that supports the driver with greater awareness of his surroundings using forward collision warnings, adaptive cruise control, and lane departure warnings. The new wave of technologies will have the potential for self-driving, but will require the integration of multiple technologies into systems to work together in order to effectively operate more safely and reduce collisions by managing the vehicle’s activity, communicating with other vehicles, and operating in a similar fashion to a human driver.

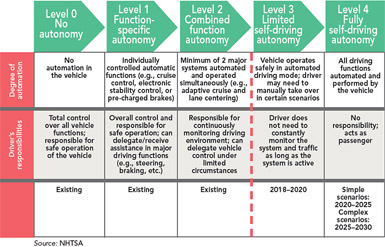

I think people are wildly underestimating the complexity of bringing automation into the system involving Joe Public. Christopher Hart, Chairman of the National Transportation Safety Board Most automakers have announced their intention to implement vehicles with staged levels of self-driving technology. However, they are looking for direction in understanding the governmental expectations and standards for vehicle autonomy. The regulatory bodies are responding and are hard at work to provide more structure and standards for the automotive makers to follow. In response to industry requests, NHTSA has published a multiple-level guideline for vehicle automation.

The majority of vehicle OEMs are targeting Level 2 functionality (see chart) over the foreseeable future, but are open to faster progress as the technologies become more established and reliable. As self-driving technologies continue to be introduced, other challenges will need to be addressed, including the updated rules from the United Nations on the Vienna Convention concerning automated driving, as well as insurance compensation rules for accident victims.

Capital Needs

Investing in self-driving technology will not be trivial. The automotive industry has always required a significant level of capital expenditures to launch and operate new vehicles; many times a vehicle program can cost more than $1 billion in equipment, tooling, testing, and labor for the design, development, and production launch of a new platform.

With other continuing demands on fuel economy, environmental emissions, light-weighting, and global expansion, the list of places to spend money is enormous. At the same time, the economic reality of ever-increasing product costs for new technologies, leading to higher vehicle prices in the market, raises significant concerns. The consumer or fleet purchaser of a new automobile will test the OEM capabilities to deliver on self-driving technologies while keeping cars affordable.

Hence, there is a high level of interest in car- or ride-sharing as an avenue to maintain customers, while providing another new, innovative technology alternative to the industry. Through sharing, the economics of using a vehicle become more variable and affordable. This is effectively achieved since cars are not in use much of the time. The typical owned or leased vehicle is generally recognized to be used at an extremely low level, in the 5 percent utilization range, which sets the stage to use technology to have the vehicle shared with other drivers.

Combining self-driving technologies with sharing becomes even more exciting for the automotive OEMs. Immediate and cheaper access to transportation, reduced or no driving responsibilities for the individual, combined with a safer driving experience may lead to what some see as a science fiction-like view of automobiles in the future. However, automakers are looking in that direction. “We think rideshare is interesting, and we think autonomous vehicles are really interesting, and we think it gets really interesting if you put the two together,” GM’s Ammann told Fortune’s Brainstorm Tech conference in Aspen in July.