Technology has consistently created these inflection points in every industry. Examples are all around us of leading-edge technologies being replaced. For example, more power exists in today’s laptops than was available in the old mainframe computers. Other high-profile examples could include flat panel televisions and smart phones. The speed of technology change is growing ever more rapid. In the case of automobiles, the transition from internal combustion engines is being led by climate change regulations and incentives from both the federal and state governments (mainly California) to reduce fossil fuel consumption. But EV technology is improving swiftly due to lower costs and better performance, driving growing consumer interest and adoption, as well as businesses looking to reduce costs and pursue sustainability targets.

The impact is driving the $1 trillion global automotive supplier industry into a crisis. On the one hand, automakers will still be demanding traditional vehicle components for the next decade, and the aftermarket for service parts will continue even longer, as gasoline vehicles remain on the roads. On the other hand, internal combustion engine parts are clearly not a growth market as electric models take up a growing share of automaker production schedules.

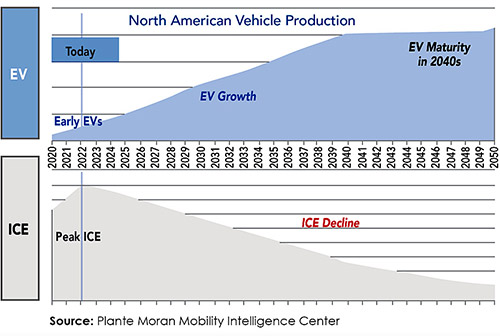

Capital investment by auto OEMs has almost completely shifted to EVs going forward. Based on research from the Plante Moran Mobility Intelligence Center, the dramatic transformation in North American production of vehicle volumes is illustrated by projected EV growth and ICE decline in the accompanying graphic. Over the next decade, 74 percent of the projected 247 new vehicle programs to be launched will be partial or full EVs. Not only will it include smaller cars, but trucks, SUVs, and other large vehicles are encompassed in automaker plans.

GM appears to be the most aggressive, with the announced target of switching 100 percent of its production to electric by 2035; but other OEMs are following suit, with targets generally aiming for completely closing down new ICE programs by the 2035–2040 time frame.

The Supply Chain Challenge

Electrification creates a new technology for propulsion of the vehicle. Nearly all powertrain components used in today’s world — such as engines, transmissions, turbochargers, air intake systems, fuel systems, and exhaust systems — will be obsolete. In their place will be battery packs, cells and materials, DC/DC converters, inverters, traction motors, gearboxes, and onboard charging modules. In effect, an electrochemical reaction from the battery causes propulsion to occur in EVs. The implication for suppliers is dramatic; either make the transition to electric or risk continuing to produce lowering ICE volumes until elimination.

The lithium-ion battery supply chain is a startling example of the risk to today’s suppliers. While the battery is the critical element in electrification, the existing supplier base in the U.S. is nearly nonexistent. Almost all of the battery cells in EVs come from Asia, either China, Japan or Korea. Even with the billions being invested by the OEMs in new lithium-ion battery plants in the U.S., almost all of the materials and components to be assembled in these battery cells will come from Asia as well. This crisis is behind the major push to build more domestic production of battery materials, cells, and packs in the U.S. It can also be viewed as an opportunity for suppliers looking to diversify from ICE components to components in the electric drivetrain.

While the battery is the critical element in electrification, the existing supplier base in the U.S. is nearly nonexistent. At the same time, the existing auto supply chain continues to reel from the effects of semiconductor shortages, raw material price escalation, scheduling fluctuations by the OEMs, and transportation headaches. Much of these disruptions have been caused by the over-reliance on an Asian supply base, which has jeopardized U.S. capabilities to supply key technologies. In order to survive and thrive in the new EV world, traditional thinking will not suffice. Suppliers need to take some dramatic actions toward transforming their organizations to be competitive in EVs, including:

- Evaluate and restructure your product portfolio. Understanding how EV technologies could replace your current products will be critical to meeting your customers future requirements. While difficult, meeting with your customers to better learn about their product plans and how you can fit in the future will be an important step. Then adapt the core competencies of your organization to align with the new product technologies. Both suppliers and OEMS will need more product alternatives and technology support from outside their organizations.

- Be willing to take more risk in your capital Investment decisions. Unless your products and manufacturing capabilities can be easily transitioned to electric products, longer term approaches to analyzing investment returns, while not popular, will be needed to make such a significant transformation. New equipment for more efficiency and precision will be required in future vehicle architectures. Factors driving product demand and volumes may need to be evaluated over 5, 10, and 20 year time frames, while not overemphasizing fast returns on investment

- Invest more in your people, along with technology. Offshoring engineering and manufacturing to low-cost countries has contributed to the current supply crisis. Even in the midst of the current labor shortage, developing the strategy for upskilling the work force through more education and training will be crucial. Engineering will require more technology skills and virtual competencies in areas such as electronics, software, simulation, and artificial intelligence. Manufacturing workers will need to adapt many of these same competencies, as the adoption of new Industry 4.0 technologies begins to blend the white- and blue-collar work forces. Skilled, capable technical expertise may cost more, but will be a critical asset for tomorrow’s manufacturer.

- Build stronger relationships with customers, suppliers, and partners. OEMs and tier suppliers will need lots of help beyond their existing pools of expertise, whether for new product development, engineering, or production. Formal alliances, through joint-venture partnerships, can provide new capabilities and skills for transitioning. However, potential acquisitions may need to be considered to rapidly build your organization’s capabilities to address future technology challenges.

In addition, the entire ecosystem for transportation is changing with the growth of EVs. Charging station infrastructure will need to increase substantially, to well over a million charging points in order to accommodate needed service levels for EVs on the road. Power generation to support the increased electrical requirements will transition from fossil based to renewable sources, especially solar. Energy storage systems (ESS) utilizing millions of lithium-ion batteries in modular units are just starting to be implemented to provide added energy capacity to the grid and localized applications, such as buildings, homes, and charging stations. Planning to be a “fast follower” and reacting to future changes resulting from technologies will be a high risk. Suppliers who plan strategically for the future will be able to move faster than those who wait to follow.

The challenges are daunting, even for the most successful companies. Automotive suppliers face a massive transition in their revenue streams, product portfolios, cost structures, and customer base. By challenging traditional thinking, strategic suppliers can create their own future in the rapidly growing EV-based automotive industry. However, the EV will not be the only dramatic change brought on by technology in the next few years. Right on the heels of widespread EV adoption will be automated driving assistance systems (ADAS) and autonomous vehicles, introducing another round of challenges and opportunities for the auto supply chain.