Critical Site Selection Factor #3: Labor Costs vs. Quality Dilemma

Although still of great importance, labor costs have taken a back seat to other factors.

Q4 2014

The importance of the outright cost of labor eased in the latest Area Development survey, to the #3 factor, compared with its ranking as the #1 factor in the prior year’s survey. Nonetheless, “labor costs” scored 90.8 percent in importance, the same absolute value as the year earlier, but lower in the rankings because survey respondents became more concerned about other things.

But labor costs remain a huge factor in many location decisions, and nothing illustrates this truth better than the monumental drama early in 2014 that determined where Boeing would build its 777X aircraft. The aerospace giant got proposals to host the massive program from 22 states and played off its own growing, lower-cost South Carolina operations against its relatively expensive unionized labor base in the Seattle area.

There’s greater recognition that the quality of labor is increasingly important, and because with the economic recovery the availability of good people is getting tighter, companies are willing to pay more and are willing to be not quite as cost-sensitive Larry Gigerich, Managing Director, Ginovus.

While many states propose millions of dollars in tax breaks and other incentives to lure airplane-manufacturing jobs, Boeing’s decision came down to its two existing operations — and their relative long-term labor costs. It strong-armed the International Association of Machinists and Aerospace Workers into voting (51 percent to 49 percent) to approve a package worth tens of millions of dollars in wage, benefit, and retirement concessions to land the 777X for Washington. In doing so, Boeing called the bluff of union leaders and politicians who argued that Boeing wouldn’t leave its Seattle-area skill base and existing infrastructure behind over something as baldly bottom-line-oriented as labor costs.

Decreasing Emphasis on Rock-Bottom Costs

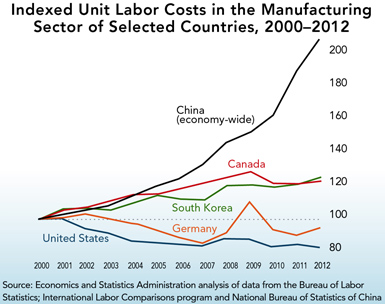

Overall, there are reasons that labor costs are easing in their relative importance as a site selection factor. For one thing, the continued movement of low-skill jobs out of the United States, still bound for places like China and Mexico, essentially puts less emphasis on the appeal of rock-bottom labor costs as a factor in site location decisions among domestic locations. At the same time, the fact that labor costs in many low-wage countries are rising relative to U.S. levels eases some of the pressure on companies to secure the cheapest possible labor in America.

“There’s also greater recognition that the quality of labor is increasingly important, and because with the economic recovery the availability of good people is getting tighter, companies are willing to pay more and are willing to be not quite as cost-sensitive,” says Larry Gigerich, managing director of Ginovus.

Yet like Boeing, many companies still look intently at labor cost differentials. Presumably that is what Reliance Worldwide, for example, did in deciding to open a new plant in Cullman, Alabama, to launch U.S. production of an innovative plumbing-connection system. In September, the Atlanta-based company announced that it would invest $50 million to create 130 jobs over five years to manufacture its SharkBite system in the town where it already has a plant that makes other plumbing components. Previously, SharkBite was made only in Australia.

And while the company and Alabama officials cited the state’s offer of employee screening and training as a lure, no doubt Reliance also was attracted by Alabama’s low labor costs — notably, the consultants ranked Alabama #1 for low labor costs in Area Development’s Top States For Doing Business survey. This advantage serves as an anchor for the state, which has been happy to supplement with other attributes.

Project Announcements

Blue Pony Energy Plans Lovington, New Mexico, Synthetic Fuel Operations

02/13/2026

James Composites Plans Marshall County. Kentucky, Manufacturing Operations

02/13/2026

Joby Aviation Plans Vandalia, Ohio, Operations

02/09/2026

Siemens Energy Plans Fort Payne, Alabama, Manufacturing Operations

02/09/2026

Preciball USA Plans Screven County, Georgia, Production Operations

02/09/2026

Mecad USA Plans Tulsa Port of Catoosa, Oklahoma, Manufacturing Campus

02/08/2026

Most Read

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025

-

Strategic Industries at the Crossroads: Defense, Aerospace, and Maritime Enter 2026

Q1 2026