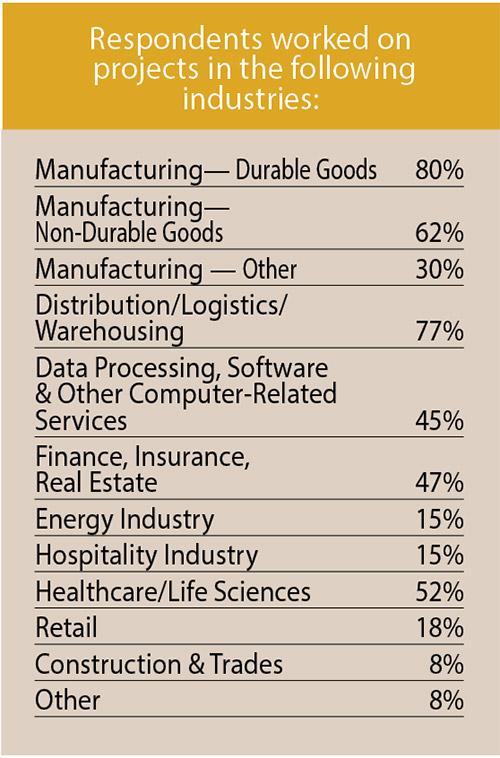

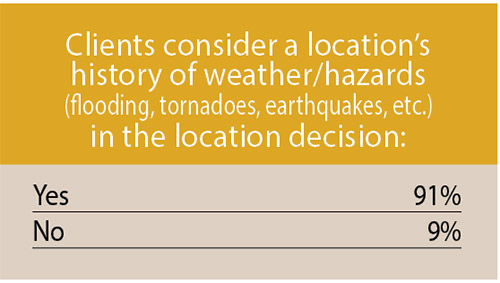

At least 80 percent of those responding to our 17th annual Consultants Survey work with manufacturers of durable goods, with some of these consultants also working with other manufacturers, and three quarters are working on distribution/logistics projects. Nearly half represent clients in data processing/computer-related sectors as well as finance/insurance/real estate.

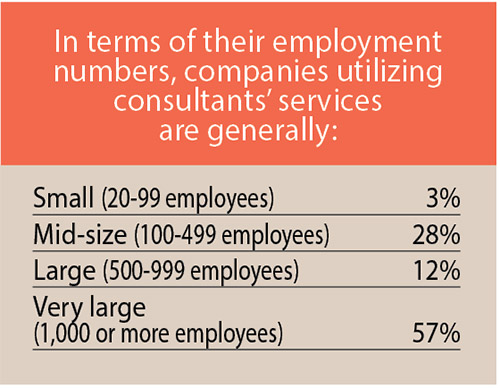

About 70 percent of the respondents work with companies that are large in terms of their employment numbers, i.e., 500 employees or more. Since 74 percent of those responding to our 35th annual Corporate Survey represent firms with fewer than 500 employees — and only 29 percent claim to use consultants when site selecting — we would expect the consultants’ reporting of their clients’ location plans and priorities to differ greatly from those reported by the Corporate Survey respondents. Let’s see if this holds true.

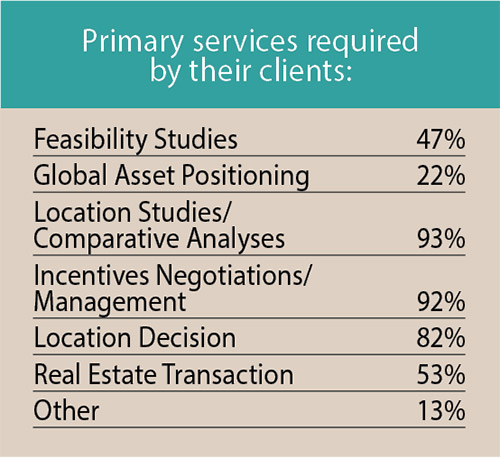

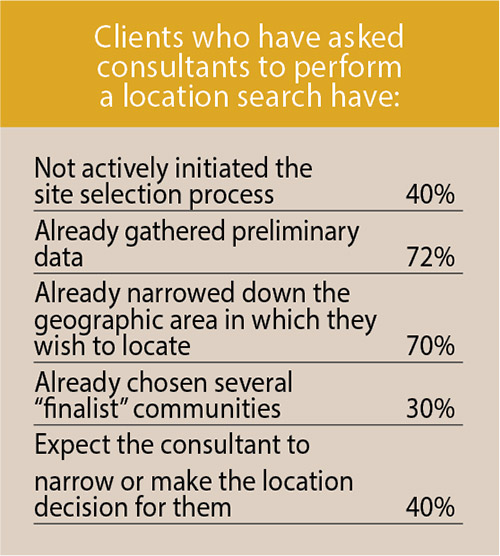

More than 90 percent of those responding to our Consultants Survey provide their clients with location studies/comparative analyses as well as incentives negotiation/management. Half are involved in their clients’ real estate transaction and 82 percent claim to make the location decision for their clients, although about 70 percent say their clients have already gathered preliminary data and narrowed down the geographic area in which they wish to location before asking the consultants to perform a location search.

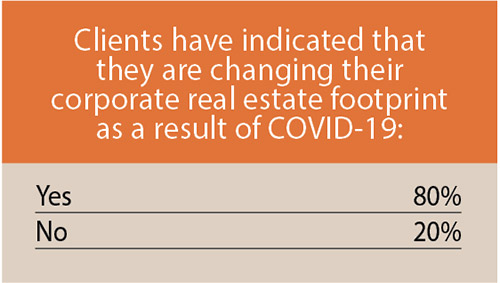

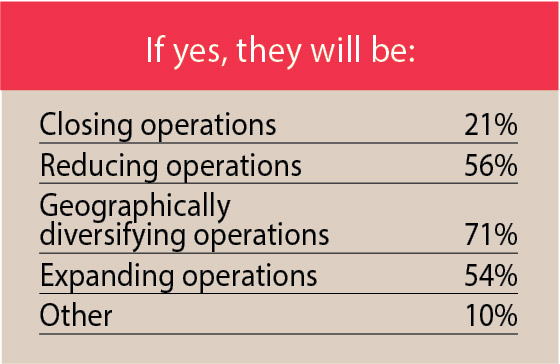

Although only a quarter of our Corporate Survey respondents say they changed their corporate real estate strategy in response to the COVID-19 pandemic, 80 percent of the respondents to the 17th annual Consultants Survey claim their clients have done so. Some 70 percent say their clients are geographically diversifying operations, while more than half claim some of their clients are reducing operations while others are expanding operations.

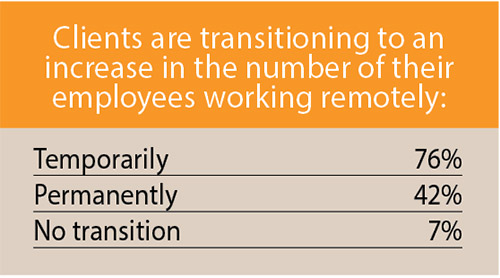

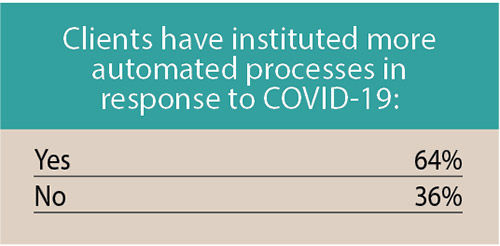

Additionally, three quarters of the responding consultants say their clients are temporarily transitioning to remote work, while 42 percent say their clients are permanently transitioning to remote work. Only 13 percent of those responding to the Corporate Survey made the latter claim. However, both groups of respondents see an uptick in the use of automated processes. Nearly two thirds of the respondents to the Consultants Survey say their clients are instituting more automated processes in response to the pandemic, and about half the respondents to the Corporate Survey say they are doing so as well.

Consultants’ Clients’ New Facility Plans

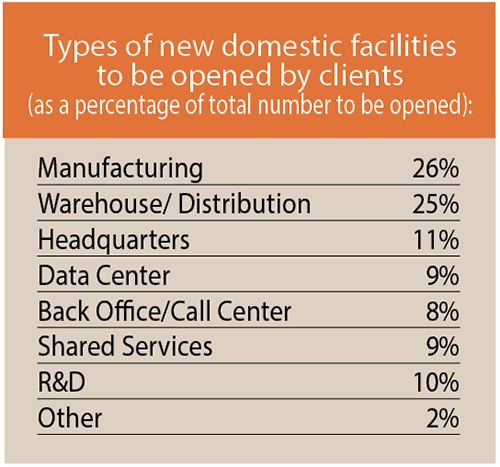

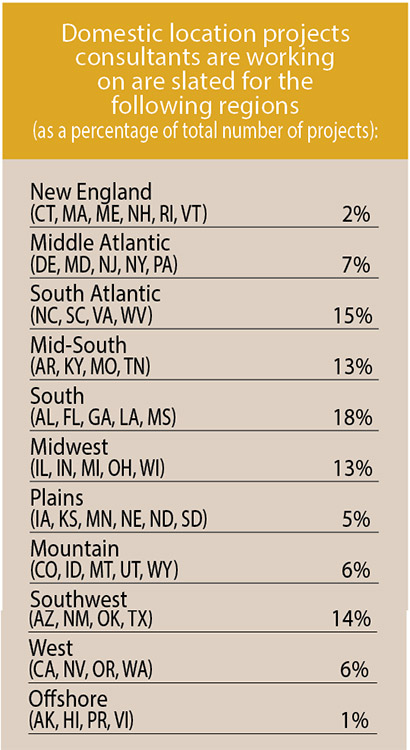

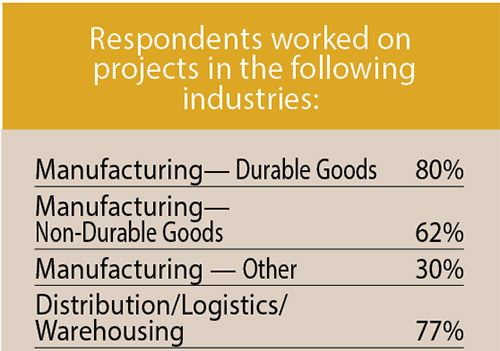

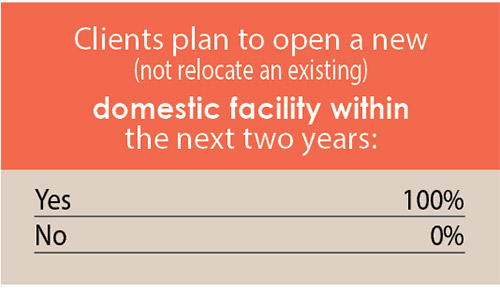

All of the responding consultants say their clients plan to open new domestic facilities within the next two years. Most of these are slated for various areas of the southern U.S. — South (18 percent of the total), South Atlantic (15 percent), Southwest (14 percent), and Mid-South (13 percent). Another 13 percent will go to the Midwest. A quarter of their clients’ new domestic facilities will house manufacturing operations and another 25 percent will be warehouse/distribution centers. Interestingly, nearly 60 percent of the responding consultants say their clients’ new domestic facilities represent foreign direct investment.

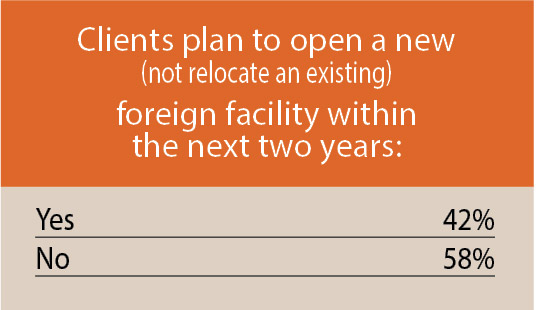

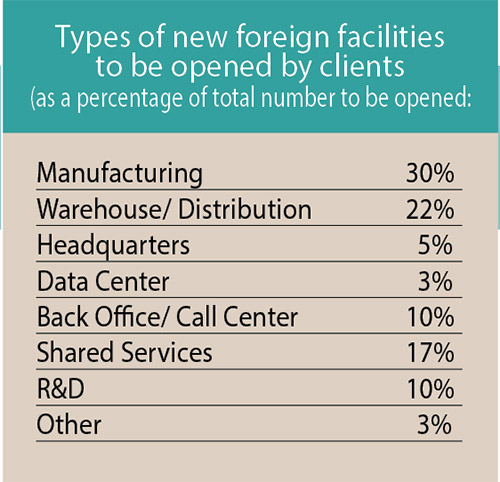

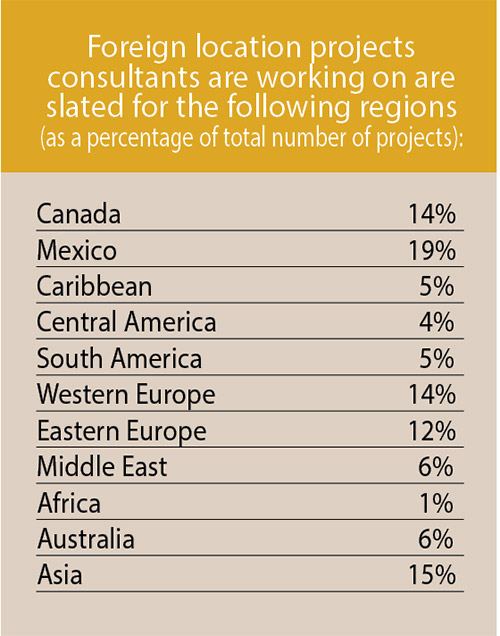

More than 40 percent of those responding to our 17th annual Consultants Survey also say their clients have plans for new foreign facilities, as compared to only 8 percent of our Corporate Survey respondents with such plans. About a fifth of the consultants’ clients’ new foreign facilities are slated for Mexico, 15 percent for Asia, and 14 percent each for Canada and Western Europe. Thirty percent of these new foreign facilities will house manufacturing operations, and more than 20 percent will be warehouse/distribution centers.

17th Annual Consultants Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

-

Chart 17

-

Chart 18

-

Chart 19

-

Chart 20

-

Chart 21

-

Chart 22

-

Chart 23

-

Chart 24

-

Chart 25

-

Chart 26

-

Chart 27

-

Chart 28

-

Chart 29

-

Chart 30

-

Chart 31

-

Chart 32

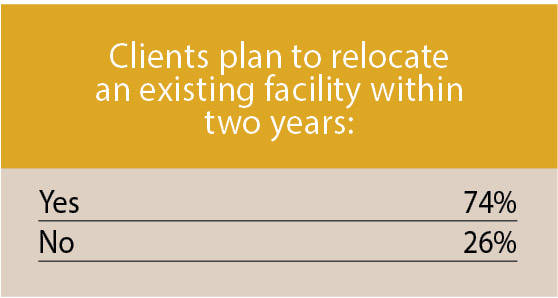

Three quarters of the respondents to our 17th annual Consultants Survey say their clients plan to relocate an existing facility within two years. More than 90 percent say their clients will relocate domestically; about a third say their clients plan to reshore or near-shore a foreign facility; and a fifth say their clients plan to offshore a domestic facility. In comparison, none of the respondents to our annual Corporate Survey had off- or near-shoring or reshoring plans.

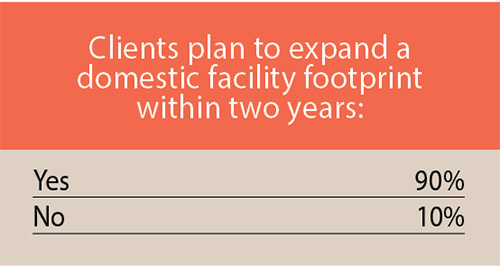

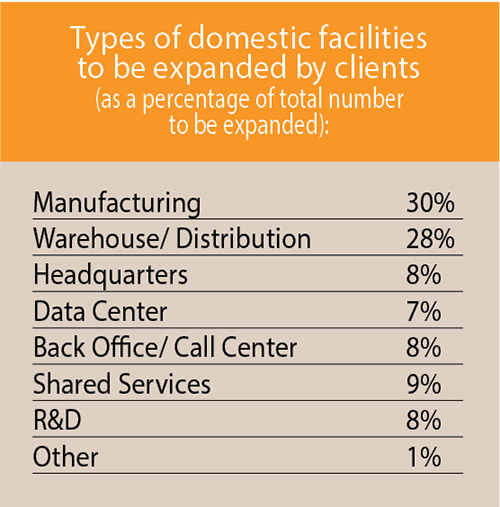

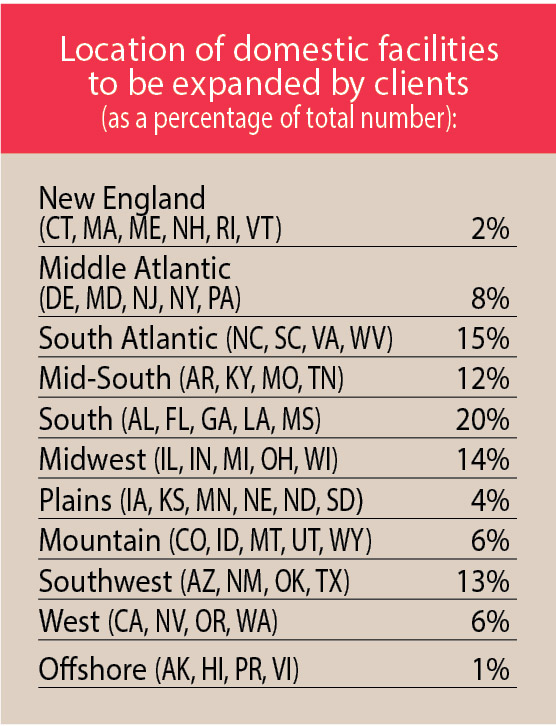

Ninety percent of the responding consultants also say their clients plan to expand a domestic facility’s footprint. Once again, most of those expansions will occur in the southern U.S. — South ( 20 percent of the total expansions), South-Atlantic (15 percent), Southwest (13 percent), and mid-South (12 percent). The Midwest will garner 14 percent of the planned domestic expansions. And, as expected of the total domestic expansions, 30 percent represent manufacturing and nearly 30 percent warehouse/distribution. Half of the responding consultants also say these expansions represent FDI.

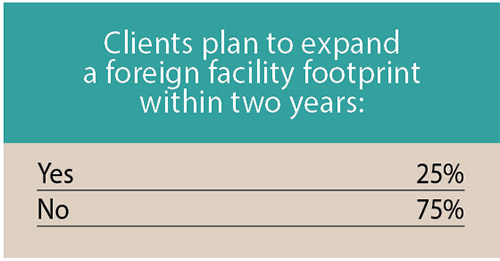

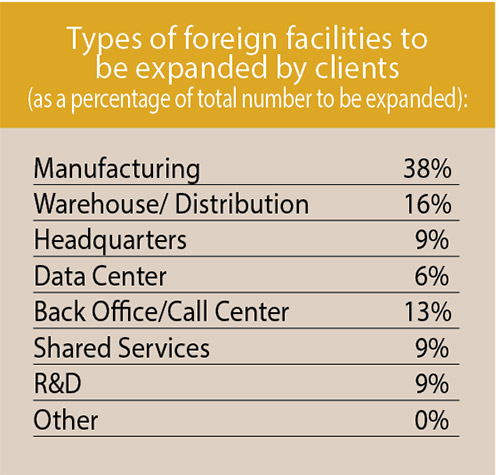

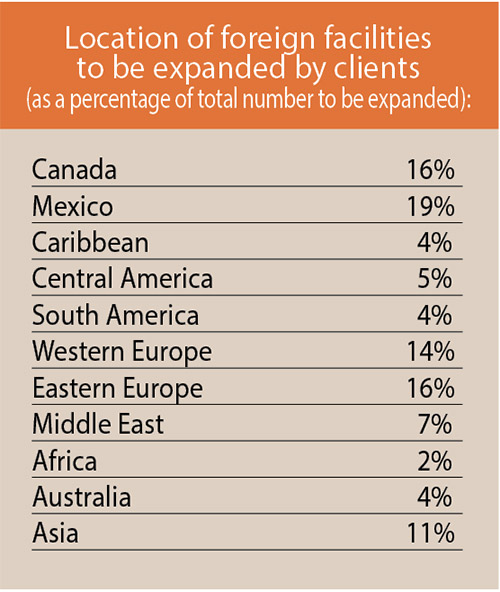

Whereas only 7 percent of the respondents to our Corporate Survey have plans for foreign facility expansions, 25 percent of the responding consultants say their clients have such plans. Mexico will take the largest share (19 percent), followed by Canada and Eastern Europe (16 percent each), and Western Europe (14 percent). It appears that manufacturing is the largest choice for these foreign expansions at nearly 40 percent of the total.

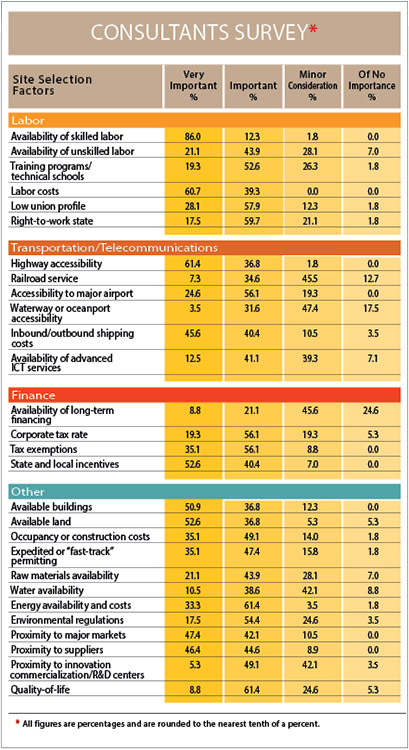

We also asked the consultants taking our annual survey to rate the site selection factors as “very important,” “important,” “minor consideration,” or “of no importance” to their clients. We then added the “very important” and “important” ratings in order to rank the factors in order of importance to their clients’ location decisions.

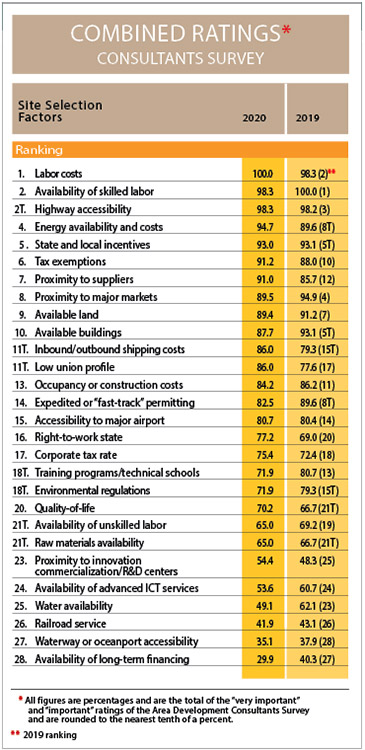

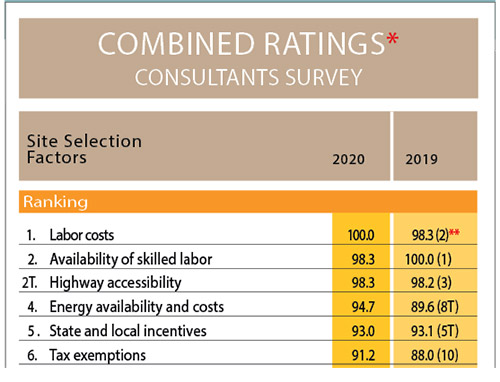

Interestingly, the consultants responding to our 17th annual Consultants Survey bumped the availability of skilled labor factor, which was ranked No. 1 a year ago, down a notch; it is now tied with highway accessibility for the No. 2 ranking, although these factors are still considered “very important” or “important” by 98.3 percent of the respondents. In fact, in the “very important” category alone, availability of skilled labor is still top-ranked by 86 percent of the respondents (about 25 percent more than any other factor).

However, 100 percent of the responding consultants rank labor costs as the top site selection factor overall when the “very important” and “important” categories are combined. This is probably not a surprise given that many of their clients are attempting to cut costs during the pandemic and position themselves for survival over the short and long term.

Two related factors that affect labor costs — low union profile and right-to-work state — also increased in importance. Low union profile jumped six spots in the consultants’ ranking to No. 11 with an 86 percent combined importance rating, and right-to-work state is now considered “very important” or “important” by more than three quarters of the responding consultants and is up four spots in the rankings from the prior year to No. 16 among the factors.

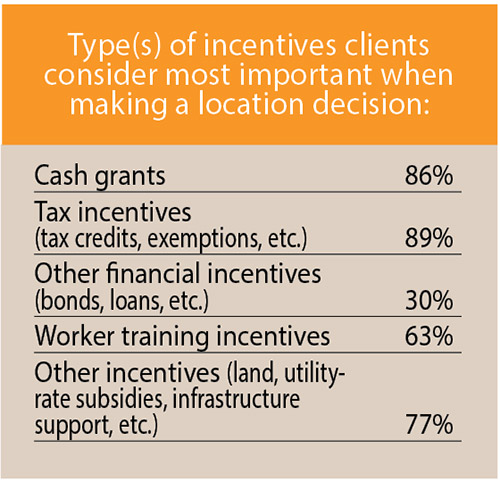

Other cost concerns are reflected in the consultants’ rankings: the energy availability and costs factor is ranked fourth, with a 94.7 percent combined importance rating, up from eighth place the year prior. And state and local incentives and tax exemptions, which help to lower costs, take the No. 5 and 6 spots, respectively, considered “very important” or “important” by more than 90 percent of the respondents. Since more than 90 percent of the responding consultants also say they are involved in incentives negotiations and management for their clients, these last two rankings are to be expected.

The global pandemic has also caused the consultants to focus on their clients’ proximity to suppliers and proximity to major markets — factors ranking seventh and eighth, respectively. Proximity to suppliers actually rose five places in the rankings. The consultants are hyper-aware of the logistical challenges brought about by the COVID-19 pandemic and want to make sure their clients re-examine their supply chains.

One factor that is far less important — comparatively speaking — for the responding consultants than for those responding to our Corporate Survey is quality of life. Those responding to our annual Consultants Survey rank this factor at No. 20, with only about 70 percent considering it “very important” or “important.” However, nearly 85 percent of the Corporate Survey respondents rated it as such, ranking quality of life fourth in importance among their location factors.

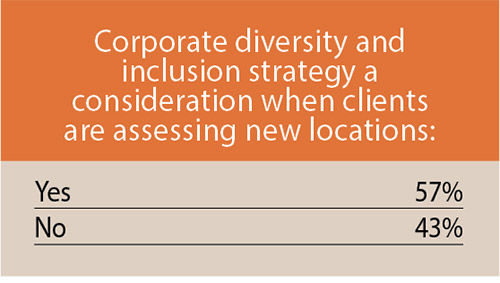

It would seem those responding to our 17th annual Consultants Survey believe their clients should be more concerned with quantitative than qualitative factors, but that may not be the case, with the global pandemic keeping workers as well as their employers closer to home. And the pandemic has also highlighted the need for corporate diversity and inclusion strategies. Both the Corporate Survey and Consultants Survey respondents seem to be aware of this, with 57 percent of the consultants saying they are a consideration when clients assess new locations.