Three factors are driving the resurgence of U.S. manufacturing. First, the U.S. dollar is weak. The favorable exchange rate helps the U.S. become a competitive producer of goods and attracts foreign investment. In 2002 $1 purchased 133 Yen. Today, that same dollar purchases only 100 Yen. The same is true with the Euro, despite all of the troubles on the continent. Today $1 buys only 0.75 Euros versus 1.14 Euros 10 years ago.

Second, the U.S. labor force is becoming more competitive. As productivity rises faster than wage costs, unit labor costs in the U.S. are falling. According to The Boston Consulting Group, worker productivity has been growing faster in the United States than in Western Europe and China. From 2005 to 2010, worker productivity in the U.S. grew at 2 percent annually, while the major economies of Western Europe averaged only 0.4 percent. This trend continued in 2011 and 2012, with U.S. productivity increasing 2.6 percent and 2.2 percent, respectively, while Europe averaged only 1.1 percent increases.

Compared with China, U.S. workers are 2.8 times more productive. In 2010 real output per worker was $120,000 in the U.S. versus $35,000 in China. Even though Chinese productivity is increasing, by about 8.4 percent per year, their productivity is not rising fast enough to offset annual wage increases of 18 percent. The Boston Consulting Group estimates that by 2015, the total labor-cost savings of manufacturing goods in China will be only 10 percent to 15 percent when productivity-adjusted labor is considered.

Third, Chinese logistics costs are rising. The total cost of China’s logistics rose by 18.5 percent in the first half of 2011 due to rising prices of raw materials, labor, and lending rates. Transport costs rose by 15.5 percent, storage costs soared 22.7 percent, and interest expenses jumped 24 percent. At these levels, China’s logistics costs are more than double the average in Western Europe, Japan, and the United States. Moreover, when you add a risk premium for “black swan” events, the costs are even higher. - In some instances, nontraditional incentives are available that do not provide cash or tax relief but can be of significant value.

With increasing global competition, state and local governments have the tools to improve the financial strength of manufacturers locating within their communities. As manufacturers analyze locations in the U.S., they should consider tapping into economic development incentives to further improve their performance.

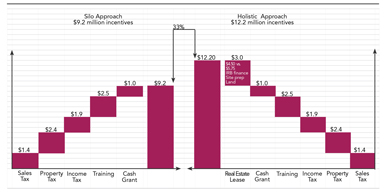

Let’s look at some of the generally available incentives that (1) reduce operating costs, (2) lower upfront investments, and (3) enhance productivity. Also consider a case study of an automotive supplier to demonstrate how to think creatively about these basic incentives, combining several programs into a holistic solution that juices your financial performance even more.

Training Incentives

Productivity is the lynchpin to U.S. competitiveness. If manufacturers are repatriating projects, and if highly automated shop floors are critical to their productivity, then states and local communities need to offer a highly skilled workforce. A common incentive is training, which comes in a number of forms. For example, Louisiana has instituted the FastStart program that replicates a private-sector consulting model. It has been recognized as one of the best in the country because it provides a comprehensive, free service to companies including employee recruitment, screening, training development, and training delivery. For companies that want to conduct their own training, Tennessee offers an excellent program. The Tennessee FastTrack Job Training incentive is a cash grant that pays 50 percent of the committed training grant after 90 days of employment, with the remaining training grant delivered after associates have been employed for 180 days. Program participants may also choose to submit their training expenses and seek a reimbursement of their costs.

Abatements, Exemptions, and Rebates

For companies investing in capital-intensive equipment to increase their productivity, abatements, exemptions, and rebates are particularly important ways to reduce operating costs and increase EBITDA (earnings before interest, taxes, depreciation, and amortization). Some professionals use these terms interchangeably; however, there is a slight difference between each one.

An abatement is typically a partial reduction in a future incremental tax, whereas an exemption is usually a complete waiver of the tax for a particular activity. A good example of an abatement is Michigan’s P.A. 198, which offers 50 percent reductions in the incremental increase in property taxes resulting from a project. For an exemption, Florida offers another good example, as the state recently enacted a sales tax exemption for manufacturing and processing equipment.

Similar to an abatement, a rebate or refund reduces a tax liability; however, the timing is delayed. For a rebate or refund, a company pays the tax and then, at a later point, receives a refund. A good example is the property tax rebate in some North Carolina communities such as Charlotte, which offers the Business Investment Program (BIP) grants. Using this program, grant recipients must consummate the qualifying investment and pay all property taxes before grants are paid.

Payments or fees in lieu of tax (PILOT or FILOT) are a closely related incentive offered in many Southern States. To promote manufacturing, South Carolina offers a statutory five-year property tax exemption as well as four types of FILOT’s known as “Big Fee,” “Little Fee,” “Simplified Fee,” and “Super Fee.” Under a “fee,” a manufacturer may negotiate a lower assessment ratio, reducing it from 10.5 percent to a lower percentage but not below 6 percent (4 percent is the minimum for certain projects investing larger sums and creating jobs). In addition, a company may negotiate for a fixed millage rate or adjust the millage rate every five years for the period of the fee.

Since logistical costs are also critical to luring manufacturers from China, reliable infrastructure is important. Having good freeway access, efficient rail yards (with access to multiple carriers), and a port with efficient and predictable labor relations is the backbone of low logistics costs.

On top of the property tax exemption and FILOT, South Carolina offers the Special Source Revenue Credit (SSRC) that can be used to pay for infrastructure improvements. In connection with the “Little” or “Big” fees, a local community may use the SSRC as either a credit against the fee payment or float a bond and use the SSRC to pay the principal and interest. In addition to infrastructure, a manufacturer may use the proceeds of the bond or the credit to acquire or improve real property or pay for personal property dedicated to the project.

In addition to state-level grants, many local communities have access to the U.S. Department of Housing and Urban Development’s (HUD) Community Development Block Grant (CDBG) funds. Manufacturers may tap these grants to pay for public infrastructure such as roads, water, and sewer lines or water treatment facilities. HUD distributes CDBG funds to each state and entitlement communities — generally larger cities and counties — to promote the employment of low- to moderate-income individuals. For projects in non-entitlement communities, a manufacturer may approach the state to tap into its statewide allocation of CDBG funds.

Similar to an abatement, a rebate or refund reduces a tax liability; however, a company pays the tax and later receives a refund. Other Incentives

To offset other startup costs, some states and local communities offer cash grants, favorable financing, or free land. The most sought-after incentive is cash. Several states, such as Texas and Florida, offer grants to close deals. Texas has the “deal-closing” Enterprise Fund that has provided approximately $380 million for projects from FY 2004 to FY 2011. Other states (e.g., Michigan’s 21st Century Investment Fund) are more entrepreneurial with their incentives and offer equity injections, loan-interest loans, or credit enhancements to their expanding manufacturers.

Another financing tool is Tax Increment Financing (TIF). Approximately 48 of the 50 states permit local governments to use some form of TIF. To start a TIF, a local community creates a district and within its boundaries captures the incremental increase in one or more taxes. For example, in Pennsylvania a TIF may capture property taxes, sales/use taxes, gross receipts, gross or net profits, or income taxes.

Once a community captures the increment, there are a couple options for conveying the benefit to a company. If authorized under statute, a TIF Authority may pay the incremental taxes to a manufacturer to reimburse for eligible expenses or float a bond and use the captured taxes to repay the bond. Pennsylvania permits fairly broad uses. The statute permits a TIF to reimburse for items including construction, demolition, remodeling, or reconstruction costs; new buildings or structures; acquisition of machinery and equipment or land; public infrastructure located outside TIF boundaries, if the investment will directly benefit a project; financing costs, including issuance of bonds or establishment of reserve funds; professional services; administrative costs, including reasonable time spent by city or authority employees; relocation costs; and reimbursement of prior expenditures related to allowed costs.

In some instances, nontraditional incentives are available that do not provide cash or tax relief but can be of significant value. Private-sector utility companies, along with local communities that own their own utility services, may grant reductions in electric, cable, water, or sewer rates or waive tap-in fees. A good example is ReCharge New York, which has 910 MW of power allocations available for businesses that meet its program criteria. Another example is the Tennessee Valley Authority, which offers a five-year credit against future utility bills through its Valley Investment Initiative.

Creating a Holistic Solution for Manufacturers by Combining Traditional Incentives

In Georgia one local community combined several traditional incentives to create a unique solution for an auto supplier. It floated a tax-exempt bond, repaying the bond with lease payments and recaptured tax revenues. The community used the proceeds to construct a facility owned by its Industrial Development Authority (IDA) and leased it to the manufacturer. The lease was triple net and resulted in a savings of $1.25 per square foot, largely because the implicit cost of funds was 5.63 percent versus 12.0 percent that a private developer would have to pay. The triple net lease was a gross rate in practice because the manufacturer received property tax abatement from the taxing authorities, while the IDA paid for the common area maintenance and the insurance on the structure.

The IDA split a $1 million OneGeorgia Authority cash grant with the manufacturer; $500,000 for tenant improvements and $500,000 for site grading and infrastructure development. Using this project as a template to spur other development, the community today touts its economic success by attracting over $3 billion of new capital investment and having created 20,000 jobs within the last 10 years.