The U.S. power grid, built over the past century, was not designed to accommodate load growth at the rate we are seeing this decade. For manufacturers and real estate decision-makers, this shifting energy landscape creates new risks—and new opportunities.

Delays in utility infrastructure can stall expansion timelines, while reliability concerns threaten operations. Battery storage systems offer a path forward by delivering faster access to power, greater energy control, and even new revenue potential.

Much of this load growth can be attributed to explosion of AI and data centers, as well as transportation electrification and industrial manufacturing facilities. About 100 TWh of new industrial load growth is expected by 2035 in the United States, according to McKinsey’s Global Energy Perspective.

BESS can be deployed in less than one year, making it ideal for industries facing urgent power demands.

While addressing load growth needs involves complex variables and is expected to require a mix of energy solutions, the maturation of battery energy storage system (BESS) technology performance, safety, and reliability is quickly making energy storage a go-to solution for users with large power load profiles and utilities.

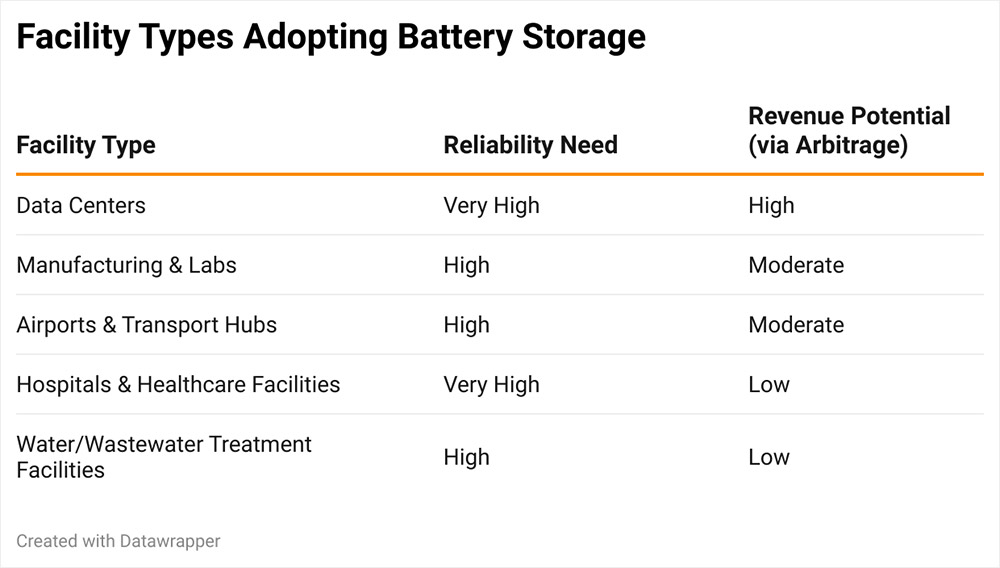

In 2024, the United States turned on 37 GWh of energy storage, and globally, 160 GWh were commissioned. Current BESS technology offers an eloquent solution for all parties, as utility-scale BESS can be designed, built, and deployed in less than one year and ensures reliability, which is especially important for critical systems that may be at risk during power surges or outages. While BESS does not generate electricity, batteries can co-locate with existing gas, solar, or other types of generation—providing resiliency to the grid. And, given the massive reductions in failure rates per deployment of BESS, they are growing in popularity as standalone energy storage systems on sites with large-load users and critical facilities such as data centers, manufacturing and laboratory facilities, airports and other transportation hubs, hospitals, and water/wastewater treatment facilities.

37 GWh

To accomplish this, it is important to recognize the safety and performance of BESS. Specifically, the predominant chemistry, lithium iron phosphate (LFP), has become the investment-grade technology solution that the insurance and investment community has underwritten for the 37 GWh deployed in the U.S. in 2024. Prior chemistries such as nickel manganese cobalt (NMC) and other nascent technologies were deployed in the last decade. While LFP is not 100 percent immune to issues, technological, performance, and safety advancements are happening quickly, and as more companies think about energy storage more broadly, we are sure to see this aspect of the market experience a spike in growth as well.

Battery storage solutions are becoming sophisticated financial instruments, generating predictable revenue streams.

(EPRI, the Electric Power Research Institute, in partnership with Wood Mackenzie, depicts the significant reduction in failure rate per deployments.)

We are also beginning to see savvy business owners as well as industrial and commercial real estate developers explore BESS as a new revenue stream. In certain markets, BESS provides the opportunity to generate ancillary revenues when the BESS has available energy in excess of the asset’s required energy profile and the energy can be sold as arbitrage back to the grid. This market structure is well-known in ERCOT (Electric Reliability Council of Texas). ERCOT operates a competitive wholesale electricity market where energy resources are traded on a real-time or day-ahead basis. Known as a liquid merchant market, stored energy and generated electricity assets participate in a competitive market of buying and selling electricity in an arbitrage model.

By viewing and positioning energy storage assets as economically resilient and sophisticated financial instruments that provide grid stability and can generate predictable revenue streams in certain markets, those who embrace them are seeing the value. Additionally, energy storage can reduce OpEx, and they offer an accelerated timeline for companies experiencing "gridlock," waiting for necessary power from utilities.