The data center conversation heading into 2026 looks familiar on the surface, and yet, things are very different underneath. It’s true that demand is still overwhelming supply. Capital is still available. Everyone still wants to talk about AI. What’s changed is where projects break, how long they take, and which markets can realistically execute.

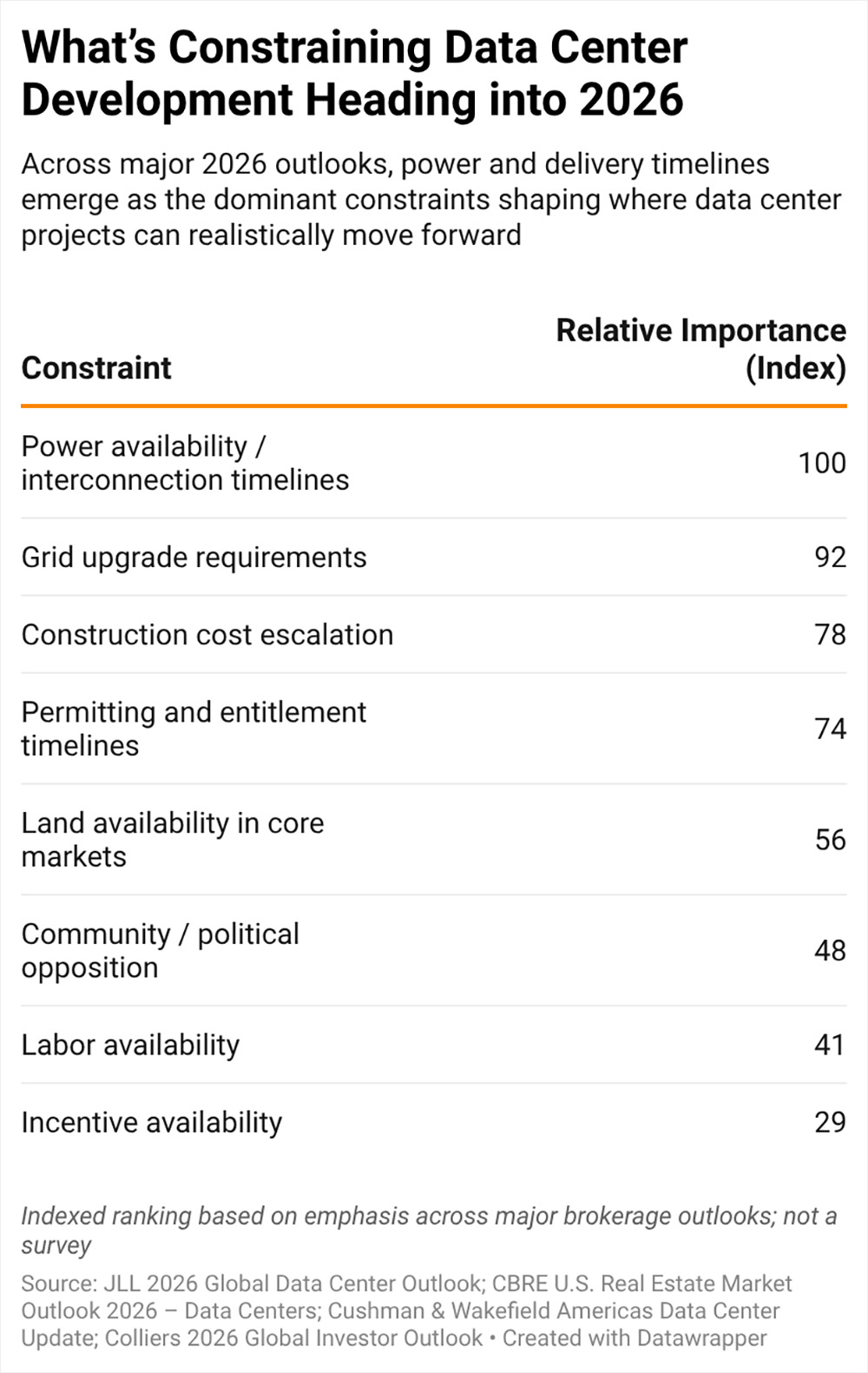

Across the major brokerage outlooks, the consensus is less about growth and more about constraint management — power, timing, cost, and political risk — with consequences for site selection decisions being made right now.

JLL’s 2026 Global Data Center Outlook puts numbers behind what most of us are already experiencing: the industry is preparing to add nearly 100 gigawatts of capacity globally between 2026 and 2030, effectively doubling today’s installed base, while sustaining a fourteen percent compound annual growth rate through the end of the decade . JLL frames this as an infrastructure supercycle, estimating up to three trillion dollars in combined real estate, fit-out, and IT investment by 2030 — not aspirational growth, but capital already lining up behind committed demand.

The implication for corporate real estate teams is straightforward: capacity isn’t optional, and delay is expensive. But the path to delivery is increasingly uneven.

In the U.S., CBRE’s 2026 Data Center Outlook underscores how tight fundamentals have become. Vacancy across primary markets remains at historic lows, preleasing on projects under construction continues to hover well above historical norms, and pricing power remains firmly with landlords and developers . CBRE is explicit that this is no longer a twelve- to eighteen-month development conversation. Utility interconnection timelines of two to four years are now common in core markets, fundamentally reshaping how early site selection and power negotiations must begin.

That shift — from land-driven to power-driven site selection — runs through every major report.

Cushman & Wakefield’s Americas Data Center Update reinforces that power availability, not zoning or fiber, is now the gating factor in nearly every established hub . Northern Virginia, Chicago, Phoenix, Dallas–Fort Worth, and Atlanta remain dominant, but Cushman notes that congestion at the utility level is pushing developers and occupiers toward secondary and tertiary markets where grid capacity is more predictable, even if labor and vendor ecosystems are thinner.

This same dynamic shows up globally. Cushman & Wakefield’s European Outlook 2026 highlights that markets with stable regulatory regimes and surplus power — particularly in the Nordics — are becoming disproportionately attractive for AI workloads, while traditional Western European hubs face mounting delivery friction tied to energy policy and permitting complexity.

Capital markets are responding accordingly. Colliers’ 2026 Global Investor Outlook shows data centers capturing roughly thirty-one percent of global private real estate investment in recent quarters, positioning digital infrastructure alongside industrial as a core allocation rather than a niche strategy . That influx of capital is a double-edged sword for occupiers: liquidity is strong, but competition for well-located, power-secured sites has intensified, and underwriting assumptions are less forgiving around entitlement risk and schedule uncertainty (Colliers).

Newmark’s U.S. Commercial Real Estate in 2026: A Sector-by-Sector Outlook situates data centers within a broader CRE stabilization narrative, but the subtext is important: digital infrastructure is no longer insulated from the realities of construction cost escalation, capital discipline, and political scrutiny (. Newmark’s framing reflects what many corporate teams are grappling with — integrating data center expansion into enterprise-wide capital planning rather than treating it as a standalone technical exercise.

What ties these outlooks together is not optimism about demand — that’s a given — but realism about execution.

Build costs continue to rise, with JLL projecting sustained mid-single-digit annual increases through the second half of the decade. Interconnection queues are lengthening, not shortening. Local opposition to large-scale infrastructure, particularly in power-constrained metros, is becoming more organized. In response, more projects are incorporating behind-the-meter generation, battery storage, and hybrid power strategies earlier in the planning process, despite higher upfront capital requirements.

For corporate real estate and site selection leaders, the practical takeaway for 2026 is that site readiness is no longer a binary condition. It’s a spectrum defined by power certainty, entitlement risk, delivery sequencing, and political alignment. Markets that can demonstrate credible power timelines and coordinated permitting are separating themselves quickly. Those that cannot are being bypassed — regardless of incentives.

The next wave of data center development will not be won by the cheapest land or the loudest incentives package, rather by the regions that can prove, early and convincingly, that they can deliver megawatts on schedule.