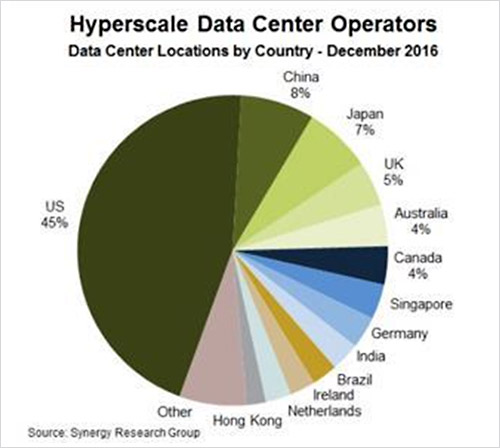

Currently, there are an estimated 390 hyperscale data centers worldwide. The market is estimated to grow to 500 by 2020 with the U.S. to maintain a market share of 44 percent. This unprecedented growth has created new trends in the industry.

Growing Secondary Markets

Historically, data centers have been strategically centered around “NFL cities” like New York, Chicago, Los Angeles, Seattle, and Dallas. Northern Virginia, in the Washington, D.C., region, accounts for more than two-third of 2016’s total 349.7 megawatt net absorption.

Rising consumer demand has caused a spike in secondary markets. Surprising locations like Phoenix, Denver, Salt Lake City, Louisville, Omaha, and Kansas City are seeing a surge in data center development, propelling job growth in these regions. With more people than ever subscribing to streaming services and turning to the internet for social media, the demand for data center service usage is unlikely to slow — causing continued growth in secondary and tertiary markets around the world.

Hyperscale data centers house large amounts of critical information and hardware for big enterprises and their users. Big cloud providers are constantly seeking space in major markets, leasing in record capacity from colocation providers in 2016. The location of a data center is critical to ensuring the facility runs securely and efficiently.

One of the most important things site selectors look for is a safe natural weather environment. Various natural disasters like earthquakes, hurricanes, and tornadoes pose significant risks to data center facilities and the sensitive information they store.

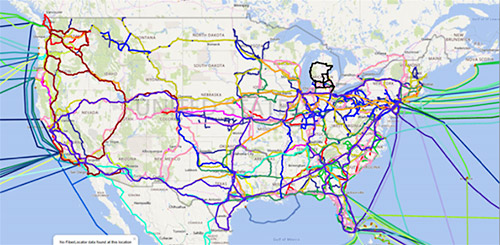

Site selectors are also looking for locations that can offer affordable and quality construction with quick connectivity and easy access to the long-haul fiber networks.

Because data centers now absorb power at alarming rates — the most recent numbers show that U.S. data centers consumed 70 billion kilowatt hours in 2014 — access to renewable energy is a huge priority for large data center facilities.

One of the areas seeing an explosion in interest from big companies for new data center locations is Reno, Nevada. Reno’s popularity with large enterprise users can be attributed to its safe location, proximity to main fiber channels, and access to renewable energies.

Feeling the heat from competition, Google acquired 1,210 acres of land a few miles south of Tesla’s Reno hyperscale data center for $29.1 million. The Wall Street Journal speculates that the land will be used to create a new data center in Reno for Google.

The growth of hyperscale data centers is unlikely to see a slowdown anytime soon. JLL reports that cloud adoption acceleration will double the size of the data center industry over the next five years. Annual global cloud IP traffic will reach 14.1 ZB (1.2 ZB per month) by the end of 2020, up from 3.9 ZB per year (321 EB per month) in 2015. The hyperscale market is expected to grow at an annual compound rate of 26.3 percent to $80.6 billion by 2022.