For years, “industries of the future” was a phrase that lived comfortably in pitch decks and conference panels. Today, it is showing up in real site searches, real capital stacks, and real pressure on communities to deliver something beyond incentives. What has changed is not just technology, but the alignment of federal priorities, private investment, and execution-ready locations.

In our work advising emerging and growth-stage companies, particularly those coming out of venture-backed innovation pipelines, a clear pattern has emerged. The industries advancing fastest are not necessarily the most visible, but they are the ones positioned where public capital, private capital, and operational feasibility intersect. In many cases, these companies are not inventing entirely new sectors. They are fundamentally changing how long-established industrial processes are carried out.

Follow the Capital—But Understand the Stage

Capital flow has become one of the most reliable indicators of where future industrial growth will occur, but only if its purpose is understood. Federal programs, particularly through the Office of Strategic Capital and the U.S. Department of Energy, are increasingly focused on companies that have moved beyond early research but have not yet reached full commercial scale.

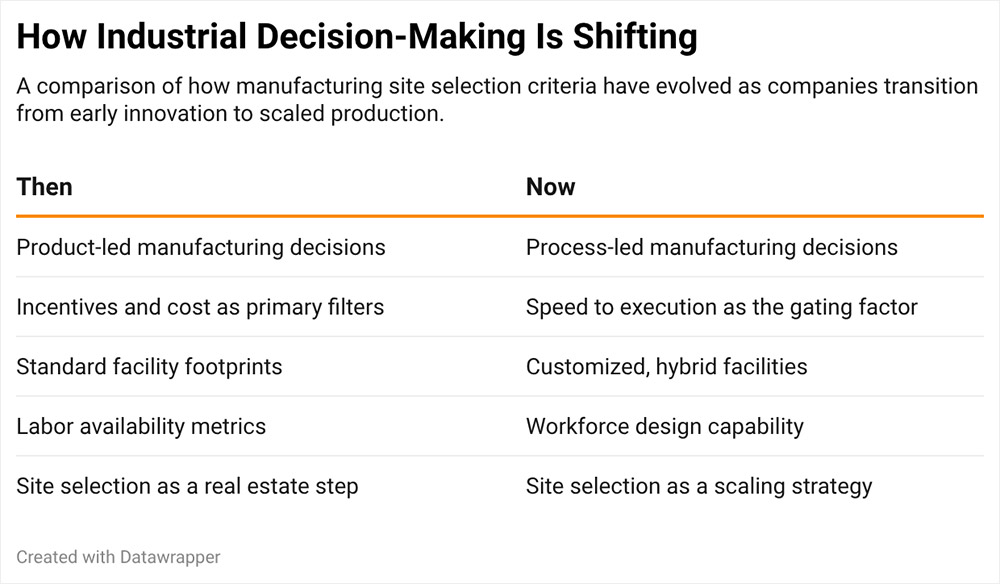

Process innovation, not product hype, is defining the next wave of U.S. manufacturing.

This phase—often described as the “valley of death”—is where many promising technologies struggle to survive. A company may have proven its concept through pilot production and raised tens of millions of dollars, but scaling manufacturing can require multiples of that investment. Federal participation at this stage is less about market speculation and more about de-risking technologies viewed as strategically important to U.S. competitiveness.

For site selection, this changes the conversation. These companies are not simply choosing a location; they are looking for a partner that can support rapid transition from innovation to execution.

Process Innovation Is the Real Signal

Much of the most meaningful industrial innovation underway today is focused on process rather than product. In sectors tied to critical materials, advanced manufacturing, and national security, companies are rethinking how inputs are produced, refined, or substituted in ways that reduce environmental impact, improve efficiency, or lessen dependence on foreign supply chains.

$10B+

These process-driven companies often do not fit legacy industrial models. Their facilities may combine research, testing, and early production under one roof. Their space requirements are highly specific. Their timelines are compressed. Locations that understand these dynamics—and are willing to adapt zoning, infrastructure planning, and development timelines accordingly—are far more likely to stay competitive.

Workforce Is a Design Problem, Not a Statistic

Every emerging industry still relies on people, but traditional labor metrics rarely provide a complete picture. What matters most is not whether a workforce perfectly matches a company’s needs on day one, but whether a community has the capacity to design and deliver customized training as those needs evolve.

Site selection today is about execution, not incentives.

Many of the companies moving from pilot to scaled production are growing quickly, often increasing output several times over in short periods. That growth raises important questions about training models, talent pipelines, and whether research and development functions should be co-located with manufacturing.

Increasingly, companies are seeking locations that allow them to balance proximity to research ecosystems with the operational advantages of manufacturing-oriented communities. Places that can support that balance—through education partnerships, workforce flexibility, and realistic labor-shed planning—stand out early in the site selection process.

Place Still Needs a “Why”

Beyond infrastructure and incentives, companies are asking a more fundamental question: why here? A location’s ability to articulate its role within a broader industrial ecosystem has become a meaningful differentiator.

Federal designations, innovation hubs, and industry-focused programs help provide that context. They signal alignment with national priorities and give companies confidence that they are joining something larger than a single project. For many emerging manufacturers, that sense of purpose matters as much as cost or speed.

The most competitive locations are designed for companies scaling fast, not pitching long-term potential.

At its core, site selection still comes down to people and place. But place is no longer just about geography. It is about intent, coordination, and the ability to support a company’s growth over time.

Looking Ahead

Technology will continue to advance regardless of political cycles. What will determine which industries scale successfully is how well capital, policy, and location strategy remain aligned. Over the coming years, the most successful projects are likely to come from companies that combine process innovation with thoughtful site selection—and from communities prepared to meet them at that intersection.

The industries of the future are no longer hypothetical. They are being built now, in places that understand how innovation moves from concept to commercial reality.