The fact remains that manufacturing has much more potential, if certain hurdles weren’t in the way. Among the top challenges manufacturers face are regulatory concerns, an inequitable tax system when compared with certain other countries, and, in some cases, unfair subsidies provided to certain industries by foreign governments. Manufacturers recognize that a safe working atmosphere and healthy environment are ensured through regulation. But, the complexity of regulations often results in duplicative, poorly designed and thus ineffective rules adding an unnecessary burden to manufacturing operations.

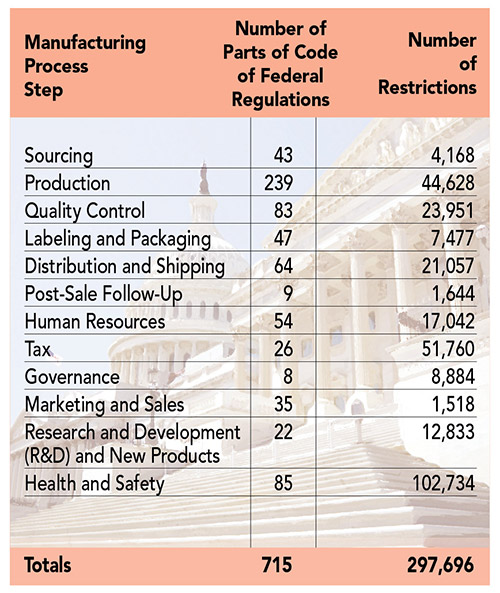

Since 1981, the federal government has issued at least one manufacturing-related regulation each week. Since 1981, the federal government has issued at least one manufacturing-related regulation each week. The National Association of Manufacturers (NAM) has found that the industrial sector faces a staggering 297,696 restrictions on their operations from federal regulations. Is the federal government overstepping its intended power? Rules and policy within reason are valuable, but will the U.S. economy begin to falter if the rate of regulation continues to rise?

Notably, no regulations have been eliminated. With the sheer volume of new rules and policies to keep up with, manufacturers are not able to focus on competitiveness and growth opportunities, factors that feed into a prosperous economy.

The Environmental Protection Agency (EPA) has issued the majority of rules that impact industrial productions across the United States. While environmental issues are vital to the future of humanity, some flaws exist that counter the real benefits. American companies and associations, including U.S. Steel Corporation and the American Petroleum Institute, have openly voiced how regulatory burdens prevent building and expansion opportunities. Valero Energy Corporation, which is a member of the American Fuels and Petrochemicals Manufacturers Association, has pointed out that its manufacturing operations are “significantly impacted by the inefficiencies of the current permitting process, the burdens of the current regulatory regime, and the competitive disadvantage this situation places on American manufacturing.”

The Manhattan Institute found that compliance costs for the EPA’s manufacturing-related regulations are more than double that of all other regulatory agencies combined. In addition, spending on regulatory compliance has been rising faster than any other cost in the manufacturing process.

Since the Great Recession, financial policies instituted by Congress to prevent another downturn have also added to the regulatory burden of manufactures. Though unintentional in nature, these regulations have made it increasingly difficult for small manufacturers, which make up 90 percent of the quarter of a million manufacturing companies in the United States, to borrow money. According to the Small Business Administration, the new financial regulations have been instrumental in driving small community banks — those that typically work with small manufacturers — out of business.

Unfortunately, federal regulations are simply part of the burden. State and local regulations also impact manufacturing investment. Often, policies at all levels of government are implemented as one-size-fits-all. All manufacturers can attest that any two processes are rarely alike.

Another problem is the lack of oversight. The institutions intended to govern the regulators issuing new laws are becoming scarce or obsolete. As a result, new legislation is being introduced piling on top of other rules that contain inconsistencies and replications that create an enormous challenge for manufacturers to navigate. Manufacturers have indicated that, even if a portion of the time spent on managing their role with existing and pending regulation could be allocated toward job growth and product and market expansion, they would achieve more innovation and productivity.

Alleviating the Regulatory Weight

Effective regulation needs to be strategically designed and executed to create positive impact. Regulations are necessary, but they should be transparent and cost-effective. If current rules were audited regularly, outdated and inefficient policies could be eliminated before new legislation is introduced.

President Trump signed an Executive Order declaring that for every new regulation issued, two be removed. In April, the Office of Information and Regulatory Affairs (OIRA) issued a guidance for federal agencies on how this order should be implemented. The Office of Management and Budget is also expected to release the regulations that agencies intend to eliminate or modify to balance new regulations. The administration has withdrawn or delayed over 860 proposed regulations in the past five months.

“The president has indicated a really fundamental shift in the way that we’re going to think about regulations,” said Neomi Rao, the newly confirmed administrator of the OMB’s Office of Information and Regulatory Affairs. “And we’re focusing very much on reducing the overall regulatory burden.”

In a further effort to cut some of the red tape for manufacturers and allow the U.S. business climate to flourish, the Regulatory Accountability Act (RAA) is trying to make its way through Congress. In short, the bipartisan bill would hold federal agencies more accountable and allow for a more transparent rule-making process by enabling public participation in the shaping of legislation, requiring agencies to utilize the most cost-effective option and ensuring public review of high-impact policy.

With the sheer volume of new rules and policies to keep up with, manufacturers are not able to focus on competitiveness and growth opportunities, factors that feed into a prosperous economy. “The facts about the RAA reveal a narrowly tailored effort by Congress to make sure that for the costliest one-half of 1 percent of regulations, the agencies do a better job of finding the facts, getting the science right, involving the public, and ensuring the benefits outweigh the costs,” explained William Kovacs, the senior vice president for Environment, Technology & Regulatory Affairs at the U.S. Chamber of Commerce.

The House counterpart of the RAA was passed as part of a larger suite of bills including the Small Business Regulatory Flexibility Improvements Act of 2017, Separation of Powers Restoration Act, Require Evaluation before Implementing Executive Wishlists (REVIEW) Act, and All Economic Regulations Are Transparent (ALERT) Act. The Senate Homeland Security and Governmental Affairs Committee also recently passed the following: Providing Accountability Through Transparency Act, Early Participation in Regulations Act, and Federal Agency Customer Experience Act.

All these bills aim to streamline and improve the regulatory process for small businesses, intending to move U.S. business forward. If made law, they would require agencies to analyze how the regulation they propose and implement impacts small businesses, including manufacturers.

Though the fate of these bills is uncertain, the fact is manufacturing supports more than 12 million jobs across America, plus many more when calculating the indirect supply chain. Trends show that foreign manufacturers want to invest in the U.S. For the first time in a decade, the Reshoring Initiative found that more reshoring happened than offshoring. Domestic companies also want to invest further into the economy but need the support of federal and local governments. Of particular note are certain tax proposals being considered by the Trump administration and Congress that would better level the playing field for companies that make products in the United States. If effective policies exist — regulatory, tax, and otherwise — the possibilities for U.S. manufacturing now through 2025 are monumental.