A combination of COVID-era supply chain disruptions and growing geopolitical tensions with China has prompted the Biden administration to pass the bipartisan CHIPS and Science Act, which aims at boosting the nation' competitiveness in the market for semiconductors. Under the act, the U.S. government is making $52.7 billion available to fund semiconductor manufacturing from 2022 to 2026. Additionally, the act is offering $24 billion worth of tax credits for chip production and $3 billion for programs aimed at leading-edge technology.

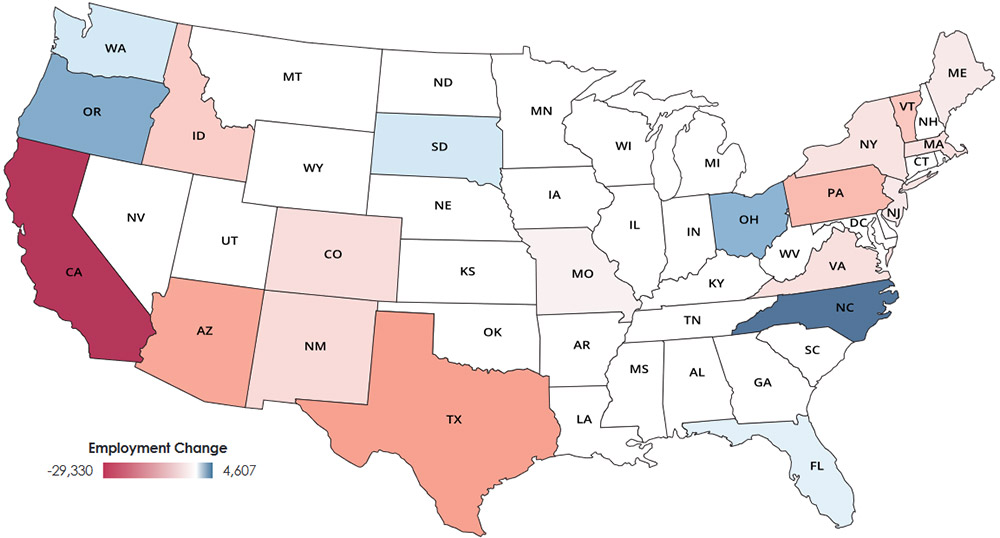

$52.7 – the total amount of funds available to bolster the US microchip industry. The goal of the act is to raise U.S. capacity in chip production to 20% of the global market by the end of the decade. The program is expected to bring back some of the 100,000 jobs lost since 2001 when the sector employed almost 300,000 workers. The employment loss was not uniform across states. As shown in the accompanying map, most states have lost employment in the sector, but a few have grown from 2001 to 2023. Several firms have already benefitted from the CHIPS and Science Act:

- Intel has been granted $8.5 billion to help fund its $100 billion investment across four projects in Chandler (AZ), Rio Rancho (NM), New Albany (OH), and Hillsboro (OR). The company is eligible for an additional $11 million in government loans and related tax credits. These projects are expected to bring more than 10,000 manufacturing jobs. Intel has committed to spend $50 million on workforce development initiatives such as the semiconductor manufacturing program in partnership with Maricopa Community Colleges.

- Samsung Electronics: The US government has agreed to provide up to $6.4 billion to support Samsung's expansion in Taylor, Texas with a goal of establishing a comprehensive semiconductor manufacturing ecosystem. Samsung plans to invest more than $40 billion in this project, which is expected to create over 20,000 jobs.

- Taiwan Semiconductor Manufacturing Company (TSMC): TSMC is set to receive up to $6.6 billion in direct funding and an additional potential $5 billion in loans to support its manufacturing capabilities. This funding aims to enhance TSMC's production capacity in the United States as part of efforts to secure the semiconductor supply chain and boost domestic manufacturing.

- Micron Technology: Micron has been granted up to $6.1 billion to support the construction of new manufacturing facilities in Clay, New York, and Boise, Idaho. These sites will focus on producing DRAM chips, with plans including the largest cleanroom space ever announced in the U.S. and significant investments in workforce training and development.

- GlobalFoundries received about $1.5 billion to fund three projects: two in Malta (NY) and one in Burlington (VT). These investments are expected to create 1,500 manufacturing jobs. The proposed preliminary memorandum also includes $10 million dedicated to workforce development funding. The opportunities created by the CHIPS and Science Act have the potential to intensify the level of concentration since most projects so far are expansions of existing fabs.

- Microchip Technology Inc. received $162 million to modernize and expand two projects, one in Colorado Springs (CO) and one in Gresham (OR).

- BAE Systems received $35 million to quadruple the production of critical chips for several defense programs in Nashua (NH).