The U.S. manufacturing sector also showed signs of weakness. The Institute for Supply Management (ISM) index registered 54.1 in December 2018, reflecting a two-year low, with new orders decreasing to 51.1, the most in almost five years.

“There’s just so much uncertainty going on everywhere that businesses are just pausing,” Timothy Fiore, chairman of ISM’s manufacturing survey committee, said in a Bloomberg interview. “No matter where you look, you’ve got chaos everywhere. Businesses can’t operate in an environment of chaos. It’s a warning shot that we need to resolve some of these issues.”

Part of that ongoing chaos includes rising tariffs on steel and aluminum — including that coming from Canada and Mexico — as well as the continuing trade war with China. As trade talks with China continue a roller-coaster ride, congressional approval of the new United States-Mexico-Canada Agreement (USMCA) is far from certain. Last September, Ford CEO Jim Hackett said the Trump administration’s tariffs on imported steel and aluminum would cost the company $1 billion. And if Ford is hurting, small manufacturers will be hurt even more by increasing tariffs as they operate on slim profit margins. Needless to say, increases in production costs are often passed on to consumers, affecting their purchasing power and further slowing economic growth.

To assess the effects of the current operating environment for businesses, especially manufacturers, Area Development surveyed our corporate executive readers about their site selection priorities and plans for the years ahead, as well as the effects of taxes and tariffs on these plans. Their responses are presented herein.

33rd Annual Corporate Survey Results

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

-

Chart 17

-

Chart 18

-

Chart 19

-

Chart 20

-

Chart 21

-

Chart 22

-

Chart 23

-

Chart 24

-

Chart 25

-

Chart 26

-

Chart 27

-

Chart 28

-

Chart 29

-

Chart 30

-

Chart 31

-

Chart 32

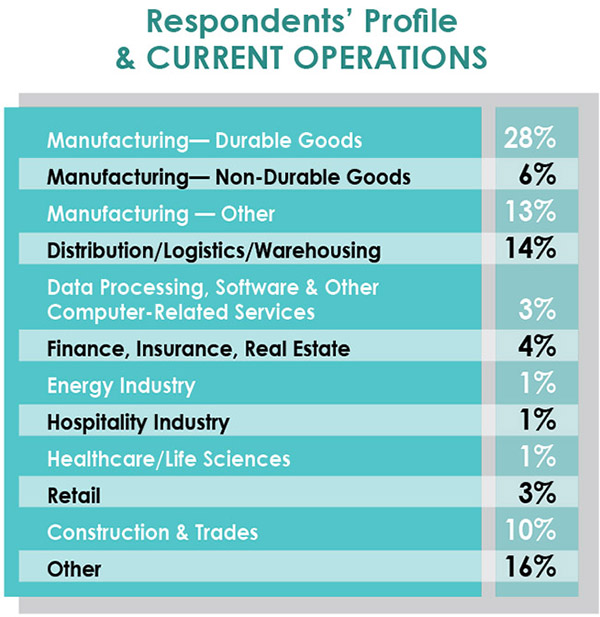

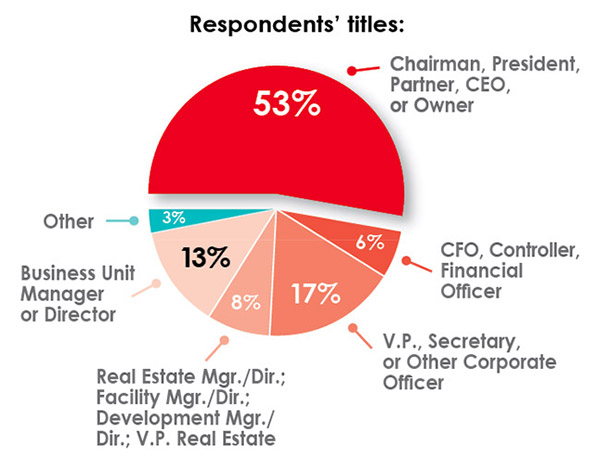

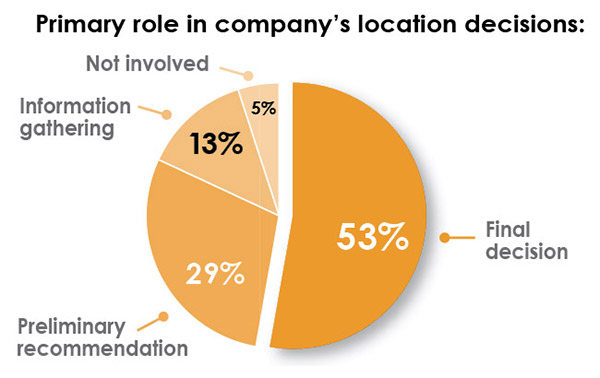

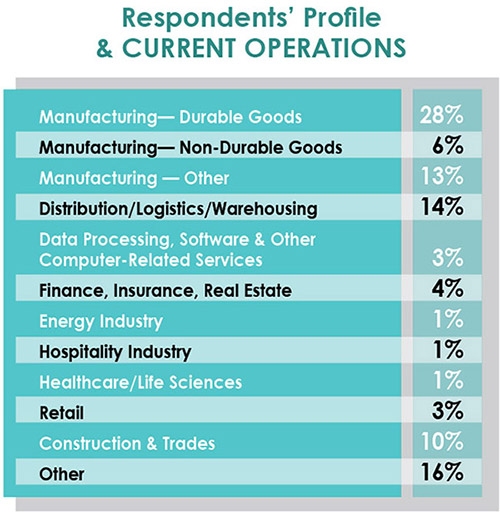

Nearly half (47 percent) of the respondents to our 33rd annual Corporate Survey are with manufacturing firms, and 14 percent say distribution/logistics/warehousing are the primary functions of their companies. More than half (53 percent) are the lead persons (owner, chairman, CEO, etc.) at their companies. It follows then that 53 percent are responsible for their companies’ final location decisions.

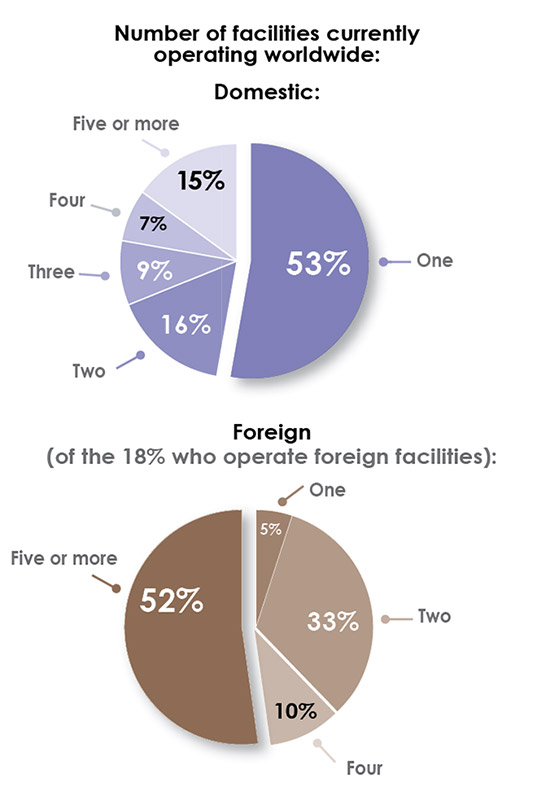

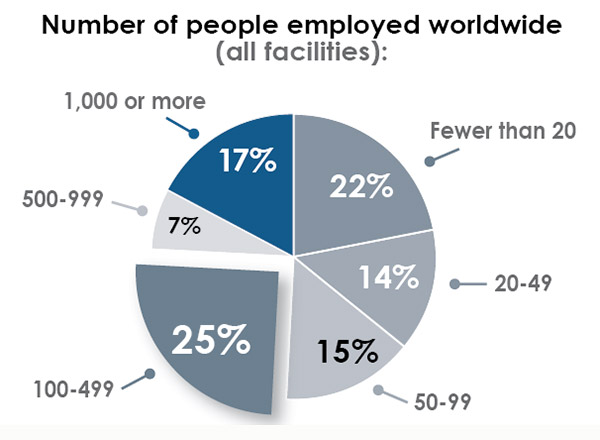

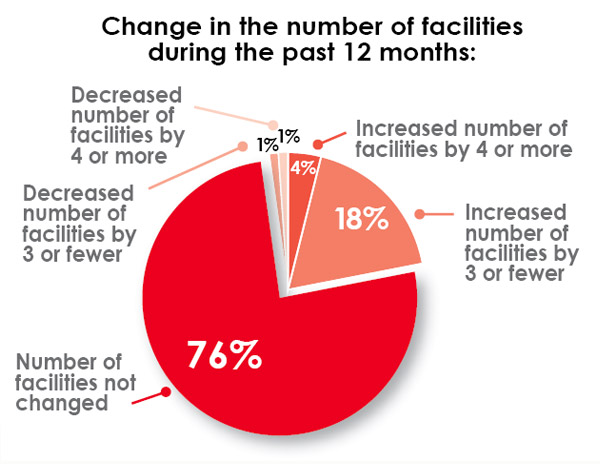

More than half also say their firms operate just one domestic facility, while just 18 percent of the respondents say they also operate two foreign facilities. A quarter of the corporate respondents say these facilities employ 100–499 people in total. Yet 22 percent claim their firms employ fewer than 20 people, while 17 percent say they employ more than 1,000 workers all told. Three quarters of those responding to the Corporate Survey state there were no changes in their companies’ number of facilities over the last year, while 22 percent did increase their number of facilities.

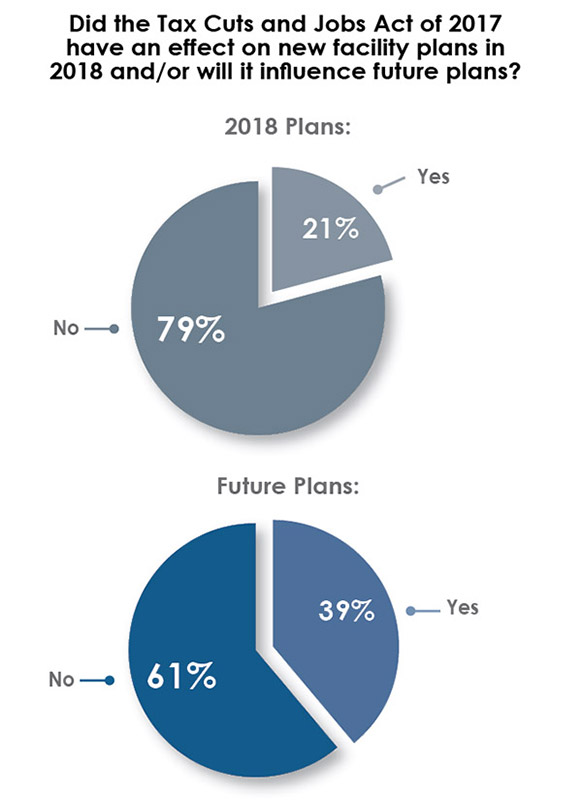

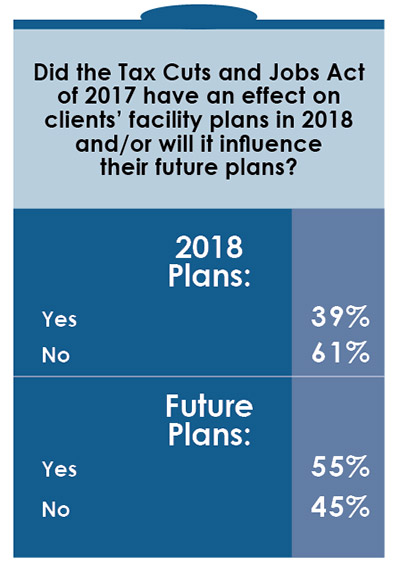

Apparently, the Tax Cuts and Jobs Act (TCJA) of 2017 had a limited effect on the corporate respondents’ facility plans of 2018 — nearly 80 percent say the act had no effect — but nearly 40 percent believe it will affect their future facility plans. This is in agreement with the results of the NABE poll: 84 percent of the respondents to that survey said the 2017 TCJA has not spurred them to change their hiring or investment plans.

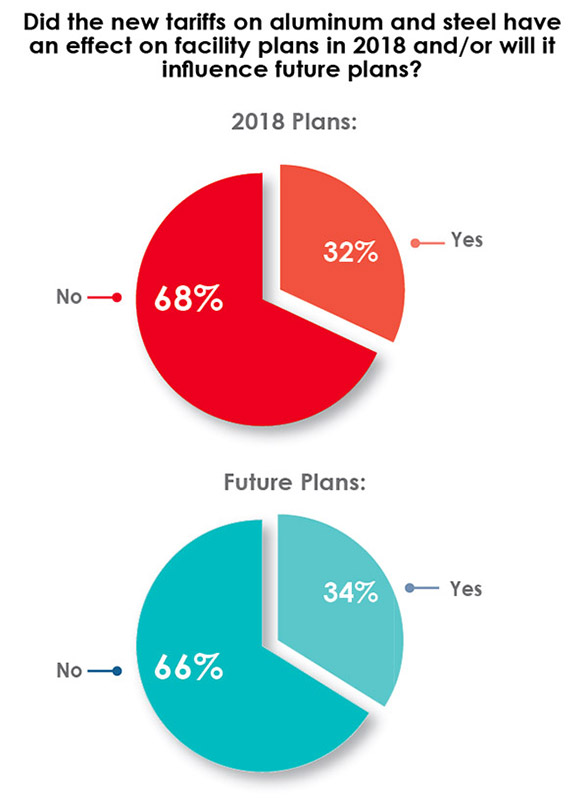

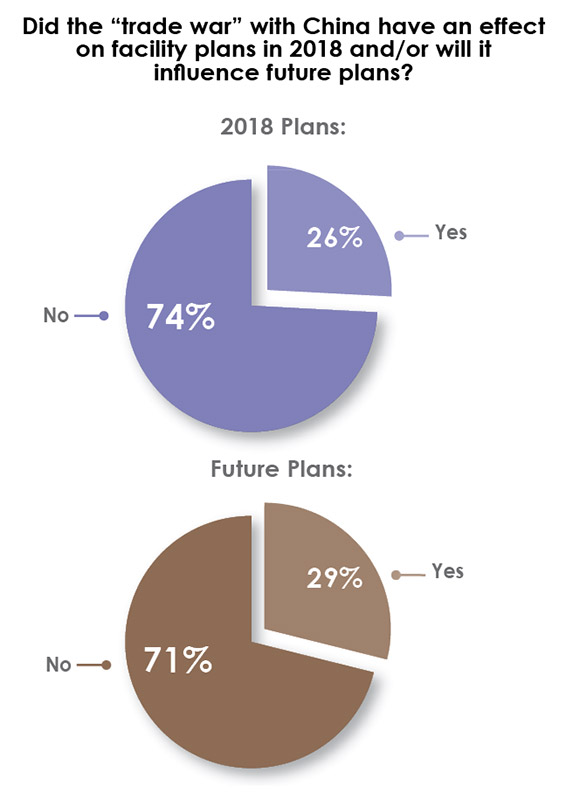

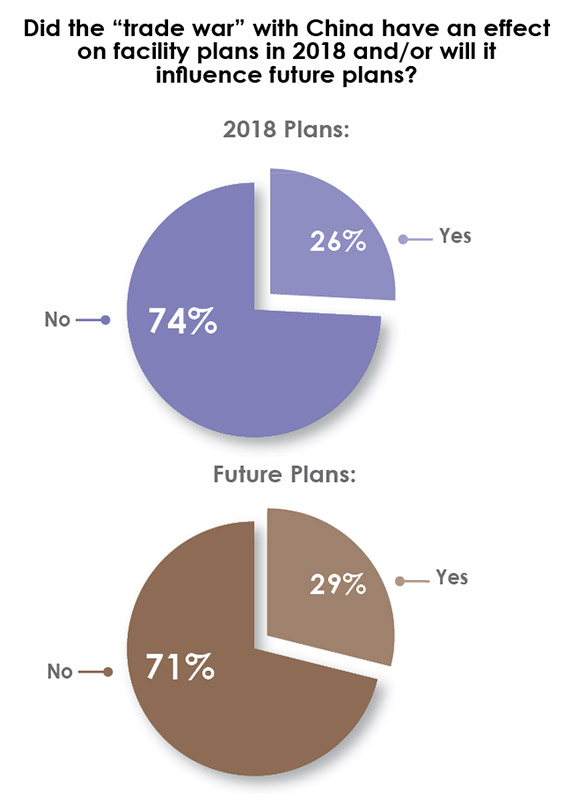

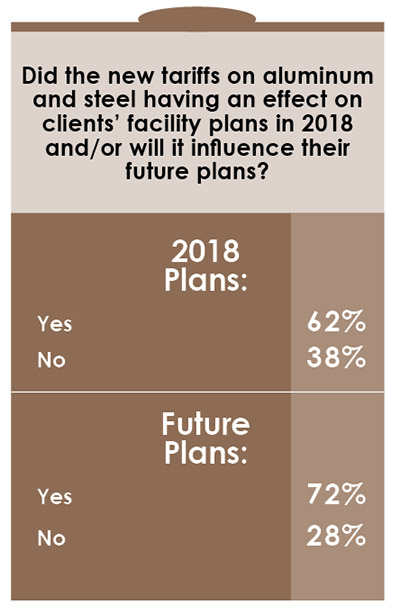

Surprisingly, two thirds of the respondents to Area Development’s Corporate Survey also say the new tariffs on aluminum and steel had no effect on their 2018 facility plans, nor will they affect their future facility plans. And, interestingly, more than 70 percent say the trade war with China did not affect 2018 facility plans and will not influence facility plans going forward.

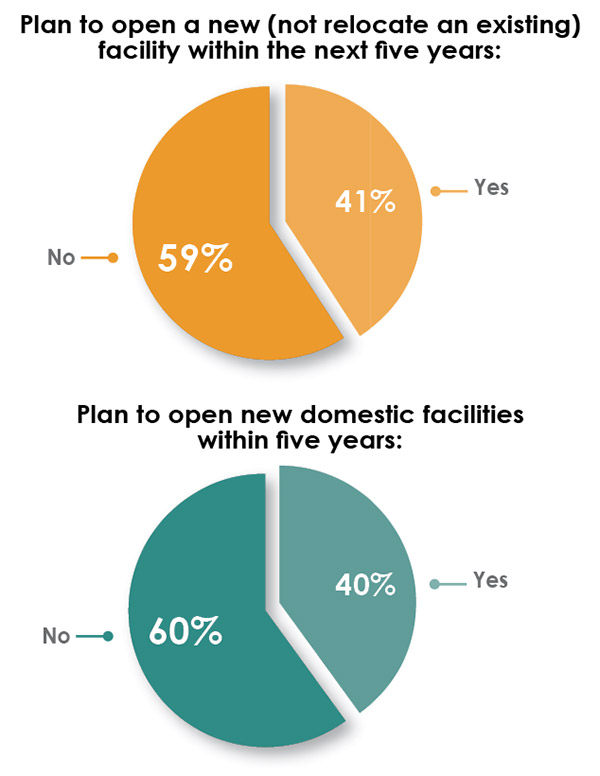

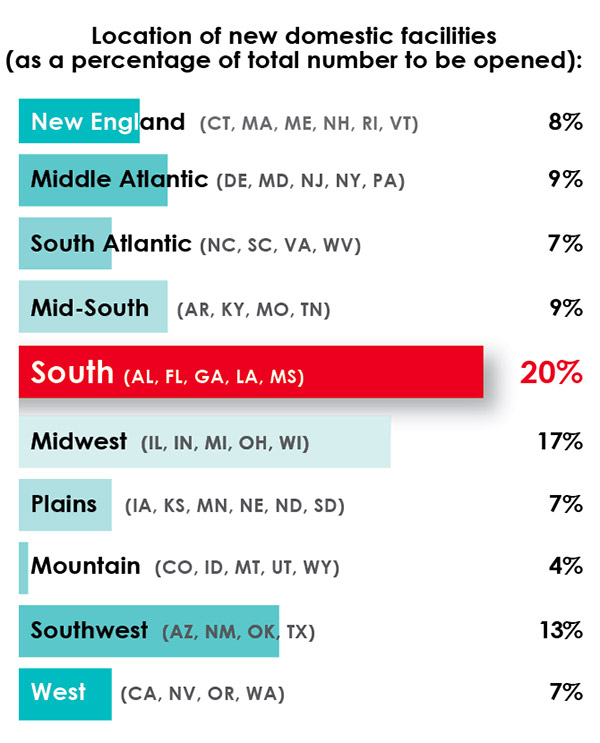

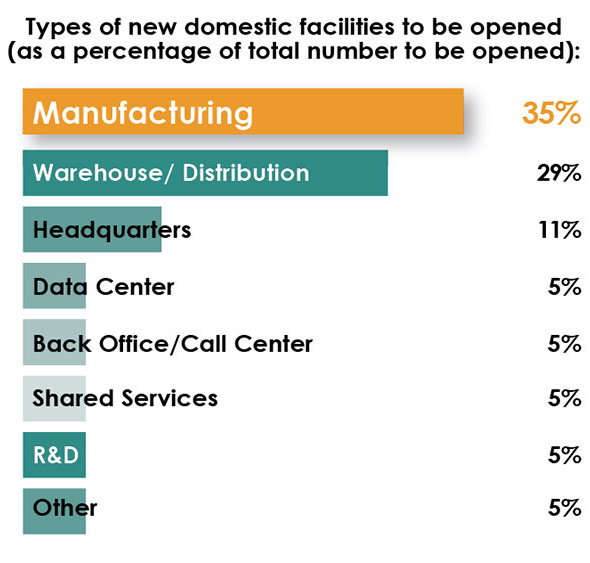

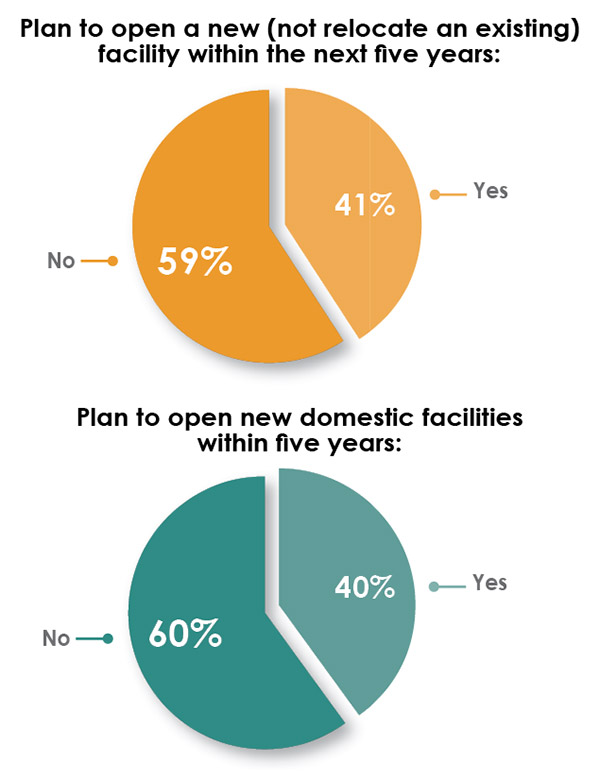

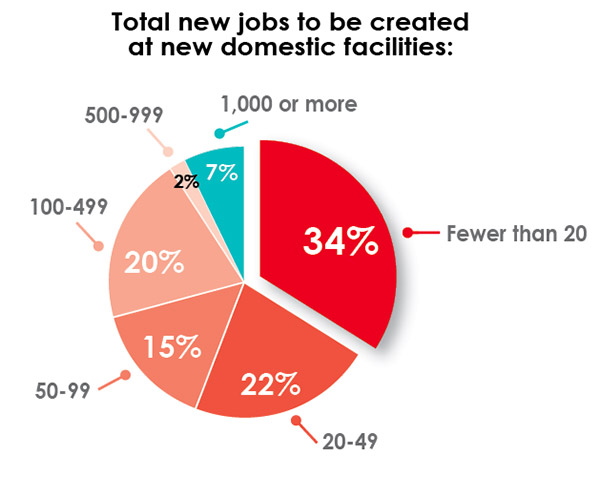

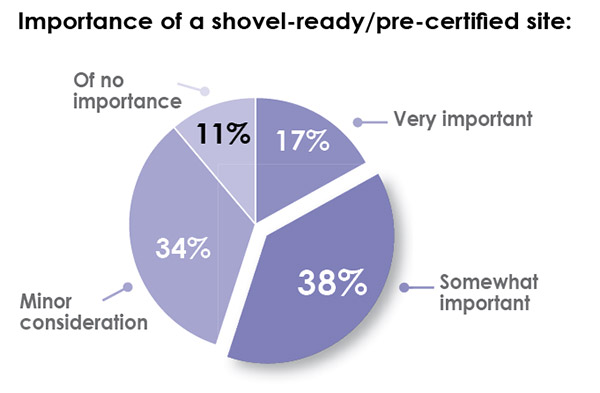

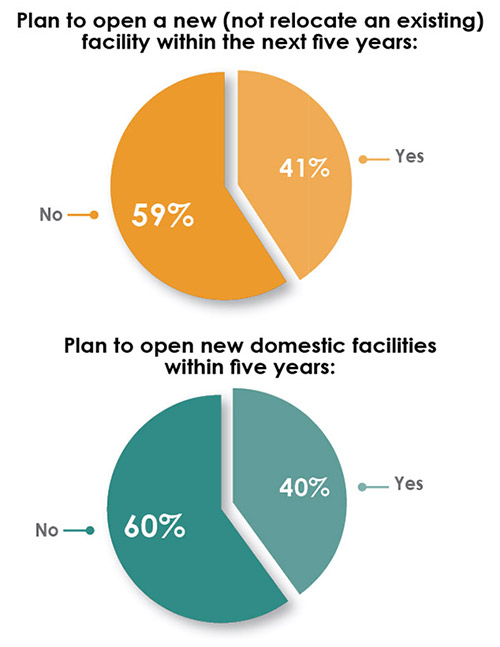

Bearing those results in mind, 40 percent of the respondents to our Corporate Survey say they plan to open new domestic facilities within the next five years. About half of those facilities will be located in the southern portion of the U.S. — the South Atlantic, Mid-South, South, and Southwest regions. More than a third will be manufacturing facilities and nearly 30 percent will serve warehouse/distribution purposes. However, only a fifth of the respondents say these new domestic facilities will be mid-sized in terms of employment (100-499 workers); 56 percent of the respondents say fewer than 50 jobs will be created by their new domestic facilities.

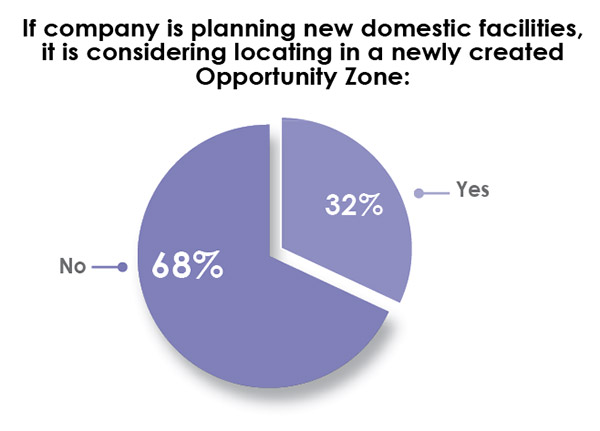

The newly authorized Opportunity Zones are drawing interest from a third of the respondents who say they are considering locating in an OZ. A product of the Tax Cuts and Jobs Act of 2017, Opportunity Zones are designed to encourage investment in low-income communities nationwide by allowing investors to qualify for preferential tax treatment.

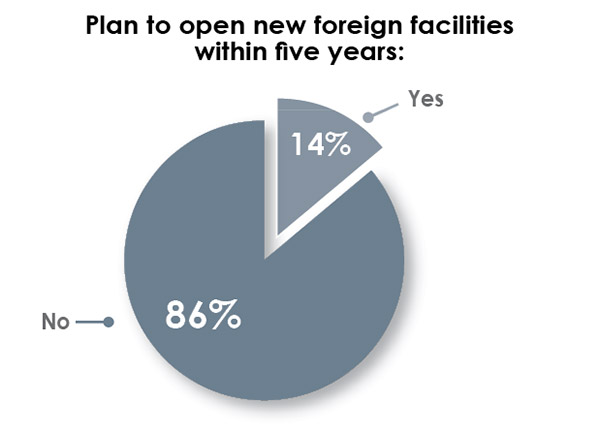

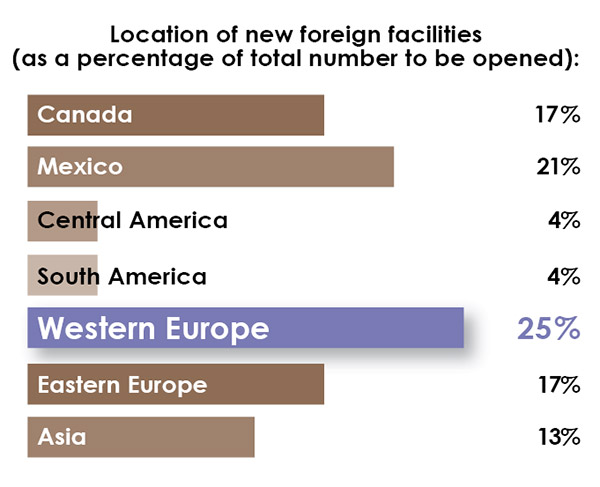

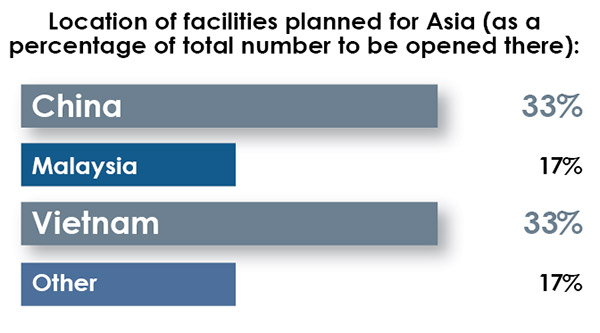

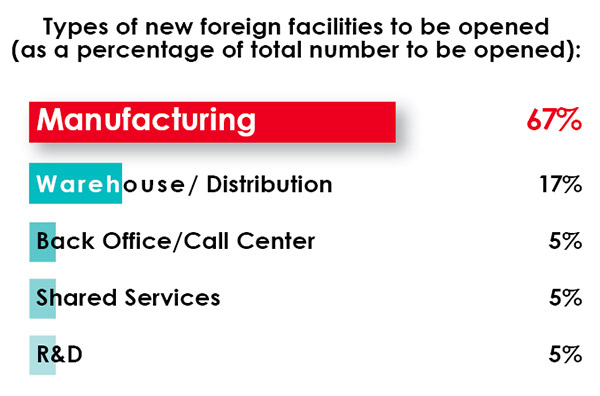

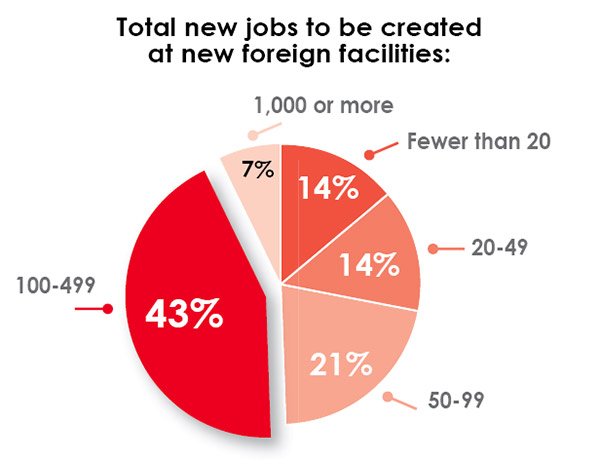

Only 14 percent of the Corporate Survey respondents have plans to open new foreign facilities within five years. A quarter of the new foreign facilities are slated for Western Europe and a fifth for Mexico. Despite the fact that the respondents claim the trade war with China is not influencing facility plans, just 13 percent say they have plans to open new Asian facilities. This is down from 21 percent in the 2017 survey and 27 percent in the 2016 survey. Of this smaller percentage, a third are still slated for China and a third for Vietnam. Two thirds of all new foreign facilities will house manufacturing operations, and 43 percent of the survey respondents say their foreign facilities will employ 100–499 people all told.

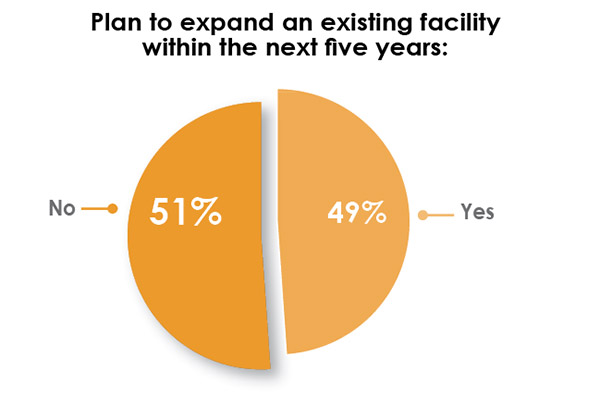

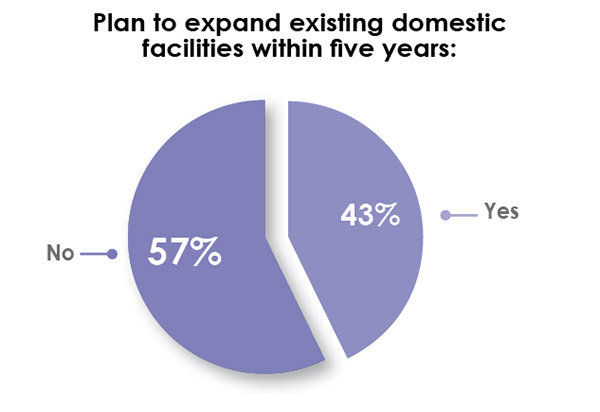

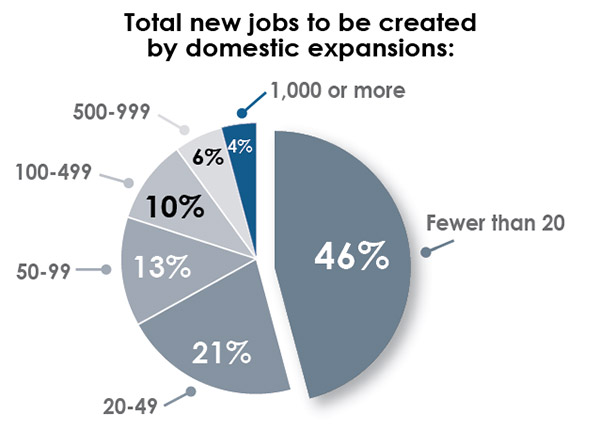

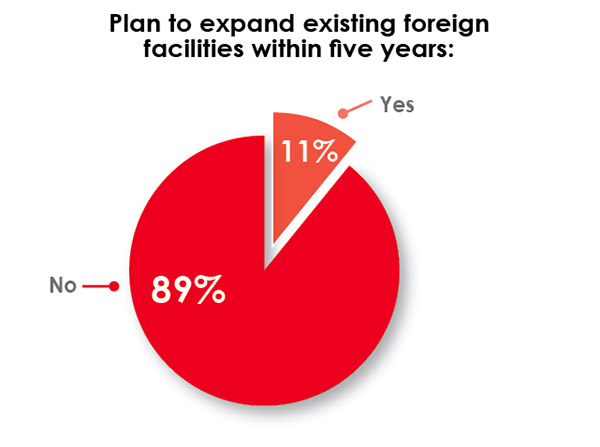

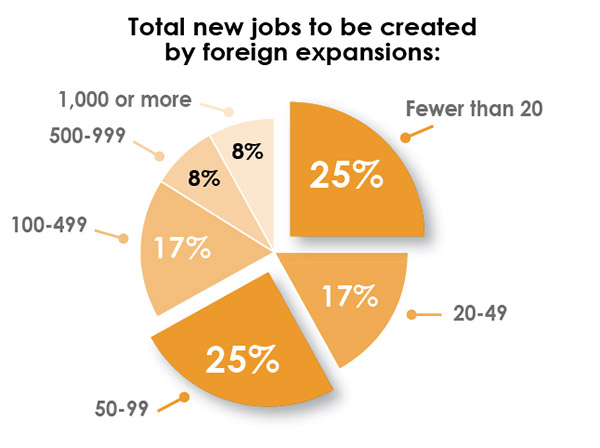

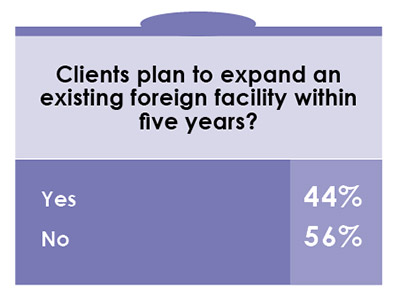

When it comes to expansion plans, 43 percent of the respondents to our annual Corporate Survey say they will expand a domestic facility within the next five years, but nearly half say those expansions will create fewer than 20 jobs. Nearly 90 percent have no plans to expand foreign facilities. A quarter of the respondents say their foreign expansions will create fewer than 20 jobs, with another quarter saying their foreign expansions will create 50–99 jobs.

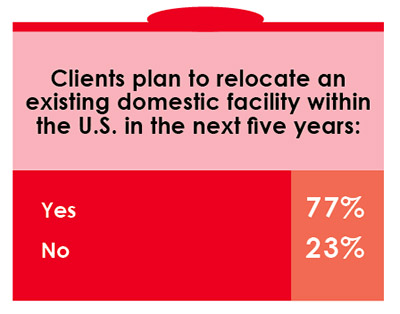

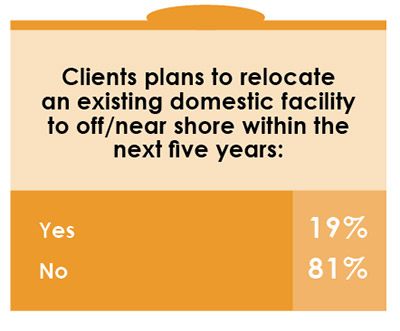

More than 80 percent of the corporate respondents have no plans to relocate an existing facility within the next five years. Of those that do have relocation plans, more than 60 percent will relocate domestically, with just 4 percent relocating to an offshore or near-shore location. Similarly, only 4 percent plan to relocate a foreign facility back to the United States.

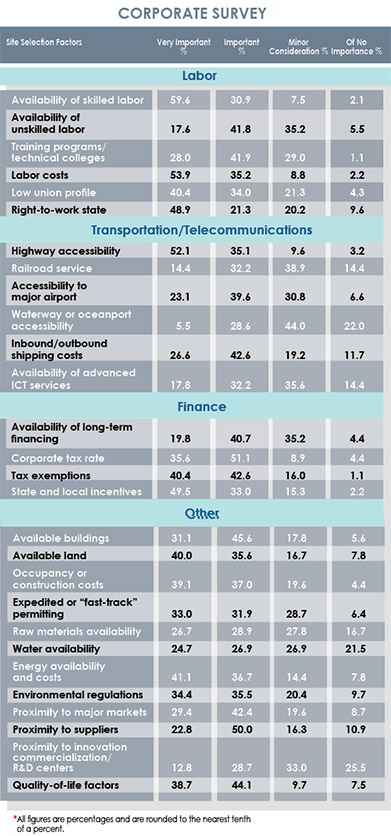

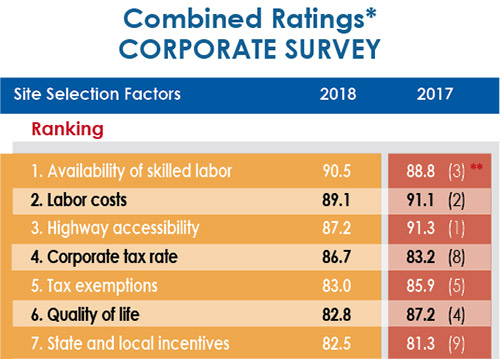

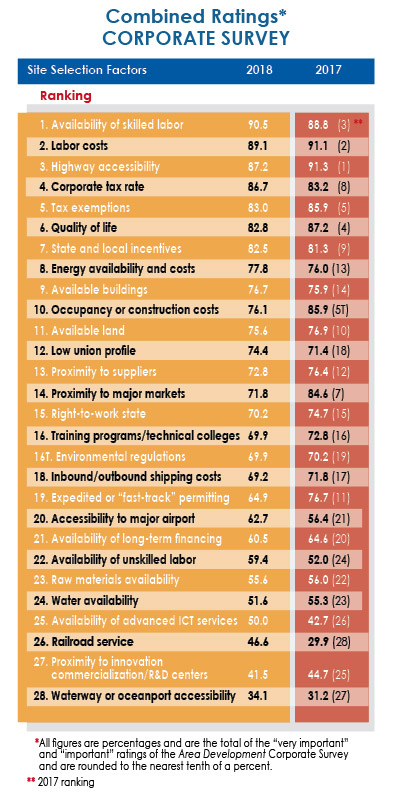

As in years past, we asked our survey-takers to rate the location factors they consider when making new facility, expansion, or relocation plans as either “very important,” “important,” “minor consideration,” or “of no importance.” We then add the “very important” and “important” ratings together in order to rank the factors in order of importance.

It’s no surprise that availability of skilled labor is the corporate respondents’ No. 1 factor in the location decision, considered “very important” or “important” by more than 90 percent of the respondents. Skilled labor is necessary in order to realize the potential of robotics and artificial intelligence that is driving Industry 4.0. Labor costs are ranked No. 2 in the Corporate Survey, followed by highway accessibility, which historically has held the first or second spot, slipping to the No. 3 ranking.

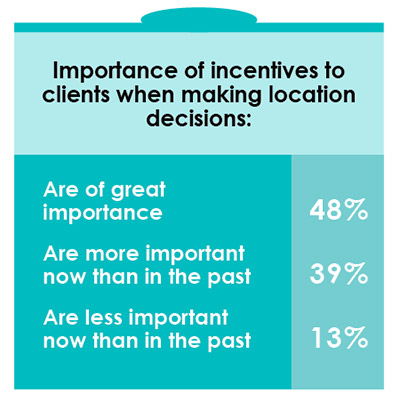

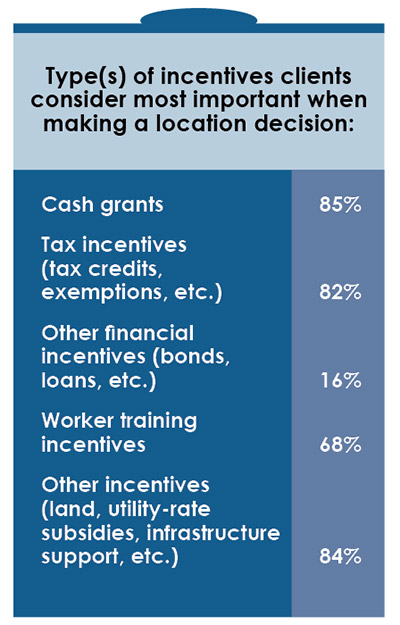

Other cost factors ranked among the top-10 include corporate tax rate (No. 4), tax exemptions (No. 5), state and local incentives (No. 7), energy availability and costs (No. 8), and occupancy and construction costs (No. 10). Corporate tax rate actually jumped four spots in the rankings. When considering state and local incentives, more than 60 percent of the survey respondents consider tax incentives most important, as well as other incentives such as land, utility-rate subsidies, and infrastructure support.

Quality of life slipped two spots in the rankings to No. 6, although it is still considered “very important” or “important” by more than 80 percent of those responding to the Corporate Survey. Corporate site selectors realize that tech-savvy millennials, who now make up the largest portion of the workforce at 35 percent, value a work-life balance. They want to locate in places that can provide cultural and recreational opportunities as well as a sense of community.

Although, according to the Bureau of Labor Statistics, union membership for private-sector workers actually dropped slightly in 2018 to 6.4 percent from 6.5 percent in 2017, nearly three quarters of the survey respondents rated low union profile as “very important” or “important,” ranking it No. 12 among the factors up from No. 18 in the previous year’s survey. This is one reason that the less unionized Southern States are capturing a greater percentage of new facilities.

The location factor showing the biggest increase in importance (16.7 percentage points) is railroad service, although it only ranks No. 26 among the factors. Rail transport is seen as a cost-effective supply chain solution and has become a driver of corporate growth. The U.S. Department of Transportation projects that demand for rail freight transportation, measured in tonnage, will increase 88 percent by 2035.

Oddly enough the factor showing the largest decrease in its importance rating is proximity to major markets, dropping 12.8 percentage points to a 72.8 percent combined “very important” or “important” rating and seven spots in the rankings to No. 14 among the factors. With consumers now expecting next-day or even same-day delivery of goods, one would think proximity to major markets would have only increased in importance. According to one consultant’s survey analysis, changing demographics might be the reason for this factor’s decrease in importance.

Also puzzling is the 11.8 percentage point decrease in the importance rating and eight-place drop in the rankings for expedited or “fast-track” permitting. This factor is now ranked No. 19 among the site selection factors although nearly two thirds of the respondents still consider it “very important” or “important.”

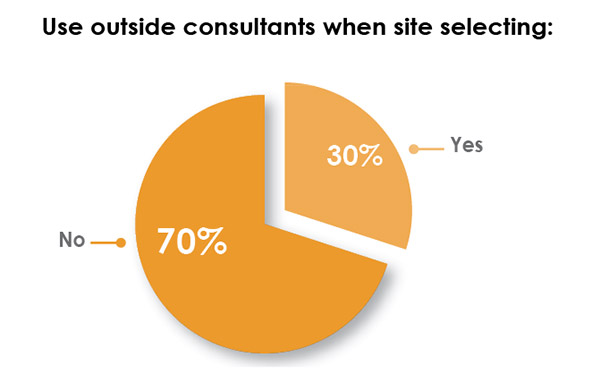

Finally, we asked our Corporate Survey takers whether they use outside consultants when site selecting and only 30 percent of the respondents say they do. With that in mind, let’s explore the responses of our 15th Annual Consultants Survey.

15th Annual Consultants Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

-

Chart 17

-

Chart 18

-

Chart 19

-

Chart 20

-

Chart 21

-

Chart 22

-

Chart 23

-

Chart 24

-

Chart 25

-

Chart 26

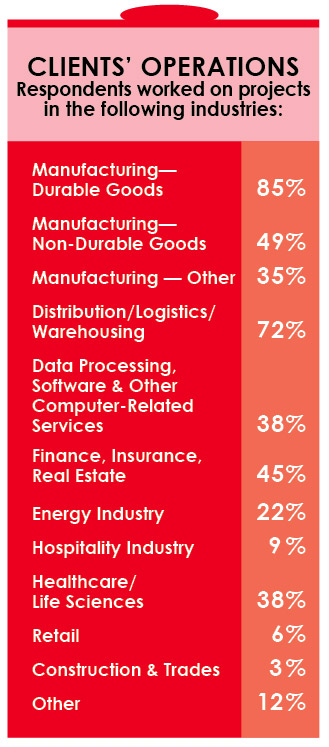

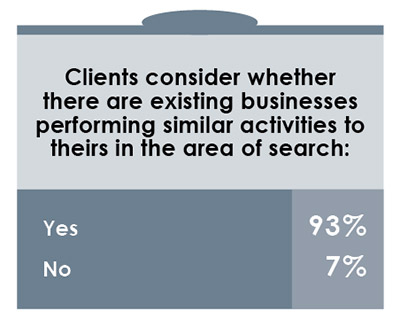

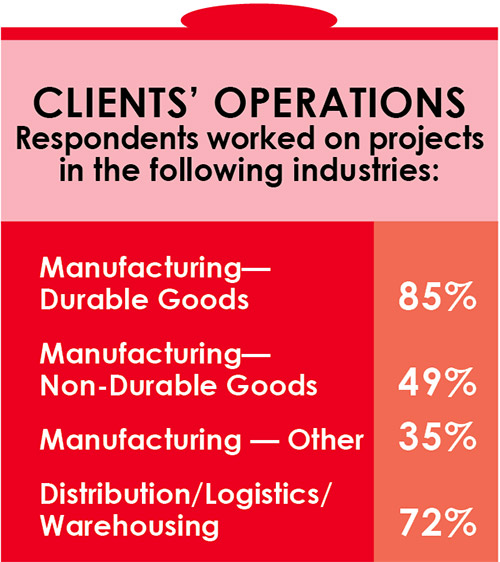

Most of the respondents to our 15th annual Consultants Survey (85 percent) say they have worked on projects for durable goods manufacturers; more than 70 percent have also worked with distribution/logistics/warehousing firms; and 45 percent with projects in the finance, insurance, real estate sector (a sector that only comprises 4 percent of the Corporate Survey respondents).

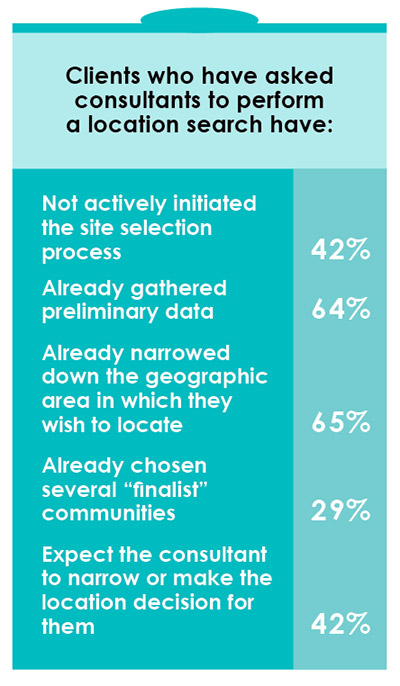

More than 90 percent of these responding consultants claim they perform location studies/comparative analyses for their clients and are involved in the negotiation and management of incentives programs. About three quarters of the respondents claim their clients require them to make the actual location decision.

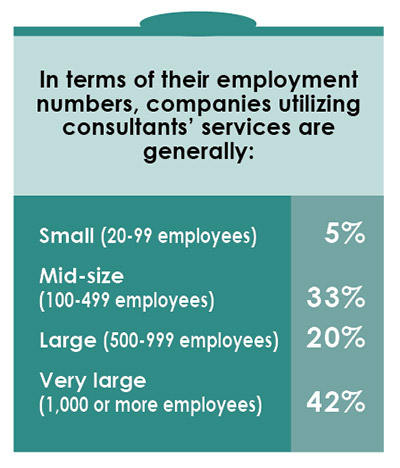

More than 40 percent of the responding consultants say that — in terms of employment numbers — they provide services to very large firms of 1,000 or more employees. A third of the respondents provide services primarily to mid-size firms of 100–499 workers, and a fifth to large firms having 500–900 employees. (Remember, more than half of the Corporate Survey respondents say their firms employ fewer than 100 people.)

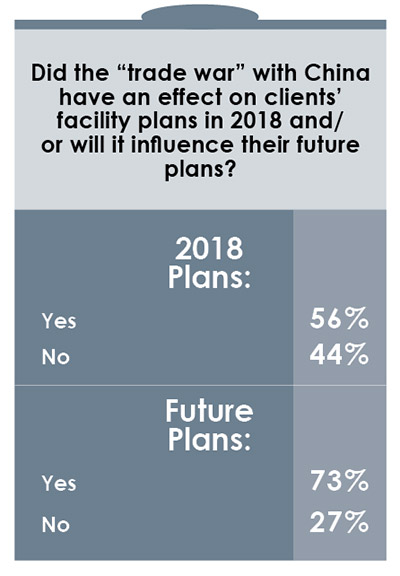

While the majority of those responding to our Corporate Survey say the TCJA, new tariffs on aluminum and steel, and the trade war with China did not have a significant effect on new facility plans in 2018, nor will they have a significant effect on future plans, those responding to our 15th annual Consultants Survey disagree — which may be because of the difference in size between the corporate respondents’ companies and the consultants’ client companies. Nearly two-fifths of the responding consultants say the TCJA affected their clients’ facility plans in 2018, and more than half say it will affect their clients’ future facility plans. Two thirds of the responding consultants also say new tariffs on aluminum and steel affected their clients’ 2018 facility plans, and more than 70 percent say it will affect future plans. And more than half of the consultants say the trade war with China affected their clients’ 2018 plans, with nearly three quarters believing it will have an effect on their clients’ new facility plans going forward.

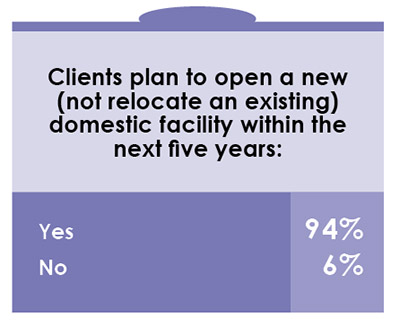

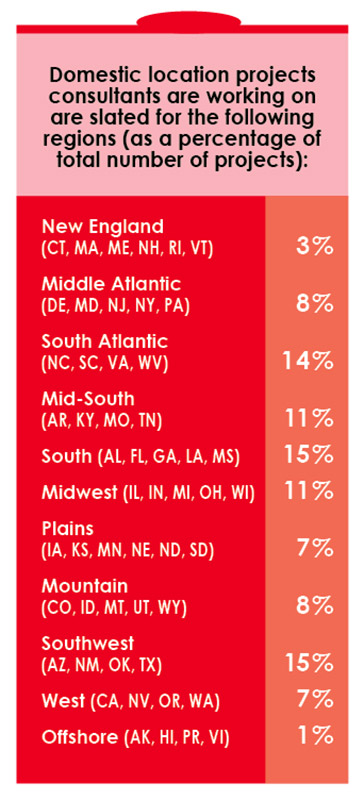

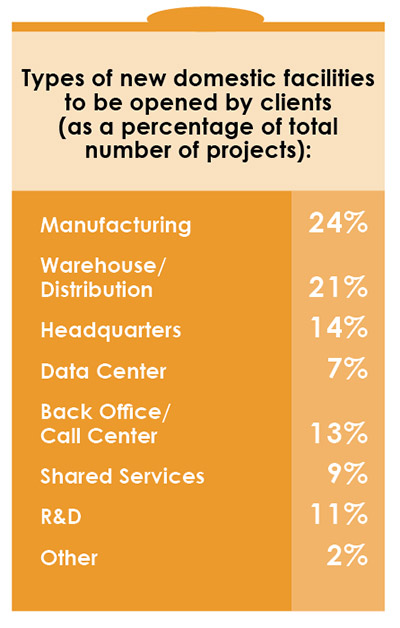

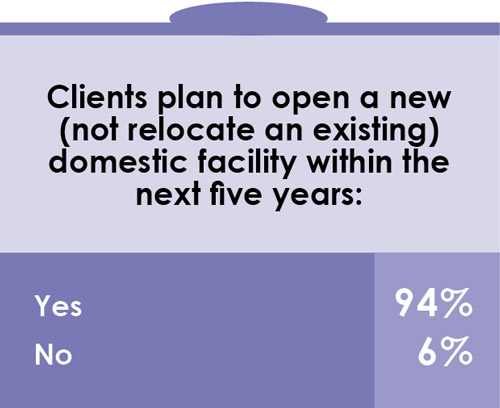

Almost all of the responding consultants — 94 percent — say their clients plan to open a new domestic facility within five years. As with the corporate respondents’ new facilities, about half of these will be opened in the southern half of the United States: the South Atlantic, Mid-South, South, and Southwest regions. A quarter of these will be manufacturing plants and a fifth will be warehouse/distribution facilities.

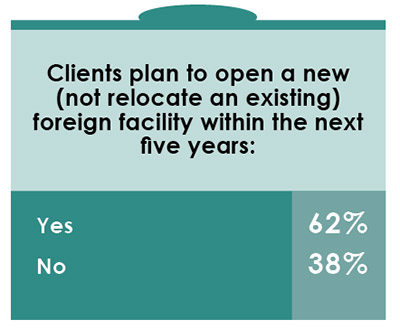

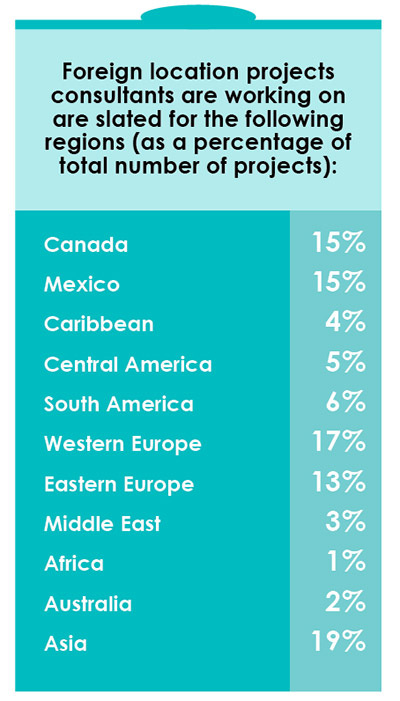

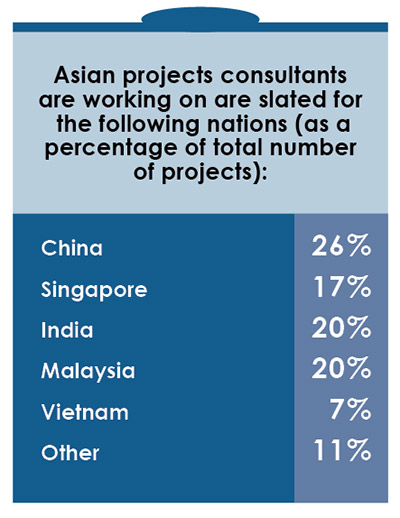

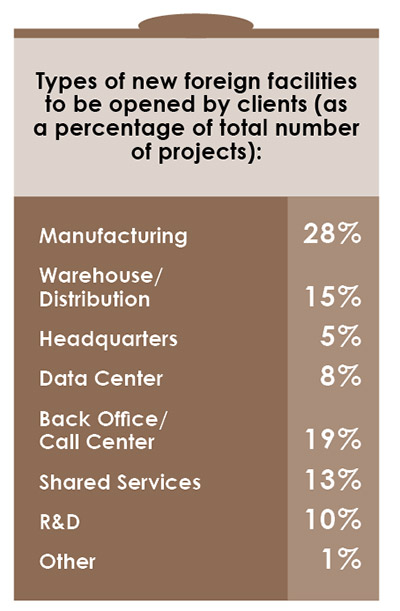

Whereas 86 percent of the Corporate Survey respondents are not planning foreign facilities, 62 percent of the responding consultants say their clients are — and these are scattered worldwide. Most of their clients’ new facilities will go to Canada, Mexico, and Western and Eastern Europe, with slightly more going to Asia. China will garner about a quarter of their clients’ Asian projects, but about a fifth will be located in India and Malaysia, with slightly fewer in Singapore. In comparison, the Corporate Survey respondents say they’ve no plans for new facilities in India or Singapore. More than a quarter of the consultants’ clients’ new foreign facilities will house manufacturing operations, but about a fifth will serve as back office/call centers.

About 90 percent of the consultants also say their clients have domestic facility expansion plans, and nearly half say they have foreign facility expansion plans within the next five years. More than 75 percent of the Consultants Survey respondents say their clients also have plans to relocate an existing domestic facility within the U.S. in the next five years, but only 19 percent say their clients are planning to offshore or near-shore an existing domestic facility. As for relocating a foreign facility back to the U.S. or reshoring, 14 percent of the consultants claim their clients did this in 2018 and 30 percent say their clients will do so this year. Again, remember that nearly all — 96 percent of the Corporate Survey respondents have no offshoring or reshoring plans. Again, this could be a function of their size and/or industry sector.

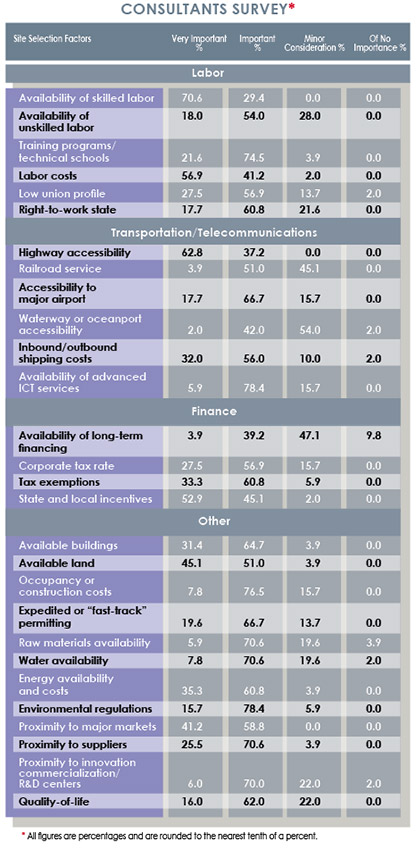

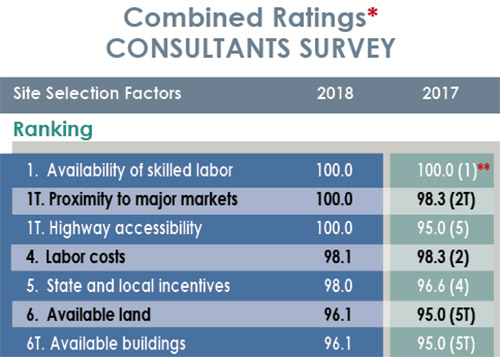

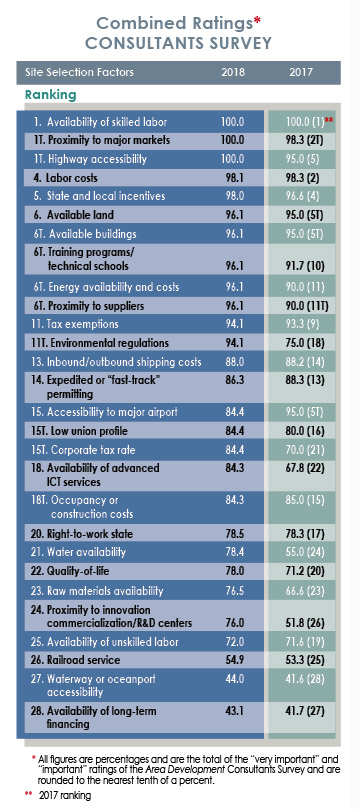

The consultants were also asked to rate the site selection factors as “very important,” “important,” “minor consideration” or “of no importance.” It should be noted that whereas every site selection factor received a “of no importance” rating from some of the Corporate Survey respondents, only seven of the 28 factors were considered “of no importance” by any of those responding to the Consultants Survey.

Interestingly, 100 percent of the respondents to our 15th annual Consultants Survey rated three factors as “very important” or “important” — availability of skilled labor, highway accessibility, and proximity to major markets, all with a No. 1 rank, with availability of skilled labor receiving the highest “very important” score among all the site selection factors. As companies look to satisfy their need for skilled workers, it’s therefore no surprise that training programs/technical schools received a 96.1 percent combined importance rating from the consultants, ranking in a tie for No. 6.

Availability of skilled labor was the only factor receiving a combined importance rating over 90 percent in the Corporate Survey, but 12 factors received a combined importance rating over 90 percent from the responding consultants. In fact, more than 98 percent of the responding consultants also consider labor costs as well as state and local incentives — ranking No. 4 and No. 5, respectively — as “very important” or “important.” Since more than 90 percent of the consultants say they provide incentives negotiation/management services to their clients, it’s only natural that they consider this latter factor a primary consideration in the location decision. More than 80 percent consider cash grants or tax credits and exemptions as the types of incentives that are most important to their clients when making location decisions.

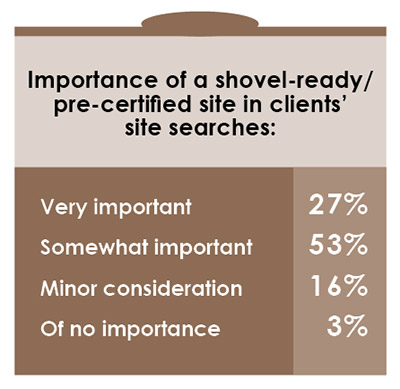

According to CBRE, demand for industrial real estate has been exceeding supply for nine consecutive years, driving the vacancy rate to an historic low of 4.3 percent. It follows that 96.1 percent of the respondents to the Consultants Survey rate both available land and available buildings as “very important” or “important,” also in the No. 6 spot.

The factor showing the largest jump in importance — 24.2 percentage points and now considered “very important” or “important” by three quarters of the responding consultants — is proximity to innovation commercialization/R&D centers. Innovation and R&D centers, which are often affiliated or work in partnership with universities, are linking the academic and “real world.” Companies can avail themselves of new technologies through these relationships and bring innovative products to market more quickly.

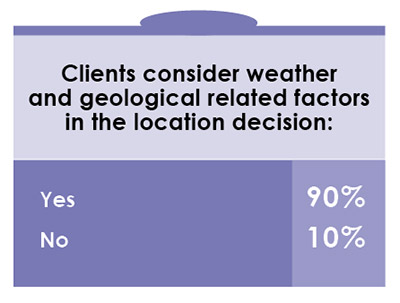

Water availability showed the second-largest increase in importance, increasing by 23.4 percentage points to a combined importance rating of 78.4 percent. Every industrial process uses water, as does all energy production at some point, increasing the importance of this factor in site consideration. The environmental regulations factor showed the third-highest increase in the ratings, with a 19.1 percent increase in importance and now receiving a 94.1 percent importance rating and ranking No. 11. While many environmental regulations have been rolled back under the current administration, consultants may realize that it’s now a given to build sustainable facilities and submitting to the lowest standards might not be advantageous in the long run.

The only factor showing a double-digit decrease in importance is accessibility to major airport, decreasing 10.6 percent points and dropping from No. 5 to No. 15 in the rankings. Whereas accessibility to major airport is still considered “very important” or “important” by 84.4 percent of those responding to the Consultants Survey, other factors seem to have taken precedence.

Other factors also take precedence over quality of life. While 78 percent of the consultants give this factor a combined importance rating, it is only ranked No. 22 among the site selection factors. In comparison, the Corporate Survey respondents ranked quality of life No. 6 among the factors, although its combined importance rating isn’t that much higher at 82.8 percent. As companies continue to try and attract tech-savvy millennials, who seek a work-life balance and are projected to make up 50 percent of the workforce by 2020, the quality of life factor might become even more important for both corporate executives and the consultants with whom they work.