Part 3 of a 3-part series on site readiness and risk.

Most business leaders don’t get to see what happens between the moment a community submits a proposal and the moment a final site is selected. And yet, that space between — where sites are scored, ranked and filtered — is where the real decisions start to take shape.

My job as a site selector is to make sense of the chaos. On most projects, we’re evaluating dozens or even hundreds of properties across multiple states. Every location comes with its own set of strengths, risks, unknowns and workarounds. It’s our job to turn all that into a decision-making framework that makes sense to the C-suite.

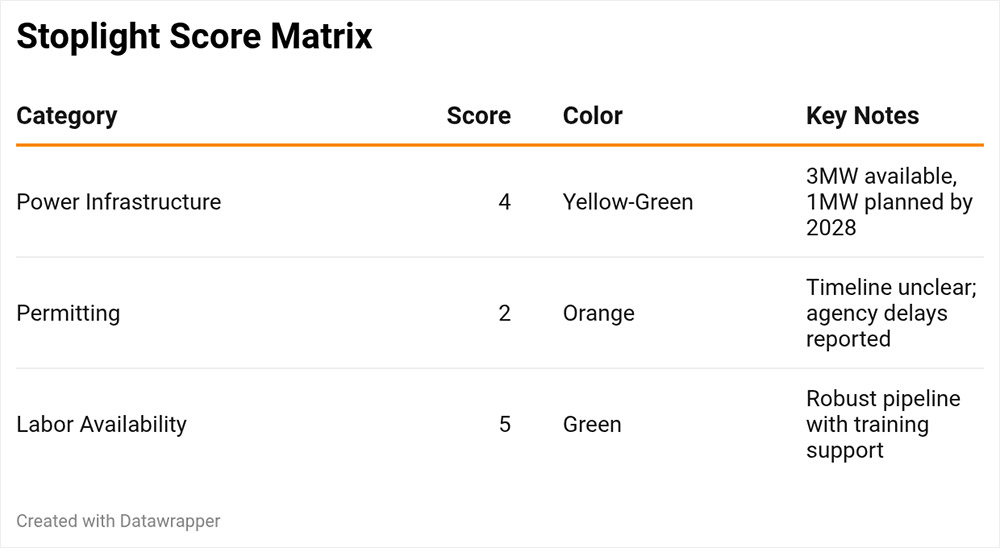

To do that, we rely on a structured analysis process — typically some variation of a “stoplight” system that scores each site from one to five across a range of categories. Green means go, red means stop, and everything else falls in between. It’s a simple visual, but what sits underneath is a dense, highly customized evaluation that weighs factors like infrastructure, permitting timelines, workforce availability, political risk and cost of doing business.

A green light doesn’t mean perfect — it means ready enough to move forward.

The challenge is that not everything is black and white. Take power, for example. A site may only have three megawatts available today, but the local utility has already outlined a credible plan to deliver the fourth by 2028. That’s not a red light, but it’s not a perfect green either. In that case, the site might score a four — still viable, with some risk attached. That single number tells a story, but it’s only meaningful if we’ve gotten clear, transparent answers from the community about what’s possible and how it’ll be delivered.

This is why vague or overly optimistic responses in an RFI can be so damaging. If a site gets through our initial screening based on a set of assumptions, and then — after being shortlisted — we discover that the promised infrastructure or labor pool doesn’t exist, we’re suddenly dealing with a much bigger problem. Now the company is spending real money evaluating the site. Stakeholders are involved. Expectations have been set. And if the data doesn’t hold up, trust is broken.

5

But when a community is honest and detailed — when they explain what’s available today and what could be available tomorrow, and back it up with conversations, plans and commitments — that creates flexibility. I can go to a client and say, “This site isn’t fully ready today, but it’s our best overall option. If we can be operational at 75 percent on day one, they can ramp us up the rest of the way within a year.” That opens the door to strategic compromises, and in many cases, that’s what leads to a deal.

The other side of this process that’s often overlooked is the role of trust. Communities that provide clear, consistent and well-documented information are the ones we remember. And when the next project comes along — especially the complex, time-sensitive ones — they’re the places we look to first. It’s not just about winning a single deal. It’s about building a reputation for being a dependable partner who understands what companies need and what readiness really looks like.

Vague responses at the RFI stage can cost real money later.

At the executive level, you don’t need to see every spreadsheet or map behind a site scoring model. But you should ask your team what methodology was used. How were the sites scored? What risk factors were weighed most heavily? Where did the finalists exceed expectations, and where did they come up short? Good site selection isn’t about finding perfection. It’s about finding clarity — enough clarity to make an informed, strategic decision with confidence.

What happens between the pitch and the boardroom is rarely glamorous. It’s a process built on cross-checking, critical thinking and a whole lot of spreadsheet formulas. But when it works, it delivers results. And for companies betting hundreds of millions of dollars on a new location, that’s what really matters.