Over the last few decades this feedback loop has kicked into overdrive as businesses and talent feed off each other in “superstar cities.” But instead of being fueled by manufacturing, as was the case during the industrial revolution, this trend is now driven by innovation, tech, and the service-based economy.

But one direction of the loop may be slowing. Talent is the number-one need of businesses. And there is only so much talent that can fit, or more accurately, afford to live, in the superstar cities and other major metros. As a result, businesses are being forced to go to where the talent is. And mid-size cities have been standing at the ready.

Affordability Is Key

In a recent quarterly earnings call, Twitter CEO Jack Dorsey spoke bluntly about the difficulties of growing a business in the Bay Area. Twitter and other companies are feeling the pain of high-cost real estate, both commercial and residential, and the difficulty of retaining talent in such a competitive market. Dorsey believes the solution is a more “distributed” workforce. One form this can take is more remote workers. But the more traditional form of establishing or expanding a physical presence in a market is also an attractive option.

Talent is the number-one need of businesses. And there is only so much talent that can fit, or more accurately, afford to live, in the superstar cities and other major metros. Many mid-sized markets have the two things growing companies need: affordability and talent. In announcing their withdrawal from San Francisco and shifting 350 jobs to Lehi, Utah, LendingClub CEO Scott Sanborn said, “Growing exclusively in San Francisco simply doesn’t make financial sense. Instead, we now have plenty of headroom to grow affordably in Lehi and access a new talent base in Utah.”

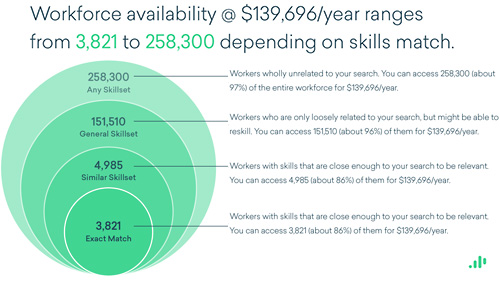

The median annual salary for software developers (applications and systems) in the San Francisco-Oakland-Berkley MSA is $136,696. In the Provo-Orem MSA (which includes Lehi) that salary is $97,091. Emsi’s Talent Supply by Occupation report shows how many workers can be accessed at a given salary in a given market. At a $136,696 salary in Provo-Orem, employers could avail themselves of 86 percent of software developer workers with exact or similar skills. In the San Francisco MSA, the availability at the median salary is 58 percent.

But it’s not just the tech industry that is looking elsewhere. While working in economic development in Spokane, Washington, a common theme emerged among many of the RFIs we received: Seattle-based professional service firms exploring Spokane as a location for back-office operations. One law firm came to the realization that their accountants, paralegals, and HR staff could no longer afford the Seattle market and their commutes were unsustainable. Much of the communication between these staff and their bosses already occurred via phone and email, as did interdepartmental communication. So whether they were sending emails between floors five and seven, or between two different office locations, didn’t make much of a difference. So they began exploring other markets such as Spokane.

Market forces, such as real estate cost, are just one factor pushing investment to mid-sized communities. Industry Clusters, Which Are Really Talent Clusters

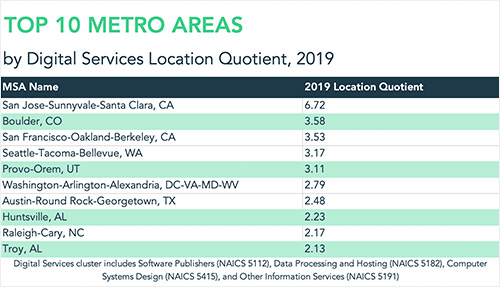

Market forces, such as real estate cost, are just one factor pushing investment to mid-sized communities. Many of these locales have recognized the power of their existing clusters and created their own feedback loops. This is the case in Huntsville, Alabama, with the rocket and aerospace industries. Bucking trends in the automotive industry, the Chattanooga, Tennessee, region has leveraged its auto manufacturing sector and seen significant investment as the electric vehicle market grows.

But industry clusters are first created by the talent that fuels them. Silicon Valley got kick-started by tech talent and innovation coming out of Stanford. As mentioned, talent is the number-one need of companies, so communities with talent-driven economic development strategies are positioning themselves well for investment. One such strategy, harnessing existing assets like higher-ed institutions, is putting communities first in line for companies seeking talent. Consequently, many of the mid-sized markets in the top tier of Leading Locations are university towns: Boulder, Tuscaloosa, Provo-Orem, and Fort Wayne.

Talent clusters emerge not just from education institutions, but from other community anchors such as hospitals or legacy industries. And talent clusters emerge not just from education institutions, but from other community anchors such as hospitals or legacy industries. While not a mid-sized community, this is something Detroit has learned. Examining their clusters from a talent perspective revealed a strength in research, engineering, and design. Only 4 percent of sales from this talent cluster go to transportation equipment manufacturing, contrary to the assumption that it primarily services the automotive industry. Meanwhile, 22 percent of the talent cluster’s sales are to the professional, scientific, and technical services sector; 21 percent to real estate; 14 percent to the federal government; and 8 percent to specialty contractors.

This reveals a talent base in research, engineering, and design capable of supporting a range of businesses and sectors. Building around this talent cluster, as opposed to the automotive industry cluster, positions the community for a far greater diversity of opportunities.

Richard Florida recently noted that, “...the amenity gap between superstar cities and other places has closed, while the housing price gap has widened.” This truth has led to mid-sized markets becoming more attractive to talent. And since it’s talent that businesses most need, these markets are gaining attention. Couple this with an attractive cost of doing business (especially on the real estate front), and this attention is turning into investment.

Sources: Emsi Occupation Snapshot, Emsi Regional Comparison