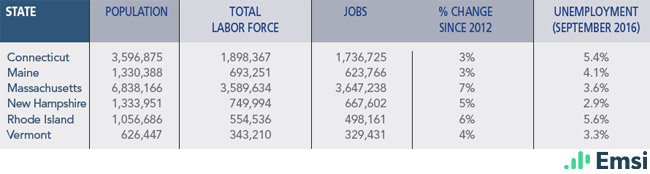

It's a turnaround from a year or so earlier, when much of the region lagged the nation in terms of economic recovery. Jobless rates, in fact, have now hit levels that are historically linked to labor shortages. By September 2016 unemployment was as low as 2.9 percent in New Hampshire, 3.3 percent in Vermont, 3.6 percent in Massachusetts, and 4.1 percent in Maine, all lower than the national average of 5.0 percent that month. On the other hand, two states checked in with jobless rates above the national average — 5.4 percent in Connecticut and 5.6 percent in Rhode Island.

New England Region Demographics and Industries

-

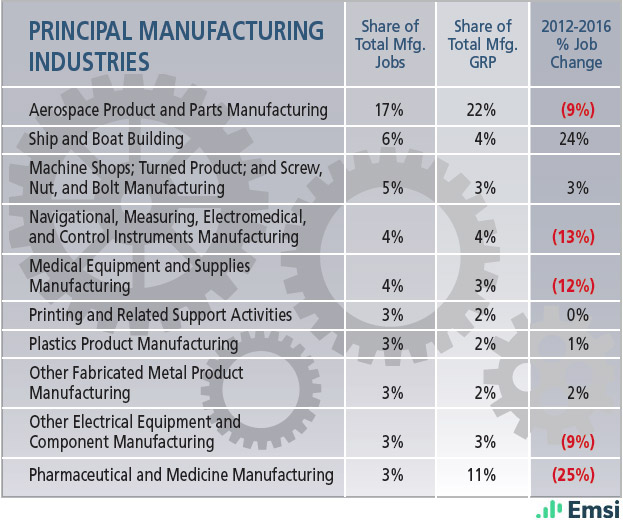

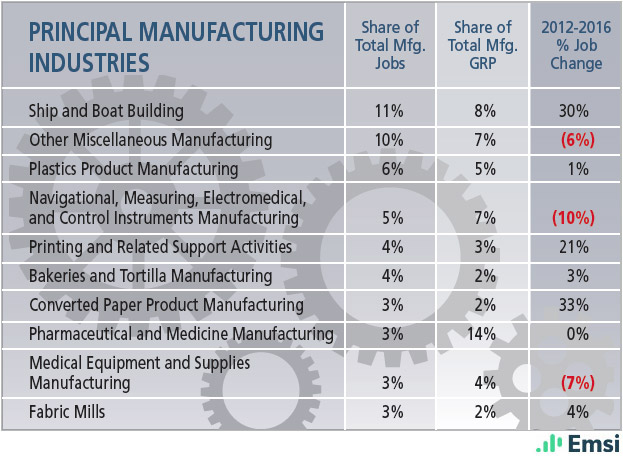

Connecticut: Principal Manufacturing Industries

-

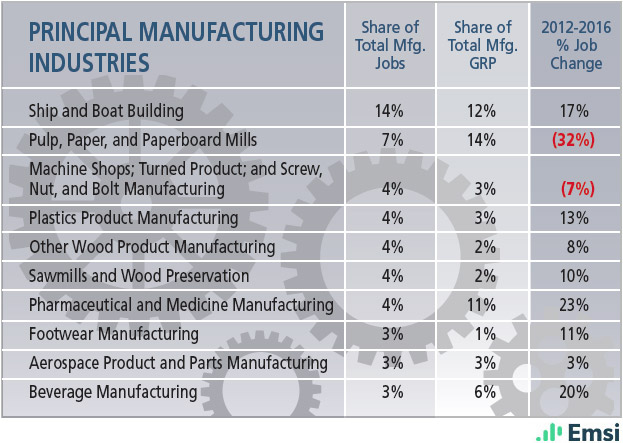

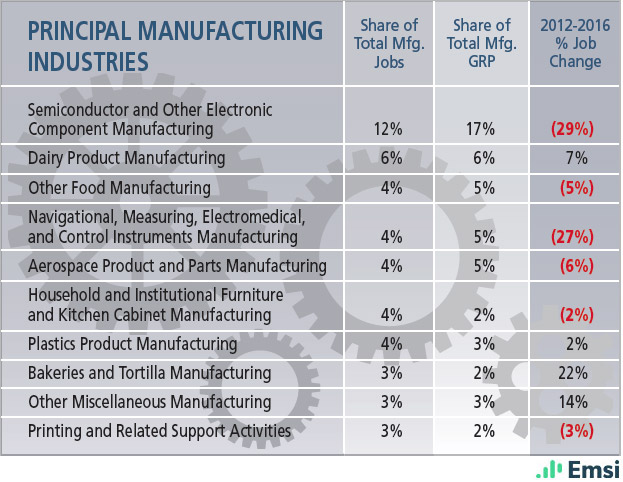

Maine: Principal Manufacturing Industries

-

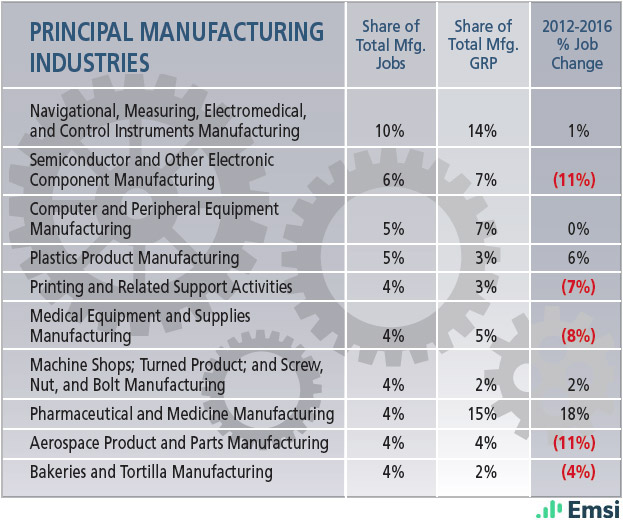

Massachusetts: Principal Manufacturing Industries

-

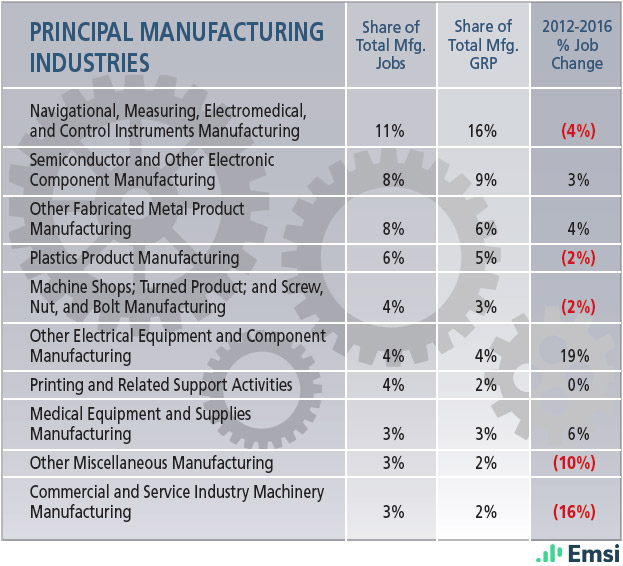

New Hampshire: Principal Manufacturing Industries

-

Rhode Island: Principal Manufacturing Industries

-

Vermont: Principal Manufacturing Industries

-

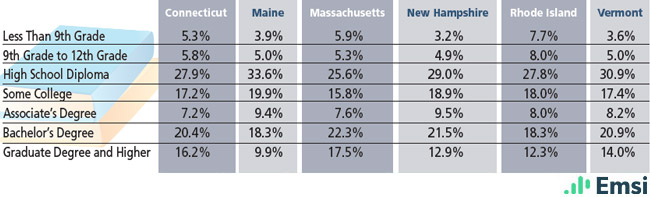

New England Region: 2016 Educational Attainment

-

New England Region: Demographics

-

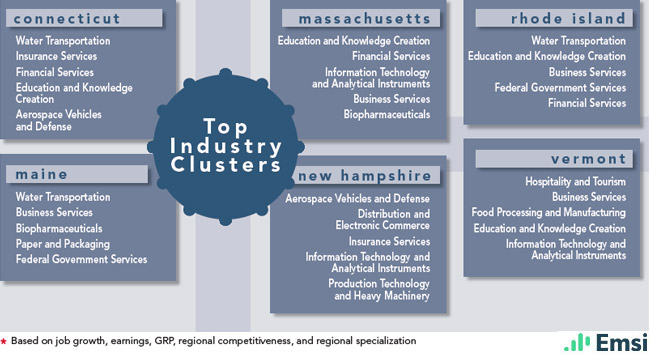

New England Region: Top Industry Clusters

Technology-related sectors are major economic drivers in New England, particularly in the longtime R&D hotbed of Massachusetts, which for generations has been renowned for the brainpower residing on its university campuses. Indeed, the State Technology and Science Index from the Milken Institute has once again named Massachusetts the nation's most innovative state (Massachusetts has topped the list every time it's been calculated since 2002).

Among the region's biggest tech-related headlines was word from Akamai Technologies that it plans to expand its corporate headquarters in Cambridge, Mass. The tech company is spread across six buildings there now and plans to consolidate into two — and in the process add 700 jobs to the 1,666 already there. Total investment is $136 million. Another 400 new tech jobs are promised in Lowell, where cloud-based workforce management solutions provider Kronos plans to move its headquarters from nearby Chelmsford. The company already employs about 1,300 in the area.

Rhode Island may be small but it gets its share of technology development, too. One of the past year's biggest announcements involved plans by GE Digital to launch an information technology center in Providence, with the potential to create hundreds of new jobs, starting with about a hundred at the outset. The company cited strong university partnership opportunities and a healthy tech talent pipeline in making its decision.

The life sciences are historically strong in the region, too, again led by Massachusetts. Among the developments there, Siemens Healthcare Diagnostics intends to invest $300 million in an expansion of its office, warehouse, and lab space in the Massachusetts community of Walpole. As many as 400 new jobs will join the 600-plus that will be retained.

Limited But Growing Strengths

Manufacturing job growth across the region is on a much smaller scale — it's the most lackluster of all industry sectors, according to the Boston Fed. On the other hand, growth is growth, and it's noteworthy that the region's slim manufacturing growth stands in contrast to the national year-over-year figures, which reveal a decline.

In this arena, Henkel Corp. made headlines on a couple of occasions in the past year, first by acquiring The Sun Products Corp. in Wilton, Conn. Later in the year, the company announced plans to pick up the headquarters of its laundry and home care segment, as well as its beauty care headquarters, and move them from Arizona to the Connecticut community of Stamford. The big picture is that the company is retaining the jobs at Sun Products, and bringing in up to 266 more. A similar situation involves the Italian aerospace company Pietro Rosa TBM. It acquired New England Airfoil Products in Connecticut, and opted to retain the current workforce and create as many as 100 new jobs over the next five years.

New England's largest metal fabrication, machining, and power coating operation is Vermont-based NSA Industries, which spent 2016 seeking opportunities to grow. That included capital investments in Vermont and a job-creating expansion in a former paper mill in New Hampshire.

New England's financial services sector has been growing, albeit at a slower pace than the national financial sector as a whole. Among noteworthy developments, AQR Capital Management has headquarters in Connecticut for its global investment management operations, and the company is making positive strides. In 2016 AQR announced plans to invest more than $72 million over the next decade, expanding its headquarters and operations. In addition to 540 jobs retained, as many as 600 new jobs are promised.

New England States Recent Industry Announcements

Companies that have announced new and/or expanded facilities in the New England region.

-

Akamai Technologies

Cambridge, MAAmong the New England region's biggest tech-related headlines was word from Akamai Technologies that it plans to expand its corporate headquarters in Cambridge, Mass.

-

Kronos

Chelmsford, MACloud-based workforce management solutions provider Kronos plans to move its headquarters to Lowell, Mass., from nearby Chelmsford and add 400 jobs to the 1,300 it already employs in the area.

-

GE Digital

Providence, RIGE Digital plans to launch an information technology center in Providence, with the potential to create hundreds of new jobs, starting with about 100 at the outset.

-

Siemens Healthcare Diagnostics

Walpole, MASiemens Healthcare Diagnostics intends to invest $300 million in an expansion of its office, warehouse, and lab space in Walpole, Mass., adding up to 400 new jobs and retaining 600-plus.

-

Henkel Corp.

Wilton, CTHenkel Corp., which acquired The Sun Products Corp. in Wilton, Conn., plans to move the headquarters of its laundry and home care segment, as well as its beauty care headquarters, from Arizona to Stamford, Conn., retaining jobs at Sun Products, and bringing in up to 266 more.

-

Pietro Rosa TBM

Farmington, CTItalian aerospace company Pietro Rosa TBM, which has acquired New England Airfoil Products in Connecticut, has opted to retain the current workforce and create as many as 100 new jobs over the next five years.

-

NSA Industries

St Johnsbury, VTNew England's largest metal fabrication, machining, and power coating operation, Vermont-based NSA Industries, made capital investments in Vermont and a job-creating expansion in a former paper mill in New Hampshire in 2016.

-

AQR Capital Management

Greenwich, CTIn 2016 AQR Capital Management announced plans to invest more than $72 million over the next decade, expanding its Connecticut headquarters and operations, thereby retaining 540 jobs and adding as many as 600 new jobs.

-

Twin Rivers Paper Co.

Madawaska, MEBy acquiring the paper manufacturing assets of the New York-based Burrows Paper Corp., Twin Rivers Paper Co. aims to solidify its position as a market leader in the lightweight packaging, publishing, and label markets.

Natural resources play a significant role across New England, particularly to the north. In Maine, for example, Twin Rivers Paper Co. moved to build upon its strengths as an integrated forest products company. By acquiring the paper manufacturing assets of the New York-based Burrows Paper Corp., Twin Rivers aims to solidify its position as a market leader in the lightweight packaging, publishing, and label markets.

Natural resources play a key role in the Vermont culture, too, from tourism to Ben & Jerry's ice cream, and the state is working to keep building upon its reputation. Its Working Lands Enterprise Initiative grants support projects across forestry and agriculture, and new loan pilot programs are backing working lands entrepreneurs and dairy farms that are transitioning to organic production. The Vermont Economic Development Authority had a record 2016 in terms of overall financing as well as agricultural loan approvals.

Pro-Business Initiatives

In pretty much every part of the region, state and local leaders are exploring a variety of ways to grow their economies. The state of Connecticut, for example, builds upon its economic strengths with a variety of programs designed to facilitate growth. Its Small Business Express program gives small businesses access to capital and job training, and has benefited more than 1,500 companies and contributed to the creation or retention of about 22,500 jobs. Meanwhile, the First Five Plus program is designed to boost large-scale expansion or relocation projects, with a focus on generating capital investment and creating jobs. According to a recent analysis of the program, just over a dozen companies have signed up to participate, and they've collectively invested more than $1.3 billion in infrastructure and human capital, creating nearly 3,800 jobs.

The state of New Hampshire is making a variety of ongoing investments to boost innovation. For example, nearly 200 companies were awarded research and development tax credits in the past year. Companies of all sizes are eligible for the state's program, which is based on qualified manufacturing research and development. And the New Hampshire Department of Resources and Economic Development recently landed federal grant money to help businesses expand their global opportunities.

Among the ways Rhode Island supports business growth is the Innovation Voucher program. A recent round of voucher funding is supporting six small companies that have entered into R&D partnerships with local universities. The recipients are involved in everything from life sciences to wind energy advancements to wireless charging of unmanned air and underwater vehicles. Also recognizing that big ideas tend to start small, the publicly financed Maine Technology Institute recently launched a new round of seed grant funding for 19 fledgling tech companies, plus several development loans and TechStart grants. Maine's leadership offered additional signals of the state's intent to keep moving in business-friendly directions — the governor, for example, laid out a proposal to gradually scale back Maine's income tax until it hits zero in 2024.