Industrial Production Picks Up Over the Month

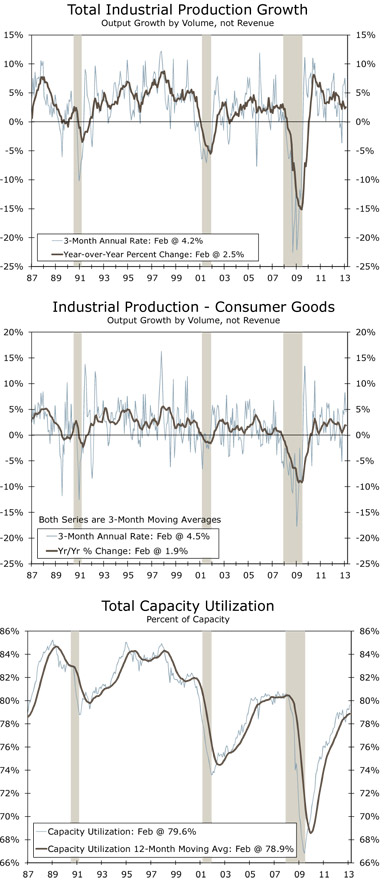

Industrial production increased 0.7 percent in February, exceeding expectations of a 0.4 percent gain. In addition to the better-than-expected headline, output in November and January was revised higher. Following an upwardly revised 4.9 percent increase in January, utilities output rose 1.6 percent in February. Utilities output bounced around over the prior two months due to warmer-than-average weather in December, but temperatures nearer to their long-term averages in January and February led to a more modest gain in February. The 0.8 percent increase in manufacturing output was more encouraging. This reversed January’s 0.3 percent decline with a pickup in both durable and nondurable industries.

Across markets, production of consumer goods rose for the fourth consecutive month. Consumer durables rose 1.7 percent, as automotive and home electronics partially rebounded from a pullback in January. Consumer spending has held up a bit better in light of higher taxes so far this year, which may have encouraged businesses to increase production in February. The average age of consumer durable goods is at a post-World War II high. Pent-up demand should support further gains in this category as rising asset prices help consumers feel better about their financial position. Output of business equipment also saw broad gains and is now up 6.6 percent over the past year.

Capacity utilization across the industrial sector rose to 79.6 percent, reversing last month’s dip. The gain represents a new cyclical high, but capacity utilization remains 1.2 percentage points below its 2007 level. Utilization rates in February rose for the manufacturing and utilities sector, but dipped for mining industries. Production in mining fell 0.6 percent in February, the third straight month of decline. The pullback has primarily stemmed from reduction in crude oil extraction. However, thanks to the shale gas boom in recent years, mining output remains well above its prerecession level while manufacturing production has yet to fully recovery.

Business Spending Set to Improve over 2013

Today’s report substantiates some of the firming we have seen in the PMI reports. The ISM manufacturing index rose to its highest level in a year and half in February, while the bulk of the regional PMIs have moved into expansion territory. In a separate report released this morning, the Empire State Manufacturing Survey showed that factory sector activity in New York continued to expand at a decent pace in March. Capital expenditure plans also seem to be improving among businesses. The Empire survey showed spending plans accelerated further in March, while a growing share of small businesses reported plans to increase investment in February. We expect business spending to gradually pick up over the year as the U.S. and global economies strengthen.