8th Annual Site Selection Consultants Survey Results

Since less than 50 percent of those responding to our 2011 Corporate Survey say they utilize the services of consultants in the site and facility planning process, we would expect the consultants' responses to differ from those of our corporate executive respondents. Let's find out to what extent they do.

Winter 2012

Fewer than half of the respondents to our 2011 Consultants Survey are working with manufacturing firms, while about the same number (42 percent) are working with distribution and logistics operations. The latter type of firms make up less than a fifth of those responding to our 2011 Corporate Survey. Additionally, about a fifth of the responding consultants are working with data center operations, financial services/insurance firms, and the healthcare and retail sectors (Slideshow, Chart A). These sectors are not significantly represented by the 2011 Corporate Survey respondents.

About 30 percent of those responding to the 2011 Consultants Survey are providing their clients with location studies/comparative analyses, as well as incentives comparisons and negotiations. A quarter of these respondents say they are actually making their clients' site selection decisions (Slideshow, Chart B). In fact, only about a quarter of the responding consultants say that the clients who ask them to perform a location search have already gathered preliminary data. Only a third say their clients have narrowed down the geographic area in which they wish to locate (Slideshow, Chart C).

The respondents to our 2011 Consultants Survey say that those using their services run the gamut from small to large in terms of their employment numbers, with mid-size firms (100-499 employees) being the primary users (Slideshow, Chart D).

Eighty percent of the responding consultants confirm that their clients' executive management is involved in the site selection process, with half noting the involvement of their clients' real estate, tax and finance, and other operational or business units as well (Slideshow, Chart E).

While 38 percent of the respondents to our 2011 Consultants Survey say their clients still plan to open new facilities or expand, despite the sluggish economy, 45 percent say the sluggish economy has caused their clients to put their new facilities plans on hold. More than 30 percent also say their clients are deferring capital spending and seeking ways to optimize current facilities (Slideshow, Chart F).

Importantly, two thirds of those responding to our 2011 Consultants Survey feel the U.S. economy will not improve until 2013 or 2014 (Slideshow, Chart G). However, the responding consultants are actually more optimistic than the 2011 Corporate Survey respondents, 80 percent of whom don't expect the economy to improve until 2013 or 2014.

When and Where Will Their Clients Open New Facilities?

When asked specifically about their clients who do expect to open new facilities, more than 85 percent of the responding consultants say those clients expect to open the new facilities within two years (Slideshow, Chart H). Of their clients planning new facilities, two thirds say their clients are planning only one, and a quarter say they are planning on opening two (Slideshow, Chart I). By comparison, of the corporate respondents planning new facilities, 70 percent are planning between two and five or more.

Many of those responding to our 2011 Consultants Survey are working on domestic location projects slated for the South (Alabama, Florida, Georgia, Louisiana, and Mississippi), accounting for 17 percent of the planned new facilities; for the South-Atlantic states (North Carolina, South Carolina, Virginia, and West Virginia), accounting for 15 percent of the projects; and for the Southwest (Arizona, New Mexico, Oklahoma, and Texas), which will see 12 percent of the consultants' clients' new facilities (Slideshow, Chart J). The Southwest region is also the one predominantly considered by the respondents to our 2011 Corporate Survey.

A quarter of the projects planned by the responding consultants' clients are slated to be manufacturing facilities, and another quarter will house warehouse/distribution operations. About 10 percent each will be headquarters or data centers (Slideshow, Chart K), many more of these last two types of facilities than planned by the respondents to our 2011 Corporate Survey.

The foreign locations mostly under consideration by the clients of those responding to our 2011 Consultants Survey include Asia (accounting for 23 percent of the projects), Mexico (18 percent), and Canada (17 percent). More of the projects planned by the respondents to our 2011 Corporate Survey are planned for Asia (33 percent), but fewer for Mexico and Canada - only 10 percent each. Those responding to the 2011 Consultants Survey say that China is their clients' preferred location for new Asian facilities (46 percent of the slated projects), followed by India (17 percent), and Malaysia (15 percent) (Slideshow, Chart L). Also of note, twice as many of the Corporate Survey respondents than the consultants' clients are planning new facilities for Western Europe (20 percent as compared with 10 percent).

Forty percent of the responding consultants' clients' foreign projects will house manufacturing operations, and 16 percent will be warehouse/distribution centers (Slideshow, Chart M). The respondents to our 2011 Consultants Survey are also working with clients who are setting up back office/call centers, data centers, and headquarters operations overseas. Interestingly, none of those responding to our 2011 Corporate Survey say they have plans for a foreign headquarters operation.

Nevertheless, 70 percent of those responding to our 2011 Consultants Survey say they have not seen an increase in the number of companies establishing foreign facilities as opposed to domestic ones over the last year (Slideshow, Chart N). And 35 percent also say that some of their clients have engaged in onshoring, i.e., have relocated a foreign facility back to the United States (Slideshow, Chart O) - a far greater percentage than being considered by the respondents to our 2011 Corporate Survey (just 3 percent).

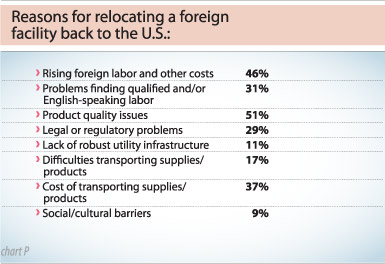

The majority of the responding consultants say that those planning onshoring moves have had problems with product quality coming out of their foreign facilities (51 percent) or are faced with rising foreign labor and other costs (46 percent) (Slideshow, Chart P). On the other hand, 62 percent of those responding to our 2011 Consultants Survey say economic instability is preventing their clients from spending more of their earnings on investment in U.S. facilities, and a third cite high corporate taxes as they reason for this lack of investment (Slideshow, Chart Q).

Do Their Clients Have Expansion or Relocation Plans?

When it comes to facility expansion plans, 84 percent of the responding consultants say that most of their clients who expect to expand facilities will do so within two years (Slideshow, Chart R). A similar percentage (83 percent) of those responding to our 2011 Consultants Survey also say their clients who are planning to relocate have one- to two-year plans (Slideshow, Chart S). A third of the responding consultants say a need for greater proximity to suppliers and/or markets served is behind their clients' relocation plans. Less than a fifth of the consultants cite high taxes, excessive government regulation, or labor costs as reasons for their clients' relocations (Slideshow, Chart T). However, these factors were cited by a much greater percentage of the respondents to the 2011 Corporate Survey as causing them to consider relocating a facility (41 percent cited high taxes and 25 percent cited both excessive government regulation and labor costs).

What Are Their Clients' Site Selection Priorities?

The consultants were also asked to rate the site selection and quality-of-life factors as "very important," "important," "minor consideration," or "of no importance" when helping their clients to make location decisions. The factors were then ranked based on the combined "very important" and "important" ratings. The 2011 consultants' ranking of the factors appears in Slideshow, Chart U.

This year, the consultants have ranked the same top factors in first and second place, respectively, as the 2011 Corporate Survey respondents. Highway accessibility is ranked as the consultants' number-one priority, with a combined importance rating of 98.3 percent. Labor costs is in the number-two spot, with a 96.3 percent importance rating.

Although highway accessibility is the only factor considered "very important" or "important" by more than 90 percent of the 2011 Corporate Survey respondents, more than 90 percent of the respondents to the 2011 Consultants Survey rated their top-five factors as "very important" or "important." Proximity to major markets - which showed the largest jump in importance in the 2011 Corporate Survey, although it is only ranked ninth by those respondents - is ranked third by the respondents to the 2011 Consultants Survey, with a 93.8 percent importance rating.

Like the respondents to our Corporate Survey, the responding consultants rate and rank availability of skilled labor quite high: it's in the number-four spot for 2011, with a 93.6 percent importance rating. On the other hand, availability of unskilled labor is near the bottom of the consultants' list of priorities, ranking 24th among the 26 site selection factors, considered "very important" or "important" by only about half of the responding consultants.

High unemployment rates may be responsible for the consultants' belief that unskilled labor is universally available and not very important in the location decision. In fact, half of the respondents to the 2011 Consultants Survey say high unemployment rates are making it easier for their clients to find the labor they need (Slideshow, Chart V) - only a third of the Corporate Survey respondents say this is the case. Nevertheless, of those consultants who think the unemployed are lacking skills, 45 percent say they are lacking both basic and advanced skills (Slideshow, Chart W).

Additionally, nearly 60 percent of the respondents to the 2011 Consultants Survey say their clients are dependent on contract or contingent labor (Slideshow, Chart X); only about 40 percent of the 2011 Corporate Survey respondents make that claim.

The available land factor shows the largest jump in importance in the consultants' list of site selection factors for 2011, gaining 7.4 percentage points over the 2010 Consultants Survey, with a 92.7 percent importance rating and ranking fifth among the factors. When rating this factor, perhaps the responding consultants have in mind large tracts, i.e., mega-sites, of shovel-ready or pre-certified sites. In fact, nearly 80 percent of the responding consultants consider the existence of such sites very or somewhat important (Slideshow, Chart Y).

Available buildings, however, is not as important to the responding consultants. This factor is ranked 16th, rated very or somewhat important by only three quarters of the responding consultants (Slideshow, Chart Z). The available buildings factor received an almost identical ranking from the 2011 Corporate Survey respondents. The sluggish economy has apparently increased the availability of facilities.

Energy availability and costs is considered quite important by the respondents to both our Corporate and Consultants surveys. The respondents to our 2011 Consultants Survey rank this factor sixth, with a combined 88.4 percent importance rating.

Project Announcements

Australia-Based Aquatic Leisure Technologies Group Plans Opp, Alabama, Manufacturing Operations

12/11/2025

Teradyne Plans Wixom, Michigan, Robotics Operations

12/11/2025

Robinson Plans Altoona, Iowa, Manufacturing Operations

12/11/2025

BioTouch Expands Columbus, Georgia, Operations

12/11/2025

Natrion Plans Erie County, New York, Battery Components Operations

12/11/2025

Czech-Based GZ PrintPak Expands Mount Pleasant, Wisconsin, Manufacturing Operations

12/11/2025

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Rethinking Local Governments Through Consolidation and Choice

Q3 2025

-

Lead with Facts, Land the Deal

Q3 2025

-

How Canada Stays Competitive

Q3 2025

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025

-

America’s Aerospace Reboot

Q3 2025

-

The Permit Puzzle and the Path to Groundbreaking

Q3 2025