For decades, manufacturing location strategy followed a familiar script: minimize cost, maximize incentives, and secure enough labor to get a plant online. That playbook no longer works.

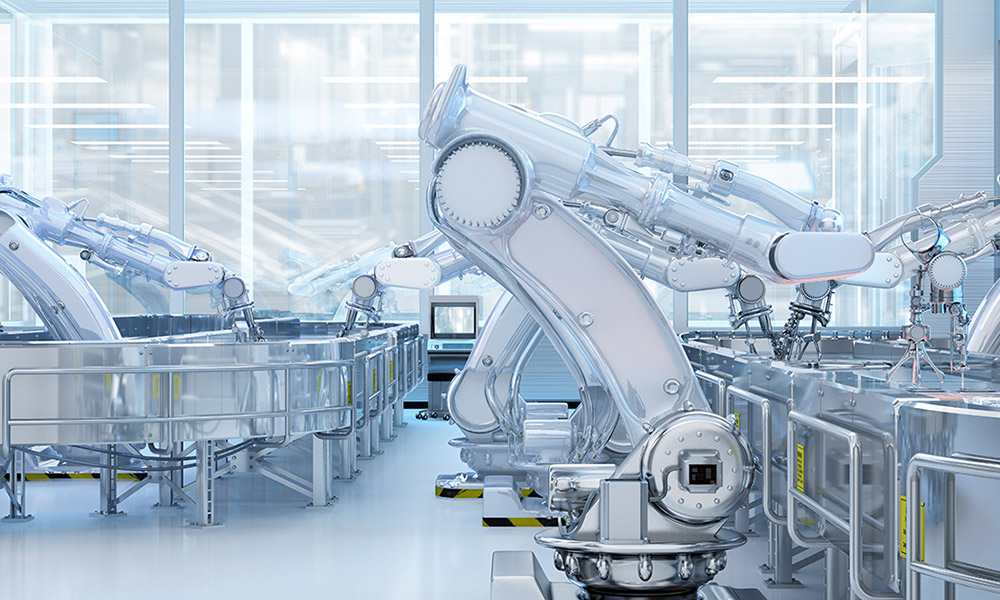

What many companies now label “advanced manufacturing” is not simply a higher-tech version of traditional production. It is a fundamentally different operating model—one that places new demands on workforce quality, site readiness, resiliency, power reliability, and long-term adaptability. Companies that fail to recognize this shift risk choosing locations that look competitive on paper but break down under real operational pressure.

Having advised corporate occupiers across technology, industrial, and advanced manufacturing portfolios for more than two decades, I’ve seen firsthand how the definition of a “good site” has changed—and why location decisions today must be made with a longer, more disciplined lens.

The New Manufacturing Workforce Is Smaller—and Harder to Replace

Advanced manufacturing facilities are often more automated, more data-driven, and more capital-intensive than their predecessors. That efficiency reduces headcount, but it raises the stakes for every remaining role.

When a plant employs fewer people, each worker represents a larger share of output and institutional knowledge. The result is a workforce model that prioritizes reliability, technical aptitude, and retention over sheer availability. Labor pools that once supported high-volume manufacturing may struggle to support facilities that rely on automation technicians, controls engineers, and maintenance specialists to keep complex systems running continuously.

1

- How stable is the local technical workforce?

- How is the local and regional education system building the workforce pipeline?

- Where do mid-career replacements come from when attrition occurs?

- Can the region support long-term skill evolution as production systems change?

Communities that cannot answer those questions with specificity should raise immediate concern—regardless of incentive packages or short-term hiring promises.

Automation Changes Space, Infrastructure, and Risk

Automation does more than alter production lines. It reshapes facility design, power demand, connectivity, and tolerance for disruption.

Advanced manufacturing is a fundamentally different operating model.

Advanced manufacturing plants often require higher ceiling heights, specialized floor loading, greater electrical capacity, and enhanced cooling. These needs reduce flexibility in site selection and increase dependence on infrastructure performance. A location that struggles with power reliability, water availability, or substation access may become a liability long after construction is complete.

From a corporate perspective, this shifts site evaluation from a transactional decision to a risk-management exercise. It is no longer sufficient to ask whether utilities can serve the facility at the time of opening. Companies must assess whether infrastructure can scale, adapt, and remain resilient over the life of the operation.

The cost of getting this wrong is rarely immediate—but it is often severe.

Speed to Market Has Become a Competitive Advantage

In many sectors, advanced manufacturing investment is tied to compressed timelines. Market windows are narrow. Customer commitments are firm. Delays in site readiness, permitting, or utility delivery can cascade into lost revenue or broken contracts.

Incentives cannot offset operational disruption.

This reality underscores the importance of execution certainty. Companies should be wary of locations that rely heavily on future commitments rather than demonstrated capability. A site that requires extensive off-site infrastructure work, environmental remediation, or multi-layered approvals may ultimately cost more—even if initial incentives appear generous.

The most competitive locations today are those that reduce unknowns. They offer clear timelines, coordinated agencies, and proven track records of delivering complex projects on schedule.

Incentives Still Matter—But Only When They Align With Operations

Incentives remain part of the equation, but their relative importance has shifted. Tax credits and grants do little to offset operational disruption, labor instability, or infrastructure failure.

For advanced manufacturing projects, incentives must be evaluated alongside compliance risk and administrative burden. Programs that require aggressive hiring thresholds, rigid timelines, or extensive reporting may create friction that outweighs their financial value. The most effective incentives are those that support long-term operational stability, such as invested capital offset, workforce development, and infrastructure investment.

24/7

Companies should treat incentives as one variable in a broader risk-adjusted analysis, not as a deciding factor in isolation.

Portfolio Thinking Beats One-Off Decisions

Another defining trait of advanced manufacturing strategy is portfolio alignment. Companies increasingly evaluate sites not as standalone investments, but as components of a broader operational network. Proximity to suppliers, customers, research partners, and logistics nodes matters more when production systems are tightly integrated.

Site selection has become a risk-management exercise.

This portfolio approach favors regions that can support multiple functions over time—manufacturing, R&D, distribution, and even headquarters operations. It also rewards flexibility: the ability to expand, retool, or repurpose facilities as technology and markets evolve.

From this perspective, site selection becomes less about winning a single project and more about sustaining long-term competitiveness.

The Bottom Line

Advanced manufacturing demands more from its locations—and from the teams selecting them. The metrics that once defined a “good deal” are no longer sufficient. Companies must interrogate labor depth, infrastructure resilience, execution certainty, and long-term adaptability with greater rigor than ever before.

Those who do will not only build successful facilities but also position themselves to compete in an industrial landscape where speed, precision, and resilience increasingly determine who wins—and who falls behind.