In other words, the process for determining optimal locations for new business operations is becoming a “both…and” proposition, where clients want to know that their chosen market affords optimal conditions for supporting successful talent attraction and retention on day one, as well as “future-proofing” their decision to ensure that conditions remain favorable over the longer term.

The CBRE Labor Analytics team’s approach to predicting the shifting fundamentals of a labor market is mostly science…with some art. While market forecasting is based on regression modeling and other predictive analytic techniques, it also benefits from combining these forecasts with an historical knowledge of the nuances and unique traits of each labor market to better understand how they may be uniquely impacted by future trends.

Longevity and Scalability

Clients generally frame their concerns about a market’s long-term sustainability in a series of questions related to a market’s longevity and scalability. The themes we commonly hear from our clients boil down to these four questions:

- How much will I be able to scale my headcount in this location?

- How many years can I be successful in this market?

- What wage levels will I need to pay to remain competitive?

- Should I renew my lease in this market?

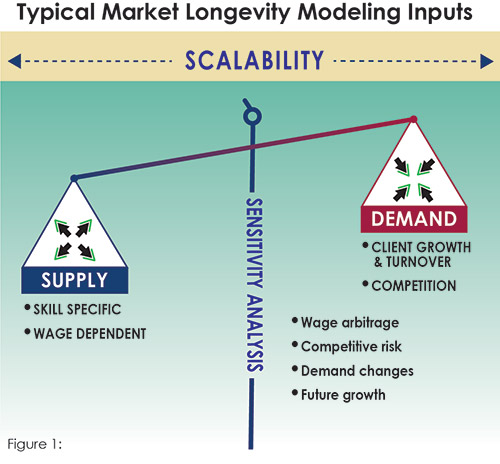

Developing an informed perspective on these questions benefits from a dynamic risk approach to market forecasting. The first step in this process is creating projections of key high-level supply and demand factors that will have a material impact on a market’s future talent availability and cost structure. For example, a favorable future market would provide a sizable and growing pool of desired skills, limited growth in hiring demand from competitors, and sustainable levels of wage growth.

Some of the specific forecasted factors that can be used as inputs to estimate a market’s potential longevity and scalability (i.e., future risk) include:

- Supply side: employed candidate pool/skill set, annual labor force growth, turnover/attrition rates, unemployment rate, etc.

- Demand side: headcount growth of the competitive set vs. client’s expected hiring demand

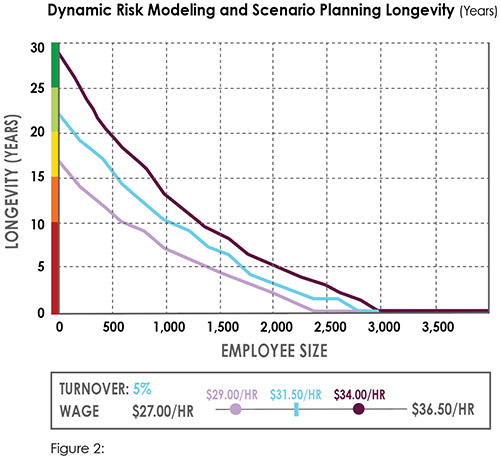

This approach also lends itself to scenario planning, wherein the client can visualize how market risk is impacted by potential changes to internal and external factors, including changes to client’s expected pay scale, its ability to increase its own hiring (i.e., scalability), assumptions regarding the hiring needs of competitors, and changes to other macroeconomic indicators such as the unemployment rate and overall turnover rates.

While economic forecasting is never 100 percent accurate, this approach does empower clients to make informed decisions regarding a market’s potential risk based on the continuation of current trends and the likely impacts of other exogenous factors such as a spike in hiring by a direct competitor or a major upswing in unemployment due to an economic recession. The client can enter a new market with greater confidence regarding the range of potential outcomes in the local market and how its hiring plans and compensation approach fit into this bigger picture.

This type of modeling could never have predicted cataclysmic societal and economic events such as the COVID-19 pandemic and resulting economic downturn, but it does allow the client and consultant team the flexibility to model likely market conditions under a range of possible outcomes, including rapid broad-based macroeconomic shifts.

A company’s worst-case scenario would be to enter a new market only to run up against talent scarcity, high turnover, and rising wages shortly after it arrives. Current Unprecedented Labor Market Uncertainty

Given the unprecedented labor market uncertainty resulting from COVID-19, CBRE’s predictive analytics is using our historical knowledge of the industry composition of U.S. markets as an input to risk modeling to understand each market’s degree of exposure to the economic ramifications of the current crisis. The impacts will not be felt uniformly across all geographies at the same time.

Specifically, we’ve divided industry sectors into three buckets: “first wave,” “second wave,” and “resilient” industries based on the likely timing and degree of impact. Markets that are heavily comprised of first wave industries (e.g., hospitality/tourism, retail trade, passenger transportation, etc.) are likely to see the earliest spikes in talent availability and possibly the first to see downward wage pressure. Markets with a higher percentage of existing employment in second wave industries may remain more stable initially, but as negative impacts ripple through the economy more broadly, these industries are also likely to be significantly impacted by employer downsizing. Some markets may be overly exposed to both first and second wave sectors. Finally, markets with a higher representation of resilient industries (e.g., B2B technology, government, and some areas of healthcare) may in the near to mid-term see comparatively less of a rise in unemployment than other markets.

The likely differences in timing and severity of impacts will vary across industry sectors, and the effects on specific markets will depend largely on each region’s industry composition. This becomes another input into the modeling of future market conditions as we attempt to highlight potential changes to talent availability and cost.

Avoiding Undesirable Outcomes

Companies invest a significant amount of time, money, and other resources when selecting and eventually opening a new location. Through these efforts, they’re seeking long-term returns on their investments and a degree of confidence that they’ve put down roots in a location that will sustainably support long-term growth and success. The worst-case scenario would be to enter a new market only to run up against talent scarcity, high turnover, and rising wages shortly after they arrive. Predictive modeling that supports workforce future-proofing can be utilized to avoid these undesirable outcomes.

As more data becomes ubiquitous and easily accessible, clients will look to their site selection consultant partners for their unique assessments of future market conditions. While no one has the proverbial “crystal ball” to predict the future, the modeling of key supply and demand factors, combined with an historical understanding of each market’s unique economic and talent composition, will go a long way in providing clients with a greater degree of confidence when making their long-term talent-driven site selection decisions.