Reshoring: Manufacturers Re-Evaluate Their Supply Chains

It's true that U.S. companies' returning operations from offshore spurs U.S. job growth, but what are the risks these companies face?

Fall 2012

Long lead times, inventory issues, higher fuel costs, and a diminished customization or innovation capability all help highlight the fragility of long-distance supply chains and are beginning to impact sourcing decisions. Natural disasters like the one in Japan, political instability, rapidly rising foreign wages coupled with U.S. currency depreciation, high oil prices, quality concerns, the loss of intellectual property, and the lack of legal protections offshore are all also part of the equation. Even such factors as emergency airfreight, travel costs, and time zone and language problems are back under a lens of scrutiny.

Many companies are now re-evaluating their supply chains and moving their manufacturing and assembly operations either to new, lower-cost locations such as Vietnam and Indonesia, or closer to their key markets in developed economies such as Mexico, and even back to the United States. For the latter, a new term has been coined in the economic development community - reshoring.

Indeed, a new nationwide initiative is under way to convince companies that it is worth bringing manufacturing back to the United States. Illinois was the first state to launch a "Reshoring Initiative" aimed at convincing large original equipment manufacturers (OEMs) to re-open factories in America. Its backers are working to create similar chapters in Michigan, Indiana, Ohio, Pennsylvania, New York, and California.

Reacting to a Changing Industrial World

According to the Reshoring Initiative, reasons to consider moving back are obvious - ranging from reducing the total cost of ownership, to improving the quality of inputs, cutting surge impact on just-in-time operations, and the ability to cluster manufacturing near R&D centers to enhance product innovation, among others. Countering potential offshore instability, political or otherwise, is not the least of those factors.

Any manufacturer considering reshoring as an option must balance those positives with potential strategic risks that can be associated with reshoring, prior to making that important decision. The risks include the impact on supply chain cost structure and the potential loss of local market service, the challenge of setting up trusted supply networks to service a new facility, and the possibility that pending U.S. policy and regulation decisions may make that decision look less favorable later on.

Planning and changing systems and people, training new staff, business disruption related to reshoring, and the potential issue of protecting intellectual property all factor into the reshoring equation. Coupling those issues with the speed of change that defines the modern industrial world means that risk factors must be evaluated and monitored constantly. Ideally, a manufacturer has a process for tracking location variables and keeping themselves informed. At the same time, their supply chain footprint must be as flexible as possible, such that it can quickly be reconfigured to remain optimal when tides shift and opportunity arises.

Examining Impacts on Cost, Inventory, Suppliers

One source of frustration for manufacturers and distributors in the past five years has been the lack of stability and pace of change in such supply chain cost variables as labor, transportation, and utilities. Companies should be aware of the current dynamic nature of supply chain cost structures. Supply chain networks are increasingly exposed to a wide range of risks that could increase costs, cause delivery delays, or prevent access to plants. Most agree that this instability is greater than it has ever been before, and analyzing the risk associated with a decision of reshoring is, therefore, just that much more difficult.

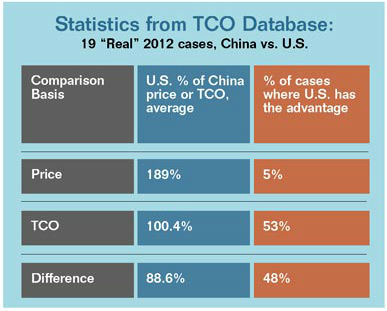

To assist in the decision-making process in terms of cost, the Reshoring Initiative has developed the Total Cost of Ownership Estimator™, a complimentary online tool that enables companies considering reshoring as an alternative to aggregate all cost and risk factors together. According to the Reshoring Initiative, companies making sourcing decisions based on price alone frequently experience a 20-30 percent miscalculation.

Next on the agenda for companies considering reshoring is the need to examine the extended supply chain and the impact on inventory. For example, the risk of order disruption and resulting high inventories will continue if components continue to be sourced, including from second- and third-tier suppliers, from near the original offshore location.

Of course we are not talking about easily adaptable warehouses - we're talking primarily about manufacturing plants. It is difficult to respond to supply chain risks when it comes to manufacturing plants, which have to be fitted out, at substantial cost, to a specific product group. Therefore, reshoring can mean an inherent loss of flexibility, and the potential downstream risks associated with that loss have to be considered carefully.

In reshoring there are also supply risks. If new tiers of suppliers are recruited at the new location, there is significant supply and quality risk associated. When a manufacturer sets up offshore operations, that company goes through a long process of identifying who will do the manufacturing for them. In reshoring, that process will have to be done all over again.

Protecting Intellectual Property

Another issue is intellectual property. To be clear, when a plant is closed offshore, or a process moves, and an empty building or an unemployed worker is left behind, someone is going to find something valuable. Intellectual property risk offshore is associated with everything from set up, to operations, to even the shut-down itself - knowledge can be transferred from anything or anyone you might have left behind.

People are the bigger risk than technology in this discussion. As a manufacturer, you train people how to do a job and how to build something for you in that market. You let them go, you leave - and someone else can hire them to do what you were doing and perhaps become your direct competitor. You leave behind your secrets, your people, your suppliers, even your machinery, and the vacuum left behind can easily be filled in an unregulated offshore environment.

Next: Considering Operational and Financial Risks

Project Announcements

DDP Specialty Electronic Materials US Expands Midland, Michigan, Manufacturing Operations

01/30/2026

Aerospace Lubricants Expands Columbus, Ohio, Production Operations

01/30/2026

Radical AI Plans Brooklyn, New York, Materials Science Operations

01/28/2026

Germany-Based KettenWulf Plans Auburn, Alabama, Production Operations

01/28/2026

Frontieras North America Plans Mason County, West Virginia, Operations

01/28/2026

North Wind Plans Rosemount, Minnesota, Research Operations

01/27/2026

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025