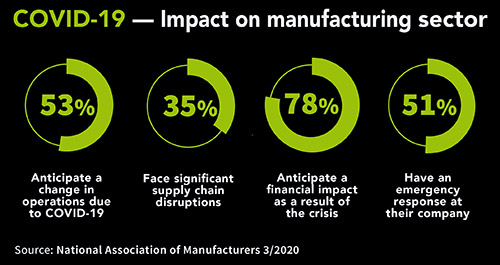

The “now” response reflects the immediate reality for businesses – survival. An early March 2020 poll by the National Association of Manufacturers showed 35 percent of manufacturers are facing significant interruptions in supply chain operations, though only 51 percent had an emergency response plan in place. Filings for unemployment claims by mid-April soared to levels not seen since the Great Depression. Yet, even as companies respond to short-term disruption in operations and in the lives of their employees and communities, business leaders are looking ahead to implement effective changes they can make to their businesses when the economy begins to recover.

Strategies for “Now”

In the near-term, the survival filter applied to operational focus draws attention to three key areas:

- Finances

- Inventory and logistics

- Strategic planning and operations (including people)

The Coronavirus Aid, Relief and Economic Security (CARES) Act provided substantial support to individuals, small businesses, and the healthcare sector, and Congress is likely to consider further stimulus legislation. Businesses need to stay in close contact with their legal, banking, and professional advisors since new COVID-19 response programs will be added and existing programs will evolve to meet local needs.

Even if businesses think their cash flow is adequate at present, they should seek out their banker and look into expanding credit lines to be better prepared for any interruptions or declines in cash flow should government assistance be insufficient for their organization’s cash coverage needs.

Most middle market companies, and often their larger global counterparts, have limited visibility into their extended supply chain. Shifting to inventory and logistics, companies need to examine their supply chains and identify where they might be short on key items. Most middle market companies, and often their larger global counterparts, have limited visibility into their extended supply chain — i.e., Tier 2, 3, and even Tier 4 suppliers. This visibility and knowledge is essential, especially in a time of supply chain disruptions as experienced in the last two years: first with trade tensions and now with COVID-19.

In practical terms, a company may have a Tier 4 component manufacturer as part of its bill of materials and — should that Tier 4 fail to deliver on its commitment to the Tier 3, who fails the Tier 2, who compromises the Tier 1 — that company is now exposed. Companies need to be aware of the entire flow of materials, their suppliers, and countries of origin to be able to respond effectively to supply chain interruptions, whether they are pandemic-related or otherwise.

Strategy planning and operations is a focus on the current state of operations and scenario planning — including staffing scenarios. Companies need to make data-driven decisions that inform how the business is operating. Companies are also adjusting to increased remote work; do they have the right workforce technology in place? How does working from home affect human resources, morale, and team unity? How do employees stay connected and engaged, even though they are not working side by side? This all takes effort and deliberate leadership to maintain, if not strengthen, a corporate culture in a time of such massive scale disruption.

Even as companies quickly shift how they did business, making sure they support both their employees and their customers, they have had to focus on cybersecurity hygiene. Companies and individuals must be vigilant in the face of criminals and bad actors who are always looking to steal data, disrupt systems, or undermine an organization’s reputation and credibility. Bogus vendors will take advantage of the unsettled environment as companies look to fill supply and resource gaps.

Strategies for “Next”

As companies deploy “now” solutions, their attention quickly begins transitioning onto sustaining the business in the mid-term. If key supplies are lacking inventory or consumers, companies may not be able to fulfill certain contracts. Taking care of customers is an essential consideration for businesses at a time when so much energy is being applied to survival. Communicate with customers; be proactive and let them know of any negative ramifications to supplies or commitments previously made. Perhaps utilize the opportunity to discuss how to protect them, securing different payment terms that help increase control over the company’s supply chain and secure necessary items to fulfill client obligations.

In the short- and medium-term, many businesses will need to evaluate their workforce needs. Should there be a need to decrease workforce, what are the impacts to production and does this affect the company’s eligibility for the PPP (Paycheck Protection Program) from the CARES Act? If the company had previously received an economic development incentive for job creation and capital investment, review what was received, and, if needed, amend it to reflect the current conditions.

Strategies for “Later”

Shoring up the business and people in the short term and making adjustments for the medium term will better prepare a company for the recovering economy. This is when companies will focus in part on which types of suppliers are best suited to shift manufacturing back to “the Americas,” including the U.S., Mexico, and Central and South America. The sector does not matter — what matters is the type of business.

Let’s focus on three types of products and explain which are best suited for a reshoring or near-shoring shift:

- Freight-intensive

- Capital-intensive

- Labor-intensive

Capital-intensive products use high-precision machine operations and automation, with a small amount of manual labor. Examples would be manufacturing a car’s drive train and steering system. Many of these types of products have been made in low-wage countries for many years, but interest is skyrocketing in reshoring or near-shoring these operations. Why? Because serious supply chain disruption — whether due to a natural disaster or a pandemic — makes the decision to depend on a supplier in a low-wage country begin to look like an expensive decision. It makes sense then to consider reshoring or near-shoring manufacturing of these types of products, even when moving this manufacturing may be difficult and expensive in the short term from an operations perspective.

Labor-intensive industries include agriculture, mining, hospitality, and food service production. Automation investments to replace human labor in these industries often do not make business sense. Many of these types of products are still made in China or other Asian countries, but as the price of labor increases in these countries, the appeal of moving production closer to the U.S. increases — assuming a business can find a capable operator for a site, the right equipment, and find, hire, and train the right people from local populations.

Shoring up the business and people in the short-term and making adjustments for the medium-term will better prepare a company for the recovering economy. For U.S. companies, shifting production to Mexico has become an attractive proposition because of (1) the increasing cost of labor in China; (2) increasing freight costs; and (3) disruptions due to trade disputes, natural disasters, and now the pandemic.

Incentive Programs Target Existing Businesses

Companies are going to have to be far more strategic about their supply chain in the economy that emerges from the pandemic crisis. In recent years, labor drove a company’s site selection decision, since the talent shortage affected most sectors and most regions of the country. As the economy reopens, having reliable local or near-shore suppliers, as well as supply chain redundancy, will drive site selection decisions more than it has in recent years.

Local economic development organizations will respond to that new reality and will focus their limited funds on the core industry clusters in their regions and what they can do to support Tier 2, Tier 3, and Tier 4 suppliers to those clusters.

As states extend their shelter-in-place orders and health officials look for a plateau and decline in the spread of COVID-19, it is impossible to predict how the economy will re-open. One scenario is a delayed recovery that accelerates toward the end of 2020 and into 2021. Equally possible is a prolonged recession that affects financial markets and supply chains well into next year.

In the coming months, successful companies will be the ones that manage their cash flows well, support and protect their employees as they shift to new working environments, demonstrate their continued value to customers, and stabilize their supply chains. As companies look at their business, how will they leverage this crisis to upgrade their approach in the market after the pandemic subsides? We welcome your insights; please share your stories with Kate Crowley and Jeff Jorge.

Note: Baker Tilly regularly updates its list of federal, state and local government financial assistance available to businesses impacted by COVID-19.