1. Investment in Mexico by U.S. companies will slow significantly.

President Trump has been very forthright about initiating policy changes that will keep U.S. companies from relocating operations to other countries, especially Mexico. While it is likely that the President is sincere in following through with this effort, his stance will not be the only contributing factor to stemming corporate investment in Mexico. Rather, it is Mexico’s diminishing value proposition that will have companies rethinking their plans to locate investment south of the border.

Anecdotally, some of Site Selection Group’s industrial clients that have a presence in Mexico are not too terribly satisfied with their operations. They frequently cite productivity issues, turnover issues, rising labor costs, and lack of support services as having the most negative impact on their operations. One executive of a tier-one automotive supplier recently expressed, “I operate a plant in Mexico because my customer insists I do so. The same is true for the majority of my competitors”. With news of multiple original equipment manufacturers such as Ford and General Motors rethinking their Mexico strategy, it is logical to assume suppliers will be re-evaluating as well.

Statistically speaking, rising labor costs alone have increased the required headcount of a production project to break-even in Mexico as compared to the United States. Five years ago, Site Selection Group estimated that a company establishing a location in Mexico only needed 300 employees to realize the savings in labor to justify the added costs of shipping, real estate, utilities, etc. Today, that break-even number is well over 500 workers. While Mexico can still offer real advantages for certain industries and project types, it is more critical than ever to evaluate locations there with your eyes wide open and oftentimes with the support of a trusted adviser.

Those familiar with the corporate site selection industry over the last 10 years will be astonished (or perhaps relieved) at the notion that project timelines might actually lengthen. Industry insiders have been preconditioned to the speed-to-market concerns of companies over the last several years. Due to a variety of reasons, but mainly the issues associated with the economic recovery, companies have waited until the last moment possible to commit to their capital projects leading to compressed timelines. More often than not, this means that site selection projects are behind schedule before they have started and, in some cases, this can lead to less optimal location decisions. While there are several macro factors that might relax timelines a bit — including upward pressure on wages and interest rates — continued political uncertainty may convince some companies to hit pause to more clearly see the direction the administration and the Republican Congress decide to go.

3. Wages will escalate even faster.

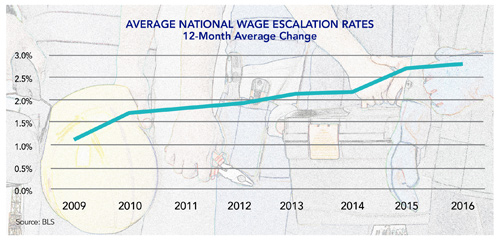

Domestic wages and salaries have been steadily escalating over the past eight years. According to the Bureau of Labor Statistics, the average annual wage escalation in 2016 was 2.8 percent.

There are certain occupations in high demand, such as skilled production workers, IT professionals, and skilled trades that have experienced annual wage escalation as high as 10 percent. As the nation’s unemployment rate falls to 4.9 percent, and the labor force participation rate dips to 62.7 percent, the country has essentially reached full employment. In other words, those workers with desired skill sets have little trouble finding employment. The current labor market has companies competing for workers largely on the basis of price, both directly in terms of wages and salaries but also indirectly in terms of hard and soft benefits. Pending some unforeseen economic circumstance, the competition for workers will continue well into 2017, thus continuing the upward trend in wages and salaries.

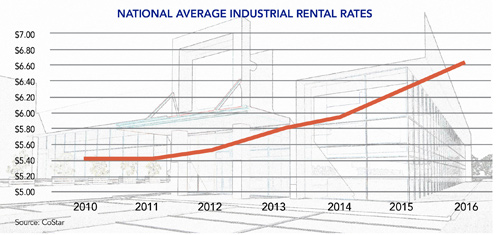

Available industrial buildings, especially quality options for production-oriented uses, have been scarce for the last several years. This has been a function of industrial activity since the economic recovery outpacing the supply of new buildings. Based on the latest construction and delivery statistics from CoStar, the trend of diminishing supply in 2017 will likely continue. The current national industrial vacancy rate of 5.4 percent is the lowest since 1999. Further compounding the issue are both construction starts and deliveries that are expected to be down 15 percent in 2017 from the previous year. All of this comes at a time when the country is otherwise primed for continued corporate growth.

Basic economic principles of supply and demand will undoubtedly affect market rental rates in 2017. Average industrial rental rates have been rising since 2010 and closed 2016 at $6.62/square foot. As the competition for space continues to be fierce this year, rental rates will continue to climb. These market factors are making companies more amenable to the notion of constructing and owning their own real estate.

5. The right-to-work movement continues.

Kentucky recently made headlines, as it became the latest state to enact right-to-work legislation. A couple of years have passed since the latest wave of states (Indiana, Michigan, and Wisconsin) passed the same legislation. All of this activity has exacerbated the pressure for non–right-to-work states with attractive site selection assets to join the mix. Key states to keep an eye on are Missouri and Ohio. Right-to-work legislation has been proposed in both states recently and appears to be gaining momentum.