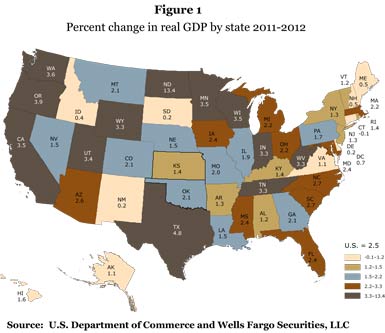

Four years have now passed since the Great Recession ended and the U.S. economy is still struggling to regain its footing. Real GDP growth has averaged just 2.1 percent since the recession ended, compared to a 3.3 percent pace averaged during the 25 years prior to the recession. Many western states have fared better, however, thanks to their heavier concentration of technology firms, energy resources and international ties. More recently, an improving housing market and resurgence in tourism have added to the region’s recovery. The economic winds are constantly changing, however, and the West now faces a whole new set of threats. Global economic growth has slowed, which has cut into the region’s exports. With the Fed contemplating winding down its securities purchases, interest rates have also increased, raising questions about what comes next for the budding recoveries in residential and commercial real estate.

We expect the western states to slightly outperform the nation during the next few years. Growth in California and Washington is likely even stronger than current numbers suggest, while Arizona, Nevada and Idaho are all gaining momentum. Although export growth has slowed, there are increasing signs that global growth may now be bottoming.

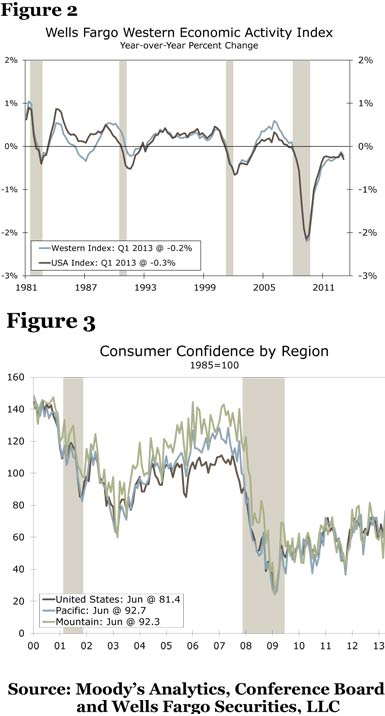

Although economic growth is gaining momentum, the Western region and nation are still growing at a pace well below their long-run average. Our new Wells Fargo Western Economic Activity Index measures the performance of the Western region relative to its long-run average. A reading below zero indicates that growth is below its long-run trend, while a reading above zero would be consistent with above-trend growth. Our index is derived from 15 different data series, incorporating measures of employment, income, retail sales and housing activity. The indices will be updated on a quarterly basis. The most recent data show the West slightly outperforming the nation during the first quarter. California, Washington, Utah, Colorado and Montana are currently growing at their long-run trend and conditions in Arizona and Nevada have improved considerably over the past year.

Most broad measures of economic activity mirror the improvement in our index. Real GDP in the West has risen at a 2.3 percent pace over the past two years, compared to a 4.0 percent pace during the 10 years prior to the recession. The West has slightly outperformed the United States over this time period, and we expect the gap to widen. The latest employment numbers show nonfarm employment rising 1.9 percent over the past year in the West compared to 1.7 percent nationwide. The unemployment rate has also fallen faster in the West, declining 1.6 percentage points over the past year to 7.8 percent, versus a 0.6 percent drop to 7.6 percent nationwide.

The improvement in labor market conditions has been a major factor driving consumer confidence higher. Consumer confidence in the Pacific and Mountain census regions has risen 43.4 points and 36.5 points, respectively in the past year, significantly eclipsing the rise in the overall national measure. The national and regional measures of consumer confidence remain well below the levels seen four years into the past few business cycles. Stronger consumer confidence is essential for the recovery to accelerate further, as consumers are more inclined to make big-ticket purchases when they feel more secure about their job and income prospects.

The West has a different industry mix than the rest of the country, with a heavier concentration of tech companies, alternative energy producers but fewer consumer durable producers. The heavy concentration in so many “industries of the future” has long been a key selling point for the West. The most recent cycle, however, has seen some rough spots. Production of tech hardware has slumped in recent years, as demand for smartphones and tablets, which are predominantly produced overseas, surged largely at the expense of desktop machines. The positives from the boom in handheld devices have more than offset the negatives, driving demand at social media, gaming, online retailing and entertainment companies in the San Francisco Bay area, Los Angeles and Seattle. Sales of tech hardware have also been negatively affected by slower global economic growth and sluggish business fixed investment in the United States. Both should improve over the next couple of years, which could add another positive element to the region’s rebound.

Full report