The rest of the world is watching as the United States finds solutions to keep the society humming, looking both for technologies that can be exported and for opportunities to invest here. The mix of conventional and renewable energy solutions may provide one example of how to translate smoothly into a sustainable global future. International investors are watching, and in some cases they are actively looking to the U.S. to be their laboratory, their testing ground, and their growth market.

The United States provides access to a large stable market of 315 million with comparatively low political, legal, and economic risk. The country has a strong logistics infrastructure for distribution and skilled workers to produce goods and provide services. The country’s access to additional markets — through free-trade agreements like NAFTA — enlarges the market into the North American continent (444 million per 2012 statistics) and beyond. This makes the U.S. the largest recipient of foreign direct investment (FDI), according to the U.S. Department of Commerce report issued October 2013.

How Does Energy Drive Innovation and Investment?

Stability in energy costs is an attractive feature for any company seeking to establish or expand. Depending upon the nature of the business, and particularly for manufacturing companies, the cost of energy is a significant operational component. For companies that have processes depending upon natural gas, the projections of cost reduction in the U.S. are extremely attractive.

Domestic cost of energy: According to the U.S. Energy Information Agency (EIA), between 2007 and 2012, U.S. prices dropped nearly 60 percent, as production rose and new reserves were uncovered. Prices per Btu among propane, distillate fuel oil, and natural gas are projected to fall in each category through 2015 as compared to 2011 prices.

Certainly this is due to a combination of efforts, including:

- Federal, state and local government policy;

- Technical innovation;

- Energy efficiency in residential and commercial real estate and in transport; and,

- Discovery and capture of natural gas through new technologies such as hydraulic fracturing.

Programs and support by the federal and state governments:

Due to the global recession, many subsidies used to support development of new energy production and distribution in Europe have been reduced or eliminated. The U.S. is in the midst of this same debate on how to spur new private investment and where government investment should be best placed.

Many current programs stem from The American Recovery and Reinvestment Act of 2009, which, among other things, sought to focus investment on infrastructure and energy efficiency and production, while stimulating the economy. There are, however, numerous current programs that assist in building energy production capacity, renewable and nonrenewable. Primary among them are:

- Business Energy Investment Tax Credit is a federal corporate program for businesses that install solar, fuel cell, and small wind turbines (30 percent tax credit), and/or geothermal microturbines and combined heat and power systems (10 percent tax credit), among other eligible renewable technologies.

- U.S. Department of Energy Loan Guarantee Program is a federal loan program that applies to commercial and industrial companies. The amount varies, but the program focuses on projects with a total cost of over $25 million. Repayment is not to exceed 30 years or 90 percent of the projected useful life of the asset to be financed.

- Qualifying Advanced Energy Manufacturing Investment Tax Credit allows a tax credit for advanced energy projects that establish, re-equip or expand a manufacturing facility that produces equipment or technologies used to produce renewable energy, refine or blend renewable fuels, or produce energy-conservation technologies. The credit is 30 percent of the qualified investment.

- Renewable Energy Production Tax Credit offered a federal per kilowatt tax credit (between $0.11 and $0.23/kWh) for generation of renewable energy. This credit expired at the end of 2013, and stimulated considerable build of renewable energy production toward the end of the year.

The U.S. Congress has still to define a long-term energy policy, though there is one proposal to replace current energy tax incentives with two new tax credits for (1) electricity and (2) transportation fuels. Both are technology-neutral and performance-based. The proposal would apply only to facilities placed into service after 2016, though it recommends that current tax incentives be extended until the new credits take effect.

While most people think that all energy advances and innovation are in areas such as solar and wind, the truth is that the U.S. economy is still heavily geared to more traditional, carbon-based and non-renewable sources. Innovation and investment in these areas are still much more readily commercialized and profitable.

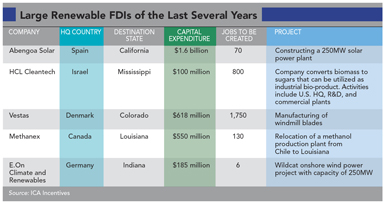

The data on “incentivized” deals, however, begins to show how international markets perceive carbon-based energy investment. ICA Incentives — which tracks awards worldwide since 2010 — contains data on approximately 105 non-renewable energy projects in the United States, with an average capital investment of just under $180 million.

A great number (more than 50) of the energy projects in the United States by U.S. companies involved infrastructure, electricity, extraction, and manufacturing of some kind or another. These represent more than $17 billion in investment and demonstrate how much of the U.S. economy still runs on oil. Interestingly, only a small proportion of these projects were the result of foreign investment — 12 projects covered in the database (about 10 percent) were due to FDI. Roughly a third of these were electric generation, transmission, and distribution investments from gas to serve American power customers. Two were directly driven by partnerships with Canadian oil sands companies. Still others, while being non-renewable oriented, involved administrative and support functions rather than R&D, manufacturing, extraction, or other forms of true energy innovation.

That being said, the largest non-renewable deals in the ICA Incentives database were foreign investment projects. For example, in December 2012, Sasol (a South African firm) announced plans to invest between $16 billion and $21 billion in an integrated gas to liquids and ethane cracker complex in Westlake, Louisiana.

There has been a considerable rebound in the renewable energy market, particularly in solar and wind power, since the financial crisis and recession. Significant cost reduction in technologies has been achieved. However, worldwide investment in clean energy fell for the second year in a row; cuts in European subsidies for clean energy investment fell 41 percent to $57.8 billion according to Bloomberg New Energy Finance. The U.S. fared better, with most occurring due to cost reductions, with an 8.4 percent drop year-over-year. Some of this may be due to policy uncertainty created by the debate over the Production Tax Credit (PTC).

Goldman Sachs notes that through 2012 $600 billion has been invested in the sector and expects that this amount will double in the next 10 years.

Solar: In addition to the slowdown in the economy, there has been a flood of foreign-produced product into the U.S. market. This brought down prices significantly, but contributed to the bankruptcy of a number of players in the market including Solyndra. First Solar, with their thin panel technology, took advantage and changed to a utility-scale business model and its profits for 2013 went back up at $450 million. The Federal Energy Regulatory Commission (FERC) calculated that 2,936 megawatts (MW) of solar power capacity was installed during 2013, 21 percent of the total. M&A activity is increasing as evidenced by the TetraSun acquisition by First Solar. The presence of new financing models for residential installation also has contributed to the strengthening market. Rooftop installation companies like Solar City now finance installation to move product into the marketplace.

Wind: M&A activity in the wind power generation sector has surged. Cleantech Group noted that “161 acquisitions of wind assets have been announced in 2013 thus far, a 9 percent increase on the 148 announced in 2012.” Bloomberg analysts predict a “a bounce back in wind installations in 2014 after last year’s lull, and public market investment should continue at 2013’s higher level.” FERC calculated that 1,129 MW of biomass capacity was installed in the U.S. during 2013, 8 percent of the total. Industry technological improvements have also modestly lowered the cost of production. Spain’s Iberdrola, Germany’s Siemens, and the United States’ Next Era are some of the top companies within wind power generation.

Biomass: BioMass magazine reports that 10 percent of the world’s energy budget is supplied by biomass, of which 30 percent is used industrially. FERC calculated that 777 MW of biomass capacity was installed in the U.S. during 2013, 5 percent of the total. From a renewable standpoint in the U.S., ethanol production is best known. Stimulated by the Energy Independence and Security Act of 2007 (EISA), U.S. ethanol production has grown from less than 10 billion gallons per year to nearly 14 billion, where production has plateaued, with drought being a factor. Though research is developing ways to convert waste-to-energy with lowered carbon emissions, these technologies are not yet widespread.

Fuel cells: Yet to find broad commercial viability, technology advances continue with fuel cells creeping into the market for stationary, megawatt generation in server farms for investors like Google and Yahoo. Fuel-cell cars have started to be available in the selected consumer markets using hybrid technology. Honda’s FCX Clarity is available for lease now, with the Toyota FCV and Hyundai Tucson planning rollout in 2015.

Mercedes promotional video with celebrities drinking their car’s emission in Death Valley.

Infrastructure build-out remains an issue for large-scale renewable energy production. Expanding the grid to handle multiple sources and convey electricity from power generation sites to population centers is an enormous challenge. Building-out hydrogen fueling stations to enable widespread usage of fuel cell vehicles is a considerable expense as well. Distributed energy, where energy is produced and consumed at or near the source, remains promising but needs investment to reduce installed prices and build scale.

Winds of Change

Overall, many of the trends above will be driven by both the costs of fuels and the market’s acceptance and even embrace of new technologies. However, even though the nation continues to rely heavily on carbon-based technologies, the winds of change are clearly blowing toward a sunny tomorrow. The world continues to look to U.S. innovation as it brings new ideas to the nation’s shores.