The evolution of workplace strategy, accelerated by the pandemic, has fundamentally reshaped how companies view physical office space. Where previously workplace strategy and location decisions operated in relatively separate spheres, today they are deeply intertwined, influencing critical decisions about site selection and corporate real estate portfolios.

The Hybrid Workplace as the New Standard

Recent employee surveys clearly illustrate a significant shift toward hybrid work environments, defined typically as working from the office one to three days per week. Interestingly, the strongest advocates for in-office work are younger employees, notably Gen Z. Contrary to expectations, they are keen to return to office environments, primarily for mentorship, professional growth, and networking opportunities. These younger employees recognize that the spontaneous interactions and learning moments offered by physical workplaces are invaluable to career development.

Office design today must support both collaboration and quiet focus.

However, this enthusiasm for returning to the office has exposed challenges. One crucial consideration that companies must now account for is commuting time. Employee perception of productivity and overall job satisfaction is heavily influenced by commute duration. Organizations are increasingly reconsidering intra-city site locations, creating satellite offices closer to urban centers where younger talent tends to live, thereby reducing commute times and enhancing job satisfaction.

Employers Move Toward Office-Centric Policies

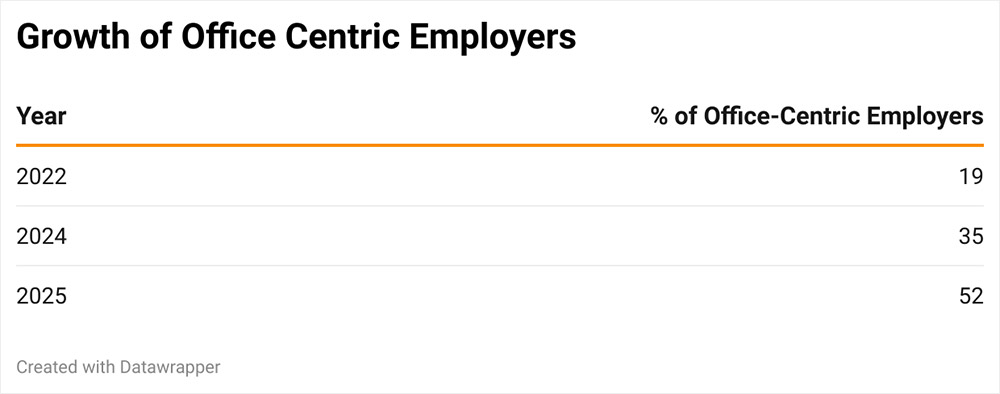

In tandem with evolving employee expectations, many employers are moving toward office-centric work policies, requiring workers to be physically present at least three days per week. According to Cushman & Wakefield data, office-centric policies have increased significantly, growing from 20 percent in 2022 to 52 percent by mid-2025.

This shift is driven by the clear correlation employers see between physical presence and employee advancement. Remote workers, despite their productivity, often experience "proximity bias," meaning they miss out on important opportunities simply because they are less visible. Leaders recognize that in-office collaboration, spontaneous problem-solving, and informal mentoring are essential for innovation and professional development.

To successfully transition employees back into physical office environments, many companies have invested in creating a workspace that mirrors how people work and the perceived value of the office. Spaces are being reimagined to foster community, collaboration, and culture in addition to the traditional focus on individual productivity. Multi-use areas that encourage informal meetings, team building, and spontaneous interactions are becoming essential in office layouts.

Not to lose sight of the prevalence of individual work, non-reservable private spaces for focused work or confidential discussions remain critical to any office design. With many employees expressing concern over distractions, office designs increasingly include quiet rooms, soundproof booths, and small private meeting areas.

Companies should ask themselves the following: Does your office support the reasons why employees come to the office—collaboration, relationship building, and connection to company culture? Does it provide a mix of spaces to support how employees work today? Has your company communicated a clear reason why employees are expected to work in the office? Do you understand your employees’ drivers to work in-office versus remotely, and how this varies by generation and department? Are you challenged with low office utilization despite established onsite working policies? Have you incorporated systems to monitor office visits? And have you used a change management program to guide employees through the transition?

Emerging Location Trends in Site Selection

The renewed emphasis on the physical workplace to support business and headcount growth has spurred a new wave of office site selection projects. Professional services, finance, insurance, and customer service sectors have been especially active for new facility searches as businesses look to establish or consolidate operations closer to their customer base and target talent pools.

Commute time is now a decisive factor in site selection.

Identifying suitable regions and submarkets has always been about talent access. Proximity to talent hubs has taken on even greater importance due to widespread employee disdain for long commutes. For the last five years, the leading reason to work remotely has been to avoid the commute, as employee perception of productivity and overall job satisfaction is heavily influenced by commute duration. In response, companies have increasingly selected established office nodes with strong transportation infrastructure and urban centers where younger talent tends to live.

Beyond talent access, companies have elevated the importance of several site selection criteria at the market level. Companies are more heavily weighing competitor presence and hiring activity in potential locations. Markets perceived as overly competitive have been eliminated due to fears of high employee turnover and escalating labor costs. The cost of housing has emerged as another significant site selection consideration. Businesses recognize that affordable housing is vital for attracting and retaining talent, especially for entry-level and mid-level positions. Regions offering affordable housing are increasingly viewed as having a distinct competitive advantage. Concerns about natural disasters and associated business disruption have increased considering recent high-profile events. Companies are becoming more selective about locations, carefully considering risks associated with hurricanes, wildfires, and other significant events, further shaping site selection strategies and even eliminating some high-risk regions entirely.

Once companies have selected a market, the top tier of office spaces have been popular destinations for their amenities, vibrant environments, and strategic urban locations. Despite higher rents, companies have relocated to smaller office footprints and reallocated budgets toward higher-quality, amenity-rich spaces. Top tier assets have attracted a large portion of market demand, with Class A space absorption improving 65 percent year over year from 2024, with approximately a third of all Class A buildings now being fully leased. For many, these buildings are worth the cost in the fight for top talent. They serve as attractive hubs that not only retain current employees but also help recruit new talent drawn to dynamic, engaging work environments.

52

As part of the reset, companies should ask: How do the home locations of existing employees differ from those of target talent you would like to hire? When ramping up hiring, are you finding a sufficient volume of qualified candidates near your existing office locations? Is your current office easily accessible to talent pools via road and public transit networks? Is it equipped with amenities like outdoor space, fitness centers, and onsite restaurants that drive employee utilization? Is your company culture and pay scale attractive enough to operate close to competitors without elevating employee turnover? And are the cost of living and home prices driving employees further from the office and increasing commute time?

Rethinking the Real Estate Portfolio

Office occupancy has stabilized over the past three years, and most companies have now implemented three-days-a-week hybrid work policies. While the office has regained importance, many corporate real estate portfolios remain oversized, poorly located, and costly to maintain. Prolonged periods of low utilization have drawn scrutiny from company leadership, elevating occupancy levels as a key factor in lease renewal decisions.

While low utilization is a highly visible concern, the real imperative behind portfolio transformation is not about empty seats—it's about maximizing the office’s value to the enterprise. The most successful transformations prioritize clients and talent. Offices must be strategically located to support business growth through client proximity and market visibility, even if these locations represent the highest costs in the portfolio.

Equally important, offices should serve as magnets for talent—providing the right spaces, tools, and technology to foster learning, collaboration, and innovation. Over the past several years, investment has consistently flowed toward hub offices for specific high-demand talent and skills in markets with strong air connectivity, reinforcing their role as engines of enterprise performance.

Conversely, offices in tertiary markets that lack access to clients and talent have been scaled back, aligning with the “fewer, better” rooftop model. This approach reflects a deliberate shift toward quality over quantity, ensuring each location contributes meaningfully to business outcomes.

Hybrid work is the new normal, not a trend.

To evaluate whether a portfolio strategy is worth exploring, leaders should ask: Is your current portfolio location strategy intentional and future-ready? Does it align with core business objectives such as cost efficiency, talent access, market growth, and evolving ways of working? Is the departmental composition within each facility optimized? Are you leveraging the right mix of functions—such as product development, customer service, and operational support—to drive business performance and efficiency? Are there signs of portfolio inefficiency? Do you maintain an excess of small offices, overlapping geographic coverage, or locations in markets with declining customer relevance? How have changes in employee work location policies impacted your physical footprint? Are you adapting your office strategy to reflect shifts in where and how work is performed across functions and geographies? And what data or metrics are you collecting on the portfolio, and how do these support your real estate investment decisions?

Strategic Takeaways for Corporate Leaders

The first half of this decade has been marked by dramatic change, prompting leaders to rethink workplace and location strategies to stay competitive. Forward-thinking organizations are approaching their portfolios with fresh eyes, building leadership consensus to align real estate decisions with strategic goals and stakeholder input. A structured scorecard approach—grounded in leadership priorities—helps evaluate which portfolio elements should evolve to better support talent, client engagement, and business objectives. By regularly assessing market conditions and employee sentiment, corporate leaders can make informed decisions that foster flexibility, engagement, and strategic location planning. Ultimately, organizations that embrace these trends will create portfolios that drive employee satisfaction, talent retention, and long-term growth—positioning themselves for sustained success.