“We did a scan of manufacturing around the world and found a complete transformation,” states Sheila Botting, senior practice partner with Deloitte Real Estate, a consulting firm in Toronto, Ontario. “It’s no longer traditional manufacturing; it’s going into advanced manufacturing. We have to embrace that.”

And that’s exactly what Canada is doing.

Supporting Innovation

The Canadian government has launched several initiatives designed to support innovation in its advanced manufacturing industries. For example, it recently awarded $49.7 million to four research networks through its Business-Led Networks of Centers of Excellence program that targets research and development (R&D) challenges.

“Companies are attracted to business-led networks because they see clearly how these kinds of collaborations add value to their bottom line,” comments Janet Walden, chief operating officer for the Natural Sciences and Engineering Research Council of Canada. “The program provides a way to bring together competing companies in pursuit of solutions to shared problems.”

About $8 million of this funding will be directed to the Refined Manufacturing Acceleration Process (ReMAP). ReMAP’s goal is to foster collaboration among academic partners, research organizations, and private-sector companies to pursue R&D that supports the electronics sector. The 25-member manufacturing research network has committed $11 million of its own resources to the research.

“Our government is investing in science and technology that drives business innovation and moves ideas from the laboratory to the marketplace more efficiently,” says Minister of State for Science and Technology Ed Holder. “ReMAP is positioning Canadian manufacturers to improve processes and materials in high-tech industries that create jobs and prosperity for Canadians.”

Canada’s knowledge-based, high-tech manufacturing industries are an important part of the Canadian economy. Overall, Canada’s manufacturing economy generated about $591 billion in sales in 2013 and accounted for half of all industry R&D. Four of its leading advanced manufacturing industries — aerospace, automotive, medical devices, and information and communications technology (ICT) — generated about $340 billion in revenue (about 60 percent of total manufacturing output) and continue to invest in cutting-edge R&D that confirms Canada’s international reputation as an innovation leader.

Aerospace

Canada’s civil aircraft production is the third highest in the world, generating more than $25 billion in 2013. With annual R&D and capital investments of more than $1.7 billion, the Canadian aerospace manufacturing sector is also one of the most R&D-intensive in the country, increasing R&D expenditures nearly 40 percent from 2008 to 2013.

Much of this work is carried out through public-private partnerships. For example, the Composite Innovation Center in Winnipeg is Canada’s largest composite technology center. It has undertaken hundreds of projects with industry partners and government agencies, including developing bio-composites and other renewable materials for industrial-grade parts. Another research partnership — the New Consortium for Aerospace Research and Innovation in Canada — was launched in 2014 and will support collaborative research by private companies, academic institutions, and research organizations.

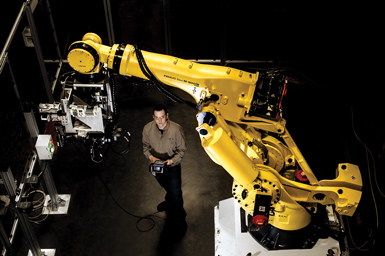

Major aerospace companies in Canada include Boeing, GE Aviation, Eurocopter, Bombardier, Bell Helicopter, Pratt & Whitney Canada, and Rolls-Royce. These companies and others manufacture a wide variety of products including commercial and business aircraft, helicopters, aircraft engines, full flight simulators, landing gear systems, advanced composites, and robotics. They also invest millions of dollars every year in advanced research. For example, in 2013 General Electric Aviation opened its $61.4 million Global Robotics, Automation and Instrumentation R&D Centre in Bromont, Quebec. The new facility will develop advanced robotic processes, software applications, and intellectual property for GE Aviation’s facilities around the world.

“Advanced manufacturing is changing both the products we make and how we make and service them,” says Jeff Immelt, chairman and CEO of GE. “Our new facility in Bromont is about increasing our speed of innovation and refocusing the way products are designed, manufactured, and serviced for our customers in Canada and for global markets.”

Automotive

With more than 1,300 automotive manufacturing and supplier facilities, Canada’s automotive industry accounted for about 12 percent of the country’s manufacturing GDP in 2012 and 16 percent of vehicle production in North America. Annual capital investment by Canada’s major players — Chrysler, Ford, General Motors, Honda, Toyota, Hino, Motor Coach Industries, PACCAR, and Volvo — averaged $3 billion from 2002 to 2011.

Annual investments by the automotive industry and its partners in R&D averaged about $455 million annually from 2002 to 2012. The Automotive Innovation Fund provides support for leading-edge innovation in automotive manufacturing, especially for greener products and processes. To date, investments have leveraged up to $1.6 billion in R&D and innovation investments in Canada’s automotive sector. Auto21 is another leading research partnership that supports automotive R&D at more than 45 academic institutions across Canada.

In partnership with the Canadian and Ontario governments, Magna International has invested more than $400 million to develop new automotive products and technologies. For example, the company has successfully advanced its capabilities to produce class-A, carbon-fiber composite body panels at the production rates needed for the automotive industry. Automotive components made from these advanced materials are essential for increasing fuel efficiency and controlling manufacturing costs. Magna can now provide automobile manufacturers with a complete range of lightweight composite parts, sub-systems, and semi-structural components.

“With our unique formulations and production expertise, we’ve been able to take our carbon-fiber processing and know-how to the next level,” says Tom Pilette, vice president of Product and Process Development for Magna Exteriors. “By continuing to develop vehicle parts and systems with cutting-edge materials, we are able to assist our customers meet fuel-economy and emissions standards for their cars and trucks.”

Medical Devices

Canada has a strong medical-device market that is anchored by companies like Nordion, Titan Medical, Abbott Point of Care, Baxter, Covidien, Hologic, Johnson & Johnson, Medtronic, Roche, Smith & Nephew, Sorin Group, and Zimmer. In 2011, Canada’s medical-device market was valued at about $6 billion, with an average annual growth rate of 7 percent between 2006 and 2011. Popular medical devices from Canada include medical imaging equipment, prosthetics, home healthcare equipment, analytical equipment, and dental implants and materials.

Innovative medical devices that were developed in Canada and are used around the world include:

- Halifax-based MedMira’s three-minute flow-through diagnostic HIV test that is approved in Canada, the United States, China, and the European Union.

- A high-resolution, intra-operative magnetic resonance imaging (MRI) system developed by Winnipeg-based IMRIS that attaches to ceiling-mounted rails and can be easily moved in and out of the operating field to quickly deliver real-time, detailed images to maximize surgical success.

- The world’s first biosynthetic cornea, which is implanted in the eye and injected with stem cells to promote the growth of a new cornea; invented by the Ottawa Hospital Research Institute, this technique may lead to the regeneration of other body parts for transplantation.

“Medtronic remains committed to Canada,” says Neil Fraser, president of Medtronic of Canada. “We look forward to continuing to advance our medical technologies here and delivering innovative health-system solutions for patients around the world.”

Information and Communications technology (ICT)

ICT is one of Canada’s greatest high-tech strengths. Canada’s top 250 ICT companies had combined revenues of $85 billion in 2013, up 2.4 percent over the previous year. Canada is recognized as a world leader in ICT innovation and is home to global companies like BlackBerry, Open Text, and CGI Group. Canadian ICT expertise includes mesh networks, WiMAX (wireless communications standard), radio-frequency identification (RFID), fiber optics, satellite applications, next-generation networks, M2M (communication between wireless and wired devices), and cloud computing applications. The ICT industry leads all other industry for private-sector R&D, capturing about 35–40 percent of all private R&D expenditures in Canada (ICT R&D expenditures totaled more than $5 billion in 2011). Key research areas are digital media, software, wireless, energy efficiency, cloud computing, nanomaterials, next-generation power amplifiers, and imaging software.

Major international companies continue to invest hundreds of millions of dollars in new R&D centers across the country. Ericsson, for example, is one of the top-10 R&D investors in Canada (in 2012 it spent more than $325 million in R&D). Last year the company announced its next research investment — building a global ICT center in Vaudreuil-Dorion, Quebec, that will develop next-generation technology and cloud-based services. The center will begin operations in early 2015.

“Our new high-tech center will be an important foundation for our future innovation,” states Mark Henderson, president and CEO of Ericsson Canada. “It also represents our commitment to the region and will contribute to building the ICT ecosystem in Canada.”