As the nation’s economy has evolved over recent decades, so have the traditional markets for certain industries and sectors. In the not so distant past, we witnessed certain corners of the country being the sole focus of investors and business leaders, whether it be historical centers for everything from steel production in Pittsburgh to energy in Houston, or in more recent memory, technology out of the San Francisco Bay Area region. Today, while these traditional centers may exist to a certain extent, we’re finding alternative markets competing for new and well established industrial sectors.

Along with the transformation and diversification of the American economy, we’ve also witnessed a shift of businesses that are not solely focused on the largest urban centers, but also considering major investments and significant job-creation projects in cities considered to be in the “mid-sized” range. Business leaders are now recognizing that core location drivers, especially workforce and operational cost savings, can be achieved in these next-tier communities.

Defining “Mid-Size” Markets

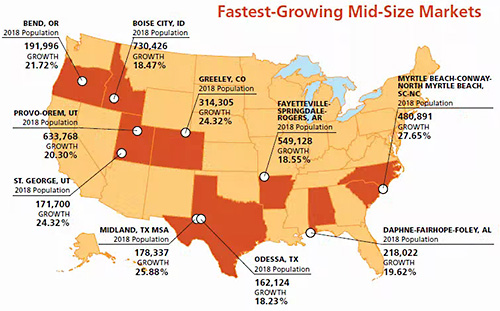

Before going further, let’s first define a “mid-size” market. Beginning with U.S. government-defined geographical regions known as metropolitan statistical areas (MSAs), we are setting our focus on markets with a population above 150,000 and below one million. To set a baseline time period, our population figures are based on government estimations from 2018, an updated assumption from the previous 2010 U.S. Census data.

Now that we defined mid-size, let’s review two of the major driving factors for investment in these markets: workforce availability and local partnerships.

Pound-for-Pound Winners

Still today, many companies focus solely on the largest markets for their business investments. There are several justifications for doing so, including the assumption of population size being a determinant of workforce availability, proximity to customers, and sound, reliable infrastructure. However, many business decision-makers are coming to find that their previous assumptions were off base, or they find that mid-size markets are truly the better bet for their core operations and future workforce.

Day in and day out businesses are finding extensive success in mid-size markets following due diligence during their location decision process. By conducting an empirically driven assessment, along with perhaps thinking outside the box, companies are thriving in mid-size communities.

When forecasting the demographics of a market, which is a vital activity in the site selection process, we’re finding many markets considered to be mid-sized may be on the cusp for moving up to the next population threshold. As can be seen in the map illustrating the fast-growing mid-size markets, we’re witnessing significant growth rates of over 20 percent. Meanwhile, other communities are losing population and labor supply.

As the nation’s economy has evolved over recent decades, so have the traditional markets for certain industries and sectors. Talent Pipeline

For nearly all strategic location decisions today, the most important factor to evaluate is workforce. In the past, the consideration for labor had a significant focus on cost and employment laws. With a full employment environment throughout the United States, attention has shifted to the availability of skills and the overall sustainability of a local workforce.

While population size can be a determinant of workforce viability, business leaders are quickly learning that more diligence must be done to ensure the bespoke roles and skills are actually available, and most importantly, they’ll be attainable in the future for their operations. This future supply of skills is what we call a “talent pipeline.”

Mid-size U.S. markets are often well-positioned with a robust talent pipeline, many times rivaling that of their larger competitors. The primary reason for the pipeline of talent in many of these markets is the presence of good public school systems, major universities, and other institutions of higher education — i.e., they’re often referred to as “college towns.” In fact, a unique aspect of the 2020 U.S. Census will be how these academic institutions impact overall population statistics in these mid-size markets. Recent government guidance has outlined that students will likely be captured as residents of their college location.

Each year, thousands of qualified, skilled graduates enter the workforce in these mid-size markets. Unfortunately, however, there is too often a “brain drain” in these communities, a term referring to the loss of talent that leaves a market. Statistics prove this exodus of young talent is not driven by a desire to leave their respective college towns. Instead, the lack of quality jobs and careers lead to graduates migrating away to major cities in other parts of the country. This trend occurring across mid-size markets presents an incredible opportunity for businesses to find the talent they need in the near term, as well as to develop a pipeline for future growth.

Skills in engineering fields — particularly in the traditional fields of electrical and mechanical, among others — are becoming increasingly difficult to find in the U.S. today. Finding talent in markets across the country, even in the largest metropolitan areas, can be an insurmountable challenge. While the skills certainly do exist, the competition for the talent has reached heights not seen before. In some markets, even if you can secure talent in these fields, retention of those employees can present significant challenges in an ultra-competitive employment environment.

In the Midwest, manufacturing is still a major industry draw for economic development in terms of employment and overall tax revenue. Many areas have even seen a resurgence in capital investment and job growth from expanding manufacturing businesses and foreign companies entering the market. However, finding engineering talent has proven to be a difficult hurdle along the way.

Mid-size markets in this dynamic region are sometimes overlooked because government employment data may show low availability for engineering, and even decreasing supply forecasted into the future. However, this data is not necessarily capturing the scores of highly qualified, skilled engineers graduating from the many public and private colleges and universities located throughout these states.

Madison, Wisconsin, is one of the great examples of this phenomenon. If doing labor research using government available data, a business may turn away from the metropolitan area of the Badger State capital because the statistics do not always show favorably to engineering skills, especially availability of prospective employees in the field. In taking a closer look by factoring in the talent pipeline, businesses will actually find a robust channel of engineering skills today and into the future.

For nearly all strategic location decisions today, the most important factor to evaluate is workforce. After reviewing alumni data released by the University of Wisconsin system, business analysts will find an increasing trend of engineering graduates staying in Madison or, at the least, choosing to remain in the state following graduation. What is driving that trend? There are a number of factors, of course, but the primary driver is the availability of quality jobs and career opportunities.

In fact, engineering graduates are more likely to stay in Madison than any other single place. According to the University of Wisconsin data, 235 graduates from the 2018 class remained in the Madison metropolitan area following graduation. That trend is a significant uptick from 10 years prior when the region only saw 92 graduates stay, which was an increase from only 54 engineering students remaining in 1998. Data shows a similar increased trend of graduates staying in the state altogether. This trend is not just limited to the main campus graduates, as statistics also show a similar increase from other regional universities and colleges known for their engineering programs.

Local Partnerships

Mid-size markets are also attracting business from other major markets because of the support of local political leadership and economic development officials to establish strong public-private partnerships with the business community. Partnerships can come in many shapes and forms across the country, with many being in the realm of economic incentives, skill development programs, zoning and permitting considerations, and infrastructure support, among a list of others.

State economic development officials have tools and resources that communities can deploy to attract, recruit, and retain businesses. However, these mechanisms may not be leveraged effectively by certain companies, especially in the case of non-refundable corporate income tax credits. In these particular cases, the regional and local leaders are needed more than ever, which is exactly why officials of mid-size markets are developing successful partnerships today.

Economic developers are now leveraging Opportunity Zones to attract investments into their communities, a federal program established by Congress in 2017. While still in an early phase, these zones are yet to be fully realized successfully. To further support businesses and drive investment in these pre-designated areas, state and local officials have developed programs to supplement the zone opportunities. As an example, businesses investing in the Santa Fe metropolitan area may now be able to capture additional funds via the Local Economic Development Act (LEDA) program, a discretionary incentive.

In sum, as businesses continue to navigate the dynamic U.S. economy, further attention will be directed toward mid-size markets from coast to coast. To implement sound location strategy, evaluating a comprehensive set of key factors tailored to their business will become more important than ever. In doing so, mid-size markets will be “winning” these location projects, especially if workforce and partnership opportunities are primary decision factors.