The Commerce Department reports that U.S. GDP declined 3.5 percent in 2020, with the economy falling into recession in February 2020 — a month before the World Health Organization declared Covid-19 a pandemic. The 3.5 percent decline is the worst year for the U.S. economy since at least the end of World War II, as reported by CNBC.

As the novel coronavirus caused businesses to shut down, the U.S. unemployment rate rose from a low of 3.5 percent in February of 2020 to 14.8 percent in April of last year. However, as of January 2021, it had declined to 6.3 percent with more than 10 million people still out of work. It should be noted that jobs in the services sector, e.g., leisure and hospitality, suffered more than those in the goods-producing sector during the pandemic-induced downturn. It is believed that the recession that began last year will be the first on record during which services employment fell faster than goods employment.

After falling by 1.4 million jobs in March/April 2020 during the beginning of the pandemic, manufacturing gained back more than 800,000 jobs through the end of 2020. Nonetheless, in light of the COVID-19 pandemic, manufacturers have had to adjust their production lines to increase worker safety and also deal with disrupted global supply chains — measures that have generally increased their operating and production costs.

As Area Development prepared to survey its corporate executive readers this winter, we wondered what effect the pandemic had on their facilities in 2020 and what effect it would have on their location plans and priorities over the next two years. The results of this survey follow.

Profile of the Corporate Survey Respondents

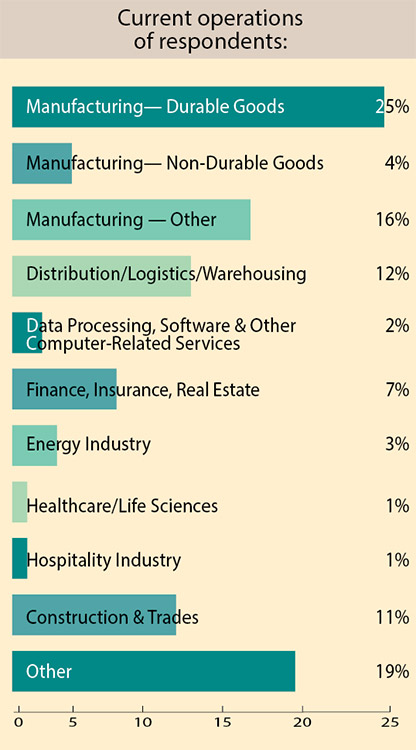

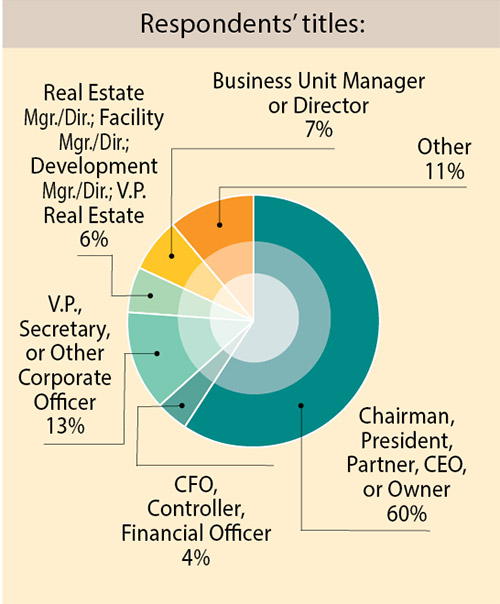

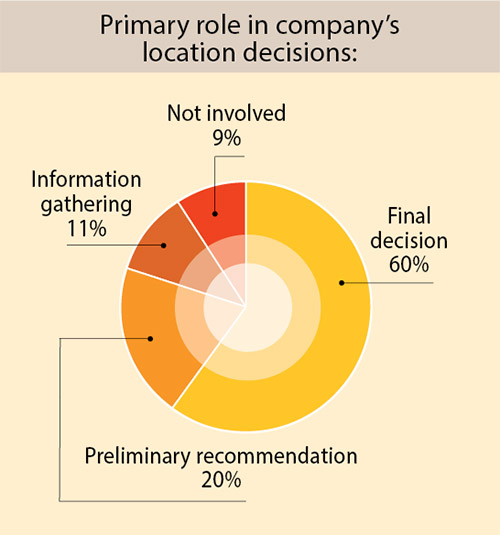

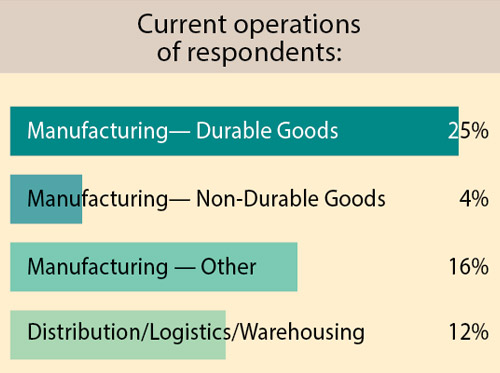

Nearly half (45 percent) of those responding to our 35th Annual Corporate Survey are with manufacturing firms and 60 percent are the owners/presidents/CEOs, with the same percentage responsible for their companies’ final location decisions.

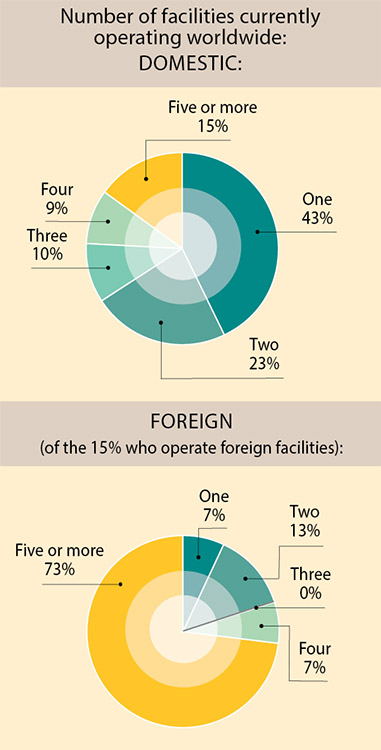

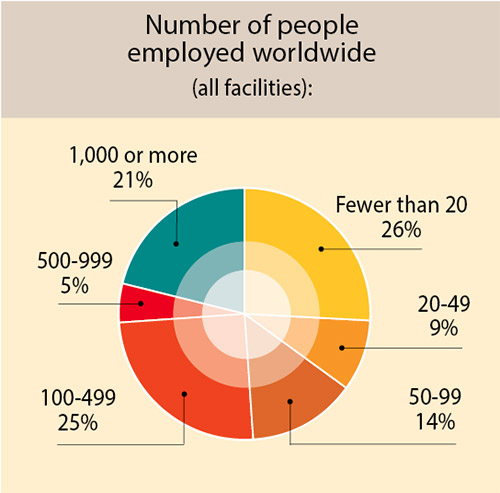

Of the responding firms, more than 40 percent of the respondents operate just one domestic facility and only 15 percent operate foreign facilities. However, of those that do operate foreign facilities, nearly three quarters operate five or more. And our Corporate Survey respondents are primarily with small to mid-size firms: 74 percent employ fewer than 500 people all told.

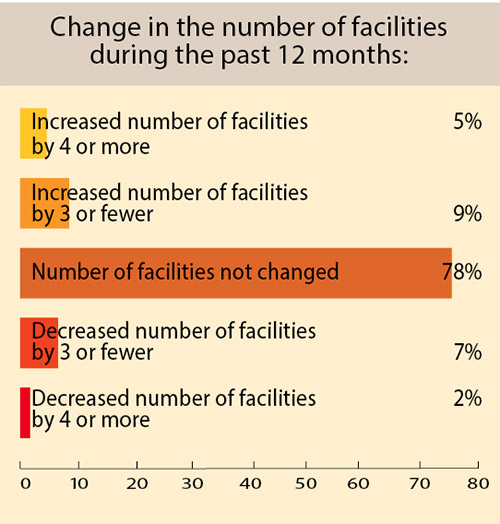

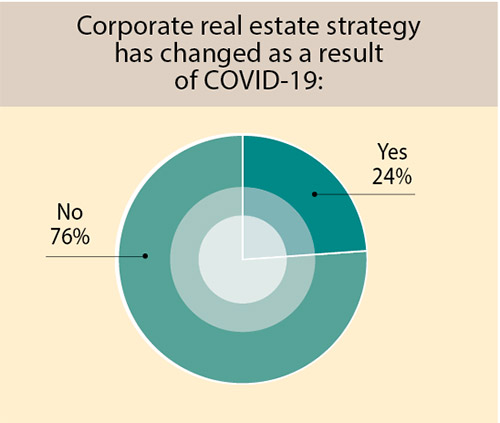

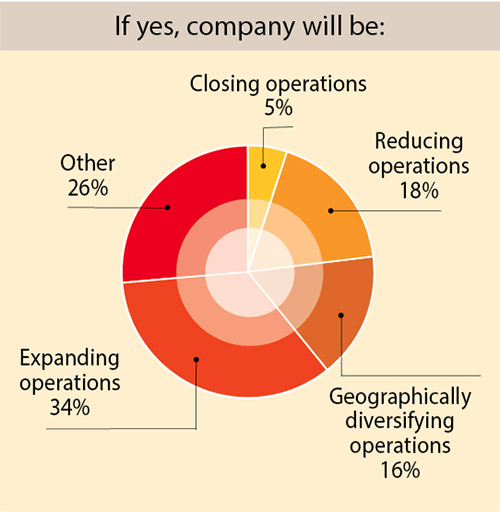

Interestingly, only 9 percent decreased their number of facilities in 2020, with 14 percent actually increasing their number of facilities — fewer than the 22 percent of the pre-pandemic respondents who said they had increased their number of facilities. In fact, three quarters of this year’s Corporate Survey respondents say they are not changing their real estate strategies as a result of the COVID-19 pandemic. Of those that are, about a quarter will close or reduce operations, and 16 percent will geographically diversify operations.

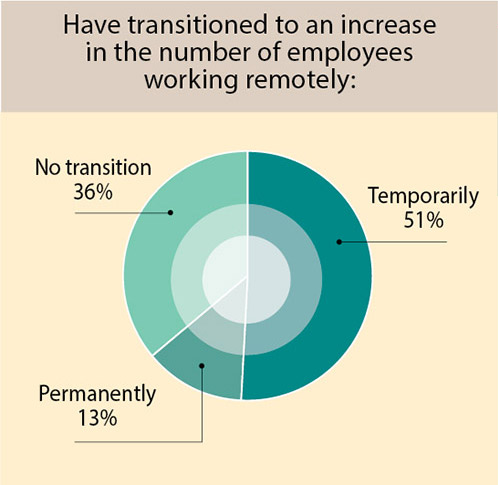

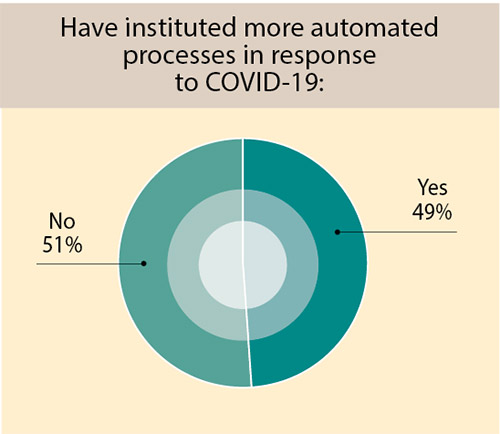

Half of the Corporate Survey respondents have temporarily transitioned to their employees working remotely during the pandemic, with just 13 percent saying they’ll do this permanently. About half have also instituted more automated processes in response to COVID-19. In fact, a Thomas Industrial Survey conducted in April 2020 found that one in four U.S. manufacturers are considering expanding industrial automation as a result of COVID-19.

35th Annual Corporate Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

-

Chart 17

-

Chart 18

-

Chart 19

-

Chart 20

-

Chart 21

-

Chart 22

-

Chart 23

-

Chart 24

-

Chart 25

-

Chart 26

-

Chart 27

-

Chart 28

-

Chart 29

-

Chart 30

-

Chart 31

-

Chart 32

-

Chart 33

-

Chart 34

-

Chart 35

-

Chart 36

-

Chart 37

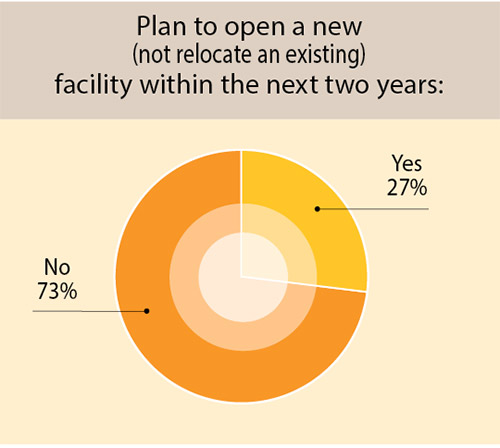

As expected, the challenges faced by businesses during the pandemic are reflected in our 35th annual Corporate Survey respondents’ plans to open new facilities. Just slightly more than a quarter of the respondents have new facility plans, as compared to nearly half who had new facility plans in the previous year’s pre-pandemic survey. And whereas 87 percent of them were planning new domestic facilities when surveyed in 2019, it’s not surprising that now only 30 percent of our Corporate Survey respondents have plans for new domestic facilities.

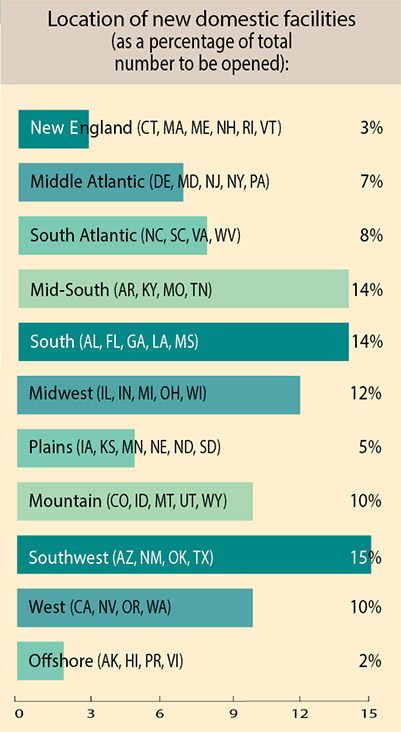

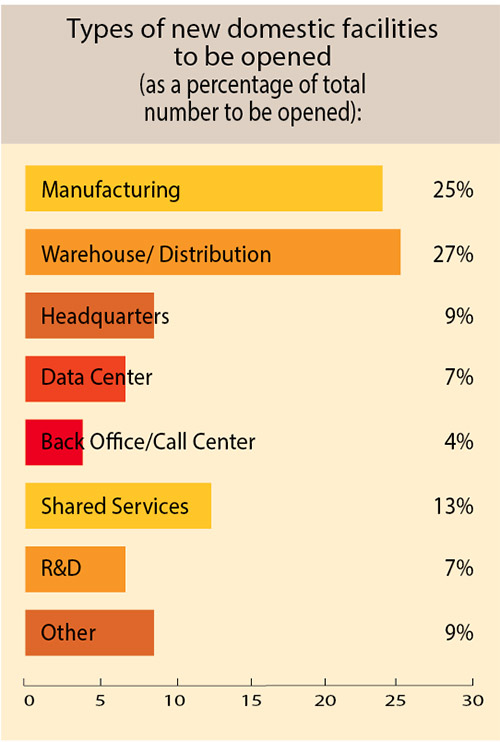

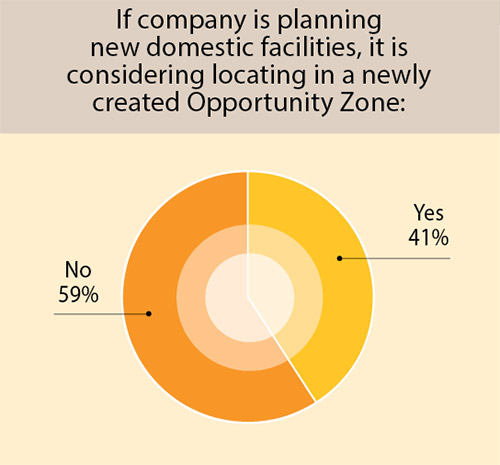

Of those with such plans, most of the new domestic facilities will be built in the Mid-South and South (14 percent each of the total) and Southwest (15 percent). Twelve percent of the new domestic facilities are slated for the Midwest. The West and Mountain regions will each garner 10 percent of the total. Manufacturing and warehouse/distribution facilities represent a quarter each of the planned new domestic facilities. And it’s interesting that about 40 percent of those with plans said they are considering locations in Opportunity Zones, double the percentage who were considering such zones in the prior year’s survey.

Plans for new foreign facilities are down even more significantly than those for new domestic facilities. Nearly all (92 percent) of this year’s Corporate Survey respondents say they have no such plans. The last time our corporate readers responded to this question, fully one third had plans for new foreign facilities.

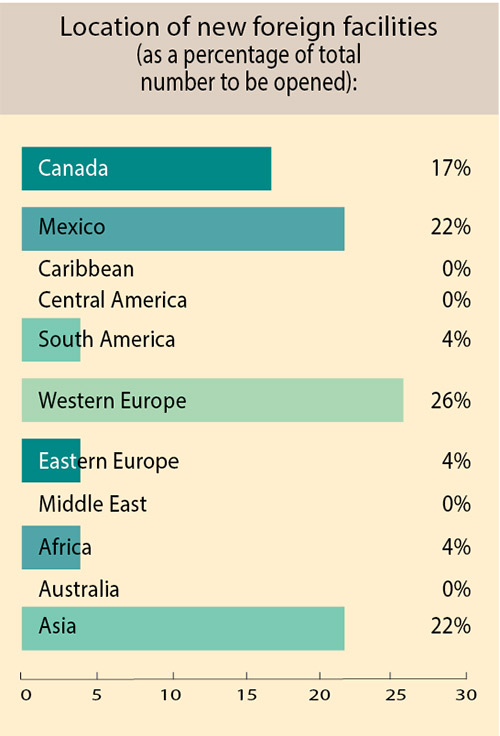

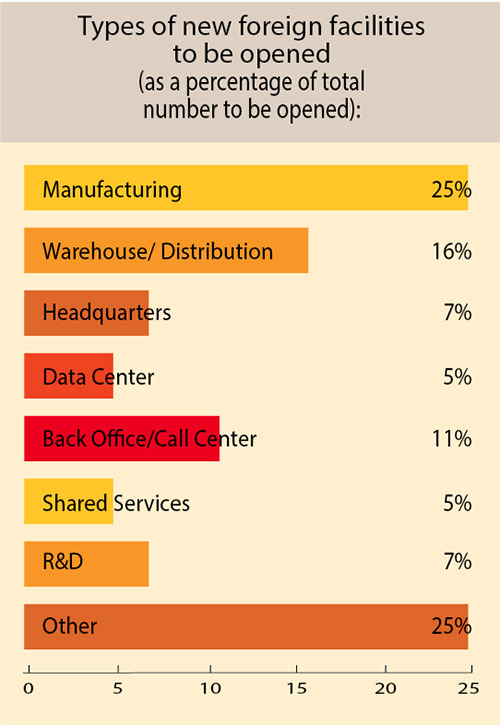

Of those few with current foreign facilities plans, a quarter are planned for Western Europe, slightly more than a fifth each for Mexico and Asia, and 17 percent for Canada. A quarter of these foreign facilities will house manufacturing operations, while 16 percent represent distribution/warehouse facilities.

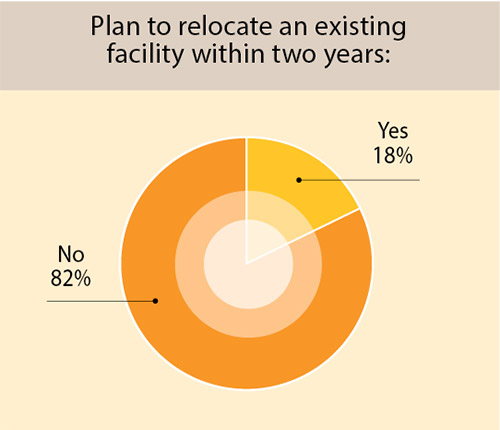

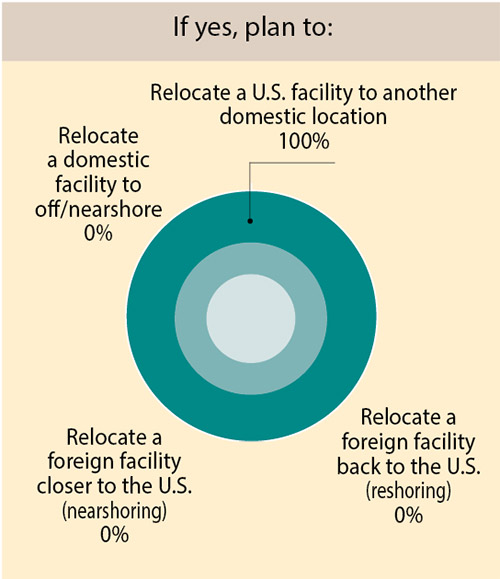

Relocation and expansion plans are also down significantly from the previous year’s pre-pandemic Corporate Survey. Only 18 percent of those responding to our 35th annual Corporate Survey say they plan to relocate an existing facility (down from 23 percent the previous year). Of those, 100 percent say they will relocate a U.S. facility to another domestic location. None have plans for off-shoring, near-shoring, or reshoring. In comparison, of those responding to the year prior survey, 5 percent had reshoring plans and 4 percent had off- or near-shoring plans.

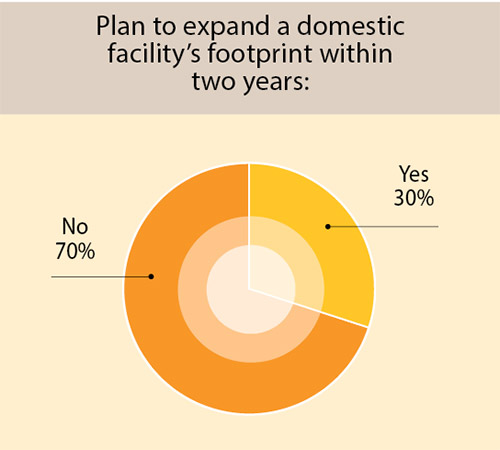

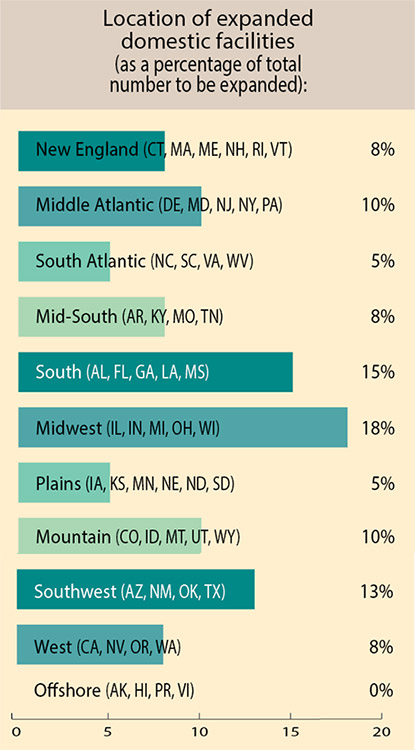

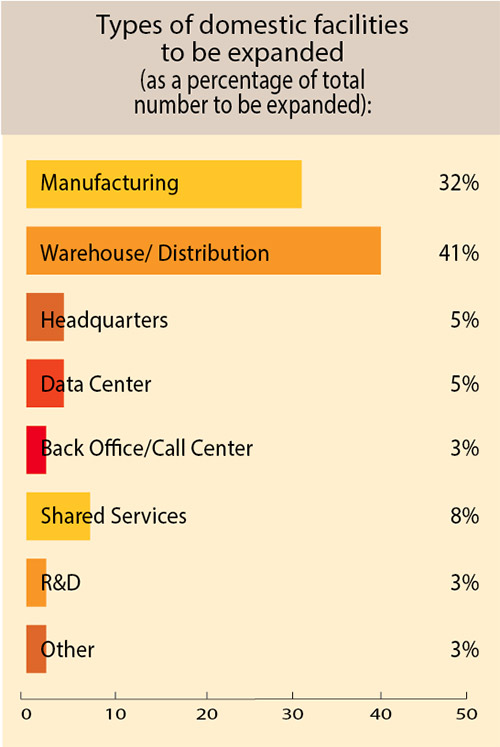

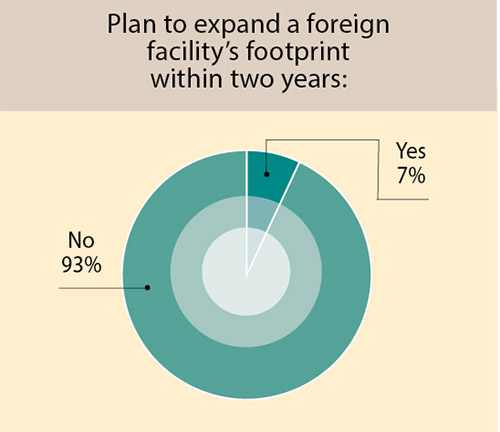

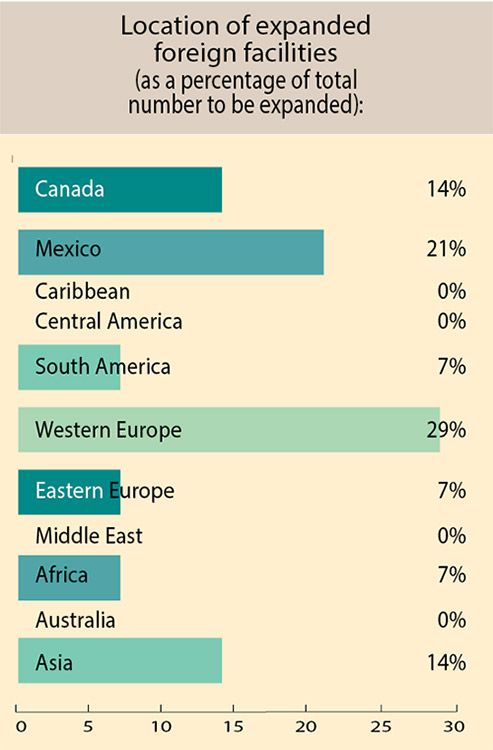

The respondents to our 35th annual Corporate Survey are also curbing their facility expansion plans — just 30 percent say they have plans to expand a domestic facility, and only 7 percent plan to expand a foreign facility. In comparison, nearly all of those responding a year ago to the pre-pandemic survey had domestic expansion plans, and 20 percent had foreign facility expansion plans. Once again, the southern regions of the U.S. are slated for many of the domestic expansions planned by the Corporate Survey respondents, with 15 percent going to the South and 13 percent to the Southwest, but the most will be garnered by the Midwest (18 percent). A third of these expansions will occur at manufacturing facilities and about 40 percent at warehouse/distribution centers.

As stated, just 7 percent of our Corporate Survey respondents have plans to expand a foreign facility, with 29 percent of these expansions occurring in Western Europe, 21 percent in Mexico, and 14 percent each in Canada and Asia. More than a quarter of the planned foreign expansions will house manufacturing operations, 22 percent will be at warehouse/distribution facilities, and nearly a fifth at back office/call centers.

Corporate Respondents’ Location Priorities

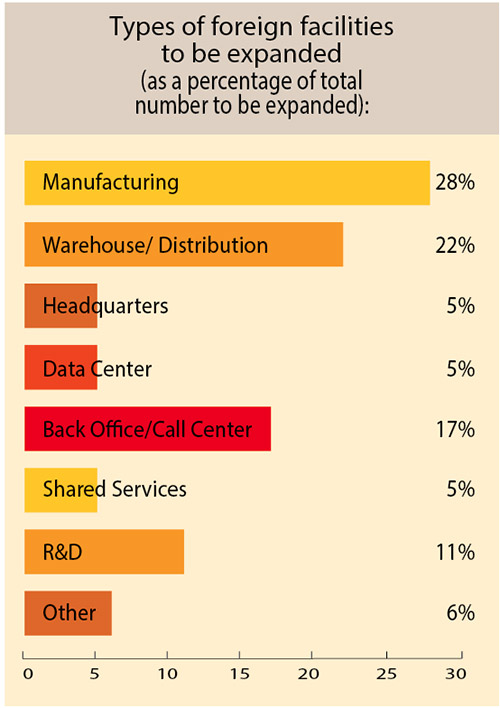

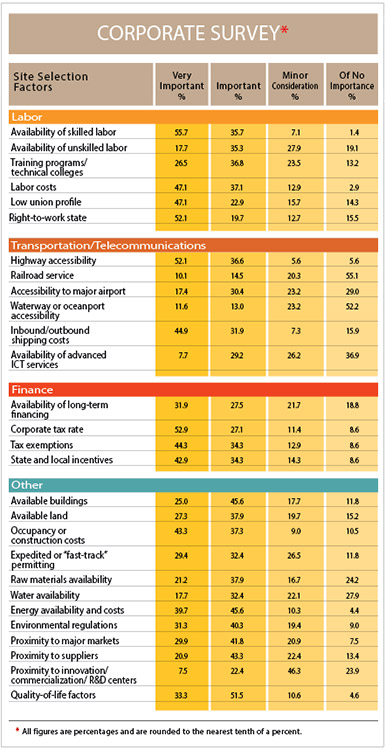

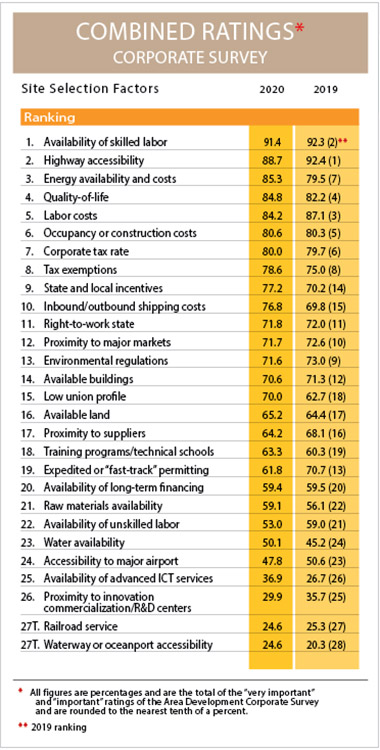

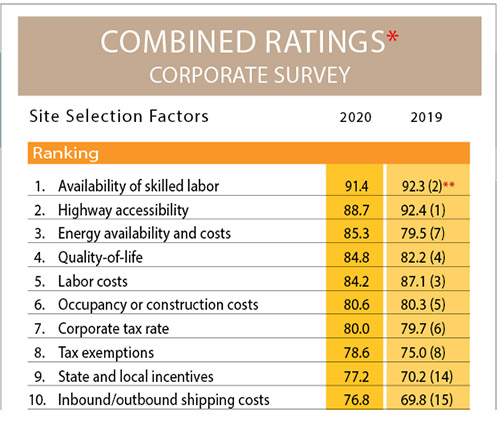

As in past years, we asked our survey-takers to rate the site selection factors as “very important,” “important,” “minor consideration,” or “of no importance.” We then added the “very important” and “important” ratings in order to rank the factors in order of importance to the location decision.

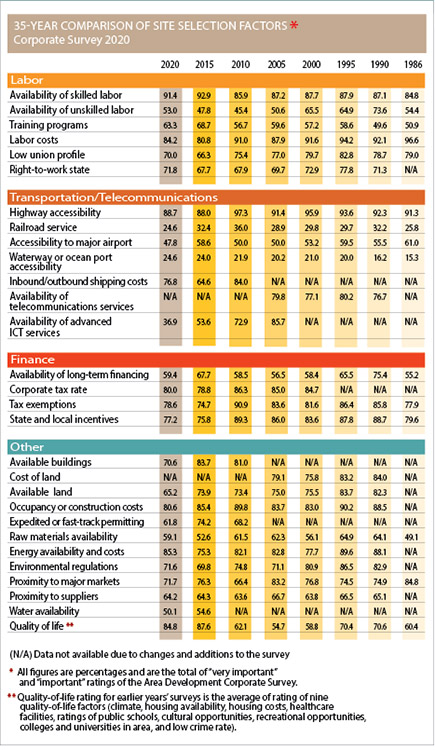

Over the 35-year course of this survey, availability of skilled labor and highway accessibility have ranked as the two most ifactors with rare exception. This year, availability of skilled labor ranks first — consideredmportant “very important” or “important” by 91.4 percent of the Corporate Survey respondents. Despite an increase in remote working during the pandemic, basing the location decision on where the available skilled workers can be found is still paramount. Remember that half of the respondents to our survey say they are only temporarily shifting to remote work, with more than a third making no such transition at all.

The respondents to our 35th annual Corporate Survey rank highway accessibility second with a combined importance rating of 88.7 percent. The ranking confirms this factor’s consistent importance in the location decision when it comes to moving supplies in and products out, as well as providing easy access to the facility for a company’s employees.

Ranked No. 4 by the Corporate Survey respondents as in the prior year’s survey is quality of life, with an 84.8 combined importance rating. This site selection factor has taken on increased importance over the last 10 years. Now, with more workers able and willing to work remotely, perhaps quality of life is even more important, as for some job functions workers can work from wherever they choose to live. In fact, many economic developers are offering incentives for the creation of remote jobs in their states and communities no matter where the company’s physical facility is located. And with more individuals working remotely permanently or temporarily during the pandemic, it’s no surprise that the factor showing the largest percentage increase — 10.2 percentage points — in the combined “very important” and “important” ratings is availability of advanced ICT services.

The COVID-19 pandemic has also increased companies’ focus on costs as many are struggling financially. Consequently, more than 84 percent of the respondents to our 35th annual Corporate Survey rate labor costs as “very important” or “important,” placing the factor in the No. 5 position. Interestingly, both labor costs and low union profile (No. 15) are rated as “very important” by nearly half of the survey respondents, with the latter factor increasing 7.3 percentage points in the combined importance ratings. And right-to-work (No. 11) is considered “very important” by more than half of the survey respondents. Having a non-union facility is also seen as a way to keep costs down.

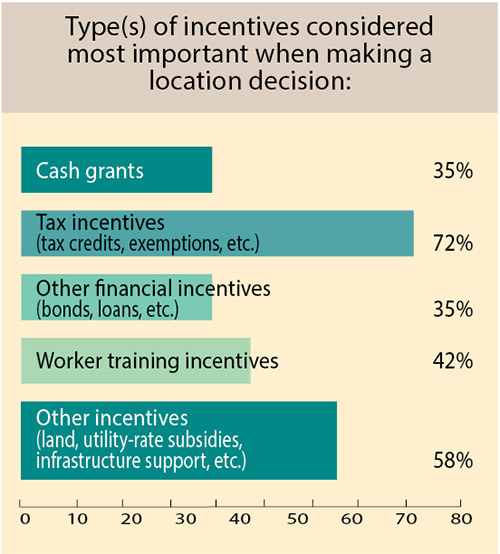

Other cost-related factors follow in the rankings. Occupancy or construction costs in the No. 6 position and corporate tax rate as No. 7, both rated as “very important” or “important” by more than 80 percent of the Corporate Survey respondents. And it’s logical that those measures sought to offset costs — i.e., tax exemptions and state and local incentives — follow in eighth and ninth place, considered “very important” or “important” by more than three quarters of the respondents to our 35th annual Corporate Survey. As companies seek more ways to keep costs in check, state and local incentives actually moved up to No. 9 from a No. 14 ranking the prior year.

Rounding out the top 10 site selection factors is inbound/outbound shipping costs, moving up five places in the rankings this year and also considered “very important” or “important” by more than three quarters of the survey respondents. With supply-chain and logistical concerns increasing in importance during the pandemic, it’s no surprise that this factor has become more important than some others.

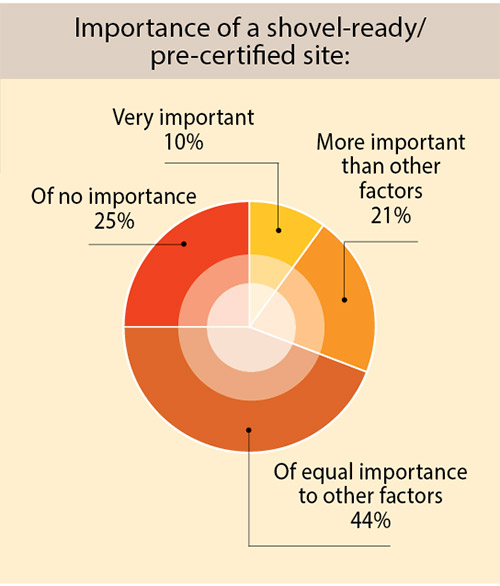

The factor showing the largest percentage decrease in the combined importance ratings is expedited or “fast-track” permitting. It dropped from the No. 13 spot to No. 19, decreasing by 8.9 percentage points in the combined importance ratings and is now considered “very important” or “important” by only slightly more than 60 percent of the respondents to our Corporate Survey. The fact that so many projects have been put on hold because of the global pandemic, and fewer are planned right now by our Corporate Survey respondents, is likely responsible for this factor’s current decrease in importance. However, in response to a related question, more than 40 percent of the survey respondents say a shovel-ready or pre-certified site is of equal importance to other factors in their location decision.

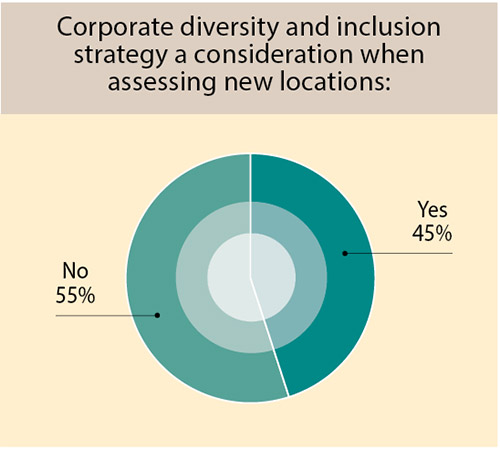

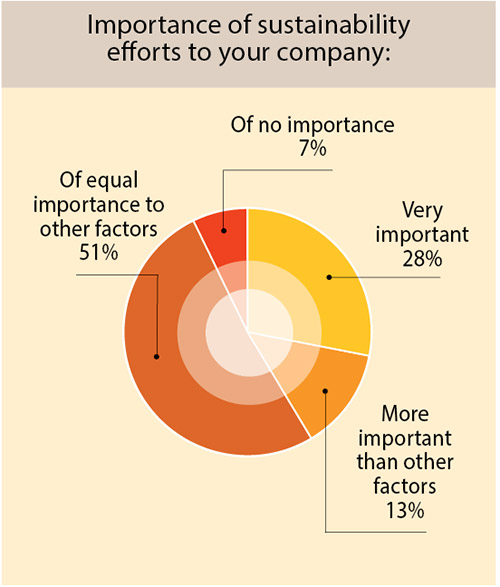

We also asked our Corporate Survey-takers about some other factors they consider when making location as well as operational decisions. Nearly half (45 percent) say they consider corporate diversity and inclusion strategies when assessing new locations, which is not surprising considering the racial inequities highlighted during 2020 and demands for more inclusive workplaces. Also, half of the respondents say sustainability efforts are of equal importance to other factors — a further confirmation that corporate leaders are aware of their larger societal responsibilities.

Corporate Outlook for 2021

As we move into 2021, business leaders are starting to be more optimistic.

According to J.P. Morgan’s 2021 Business Leaders Outlook, leaders of midsize U.S. businesses are voicing optimism about growth in 2021 even as they plan for continued economic unpredictability. Through technology adoption, embracing e-commerce, realigning supply chains, and successfully employing digital technology for remote workforces, they have managed to weather 2020’s economic turbulence. And the J.P. Morgan survey also confirms that they have an increased focus on “causes that matter to their communities, employees, and other key stakeholders.”

The changes companies made during 2020 will undoubtedly have a lasting effect on the way they operate going forward, and it will be interesting to see how these changes will be reflected by our next annual Corporate Survey of our readers.