Of course, the COVID-19 pandemic is a major part of the problem. When automotive production was abruptly halted in March, there were not any new vehicles being produced until early May. Even then, production has been proceeding in fits and starts. At the same time, consumers have continued to purchase vehicles, keeping auto demand surprisingly strong in an uncertain economy.

OEM assembly lines have been attempting to move up to full production, but most are not there yet. While some blame it on productivity problems from social distancing, lack of labor available to come back to work, or line shutdowns due to coronavirus infections, the key culprit has been the automotive supply chain. As suppliers have been trying to ramp up, they have been hamstrung by their own designed global supply chains. Part volumes coming from Asia, especially China, are still recovering to prior levels. Trade disputes with China have not helped. And other closer countries, such as Mexico, continue to struggle with infection levels and manufacturing shutdowns on a daily basis.

The global supply chain can no longer meet demand, exposing structural flaws in the automotive industry’s supply chain that will not be easily resolved and returned to a “normal” state in the COVID-19 world.

Global Iinstabilities

Just since the turn of the 21st century, the U.S. economy has been disrupted by two major events that created catastrophes to the business world — 9/11 and the Great Recession of 2008–2009. The COVID-19 pandemic has been another economic crisis; however, it has been dramatically different. The extreme impacts to economies around the world liken it closer to World War II. Virtually every country has felt the residual effects ranging from complete lockdowns to frightened citizens who have been displaced by economic retractions.

Trade policy disfunctions have also come into play. U.S. and China relations are at a new low point. Tariffs on steel, aluminum, and other products continue to be in force, and technology disagreements such as TikTok and Huawei are in the headlines daily. There is very little that can be predictable about trade in the near or long term.

Combine these current global manufacturing challenges with “lean” supply chains developed over several decades, and you find an auto industry unable to function efficiently or come back quickly. Uncertainty about consumer demand going forward provides even more instability to vehicle production schedules upon which suppliers depend. The concepts of lean manufacturing thrive when production can be level, stable, and smooth. In that type of environment, inventories can be just-in-time and production moves ahead like clockwork.

COVID-19 has shown how defenseless the global supply chain can become in the face of interruptions, catastrophe, and crisis. Though fixing it rapidly and in the middle of coming back from pandemic problems is a daunting task, an alternative which must be considered lies in returning at least some automotive production capacity to U.S. shores — not so much vehicle assembly, but the critical auto components needed to produce a functioning car, SUV, or truck.

The Case For American-Made

The advantages of increased U.S. auto parts production are obvious. It would tighten what’s become a far-flung global supply chain, weaning automakers of dependence on foreign suppliers and offering a leaner, faster route to reducing the cost of stockpiling inventory as a contingency plan.

It’s also beginning to make more economic sense. The global supply chain as a whole is only getting more expensive. China has been the low-cost country of choice for years. However, their cost of production is increasing and likely to increase even more in an inwardly focused COVID-19 world. Other countries may be alternatives, such as Vietnam or Thailand; however, the supply chain from Asia is still long.

COVID-19 has shown how defenseless the global supply chain can become in the face of interruptions, catastrophe, and crisis. Mexico is a solution closer to home and supported by the recent USMCA trade agreement to require more auto production in North America. But COVID-19 continues to haunt Mexico auto production, with high infection rates and production line shutdowns. The low labor cost advantage historically enjoyed by Mexico will be reduced now, according to USMCA terms, which will require higher direct labor wages for Mexican workers.

Still, U.S.-based auto manufacturing faces obstacles of its own, beginning with the capital investment needed in new plants, new tooling, and new equipment. Perhaps even more challenging is the lack of manufacturing labor across the country. With unemployment still at record levels, you would think that there should be plenty of workers available. But despite years of headlines calling for the rebuilding of U.S. manufacturing, factory work still carries a stigma among American workers, leaving the country too light in skilled production employees.

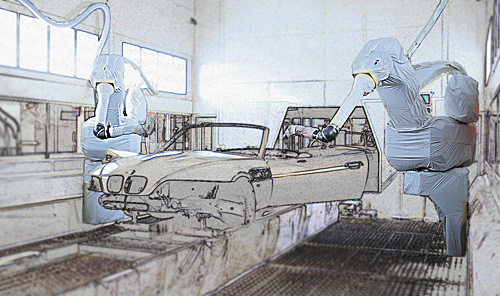

Yet, there may be some hope for the forward-looking auto supplier. More automation, robotics, and new technologies will need to be used in the production lines. Automation will eventually make for better, higher-quality products, while also supporting productivity improvements needed in the work force due to coronavirus production changes. Capital investment — be it through new production plants and equipment, or by purchasing weaker competitors — will allow the strongest suppliers to grow and grab volume and market share. While COVID-19 may have left the industry in disarray, it’s created a prime opportunity to expand the business and establish a stronger U.S. footprint.

Mapping Out Your Plan

The coronavirus is not likely to go away for a very long time. There is no cure today, testing is still inconsistent, and while vaccines look promising, they are a long way from full production in volumes that will have a significant impact. Hot spots of infection will probably continue to pop up and disrupt production operations over the next 12 months and beyond. At Plante Moran, we have helped our clients in critical planning for their supply chains, focusing on key activities in three phases:

- Respond: Manage through the current crisis.

- Restart: Plan to reinitiate business operations.

- Plan: Build readiness for the next disruption.

Suppliers need to have a structured plan and capability, including decision processes that can be flexible with events. COVID-19 was truly a Black Swan event; really no one saw it coming, even though many thought it was highly likely to occur. Scientists have long predicted a pandemic, but the rest of the world did not worry much. Major disruptions don’t happen often, and in the meantime, our attention typically goes to the immediate crisis at hand. Planning for readiness in your supply chain has not received much credibility — until now.

Part of that planning to boost preparedness ahead of what seems to be inevitable supply chain disruptions will be mapping out your supply chain. Think not only about where you acquire your parts and materials, but where the companies that you buy parts from will buy their parts. The first time around, this analytical effort will require significant research, but subsequent updates will become easier thanks to that initial heavy lift. The key is to reach out directly to your suppliers to identify the layers in the supply chain, finding out what parts are sourced and from whom and where. The results can be surprising, especially when you discover the tier 2 or 3 suppliers are not in the same countries.

Hope is not a plan, and all businesses are wise to think about their worst-case scenarios regularly, but even doing that can still leave you exposed, albeit less vulnerable to disruptions.

The New Normal of Supply Chain

In the meantime, the auto industry will remain in a state of flux. We’re already seeing how shortages have reduced vehicle inventories, elevated auto prices, and killed off incentive programs that were ubiquitous just a few months ago. Even with reduced production, suppliers have not been able to keep up. Add in unemployment and shaky consumer confidence, and the COVID-19 era is bound to favor companies that can adjust to the new environment. OEMs like Toyota, Honda, and Hyundai, which have more integrated supply chains and a track record of less expensive vehicles, will have an advantage over their competitors.

Expect supplier consolidation to rise in the coming months. Lean manufacturing was built on the concepts of level, stable, and smooth. Nothing about the current climate meets that criteria. Suppliers must now operate at lower volume and higher labor costs, further burdened by the expense of shutting down and cleaning when outbreaks occur.

Some have been temporarily propped up by government aid. But as that money dissipates and financial pressures heighten, lower valuations will mean discount shopping for strategic buyers seeking to expand their footprint. Auto supplier leadership will need to consider the uncomfortable calculus of how their business’ valuation might degrade in a variety of possible scenarios.

No one can be certain how long all this will last, but to assume the industry will return to normal next year is unrealistic. That means now is the time to start making plans to position yourself for whatever’s to come. After months of outbreak with little sign of reprieve, this will be the new normal for some time to come.