It’s been 20 years since Area Development first handed out its inaugural Shovel Awards. In those two decades, we’ve seen seismic shifts in where and how America grows. From the rise of the electric vehicle industry to the return of semiconductor manufacturing on U.S. soil, the momentum has never let up. If anything, the pace has only quickened. And through it all, the states that earn Shovel Awards have led the charge, securing investments, creating jobs, and laying the groundwork for sustainable, long-term economic success.

The 2025 Gold and Silver Shovel Awards arrive during a time of remarkable resilience and forward-looking energy. Despite global headwinds, domestic uncertainty, and technological upheaval, the American economy continues to expand, fueled by billions in capital investment and a renaissance in domestic manufacturing. From EV batteries to semiconductors, aerospace to food production, and from rural communities to megaregions, the growth stories behind this year’s winners offer a powerful testament to the vision and coordination it takes to compete in today’s global economy.

Each year, Area Development recognizes states that stand out for their ability to attract high-impact economic development projects. Using data submitted by state economic development agencies, we evaluate the top projects based on job creation, capital investment, diversity of industry, and each state’s overall economic strategy. Gold and Silver Shovel Awards are given out in five population categories to ensure fair comparisons, and in recent years we’ve added Platinum and Green Shovel Awards to highlight standout overall performance and leadership in environmentally sustainable development, respectively. Read on for a detailed look at this year’s top-performing states, the projects that earned them recognition, and the broader economic trends shaping America’s industrial future.

2025 PLATINUM Shovel Award

- North Carolina (12+ Million Population)

2025 Green Shovel Award

- Louisiana (3 to 5 Million Population)

2025 Gold Shovel Awards: The Winning States

- Texas (12+ Million Population)

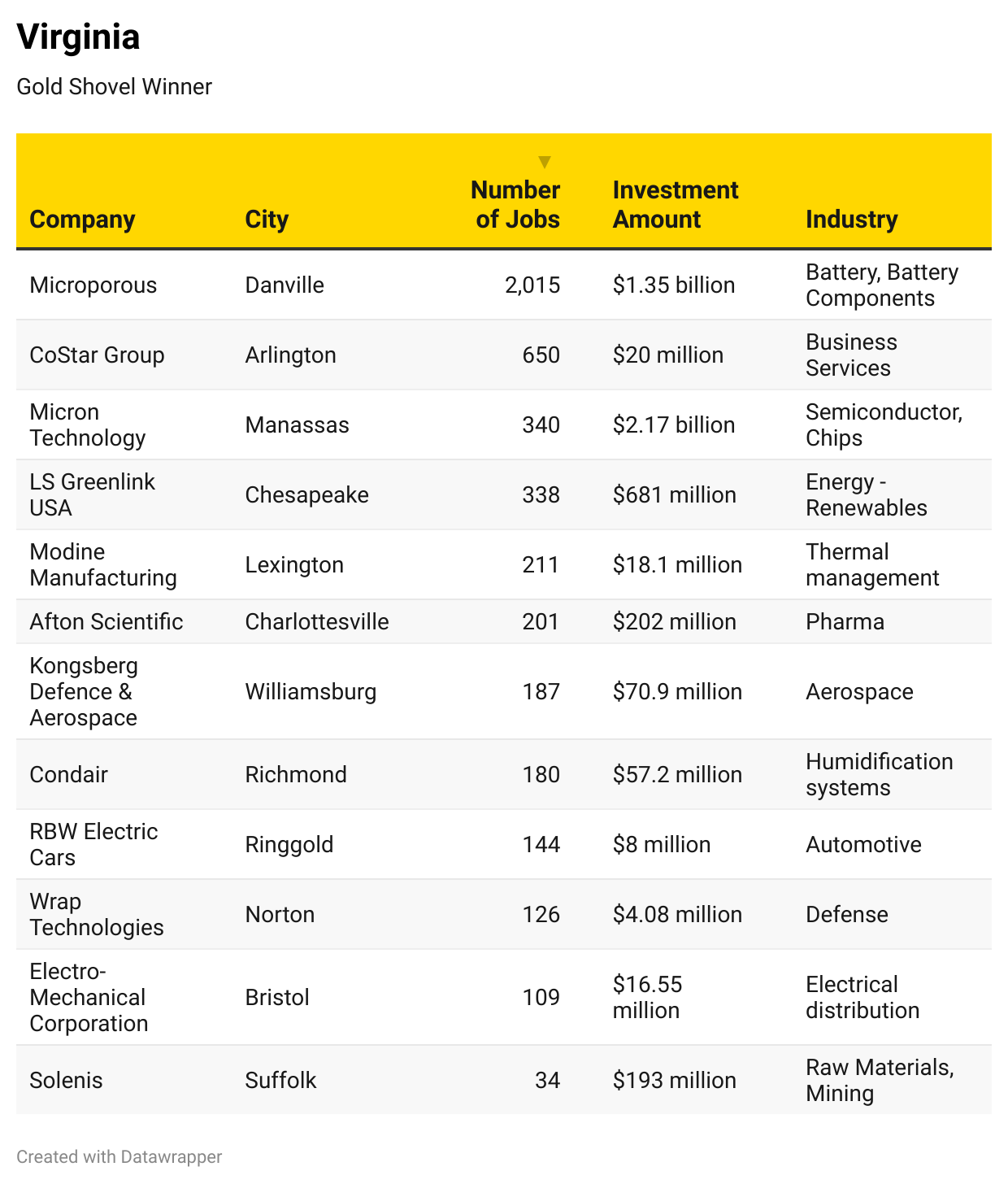

- Virginia (8 to 12 Million Population)

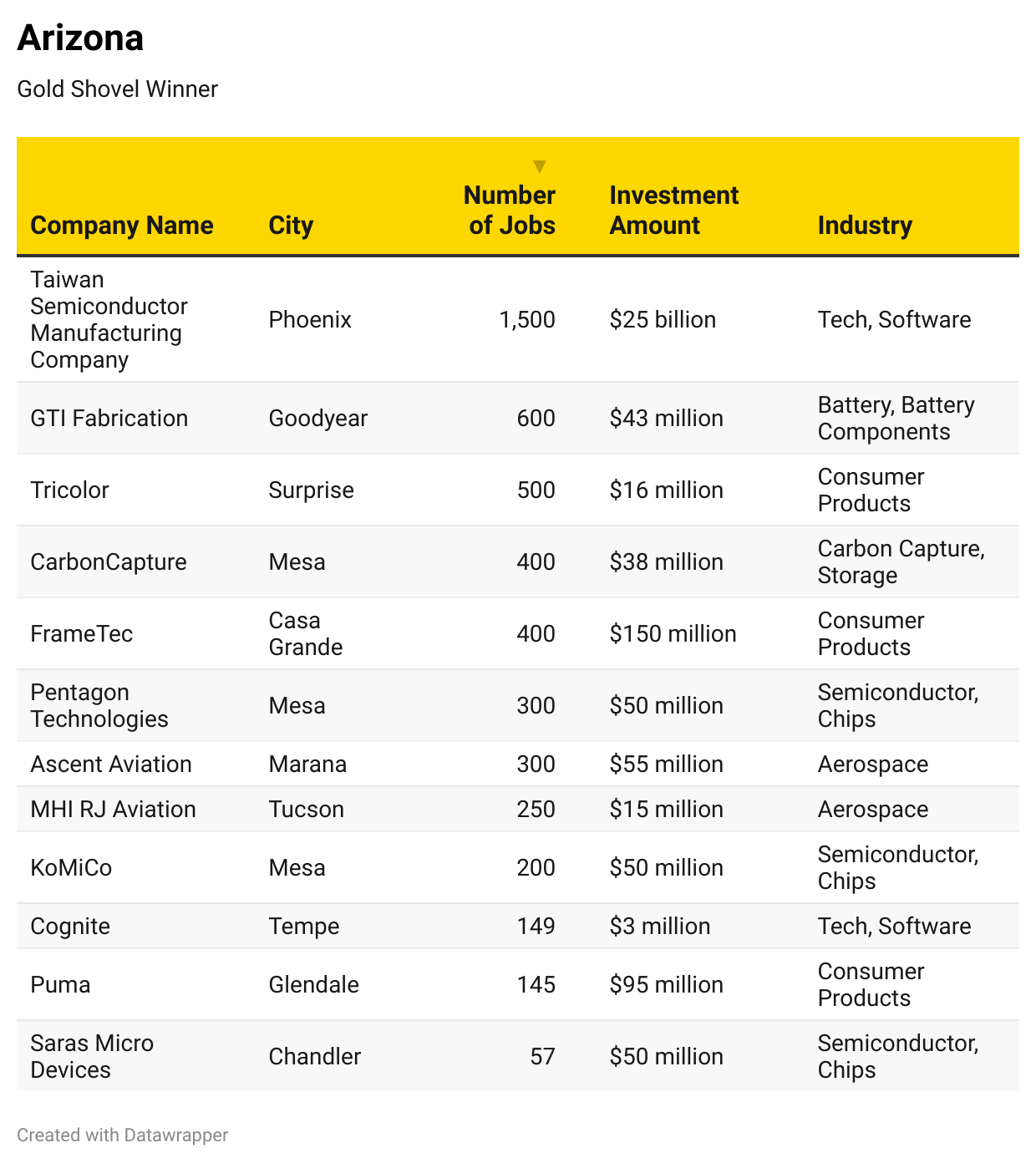

- Arizona (5 to 8 Million Population)

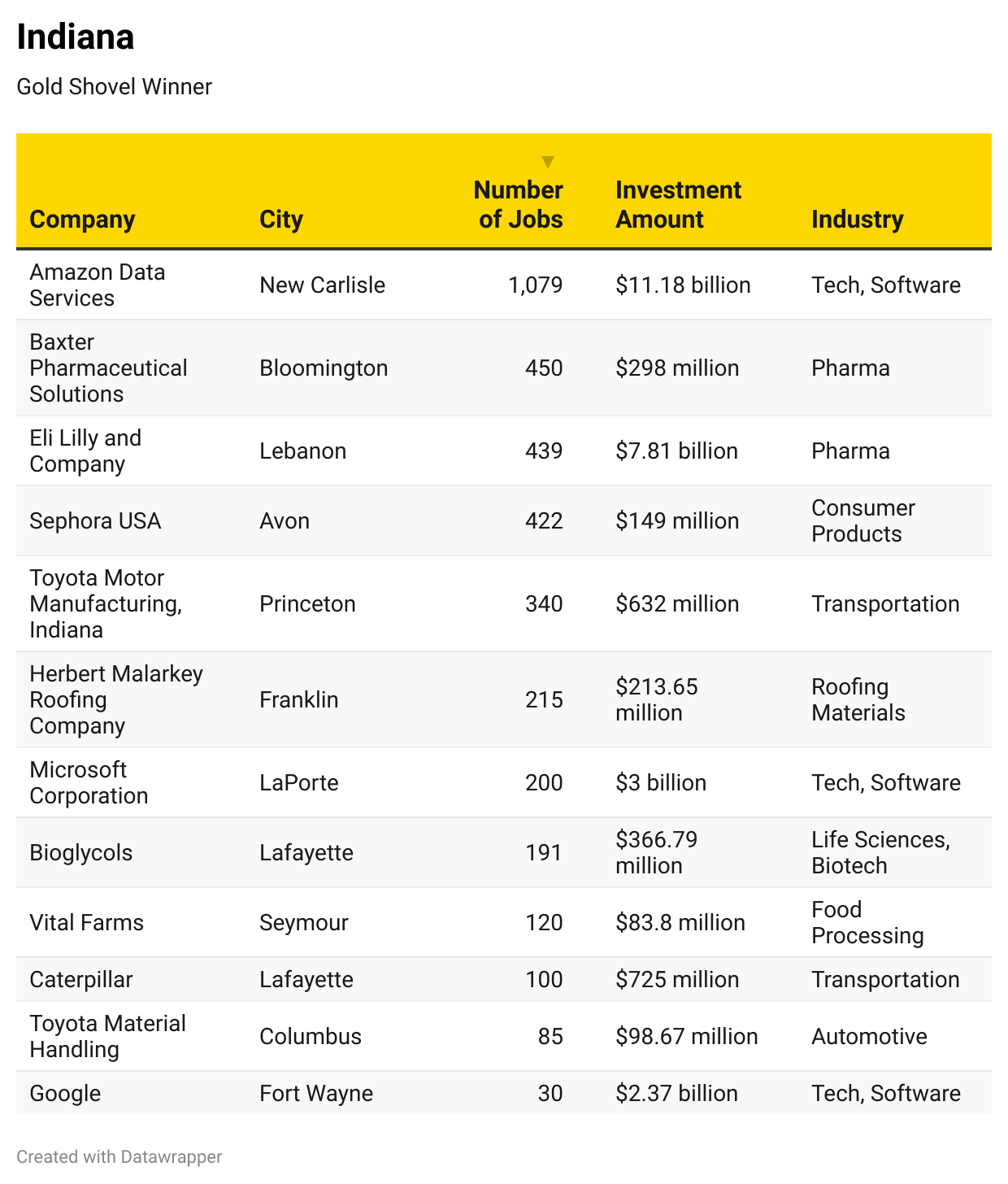

- Indiana (5 to 8 Million Population)

- Louisiana (3 to 5 Million Population)

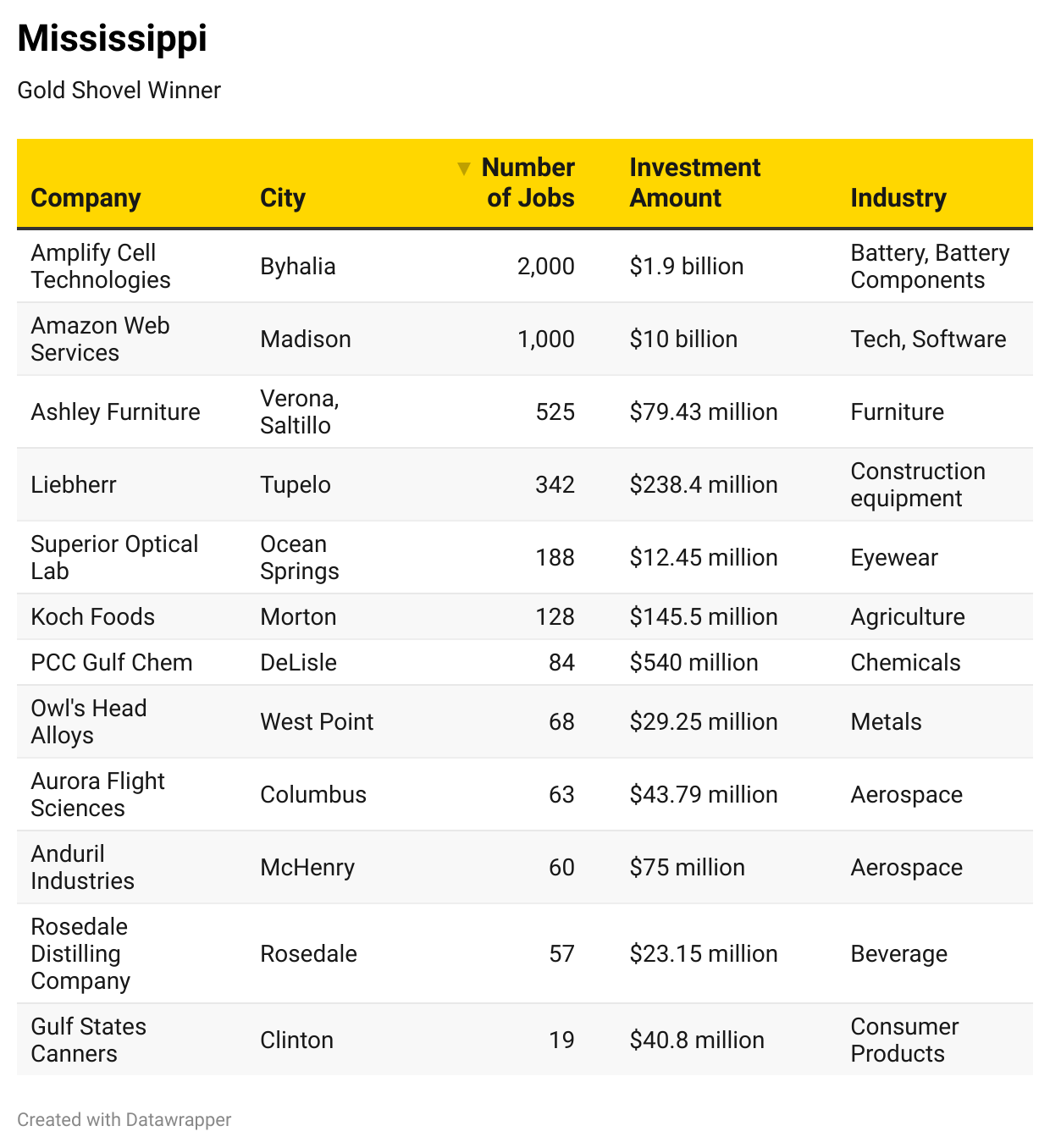

- Mississippi (Under 3 Million Population)

2025 Silver Shovel Awards

12+ Million Population Category

- New York

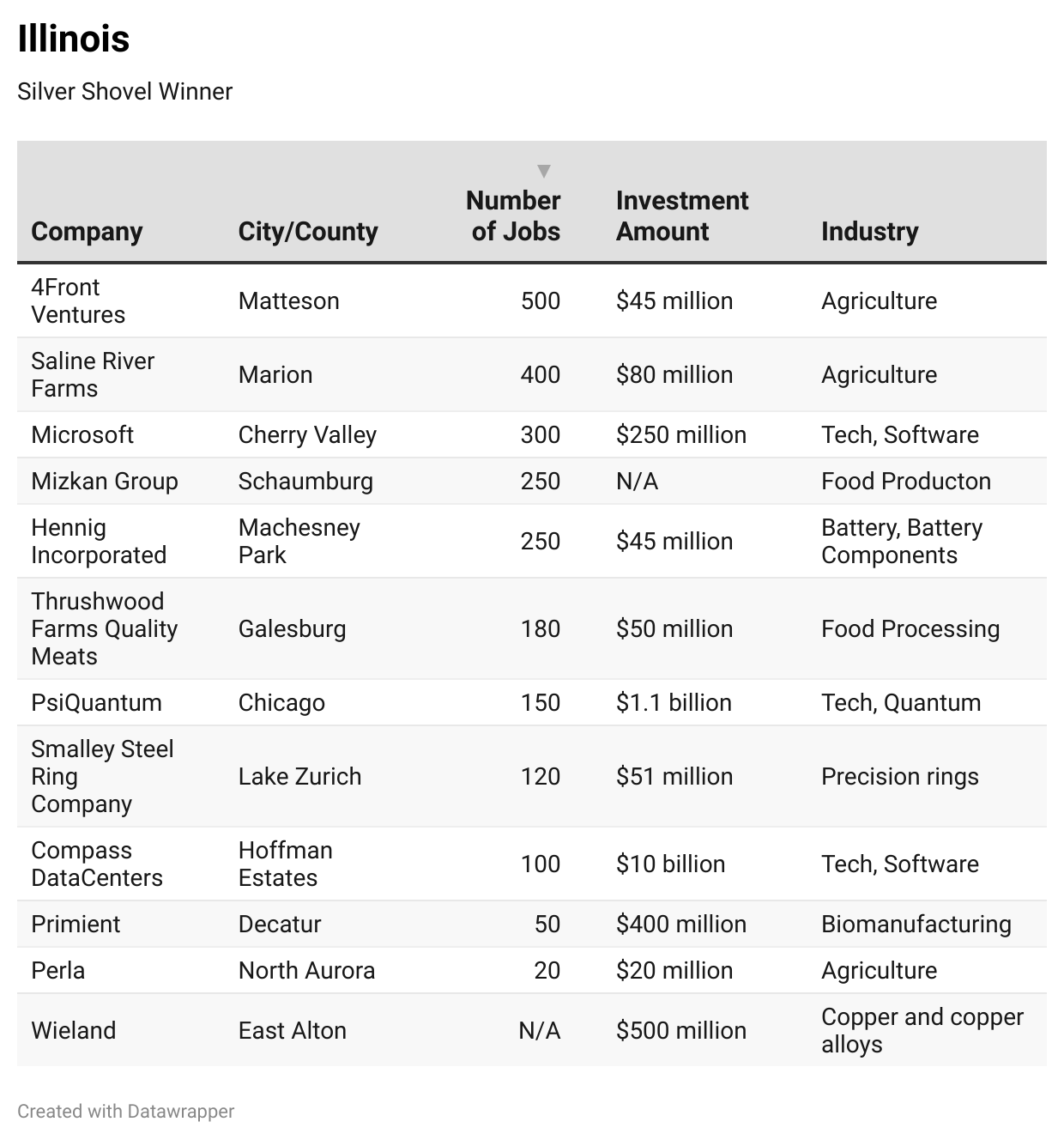

- Illinois

8 to 12 Million Population Category

- Michigan

- Georgia

5 to 8 Million Population Category

- Wisconsin

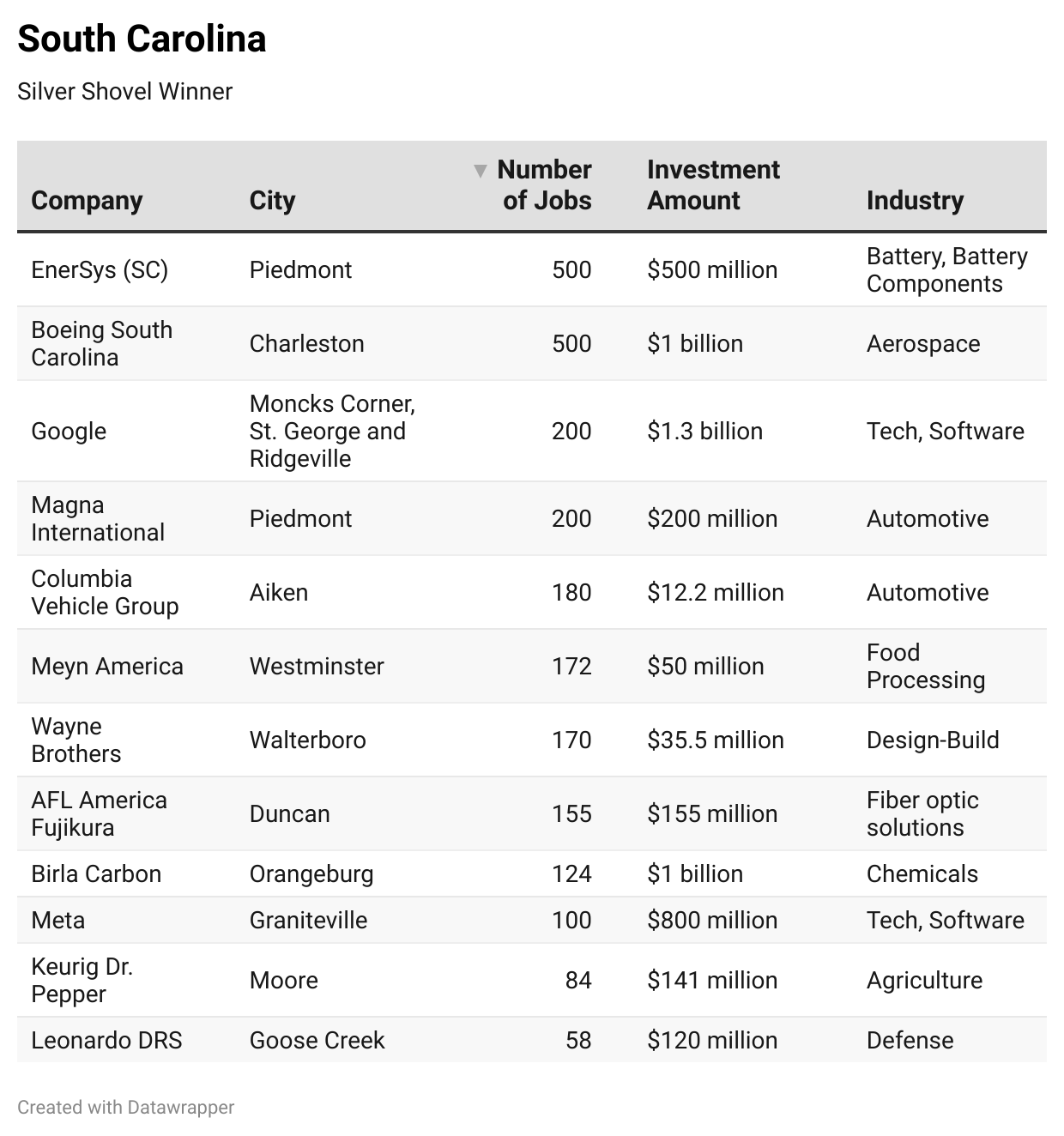

- South Carolina

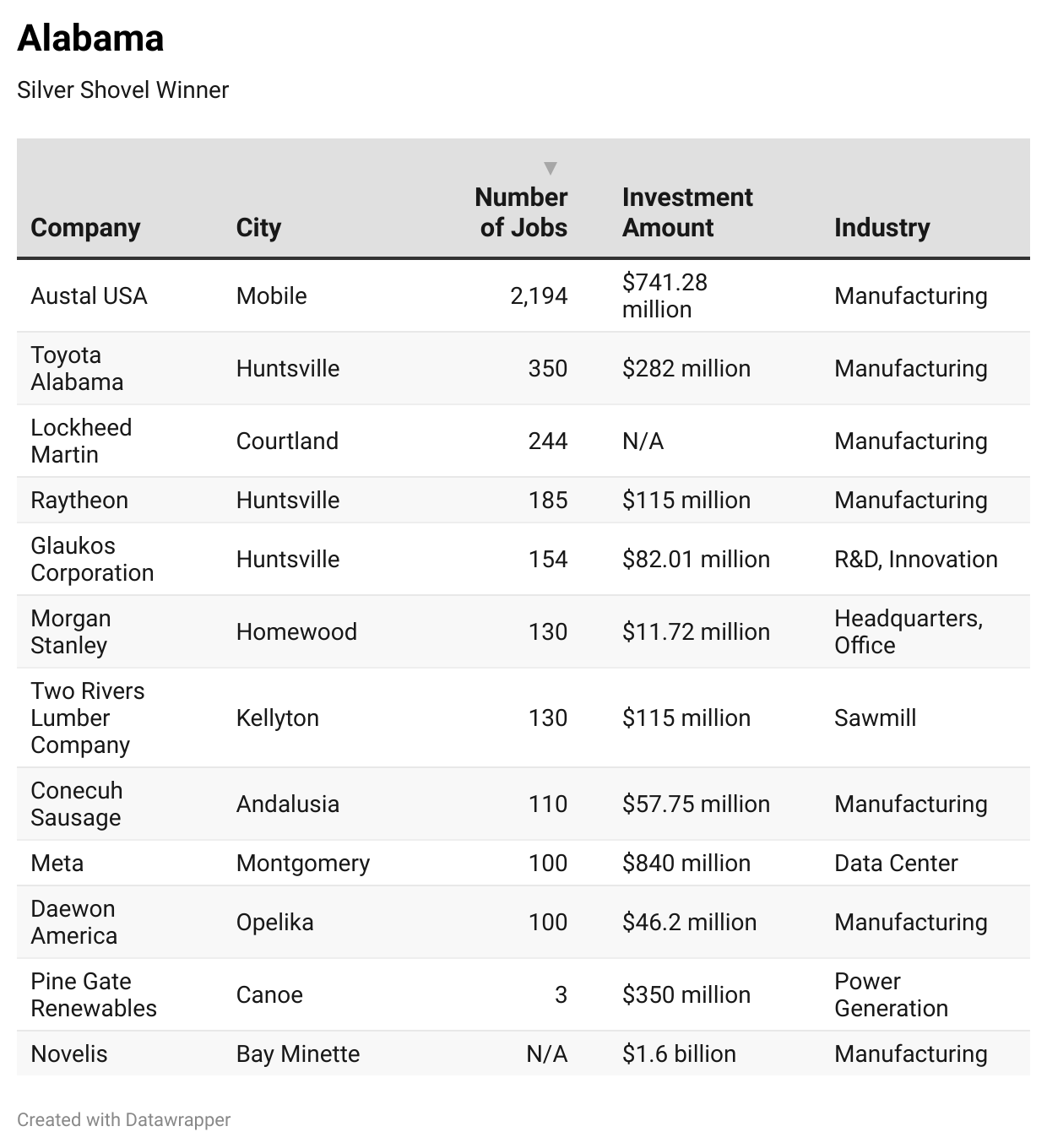

- Alabama

3 to 5 Million Population Category

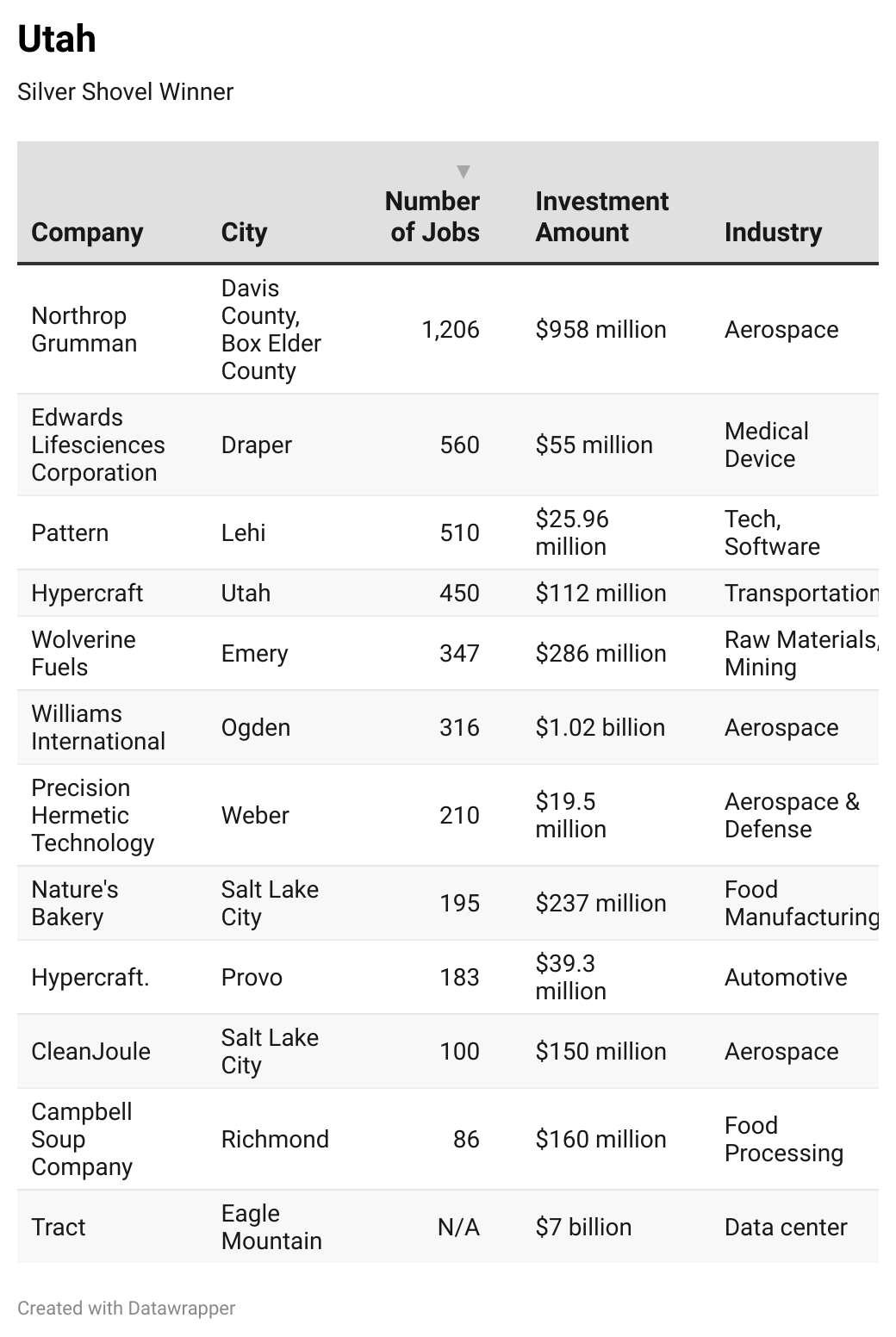

- Utah

- Kentucky

Under 3 Million Population Category

- Kansas

- South Dakota

Platinum Shovel Winner:

North Carolina (8 to 12 Million Population)

North Carolina earned this year’s Platinum Shovel with a remarkable blend of scale, sectoral breadth, and future-forward vision. At the heart of the state’s success are four standout Projects of the Year — each reinforcing a different aspect of North Carolina’s competitive advantage.

In Clayton, Novo Nordisk committed $4.1 billion to expand its pharmaceutical production campus, adding 1,000 jobs and reaffirming the Research Triangle’s place as a global life sciences leader. The project represents not only capital investment but also the kind of long-term, knowledge-based employment that lifts entire regions.

Also in pharma, FUJIFILM Diosynth Biotechnologies is investing $1.2 billion in its Holly Springs site, expanding capacity for biologics manufacturing and creating 680 new jobs. It’s a critical node in the nation’s healthcare supply chain and a clear signal that biomanufacturing is a North Carolina specialty.

The clean energy economy is growing here, too. Natron Energy selected Edgecombe County for a $1.4 billion battery component plant with 1,000 jobs, and Boviet Solar is launching a nearly $300 million solar manufacturing facility in Greenville. Together, these projects place North Carolina on the map as a key contributor to the renewable energy supply chain.

Supporting these mega-deals are a wide range of additional investments, including IQE’s $305 million semiconductor expansion in Greensboro, Nipro’s $398 million medical device project in Greenville, and a trio of new and expanded facilities from Johnson & Johnson, Reckitt, and SCHOTT Pharma in Wilson County.

Whether it’s chips, drugs, batteries, or solar cells, North Carolina has emerged as a magnet for capital and innovation. Its well-coordinated ecosystem — from community colleges to logistics corridors — has proven to be more than ready for today’s advanced industries. That’s why, in 2025, North Carolina stands alone at the top of the Shovel Awards podium.

Gold Shovel Winners: Outstanding Performance by Population Category

Texas (12+ Million Population)

Texas takes home the Gold Shovel once again in the largest population category, anchored this year by an astonishing $10.6 billion in total capital investment across a dozen high-impact projects. Leading the charge is ECL, with a massive $8 billion commitment to build a new data processing facility in Houston — a transformative project that positions the state as a backbone of the global cloud and AI infrastructure economy.

But Texas’s wins this year go far beyond digital infrastructure. The state is seeing notable growth in energy-related technologies, including battery and power management. Freyr Battery is investing $340 million in a facility that adds crucial momentum to the domestic energy storage sector, while Delta Electronics, a manufacturing project of the year, is contributing another $452 million to strengthen Texas’s role in power electronics and grid support.

Life sciences are also taking root in Texas, with projects from QYK Brands, a manufacturing project of the year, and BillionToOne — the former committing $400 million to biotech production and the latter contributing intellectual and R&D firepower to the mix.

Meanwhile, companies like Crystal Window and Door Systems are reinforcing the state’s role in advanced construction products with a $121 million facility in Mansfield expected to bring more than 500 jobs. Rounding out the year’s highlights are expansions from Amazon, Flex Ltd., and Raising Cane’s, each playing a role in strengthening Texas’s logistics, consumer products, and food processing base.

Virginia (8 to 12 Million Population)

Virginia earns this year’s Gold Shovel with a slate of projects that showcase the state’s range — from deep-tech investments in semiconductors and batteries to strategic growth in pharmaceuticals, defense, and clean energy. Together, these initiatives represent billions in capital investment and more than 4,500 new jobs across the commonwealth.

At the top of the list is Micron Technology’s $2.17 billion expansion in Manassas, a project of the year that reinforces Virginia’s role in the domestic semiconductor supply chain. It’s a major vote of confidence in both the region’s technical talent and its global competitiveness in high-tech manufacturing.

Another standout project and project of the year is Microporous, investing $1.35 billion in Danville to produce advanced battery components. That single project accounts for more than 2,000 of the new jobs in Virginia this year and is a critical building block in the broader transition to electric vehicles and grid-scale storage.

Energy is also part of the story, with LS Greenlink USA committing $681 million to Chesapeake for a renewable power transmission project. On the life sciences front, Afton Scientific is expanding in Charlottesville with a $202 million pharmaceutical manufacturing facility.

Virginia’s momentum also reaches into aerospace, defense, automotive, and advanced HVAC. Kongsberg Defence & Aerospace, RBW Electric Cars, and Condair are just a few of the companies helping round out a roster that touches virtually every corner of the advanced manufacturing economy.

What binds these projects together is a strong workforce pipeline, strategic infrastructure, and the ability of state and local leaders to move fast on opportunity.

Arizona (5 to 8 Million Population)

Arizona reclaims Gold Shovel honors in 2025 with a blockbuster year led by one of the largest investments in U.S. tech history. In April 2024, Taiwan Semiconductor Manufacturing Company (TSMC) announced a third fab at its Phoenix operations, bringing their total investment at the time to $65 billion and 4,500 jobs. TSMC has already increased its announced investment since then to an unprecedented $165 billion, accelerating Arizona’s transformation into a global hub for advanced microelectronics.

TSMC’s staggering commitment headlines a deep roster of semiconductor and chip-related investments. KoMiCo, Pentagon Technologies, and Saras Micro Devices all added multimillion-dollar expansions in Mesa and Chandler, further solidifying Arizona’s semiconductor cluster and its strategic value to U.S. reshoring efforts. These moves build on the state’s growing reputation as a critical piece of the national supply chain for everything from smartphones to satellites.

But chips weren’t the only bright spot. GTI Energy in Goodyear is ramping up battery component production with a $53 million investment and 600 new jobs. And in Mesa, CarbonCapture is laying the foundation for a new carbon storage hub — a rare play in the climate tech space that underscores Arizona’s diversity of innovation.

Aerospace also had lift. Ascent Aviation in Marana and MHI RJ Aviation in Tucson committed to growing Arizona’s MRO (maintenance, repair, and overhaul) capabilities, expanding the state’s aviation workforce and infrastructure. Meanwhile, major consumer goods expansions from FrameTec, Puma, and Tricolor round out the state’s industrial growth with more than 1,000 additional jobs.

From semiconductors to carbon storage, and aviation to batteries, Arizona’s 2025 project slate proves it’s not just scaling — it’s evolving. That dynamic, future-facing growth earns the Grand Canyon State a well-deserved Gold Shovel.

Indiana (5 to 8 Million Population) — Gold Shovel Winner

Indiana moves up to the Gold Shovel ranks this year on the strength of a high-powered portfolio that spans pharma, automotive, aerospace, and digital infrastructure — with multiple billion-dollar-plus projects driving statewide impact.

The headliner is Amazon Data Services, building a $11.2 billion data center campus in New Carlisle, one of the largest single capital investments in state history. It’s a transformative project not only for St. Joseph County but for Indiana’s long-term role in supporting the nation’s digital backbone.

But that’s far from the only headline. Eli Lilly’s $7.8 billion pharma campus in Lebanon will create nearly 440 jobs and anchor a biotech cluster outside Indianapolis. And Microsoft has committed $3 billion to a new data center in LaPorte County, reinforcing Indiana’s dual role in tech and life sciences.

There’s muscle in the industrial sectors, too. Toyota Motor Manufacturing Indiana is putting $632 million into its Princeton facility. Caterpillar continues to deepen its Lafayette presence with a $725 million investment, and Google adds a $2.4 billion site in Fort Wayne, further reinforcing Indiana’s draw for tech titans.

Complementary growth includes Sephora’s new distribution center in Avon, Vital Farms’ expansion in Seymour, and additional projects in roofing materials, R&D, and advanced manufacturing.

This year’s Gold Shovel for Indiana reflects the state’s steady evolution — from a manufacturing stalwart to a modern logistics and tech magnet, ready for a reshaped industrial era.

Louisiana (3 to 5 Million Population)

Louisiana’s Gold Shovel is marked by a sweeping surge in energy transition investments, advanced manufacturing, and carbon capture infrastructure — a bold new chapter for a state long known for its industrial might. It’s no surprise that Louisiana also earned Area Development’s Green Shovel honor, too.

Leading the way is Lake Charles Methanol, committing $3.2 billion to a major facility in southwest Louisiana that will use carbon capture technologies to reduce emissions in hydrogen and methanol production. It’s one of several projects in the state’s rapidly growing climate-tech corridor, which also includes Heirloom Carbon Technologies in Shreveport and Climeworks in Calcasieu Parish — two next-generation direct air capture hubs.

Meanwhile, Woodlands Biofuels Inc. is bringing $1.35 billion to Reserve for a biorefinery that converts biomass into clean fuel, and UBE C1 Chemicals America is investing $500 million in Jefferson Parish for advanced materials manufacturing. These projects signal a shift in the state’s industrial strategy — one that layers clean energy priorities onto an already deep foundation of chemical and refining expertise.

But the biggest single deal is squarely in the digital space. Meta’s $10 billion data center in Holly Ridge — one of the largest in the country and a non-manufacturing project of the year— is more than a capital commitment; it’s a transformation. The project not only introduces high-tech jobs into a traditionally manufacturing-heavy region, but also places Louisiana on the digital infrastructure map for decades to come.

Smaller-scale but equally diverse wins round out the story: Global Seamless Tubes & Pipes in Mansfield, Agile Food Storage in Pearl River, and Life for Tyres in Reserve add jobs in metal fabrication, logistics, and recycling, respectively.

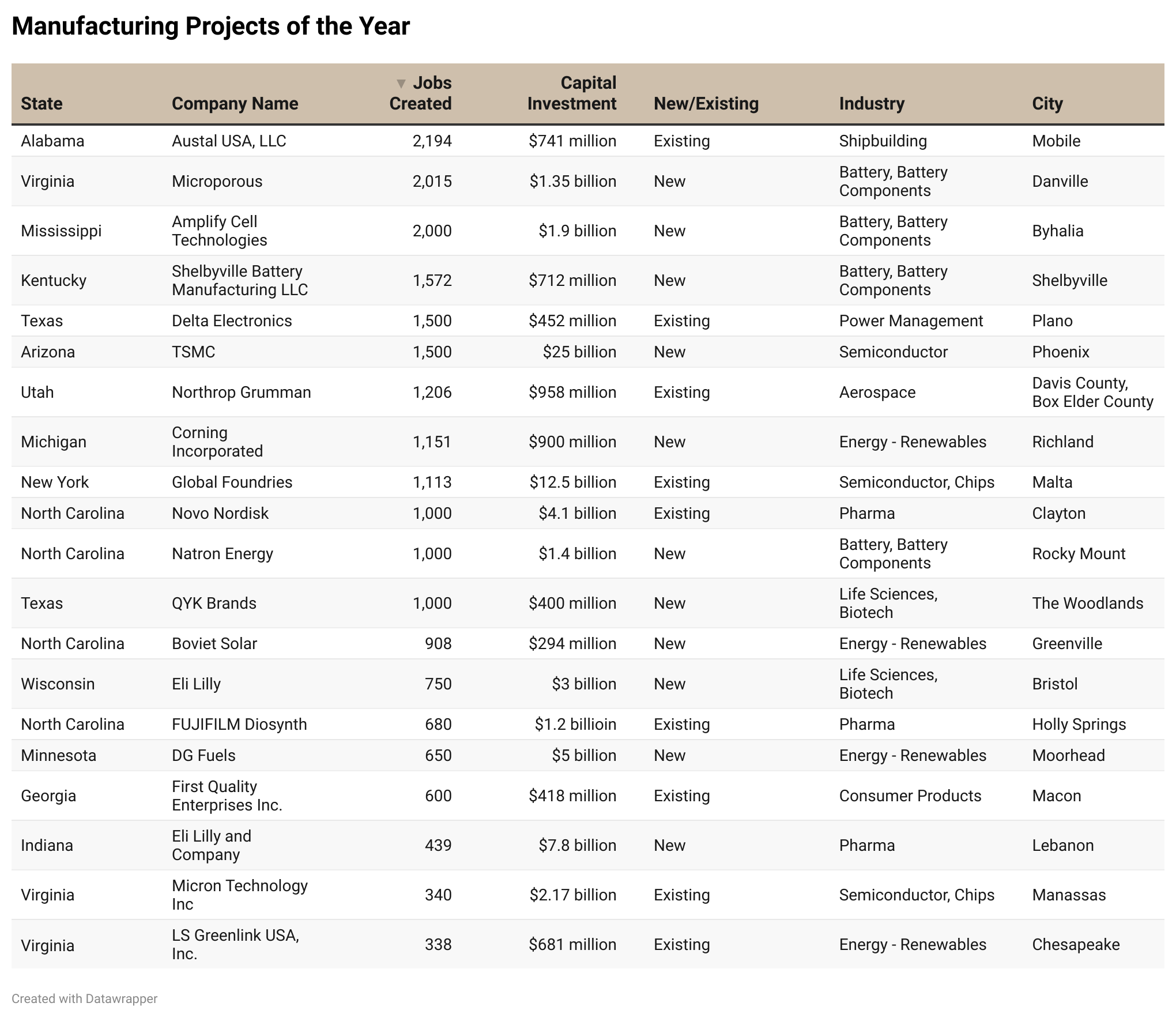

2025 Gold & Silver Shovel Awards: Projects Of The Year (2024)

2025 Gold & Silver Shovel Awards: Top 2024 Projects By State

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

-

Chart 17

-

Chart 18

-

Chart 19

-

Chart 20

Mississippi (Under 3 Million Population)

In a stunning show of confidence from one of the world’s biggest tech giants, Amazon Web Services announced a $10 billion investment in Madison, Mississippi — the kind of jaw-dropping number that reshapes an entire state’s economic trajectory. This hyperscale data center project is not only the largest single investment in Mississippi history, it places the Magnolia State squarely in the conversation about cloud infrastructure and next-generation digital economy assets.

But Amazon’s megadeal was just the headline. Another transformational project comes from Amplify Cell Technologies, with a $1.9 billion battery component manufacturing facility in Marshall County that’s expected to create 2,000 jobs – which earned it project of the year honors. With this investment, Mississippi deepens its ties to the fast-growing EV supply chain while bringing high-tech manufacturing to the northern corridor.

Elsewhere, the state continues to diversify its industrial base. Liebherr is investing more than $238 million to grow its construction equipment footprint in Tupelo, and PCC Gulf Chem is expanding its chemical production capabilities in DeLisle with a $540 million commitment. Aerospace firms like Anduril Industries and Aurora Flight Sciences are scaling operations in McHenry and Columbus, respectively — further boosting Mississippi’s standing in defense and aerospace manufacturing.

Consumer products and legacy sectors had their moment, too. Ashley Furniture is investing in twin facilities in Verona and Saltillo, while Koch Foods, Superior Optical Lab, and Gulf States Canners are anchoring food, eyewear, and packaging production across multiple counties.

With more than $13 billion in capital investment tallied across just a dozen major projects, Mississippi proved this year that small states can land big deals — and that when tech titans and clean tech manufacturers go shopping for locations, Mississippi is ready with shovel-ready sites and statewide support.

Silver Shovel Winners: Excellence Across the Map

The Silver Shovel Awards honor states that demonstrated outstanding economic development performance, even if they didn’t reach the Gold tier. From foundational reinvestments to sector-specific breakthroughs, these winners helped shape the industrial landscape of 2025 with projects that matter.

New York and Illinois (12+ Million Population)

New York

New York’s Silver Shovel year was highlighted by one of the largest individual capital investments in the nation: Global Foundries’ $12.5 billion expansion, a massive project that adds more than 1,100 jobs and positions the state at the epicenter of the domestic semiconductor revival.

That marquee investment, a project of the year, was supported by a well-rounded mix of expansions and new operations in food processing, industrial equipment, renewable energy, and financial services. Wells Enterprises, now a part of the Ferrero Group, is investing $175 million in its Dunkirk facility to expand frozen dessert production, and Chobani is investing $100 million in its headquarters, which earned a non-manufacturing project of the year.

Meanwhile, Corning Incorporated is committing $371 million to its Canton operations to enhance optical materials manufacturing — key infrastructure for modern telecommunications.The renewable energy and cleantech space saw a boost with GE Vernova’s $96 million expansion in Schenectady, and service-sector firms like CBRE, Bridgewater Associates, and iCapital added jobs and capital investment in the financial core.

Illinois

Illinois secured its Silver Shovel this year with a pair of standout technology investments that signaled the state’s growing role in the digital and quantum economy. Leading the way is Compass DataCenters, committing $10 billion to a massive facility in Hoffman Estates that will power cloud-based services, AI applications, and digital infrastructure in the region. Not far behind is PsiQuantum, bringing more than $1 billion to Chicago in pursuit of the world’s first commercially viable quantum computer. Microsoft is also investing $250 million in a data center here, which earned non-manufacturing project of the year honors.

That tech firepower is balanced by traditional strengths in manufacturing and agriculture. Wieland’s $500 million investment in East Alton expands production of copper and alloy products, reinforcing Illinois’ role in industrial materials.

With billions flowing into next-gen computing and foundational reinvestments across multiple sectors, Illinois once again demonstrated why it remains an industrial and technological cornerstone of the Midwest.

Michigan and Georgia (8 to 12 Million Population)

Michigan

Michigan’s Silver Shovel this year reflects a state retooling for the future — while remaining firmly rooted in its industrial DNA. From the shores of Lake Michigan to the tech corridors of Detroit, Michigan attracted more than $3.7 billion in capital investment across a dozen major projects.

One of the most significant is Dow, Inc.’s $1.57 billion reinvestment in Midland, modernizing its legacy chemicals complex with a sustainability-driven expansion. This isn’t just maintenance — it’s a vision for decarbonized, next-generation chemical production that can anchor both domestic supply chains and global competitiveness.

Meanwhile, Corning Incorporated is bringing $900 million to Richland for a major energy-efficient materials facility, creating over 1,100 jobs in the process. That project adds major momentum to the state’s renewable energy component manufacturing base and earned a non-manufacturing project of the year distinction.

Detroit, as ever, is in motion. The city and its suburbs welcomed investments from Fortescue Future Industries, Detroit Diesel, Laepple Automotive, Lucid Motors, and Piston Automotive — all contributing to the state’s continued relevance in the auto and mobility space, now increasingly tied to electrification and low-emission vehicle platforms.

There were wins in aerospace, too — Howmet’s $215 million expansion in Whitehall boosts capacity for aircraft components, and SAAB’s $75 million investment in Grayling brings advanced auto tech to the northern part of the state.

Georgia

Georgia’s Silver Shovel this year is all about breadth — from paper products and EV supply chains to fantasy sports tech and e-commerce logistics. Across this varied portfolio, the state secured significant capital investment and created more than 5,000 new jobs.

Two major expansions in Macon led the way. Irving Consumer Products committed over $577 million to grow its paper goods production, while First Quality Enterprises invested $418 million in its hygiene and paper facility – a project of the year. Together, the two projects deepen Georgia’s long-standing strengths in consumer products and advanced manufacturing.

On the EV and automotive front, Georg Fischer Automotive AG broke ground on a $184 million battery component facility in Augusta, and Hwashin committed $176 million in Dublin for auto parts production. These projects support Georgia’s broader role in the electrification of mobility across the Southeast.

Georgia also saw key wins in automation and logistics, including GreenBox Systems’ $144 million investment in Jackson for high-tech warehouse services -- a non-manufacturing project of the year winner -- and a $70 million Amazon facility in White, adding 1,000 jobs.

In a unique twist, one of the state’s fastest-growing employers is in fantasy sports: PrizePicks, a tech-based sports gaming firm, is bringing more than 1,000 jobs to Atlanta with a $25 million headquarters project. It’s a sign that Georgia’s tech ecosystem is thriving in both traditional and emerging verticals.

Wisconsin, South Carolina, Alabama (5 to 8 Million Population)

Wisconsin

Wisconsin lands a Silver Shovel in 2025, thanks to a well-balanced mix of high-tech infrastructure and legacy manufacturing strength — including one of the largest tech projects in the country.

Microsoft’s $3.3 billion data center in Mt. Pleasant headlines the year, cementing the state’s foothold in the digital infrastructure race. Eli Lilly also made waves, selecting Bristol for a $3 billion life sciences facility that will add hundreds of jobs to the Kenosha County corridor.

Wisconsin’s broader project slate touches food processing, battery materials, and precision manufacturing. Investments from Kikkoman, Nestlé Purina, and Orbia reflect enduring strength in consumer goods and industrial components. Meanwhile, Vista Sands Solar and National Grid Renewables point to a rising emphasis on clean energy in the upper Midwest.

It’s a portfolio that balances scale with substance — and positions Wisconsin to keep punching above its weight.

South Carolina

South Carolina’s win revolves around a remarkable surge in battery-related investment — an unmistakable trend that’s turning the state into a vital hub for the EV and energy storage supply chain.

Leading the way is AESC’s $1.5 billion investment in Florence, a project of the year, which is expected to create more than 1,000 jobs in EV battery production. It’s joined by EnerSys, bringing $500 million to Piedmont for advanced battery components manufacturing. Together, these projects signal a shift in the state’s identity: from traditional automotive strength to full participation in the electrified future.

Supporting this transition is a broad roster of big-name investments across industries. Boeing South Carolina is expanding its Charleston footprint with a $1 billion aerospace investment, and Birla Carbon is infusing $1 billion into its Orangeburg operations, reinforcing the materials side of the state’s industrial base.

Meanwhile, the Palmetto State continues to attract tech titans. Google committed $1.3 billion across multiple data center campuses in Moncks Corner, St. George, and Ridgeville, which counts as a non-manufacturing project of the year, and Meta added another $800 million in Graniteville.

Alabama

Alabama’s Silver Shovel year stands out for both scale and sector variety — from massive metals investments to a revitalization of one of the South’s oldest industries: lumber.

The largest single project comes from Austal USA, which is investing more than $741 million in its Mobile shipyard operations, creating over 2,100 jobs. It’s a major boost for the state’s maritime manufacturing presence and a strong signal that shipbuilding remains a pillar of Alabama’s industrial economy, which is why it earned project of the year honors.

In Bay Minette, Novelis is bringing $1.6 billion into aluminum manufacturing — a transformative investment that ties directly into the EV and sustainable packaging sectors. It’s one of several high-impact manufacturing expansions across the state, including a $282 million upgrade by Toyota Alabama in Huntsville, and a new $115 million sawmill by Two Rivers Lumber Company in Kellyton that highlights the enduring importance of forestry and wood processing in the state’s rural regions.

The list of contributors rounds out with companies like Meta, Southwire, Raytheon, Lockheed Martin, and Glaukos Corporation, representing wire and cable, tech, defense, R&D, and medtech.

Utah and Kentucky (3 to 5 Million Population)

Utah

Utah’s Silver Shovel performance in 2025 is anchored by one of the year’s largest tech infrastructure investments nationwide: Tract’s $7 billion data center development in Eagle Mountain. It’s a future-facing project that not only boosts the region’s role in digital infrastructure but also signals long-term confidence in Utah’s ability to deliver on energy, connectivity, and talent.

The aerospace and defense sector soared this year, too. Northrop Grumman added more than 1,200 jobs and invested $958 million across Davis and Box Elder counties, while Williams International made a $1 billion commitment to expand aerospace propulsion manufacturing in Ogden. Companies like CleanJoule and Precision Hermetic Technology are helping cement the state’s role in sustainable aviation fuels and defense components, respectively. Wolverine Fuels is investing $286 million in its mine here, which earns a non-manufacturing project of the year.

Utah’s food and consumer goods industry also notched wins. Nature’s Bakeryis bringing nearly 200 jobs to Salt Lake City with a $237 million investment, and Campbell Soup Company is expanding its Richmond facility by $160 million.

Kentucky

Toyota’s twin reinvestments in its Georgetown operations — totaling more than $1.6 billion — headline Kentucky’s winning year and demonstrate the automaker’s long-term confidence in the Bluegrass State. While these upgrades didn’t immediately create new jobs, they’re designed to modernize the plant for future EV production, advanced automation, and long-term global competitiveness.

But Kentucky’s Gold Shovel isn’t just about one industry or one name. In Shelbyville, a project of the year from Shelbyville Battery Manufacturing LLC is injecting $711 million into battery production, a clear signal that Kentucky continues to climb the value chain in electrification. And speaking of Shelbyville, Kuehne + Nagel is adding more than 350 jobs in logistics, rounding out a smart supply chain story for the region.

The state also leaned into its legacy strengths in food and drink. Legacy Spirits of Kentucky, investing over $252 million in Richmond, continues the state’s long tradition of innovation in distilled spirits. Add to that expansions by Staghorn, Niagara Bottling, and Kitchen Food Company, and you get a robust beverage and food manufacturing cluster.

Rounding out the list are strategic manufacturing expansions from Mitsubishi Electric US, Swedish Match North America, and Belmark, all of which are growing their footprint in packaging, tobacco products, and heat pump systems — industries that support both domestic consumption and international exports.

Kansas and South Dakota (Under 3 Million Population)

Kansas

Kansas’s Silver Shovel showing in 2025 is powered by the sheer concentration of food and agricultural investment — a testament to the state’s role in feeding the country and the world. Nearly every corner of the state saw activity in food processing, from snacks and beverages to premium meats and animal health.

Kellanova Manufacturing, formerly part of the Kellogg Company, is investing more than $68 million in its Kansas City facility, reinforcing the region’s legacy in branded food products. Right alongside it, Associated Wholesale Grocers is upgrading its distribution infrastructure with nearly $80 million in improvements.

In southwest Kansas, Creekstone Farms Premium Beef committed $103 million to its Arkansas City operation, and Blue Sky Farms is putting $100 million into facilities in Lewis. Meanwhile, beverage bottling remains strong, with Heartland Coca-Cola Bottling pouring $104 million into its Olathe footprint.

South Dakota

South Dakota rounds out this year’s Silver Shovel winners with a series of steady, practical investments across agriculture, food processing, and industrial manufacturing — sectors that may not dominate headlines but form the backbone of economic resilience in the Upper Midwest.

The biggest-ticket item is SFC Global Supply Chain’s $250 million investment in Sioux Falls, supporting its presence in the frozen food sector and adding jobs in one of the state’s fastest-growing regions. In the agricultural space, Riverview LLP is expanding operations with a $190 million project, and Plainview Dairy is investing $60 million in new dairy infrastructure in Toronto — both reaffirming South Dakota’s leadership in food production.

The renewable energy sector is represented by Brookings Biogas, which is injecting $77 million into anaerobic digestion infrastructure in Bruce, pushing the state into new territory for sustainable energy and waste reduction.

Methodology

Area Development evaluated leading economic development projects announced in 2024 using a combination of proprietary data and input from all 50 states. Rankings are based on several weighted criteria, including the number of new jobs created, total capital investment, the number of new or expanded facilities, and the diversity of industries represented. These factors are normalized by state population and grouped into five categories: under 3 million; 3 to 5 million; 5 to 8 million; 8 to 12 million; and over 12 million. Gold Shovels are awarded in each population tier, with Silver Shovels recognizing strong runners-up. A single Platinum Shovel goes to the state with the most exceptional overall performance, and a Green Shovel honors a state with a particularly strong emphasis on clean tech and renewable energy investments.