Area Development discussed middle market investment strategies with Kate Crowley, Principal, Baker Tilly, following her “Investment Decisions in the Middle Market” presentation at our Women in Economic Development Forum. Interview conducted by Margy Sweeney, Founder and CEO, Akrete, Inc. and Area Development Editorial Board member

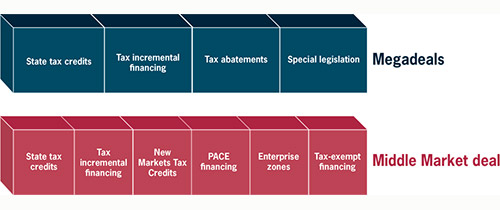

Many large mega-deals have been in the news lately, wherein companies making investments in the billions of dollars have received incentives covering 20, 30 or even up to 40 percent of their project costs. For example, Foxconn’s $10 billion investment in Wisconsin is expected to create 13,000 jobs, and the company was awarded a $4 billion incentive package! Mega-deals such as the Foxconn project benefit from state tax credits, tax incremental financing, tax abatements, and often special legislation.

Middle-market companies, on the other hand, are defined as those with revenues between $5 million and $250 million. If your company is considered a middle-market business and you’re considering a major U.S. expansion, there are many types of financing programs available to you as well. These also include state tax credits and tax incremental financing, and may also include New Markets Tax Credits, PACE financing, tax-exempt financing, and benefits afforded by locating in an Enterprise Zone. Incentives vary depending on where your business chooses to locate.

Needless to say, jobs are king for state governments. So if your company is creating jobs — especially those that pay wages that can support a family — states will provide more funding and may provide assistance with recruiting and workforce training, either on the job or at local academic institutions.

Federal incentives, which are geared toward community development, may also be available. If your company is doing environmental cleanup on a site or is energy-efficient or is creating jobs in an economically depressed area, the federal government is there to help. Federal incentives on top of state and local incentives could add up to covering 20 or 30 percent of project costs.

One of the newest programs available is Opportunity Zones. These were added to the Tax Cuts and Jobs Act in December 2017, although the IRS has still to provide complete guidance on this new funding tool. Your company is advised to meet with its tax advisor — who should be on the location team — in order to realize the program’s benefits, which could include deferral or partial forgiveness of capital gains.

It’s also important to start investigating incentive programs as soon as your company starts thinking about an expansion project. And your company should also take advantage of the expertise of state and local economic developers. They are the conduit for the business community in the prospective location.

Editor's Note: Area Development’s Women in Economic Development Forum featured a presentation on the growth of middle-market companies by Kate Crowley, a principal with Baker Tilly. The preceding were some key topics from Crowley’s presentation and subsequent interview as compiled by Geraldine Gambale, Editor, Area Development.