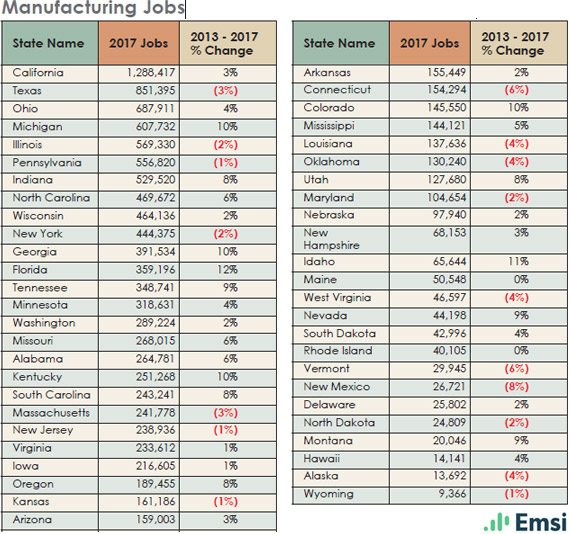

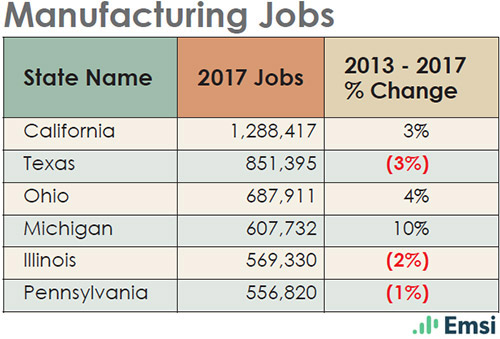

California has the greatest number of total manufacturing jobs in the U.S. in 2017, with nearly 1.3 million workers (over the last four years, from 2013 to 2017, manufacturing jobs in California increased at a rate of 3 percent). Texas is in second place with a total of more than 851,000 manufacturing jobs in 2017; however, between 2013 and 2017 Texas manufacturing jobs actually fell by 3 percent (negative growth in oil and gas, aerospace, agricultural and heavy equipment, and semiconductor manufacturing jobs).

States with the highest rates of growth in manufacturing jobs from 2013 to 2017 are Florida (12 percent) and Idaho (11 percent), followed by Michigan, Georgia, Kentucky, and Colorado (all at 10 percent). In addition to Texas, 16 other states showed overall job losses from 2013 to 2017 across their combined manufacturing sectors. The largest decrease was in New Mexico, where manufacturing jobs fell 8 percent, followed by Vermont and Connecticut, both experiencing 6 percent declines.

States With Manufacturing Job Gains

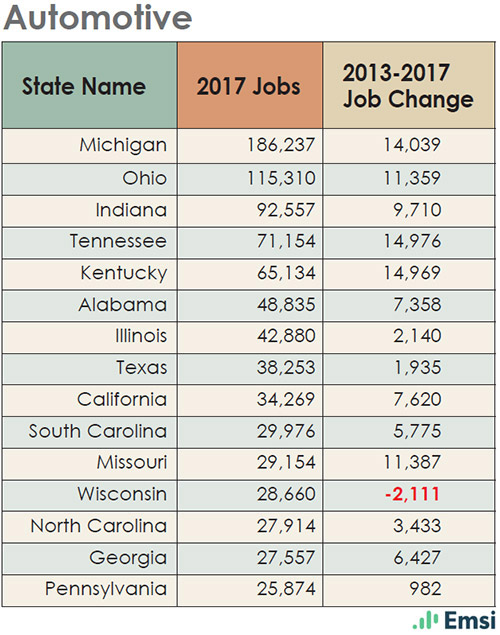

One of the biggest economic drivers among the states adding manufacturing jobs is automotive and automotive parts manufacturing. For total jobs in the overall automotive manufacturing sector in 2017, Michigan is ranked first with 186,237 employees (14,039 of these were added in 2013–2017). As the state rebounded from the Great Recession, nearly one out of eight new Michigan jobs was in the automotive industry, including automotive parts manufacturing.

Manufacturing Jobs

-

Manufacturing Jobs

-

Automotive

-

Food Processing & Manufacturing

-

Aerospace Vehicles

-

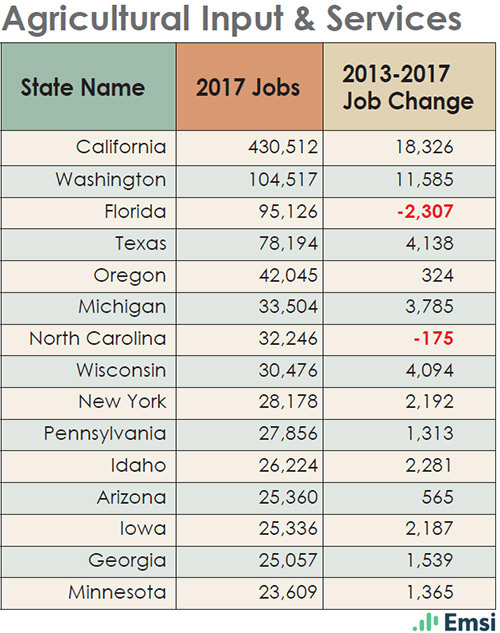

Agricultural Input & Services

-

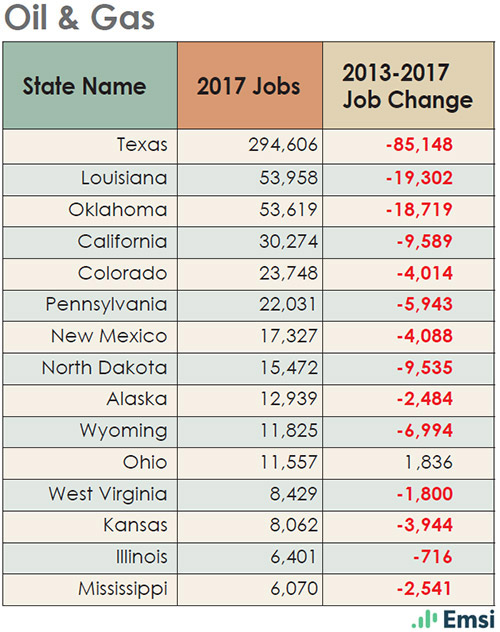

Oil & Gas

-

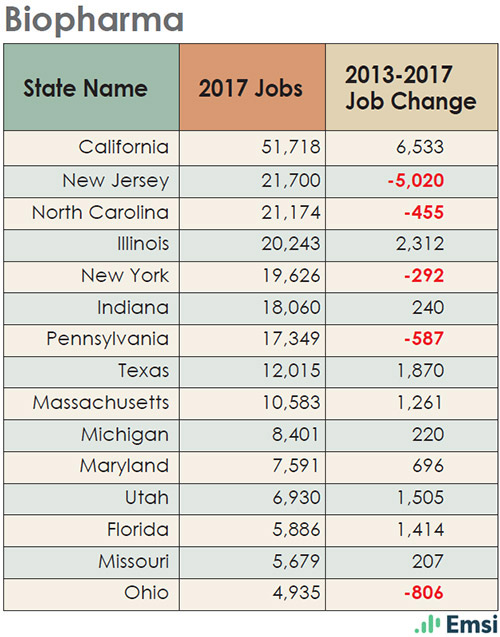

Biopharma

-

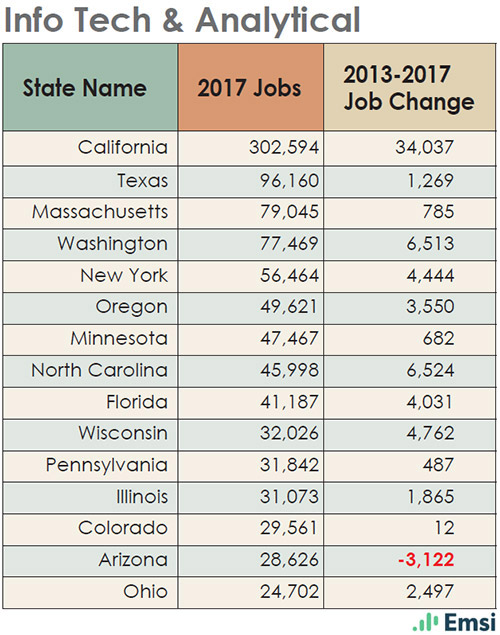

Info Tech & Analytical

-

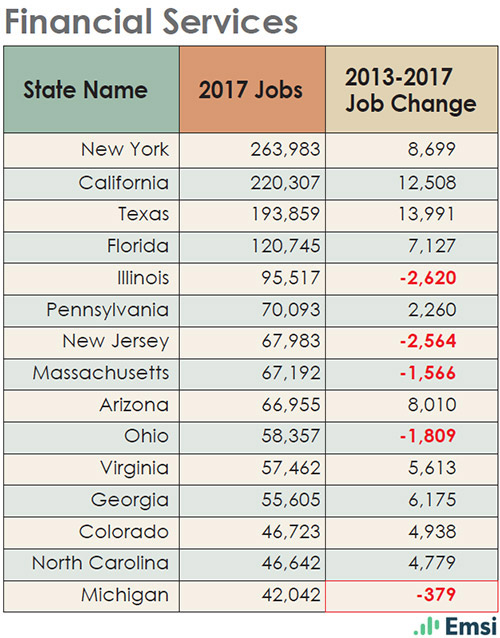

Financial Services

-

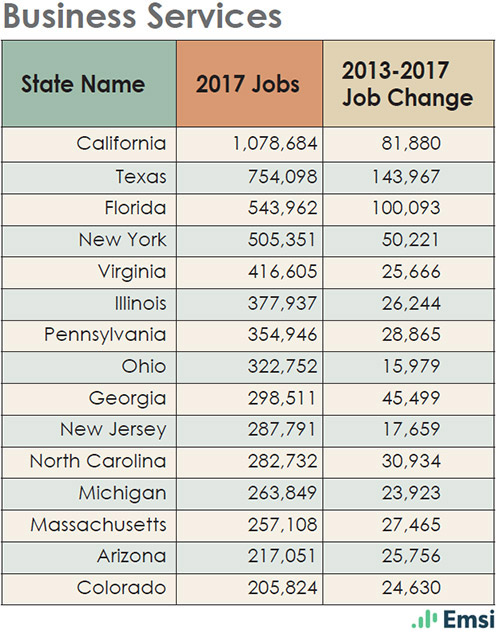

Business Services

-

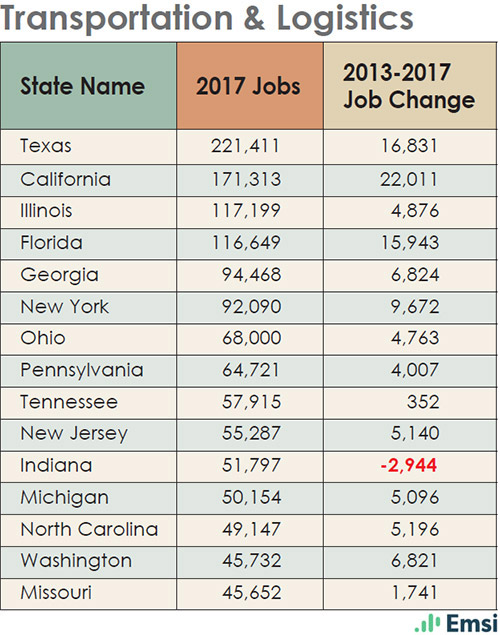

Transportation & Logistics

-

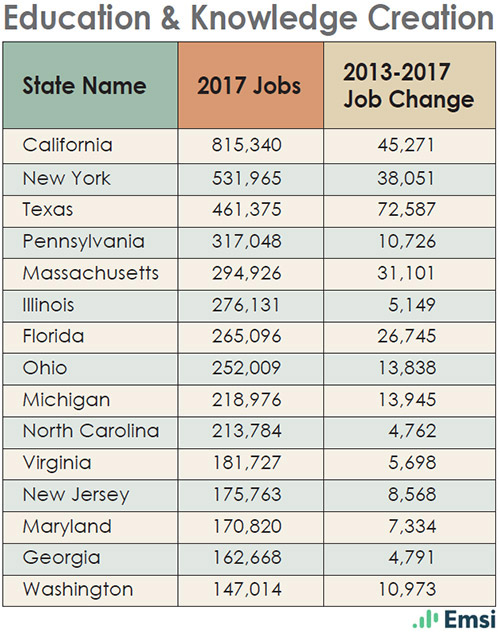

Education & Knowledge Creation

Specifically, automotive parts manufacturing is also booming. Where automobile manufacturing plants locate, auto parts manufacturers and suppliers soon follow. From 2013–2017 motor vehicle parts manufacturing jobs grew by 16 percent in Michigan, 19 percent in Kentucky, and 38 percent in Georgia. For example, German-based LINDE + WIEMANN GmbH KG, a global manufacturer of complex structural steel systems for automotive OEMs, recently opened a $35 million assembly operation in Hart County, Georgia, to supply nearby customers, including BMW and Daimler. In Kentucky, Logan Aluminum recently announced plans for a $248 million expansion of an existing operation to produce lightweight components for the automakers. Braidy Industries also plans to construct a $1.3 billion aluminum rolling mill in Greenup County in eastern Kentucky to produce sheet and plate for automakers that include Ford and Toyota.

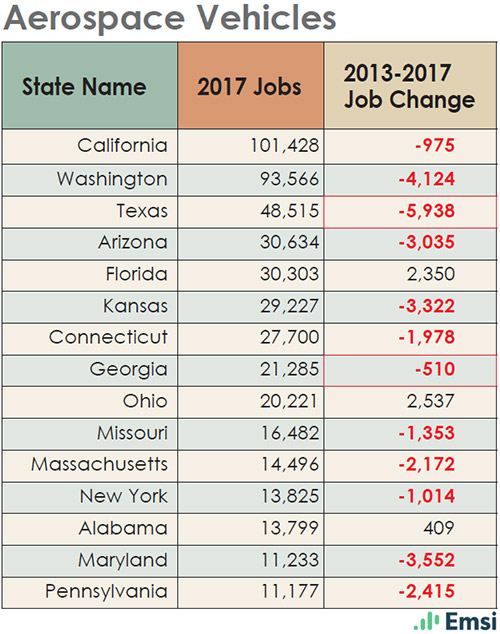

Other states showing manufacturing job gains — Colorado, Florida, and Idaho — have strong manufacturing sectors in aerospace, medical devices, plastics, food and beverage, agriculture and dairy, wood products, and some oil- and gas-related manufacturing. In aerospace products and parts manufacturing jobs, both Florida (9 percent growth in 2013–2017) and Colorado (11 percent growth in 2013–2017) have performed well. Aerospace-related companies in Florida provide a variety of products and services, including aircraft parts and assembly, intelligence, surveillance, reconnaissance, and even missile systems. Florida is home to the “Space Coast” and Cape Canaveral.

With more than 400 aerospace companies and over 25,000 private aerospace workers, Colorado ranks just behind California in terms of its aerospace economy, according to CNBC. It provides research and development, design, and manufacture of guided missiles, space vehicles, satellites and communications equipment, and navigation and detection instruments, as well as planetary spacecraft and launch systems. Colorado also supports innovation and commercial space opportunities, including the development of Spaceport Colorado. For example, in June 2017, Colorado-based United Launch Alliance beat out SpaceX for an Air Force satellite launch contract worth $191 million.

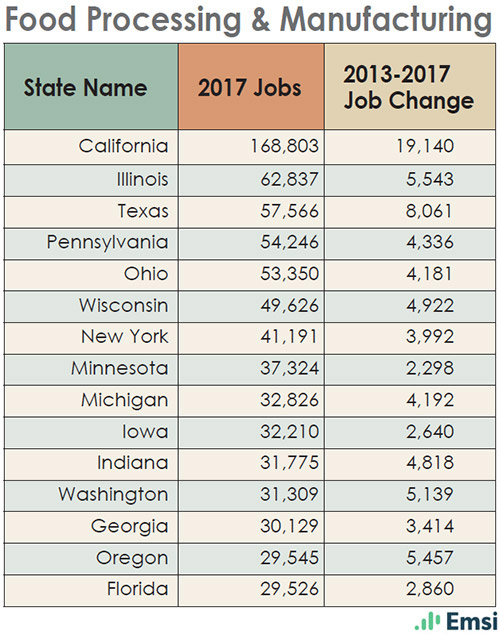

Food and beverage is a strong manufacturing sector for these states as well. Colorado ranks section in the nation for craft beer sales and production, with approximately 334 craft breweries in the state, according to the Brewers Association. Thus, it is no surprise that beverage manufacturing jobs increased 36 percent from 2013 to 2017.

Idaho is known for a variety of food products, including a wide range of crops, seeds, dairy products, cattle and other livestock, wine, and beer. Over the last four years dairy product manufacturing jobs in the state have increased by 20 percent. For example, cheese producer Glanbia Foods plans for an $82 million expansion of its manufacturing plants in south-central Idaho to meet the increasing demand for whey — a byproduct from making cheese.

According to the U.S. Department of Commerce, the U.S. is the world’s largest recipient of FDI ($373 billion in 2016); California attracts roughly one third of this total, the most FDI of any state. States With Manufacturing Job Losses

Negative growth in manufacturing jobs from 2013 to 2017 occurred in several states including New Mexico (-8 percent), Vermont (-6 percent), Connecticut (-6 percent), Louisiana (-4 percent), Oklahoma (-4 percent), West Virginia (-4 percent), Alaska (-4 percent), Massachusetts (-3 percent), and Texas (-3 percent), among others with 2 percent declines.

Some of these declines are related to volatility in the oil and gas markets. Even though prices are on the upswing and more rigs are back to work, downward trends in 2013–2017 job numbers reflect the hardship this sector has caused.

For example, although the oil and gas sector in Texas currently employs approximately 294,000 workers, it has lost 85,148 jobs over the last four years; Louisiana is next at nearly 54,000 workers (-19,302 workers, 2013–2017); Oklahoma at more than 53,600 (-18,719 workers 2013–2017).

North Dakota, Alaska, West Virginia, Illinois, and Mississippi are among other states that have also experienced oil and gas employment declines over the same time period. This reduction in exploration and production activity has also impacted heavy equipment manufacturers — employment in this key manufacturing sector is down by 30 percent in Texas, 25 percent in Louisiana, and 28 percent in Oklahoma.

States are also weighed down by other nonproductive sectors: metal fabrication; ship and boatbuilding; structural metal manufacturing; boilers, tanks, and containers; rubber; iron and steel manufacturing; machine shops; and semiconductors and electronic components also show job reductions from 2013 to 2017.

A bright spot for many states is plastics. The percentage of job gains in the plastics products sector over the last four years includes 29 percent in Alabama; 20 percent in Tennessee; 19 percent in Nevada and North Carolina; 18 percent in Michigan; 17 percent in Colorado; 16 percent in New Jersey; 15 percent in Iowa; 13 percent in Georgia, Kentucky, and Missouri; 11 percent in Kansas, Maine, Utah, and Virginia; and 10 percent in Indiana, among smaller gains in several other states. Production is up thanks to increased substitution of plastics for other materials such as metal and easy access to shale gas feedstocks.

According to a January 2017 report in Plastics News, employment in plastics manufacturing rose 1.4 percent to 954,000 in 2015 (the most recent figures available) with U.S. production approaching $420 billion, making plastics the third-largest manufacturing sector behind oil and gas extraction and automobiles. The report also noted more than 500 investments in expansion or new locations were announced that year, with many located in the Midwest and Texas.

Texas is home to an abundance of plastics manufacturers that employ about 75,000 workers — the largest plastics workforce in the nation. Texas’ plastics products manufacturing workforce grew by 3 percent from 2013 to 2017. Texas also has easy access to abundant raw materials and an excellent petrochemical infrastructure, especially along the Gulf Coast.

Other manufacturing categories are helping stabilize uneven state economies. For example, Massachusetts experienced a 3 percent drop in overall manufacturing employment from 2013 to 2017. Significant losses occurred in semiconductors, computers and peripheral equipment, printing and related support activities, and aerospace products and parts, as well as smaller losses in other sectors. Bright spots in the economy include pharmaceutical and medicine manufacturing, where jobs grew 14 percent over the four-year period. Massachusetts is also experiencing growth in the beverage industry, where jobs have grown 43 percent.

In New Mexico, manufacturing job losses from 2013 to 2017 have occurred in semiconductors and electronic components, instruments, and some other manufacturing sectors. In contrast, the strongest job gains over that time period have been fruit and vegetable preserving and specialty food manufacturing (+44 percent) and other food manufacturing (+18 percent).

Specialty foods from New Mexico are in high demand around the world, especially its chile varieties. Planted chile acreage in 2016 totaled about 9,200 acres, producing 69,000 tons of product valued at about $50.6 million. Luna and Doña Ana counties lead New Mexico in chile production. Reflective of the increased demand for specialty foods, El Pinto Foods announced in January 2017 plans for a $7 million expansion of its Albuquerque facility. Its salsa manufacturing division currently produces 25,000 salsa and chile jars per shift and has the capacity to make three to four million jars annually. The expansion is needed to meet growing demands for individual-sized portion cups for private-label customers.

Diversity Is Essential for Growth

A state that develops and supports multiple manufacturing clusters has a much better chance of successfully riding out economic ups and downs, as well as employing its workforce in good-paying jobs, keeping unemployment rates low. A good example is California, whose manufacturing job numbers increased by 3 percent from 2013 to 2017, bringing its current total to nearly 1.3 million.

It’s projected that over the next decade, nearly 3.5 million manufacturing jobs will be created — two million of which will go unfilled because employers won’t be able to find workers with the required skills. California shows diverse economic strength through all of its key sectors. It has the greatest number of jobs in aerospace vehicle manufacturing, biopharmaceuticals, information technology and analytics, agricultural input and services, food manufacturing and processing, business services, and education and knowledge creation, and is second in transportation and logistics and financial services.

NAM reports that manufacturers in California account for about 12 percent of the state’s total output and employ nearly 8 percent of the workforce. Total output from manufacturing in California was about $280 billion in 2015. Much of this vitality and success of manufacturing is due in part to the attractiveness of California for foreign direct investment (FDI). According to the U.S. Department of Commerce, the U.S. is the world’s largest recipient of FDI ($373 billion in 2016); California attracts roughly one third of this total, the most FDI of any state. In 2015, nearly 70 percent of FDI flows, and more than one third of jobs created at U.S. majority-owned affiliates of foreign entities, were in a manufacturing venture, with the largest proportions going toward automotive, chemicals, plastics, pharma, and medicines.

It’s projected that over the next decade, nearly 3.5 million manufacturing jobs will be created — two million of which will go unfilled because employers won’t be able to find workers with the required skills.11 This is actually happening now: according to Deloitte and the Manufacturing Institute, 80 percent of manufacturers report a moderate or serious shortage of qualified applicants for skilled and highly skilled production positions. If national and state governments and their manufacturers want to remain competitive, domestically and globally, they must work collaboratively with each other and with educational institutions to provide future workers with the critical skills they need to fill these positions. A strong and capable workforce is a critical asset for any company and for any location, especially those that may have other weaknesses or trouble spots.

In Connecticut, for example, from 2013 to 2017, manufacturing jobs dropped in aerospace products and parts (-6 percent), machining (-1 percent), instruments (-12 percent), and medical equipment and supplies (-14 percent). So far, however, most of Connecticut’s 4,000 manufacturers are hanging tough, employing about 155,000 workers. State government is providing high-value incentive packages, including financial aid and workforce training, to keep critical manufacturers like Sikorsky Aircraft and Pratt & Whitney from finding better deals elsewhere. State-sponsored incentives include Connecticut’s Small Business Express program for smaller companies, which provides more accessible capital and screening, hiring, and training programs for employees.

States that already have robust high-tech sectors and skilled labor pools are at a competitive advantage to win more big projects and grow their clusters, but they must also push relentlessly to develop their workers for the future. For example, because of California’s vibrant and diverse technology sectors, “California is in a unique position to prepare its workforce to attract those 21st century jobs, but we have to make the necessary investments now,” says U.S. Senator Dianne Feinstein in a recent op-ed in the Huffington Post.

California is already home to two federally supported manufacturing institutes, which foster partnerships between the public, private, and education sectors to advance manufacturing and promote long-term sustainable research and development, as well as develop a highly qualified future workforce. Federal programs, Feinstein adds, such as Hollings Manufacturing Extension Partnership (MEP), are critical for maintaining U.S. global leadership in manufacturing. MEP, part of the National Institute of Standards and Technology, works with U.S. manufacturers to help them create and retain jobs, increase profits, and save time and money. As a nationwide network, MEP centers are located in every state and provide a variety of services, from innovation strategies to process improvements to green manufacturing.

“MEP facilitates partnerships between federal, state, and local stakeholders to help manufacturers reach untapped markets, embrace groundbreaking technology, and increase the value of their products,” says Feinstein. “In 2016 alone, MEP contributed to more than $9 billion in sales and facilitated $3.5 billion in new investment for manufacturers across the country. It’s vital that we continue to support manufacturers and manufacturing workers by promoting collaborative partnerships across multiple sectors and supporting robust federal investments in programs like MEP.”