Who's Got Talent? Skilled Labor and the Location Decision

While immediate financial concerns may cause companies to shift focus, skilled labor still drives long-term success.

June/July 09

The Case for Skilled Talent

The survey asked for the most critical items in selecting sites. The term "site" can be used to narrowly refer to the selection of a specific plot of land or facility. On the other hand, the term "site selection" or "site selection process" can broadly refer to finding new business locations with all the attendant concerns, both strategic and tactical. Strategic questions - Why do we need this location? How will we define success? How might our needs change? - involve many factors, and skilled labor may be one of the most important.

Before we jump into the importance of skilled labor, it is useful to further define the term "labor" itself. In a broad sense, labor includes anyone who works at a location. However, some of the employees are indispensable to the success of the business. This can include managerial, scientific, financial, professional, or technical talent. At base, these people are required for any measure of success. At best, they drive excellence.

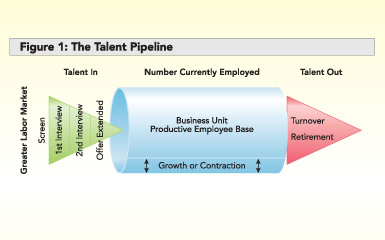

Access to skilled talent can be of utmost importance when making strategic location decisions. Figure 1 shows how employees filter through the employment lifecycle - from initial exposure to the labor market, through screening and evaluation, to and including productive employment, and ending in turnover or retirement.

Clearly, a robust labor - or talent - market needs to exist for this model to perform adequately. Financial services, high-tech, pharmaceuticals, aerospace, automotive, medical devices - all of these industries require this pipeline remain viable. Indeed, the breakdown of this pipeline can cause a company to move out of a community.

Moreover, companies need to understand how effective this talent is at a given task for a given price. Without this knowledge, predictions for success in a current or future community lack empirical basis.

So, how do companies evaluate the pool of skilled talent in a community? Simply put, to attract any given industry or use, the location needs to be able to answer three key questions for any and all of a series of key occupations:

1. Is it already here?

2. Can we develop it ourselves?

3. Can we attract it here?

Communities can ask themselves the same questions when trying to identify best-fit industries and uses.

Do We Already Have It?

The size of the overall labor market is usually easy to determine. Labor force statistics and general demographics provide insight into both the existing base as well as the expected dynamics. After all, it takes 20-45 years to make a 20-45 year old. Hence, we should be able to look at current year statistics for 10-year-olds of a particular population to estimate the size of the 20-year-old labor force within 10 years (in- and out- migration aside).

Additionally, companies are extremely interested in the availability of experienced individuals with sets of defined skills. These defined skills - cleanroom technician, machinist, international benefits specialist, medical claims officer - can involve many years of specialization. The difference between finding an exact match and an approximate match can mean either having to hire multiple people to fit one role or otherwise introduce unacceptable operational risk into key business processes.

While commercial data captures talent availability for some occupations, it lacks in specificity for others. Moreover this data can be difficult to obtain even in its imperfect form. The U.S. Bureau of Labor Statistics collects this data on a rolling and periodic basis. This means companies must compare communities at different points in time, using aged data.

Another indicator of talent availability is the number and types of companies already operating in a specific area. Paying attention to plant expansion, relocation, and downsizing notices provides insight into both opportunities and risks in candidate communities.

On-the-ground evaluation is a critical tool in the site selection process. It can provide best practices on where to find talent, local customs and regulations, as well as salary and other compensation. It can even provide information as to how to arrange and operate the workplace in order to maximize employee effectiveness.

Project Announcements

Eurofins Lancaster Laboratories Expands Lancaster County, Research Operations

01/03/2026

Valerie Health Plans Chattanooga, Tennessee, Operations

01/02/2026

Samsung Biologics Plans Rockville, Maryland, Manufacturing Operations

12/31/2025

Kraken Technologies Limited Plans New York City Headquarters Operations

12/29/2025

Lupin Expands Coral Springs, Florida, Operations

12/29/2025

KPPC Advanced Chemicals Expands Casa Grande, Arizona, Operations

12/29/2025

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Rethinking Local Governments Through Consolidation and Choice

Q3 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025

-

The Permit Puzzle and the Path to Groundbreaking

Q3 2025

-

Supply Chain Whiplash Reshapes CRE

Q3 2025