Profile of the Responding Consultants

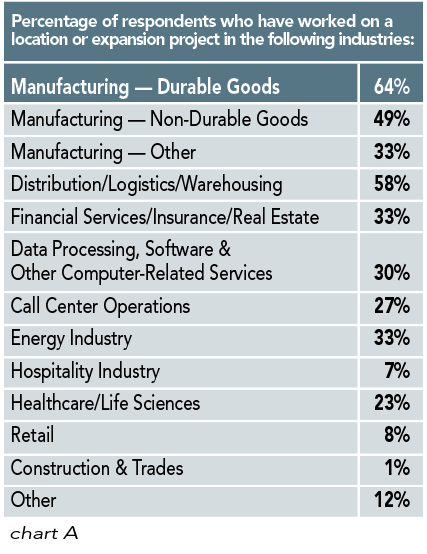

Nearly two thirds of those responding to our 11th Annual Consultants Survey have worked on location or expansion projects in the durable goods manufacturing sector and half in the nondurable goods manufacturing sector. Nearly 60 percent have assisted distribution/logistics/warehousing firms with their plans, and fully a third have worked with firms in financial services/insurance/real estate as well as the energy industry (chart A).

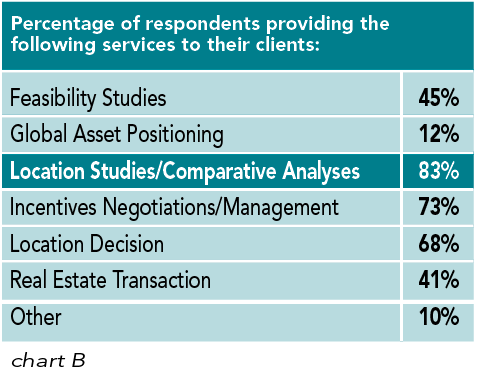

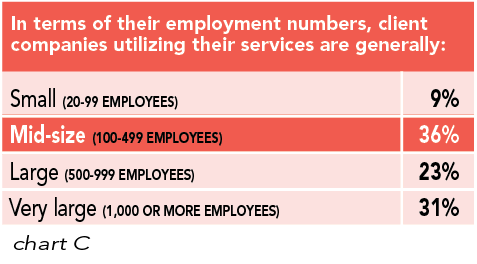

More than 80 percent of the responding consultants say they have helped their clients with location studies/comparative analyses, and nearly three quarters handle incentives negotiation and management for their clients. Interestingly, 68 percent claim to assistant in their clients’ location decisions (chart B). In terms of their employment numbers, 90 percent of the companies using the consultants’ services are mid-size to very large (100 to 1,000+ workers) (chart C). Since 32 percent of those responding to our Corporate Survey are with companies with fewer than 100 employees, we can see why the responses to our Corporate and Consultants surveys would differ.

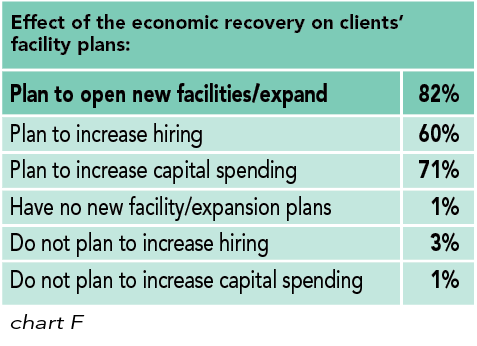

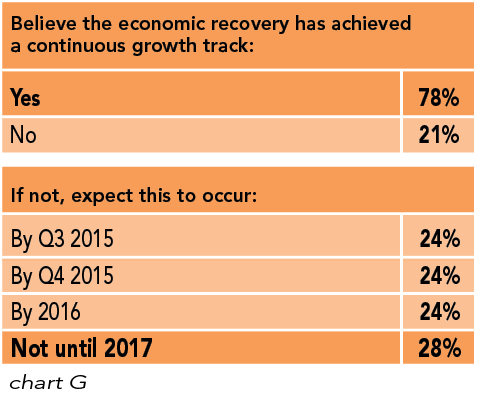

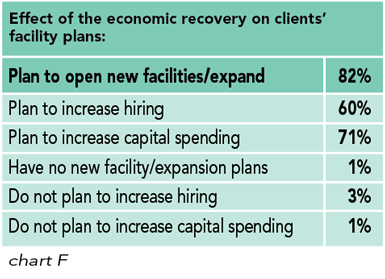

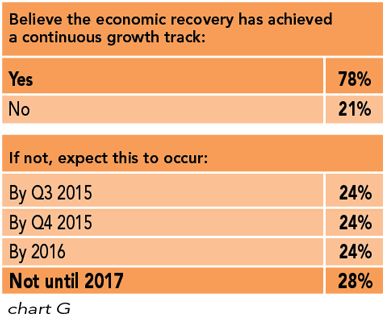

Since consultants are utilized by their clients once they’ve already initiated the location process, it follows that nearly all of the responding consultants say the economic recovery has had a positive effect on their clients’ facility plans: 82 percent claim their clients plan to open new facilities; 71 percent say they plan to increase capital spending; and 60 percent say their clients will also increase hiring (chart F). In fact, more than three quarters of those responding to our Annual Consultants Survey believe the economy has achieved a continuous growth track — twice the percentage of Corporate Survey respondents who hold that belief — and of those consultants who feel it has not, nearly half expect this to occur by year’s end (chart G).

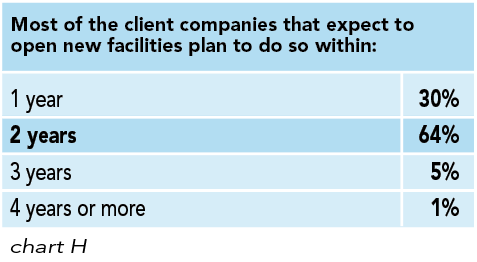

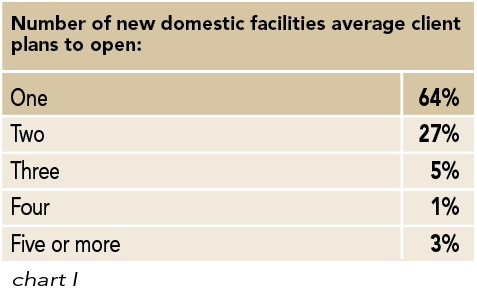

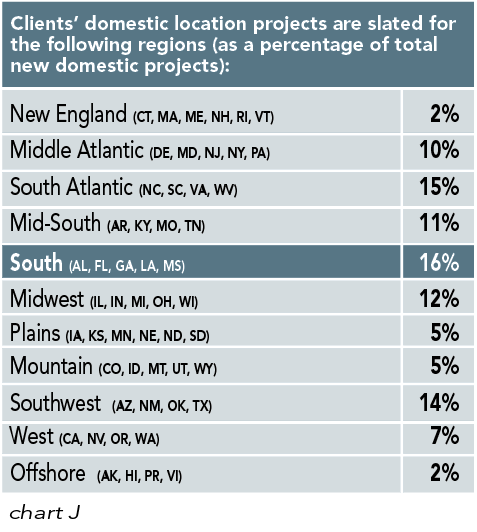

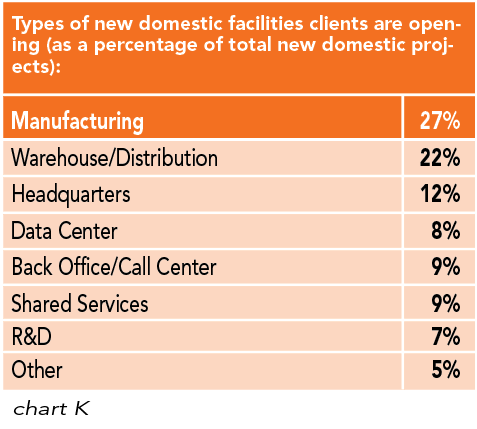

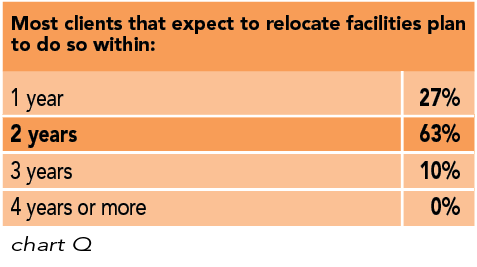

It also follows that most (94 percent) of the consultants say their client companies expect to open new facilities within one to two years (chart H). Of those, nearly two thirds say their clients will open just one domestic facility, and a quarter of the respondents claim these organizations will open two (chart I). The location of clients’ domestic projects differs somewhat from that reported by the respondents to our Annual Corporate Survey. The largest share of projects (16 percent) that the responding consultants are working on is slated for the South (Alabama, Florida, Georgia, Louisiana, Mississippi) and the South Atlantic (North Carolina, South Carolina, Virginia, West Virginia) (15 percent). Only 12 percent of their clients’ projects are to be located in the Midwest (Illinois, Indiana, Michigan, Ohio, Wisconsin), whereas our Corporate Survey respondents have slated 20 percent — the largest share — of their projects for that region (chart J). Roughly a quarter of the consultants’ client organizations’ projects are destined to house manufacturing operations, and more than 20 percent will be warehouse/distribution centers (chart K).

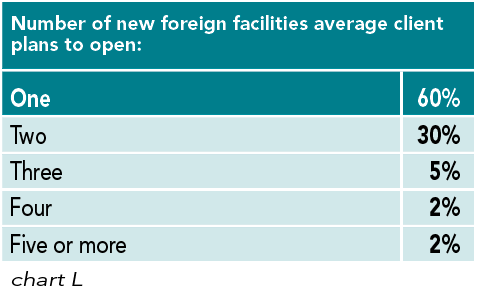

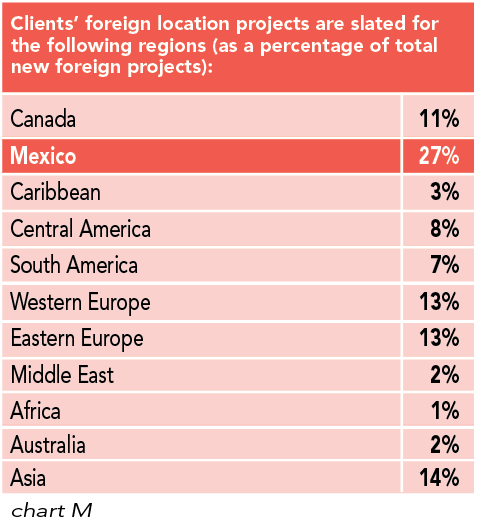

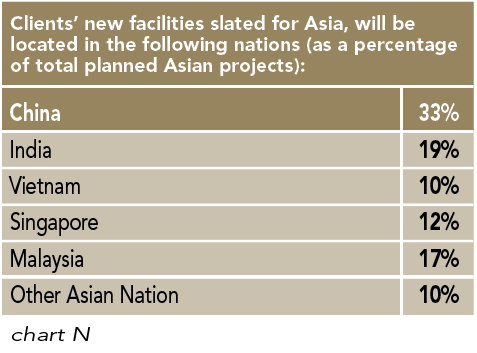

Sixty percent of those responding to the 11th Annual Consultants Survey say that, on average, their clients will open just one new foreign facility, while 30 percent claim they will open two (chart L). By comparison, nearly 40 percent of our Corporate Survey respondents claim they will open three or more foreign facilities. And while our Corporate Survey respondents say a quarter of their new foreign facilities are slated for Canada and 9 percent for Mexico, those responding to our Consultants Survey say only 11 percent of their clients’ projects will go to Canada and 27 percent to Mexico. The consultants are also working on many more projects for Eastern and Western Europe — 13 percent for each region — and fewer for Asia — just 14 percent as compared with 25 percent of those planned by the Corporate Survey respondents (chart M). When it comes to new Asian facilities, the consultants’ clients plan a third for China, 19 percent for India, and 17 percent for Malaysia, with the rest going to Vietnam, Singapore, or other Asian nations (chart N). The corporate respondents more heavily favored China and India.

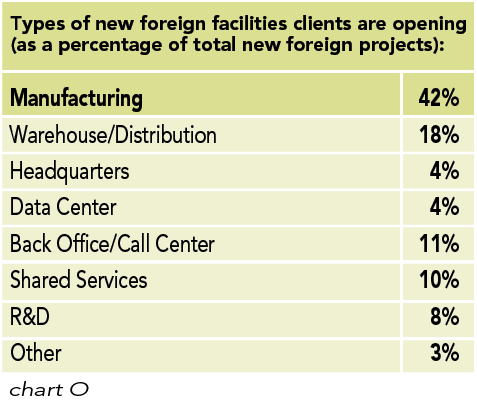

The responding consultants say that more than 40 percent of the new foreign facilities will be manufacturing plants and nearly a fifth are slated to serve as distribution/warehouse centers (chart O).

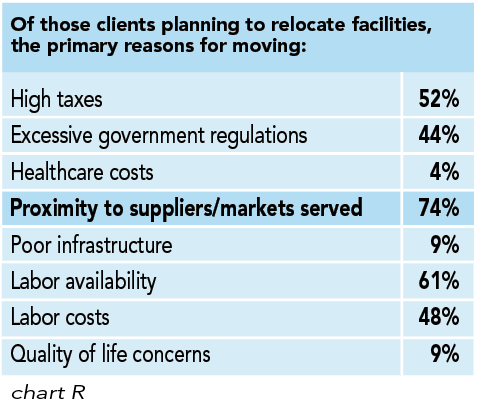

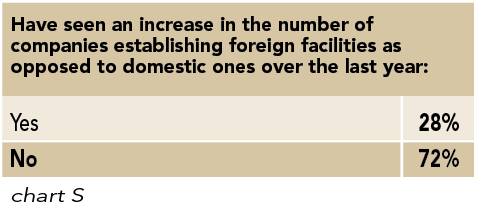

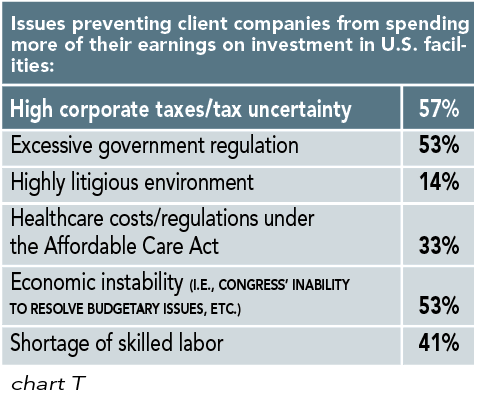

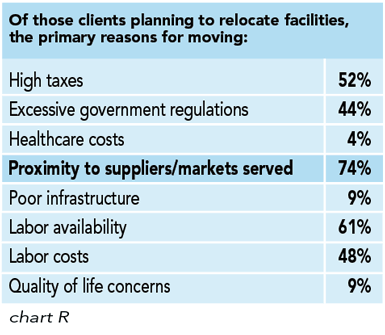

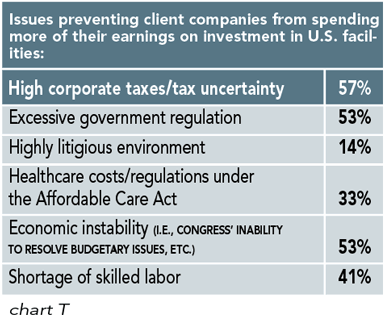

Although nearly all of the respondents to our Corporate Survey say they have no plans to relocate a domestic facility to offshore, a quarter of those responding to our Consultants Survey say they have seen an increase in the number of companies establishing foreign facilities as opposed to domestic ones in the last year (chart S). More than half of the consultants cite high corporate taxes, excessive government regulation, and economic instability (i.e., congressional budget woes) as the reasons preventing their client companies from spending more of their earnings on investment in U.S. facilities (chart T).

Next:Consultants’ Clients’ Location Priorities