Hiring Profiles

Increasing automation has not yet completely disrupted the traditional hiring profiles for manufacturing companies. However, it is creating demand for positions with dramatically different skill profiles. The need for historically commonplace manufacturing roles that focus on one or two discrete, repetitive, and often burdensome tasks — such as assemblers, maintenance mechanics, machine operators, drivers, and general production workers — may be diminished slightly over time but will not disappear completely. Yet, these positions will increasingly require a skill set that evolves to support the complex technologies enabling more automated manufacturing operations.

For example, at the Toyota Assembly Plant in Georgetown, Kentucky, an advance in technology has made an existing part of the assembly process more efficient while creating the need to retrain incumbent workers, providing them with new skills. Collaborative robots, also known as “cobots” or robots specifically designed to work side-by-side with humans, have appeared alongside the assembly team that is charged with producing fuel tanks. Nearly the same number of human employees that existed before the cobots arrived are still on the assembly line; however, many of these are designers of the new devices, and the other employees’ roles have changed to overseeing the often painstaking tactile and visual inspections required to check for flaws in the fuel tank, including any holes or weaknesses in its connection to the critical fuel line. The cobots have streamlined the assembly process but have not erased the need for humans who are necessary to support and monitor the new, more highly automated systems. In terms of site selection, markets exhibiting a demonstrated ability to re-train existing workers — while concurrently developing a pipeline of new talent coming out of secondary schools, vocational programs, and community colleges — stand to enjoy a competitive advantage in attracting new companies and growing existing ones.

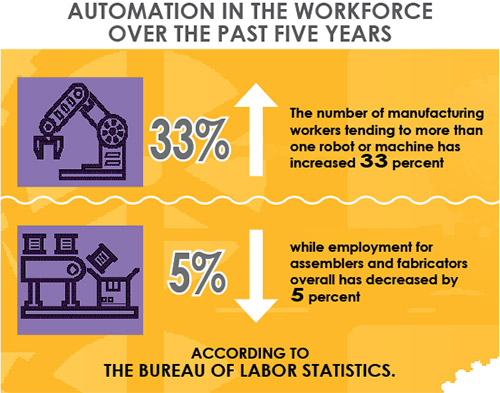

Overall, as more machines and robots are integrated into manufacturing, the need to oversee and maintain these has increased. Over the past five years, the number of manufacturing workers tending to more than one robot or machine has increased 33 percent, while employment for assemblers and fabricators overall has decreased by 5 percent, according to the Bureau of Labor Statistics. This suggests not only a slightly diminished demand for traditional assembly workers, but also a re-skilling of labor to be able to support ongoing automation. Additionally, CBRE Labor Analytics forecasts that over the next 10 years, an additional 23,000 jobs will be created nationally for workers overseeing robots and automated equipment in manufacturing facilities, representing a 21 percent increase over today.

As many manufacturing roles are being “up-skilled,” employers are also seeking out qualified candidates with skill sets that were previously not part of the typical manufacturing workforce. These new roles are necessary to support the integration and maintenance of technology into the manufacturing process. They will be responsible for helping to build, program, monitor, calibrate, maintain, and repair the machines and technology that enables automation. In addition to technical acumen, these workers will need to possess many skills that are more akin to those possessed by knowledge workers, including complex problem-solving, mental elasticity, and critical thinking.

Changing labor needs will have real impacts on site selection as manufacturing companies begin moving away from a primary focus on hiring almost entirely for general skill sets that are relatively easy to find in most markets. Because of the near ubiquity of traditional manufacturing skill sets, manufacturers have historically tended to focus site searches based more on labor cost than labor availability or quality. This will begin to change as more specialized skill sets are required to operate the highly technical machinery and systems driving advanced manufacturing. Not all markets will possess a deep pool of candidates with the specific technical acumen and cognitive capacity that the new processes require. It’s expected that the ratio of technical to non-technical skill sets needed on the manufacturing floor will only increase over time, favoring those markets that have a workforce trained to meet this need.

Advanced Manufacturing’s Site Selection Process

Technology and automation are indeed shaping decisions around where manufacturing companies locate and expand. The following is a sampling of tactics being utilized by site selection teams as their location needs change:

- Skills > Job Title

As advanced manufacturing job roles quickly evolve, a skills-based approach to assessing the local workforce becomes more valuable than measuring only the total count of legacy manufacturing occupations. Occupation-based data is typically slow to adapt to industry changes, and that metric alone is an incomplete barometer of a labor market’s potential that often omits potentially qualified employees in other occupations with relevant skills that can be easily cross-trained.

- Competitive Landscape

This allows site selectors to assess which markets have a well-established manufacturing innovation ecosystem and the right mix of supply-chain providers. Understanding which companies a manufacturer historically competes well against for talent helps in formulating a competitive market-entry strategy.

- Educational Assets

It’s increasingly important to uncover the full picture of the size and relevance of all formal education programs and training pathways that exist in a market to ensure a sustainable pipeline of quality talent trained in the relevant skills.

- Market Longevity

Statistical forecasting can be utilized to conduct a pressure test of all candidate markets to understand their ability to accommodate continued scaling of the qualified workforce. This is a risk assessment that helps manufacturers “future proof” their location decisions.

- Community Visits

Since many critical location factors for advanced manufacturing are changing rapidly and are more difficult to assess using desktop data alone, it’s increasingly important to spend time visiting each finalist market to empirically collect data and gain a deeper understanding of the nuances of local labor markets, manufacturing clusters, and supply chains.

As technology rapidly evolves and new equipment and processes are added to manufacturing operations, the training (and re-training) of local workforces will be critical to ensure a readily available pool of quality labor. Education providing literacy of new technologies and cognitive capacities such as data analytics and systems thinking will be needed for the advanced manufacturing workforce, and many traditional educational programs at all levels are not currently meeting this need. As a result, the gap between emerging jobs and workers with the requisite skills continues to expand in the manufacturing sector creating an acute labor shortage.

In terms of site selection, markets exhibiting a demonstrated ability to re-train existing workers — while concurrently developing a pipeline of new talent coming out of secondary schools, vocational programs, and community colleges — stand to enjoy a competitive advantage in attracting new companies and growing existing ones.

Manufacturers, and their site selection consultants, will be seeking to understand the depth and type of workforce training initiatives in individual states and communities. The most attractive locations will possess manufacturing-focused STEM education that has a direct connection and adaptability to the ever-changing skills needed in today’s manufacturing environment. Appropriate education and training should be provided at all levels including elementary through high school, technical training programs, re-training, apprenticeships, and postsecondary education.

In addition to the types and subject matter of the education pathways, the total number of trainees passing through these programs will be of the utmost importance during the site selection process to fully grasp the potential size of the talent pool for advanced manufacturing roles. Even the best, most innovative training programs will struggle to attract the attention of manufacturers if their graduate output represents only a negligible percentage of the region’s workforce.

Locations can also develop a talent pipeline for advanced manufacturing by actively working to change the perception of manufacturing as a desirable career choice among secondary and postsecondary students. Many young people who stand to benefit from the higher-paying, technically-skilled jobs available in advanced manufacturing are bypassing these opportunities due to outdated presumptions that jobs in this industry remain mostly repetitive, laborious, and low-paying. However, many of the jobs available in manufacturing today have similarities to the highly sought-after jobs of the tech and software industry. In fact, according to the Bureau of Labor Statistics Occupation Employment Statistics database, 10 percent of all U.S. software developers and programmers are presently employed in the manufacturing sector. The difference being that, unlike in many other sectors, these technical positions in manufacturing often do not require a four-year college degree. The ability to expand the pool of available talent for manufacturing through these types of perception-changing efforts begins as early as the elementary or middle-school level in many areas in order to educate students, parents, and even school guidance counsellors on the changing career opportunities in advanced manufacturing.

Supply Chain Access

Advanced manufacturing supply chains are, in many ways, no different than those for more traditional manufacturing. They include a complex constellation of large and small manufacturers, raw materials producers, logistics firms, and an array of vendors providing other support services. However, access to many of these providers becomes even more critical when considering advanced manufacturing. As technology rapidly evolves and new equipment and processes are added to manufacturing operations, the training (and re-training) of local workforces will be critical to ensure a readily available pool of quality labor.

For example, the advent of additive manufacturing/3-D printing has created a renewed ability to cost-effectively focus on small-batch manufacturing. Co-locating near suppliers, for instance, allows companies to be more efficient and flexible in managing the production process, which can reduce risk related to fulfillment times. For 3-D printing, there is often a single source vendor for a variety of parts providing manufacturers with less risk, more control, and greater agility. However, as a still emerging process, the density of quality vendors in this space is not equally dispersed across all markets, thus making access to these partners a critical part of any advanced manufacturing location decision.

In addition to seeking access to suppliers and vendors, advanced manufacturing companies are deriving benefits from clustering with other similar entities, including direct competitors, into what could be called manufacturing innovation ecosystems. This agglomeration effect brings together large manufacturers, startup companies, and high-tech enterprises that together can be sources of disruptive innovations generating new products, processes, and business models, and even lead to opening new markets for expansion.

In terms of location preferences, this tends to benefit locations with existing and growing advanced manufacturing clusters that have a well-developed supply chain, an existing advanced manufacturing ecosystem, and most likely a deep and qualified pool of labor.

Incentives

Finally, economic incentives play a part in many manufacturing location decisions. The rise of advanced manufacturing is changing the way that site selection consultants are evaluating these opportunities. Especially in the future, new methods of manufacturing may rely less on labor and more on capital investment in high cost equipment, including robotics and industrial-grade 3-D printers. The localities that have updated their incentives programs to accommodate this shift are often more appealing to advanced manufacturers considering new facilities. For example, programs that place a value on capital investment over total employee count may be more appealing to these companies.

Likewise, the previously mentioned shift to a more technically skilled labor force has also led many companies to place a higher value on training grants that ensure access to a qualified talent pipeline and lower a company’s training costs. Ideally, the locality would also be open to developing a partnership that allows for a longer-term training relationship that adapts to the company’s evolving talent needs.