According to the Commerce Department, the U.S. GDP grew at a 5.7 annualized rate in 2021, the fastest rate since 1984! This was primarily driven by consumer spending, which was bolstered by stimulus payments and emergency relief during the pandemic. This good news is tempered by the supply chain bottlenecks created by the surge in demand for everything from furniture to appliances to automobiles, and even to household necessities (remember the hoarding of toilet paper?), which is causing manufacturers to rethink their lean manufacturing strategies that minimize inventory.

There was also much talk of the Great Resignation, as workers quit their jobs during the pandemic because of health concerns, lack of childcare, or the desire for better work/life balance. Yet, despite this, the unemployment rate fell from a high of more than 14 percent in April 2020 to a low of just 4 percent by January of this year, exacerbating the labor shortage already faced by businesses pre-pandemic.

All these disruptive events have analysts predicting a “new normal” for industry. Consequently, as Area Development prepared to survey our corporate readers, we wondered if their responses would reflect any drastic changes in their location plans and priorities over the next two years. The survey results follow.

The Corporate Survey Respondents

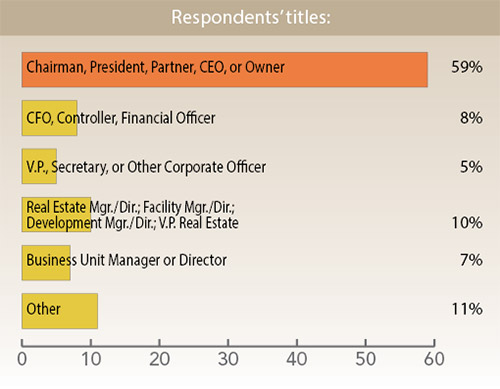

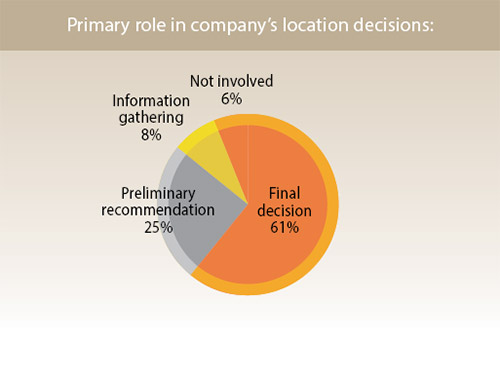

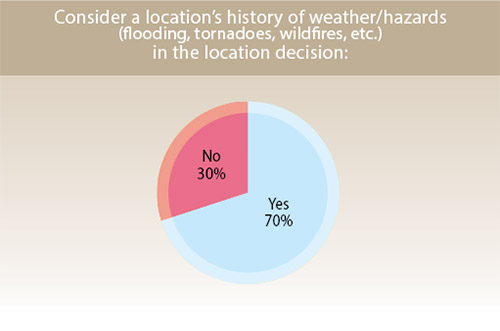

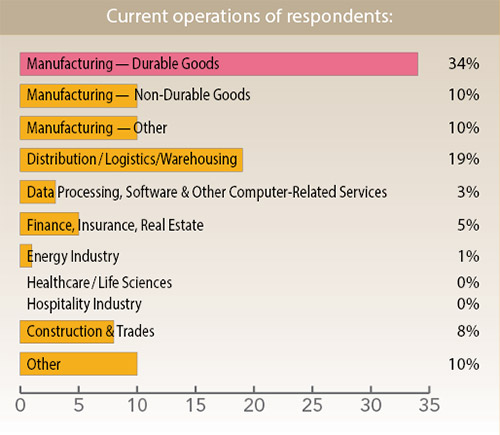

More than half the respondents to our 36th Annual Corporate Survey are with manufacturing firms, and a fifth represent distribution/warehousing/logistics entities. Also, nearly 60 percent are the top C-level executives at their companies, i.e., chairman, CEO, etc., while 8 percent are their firms’ chief financial officers. It therefore follows that about 60 percent of the survey respondents are also making their companies’ final location decisions, with another quarter making a preliminary recommendation on the final site selection.

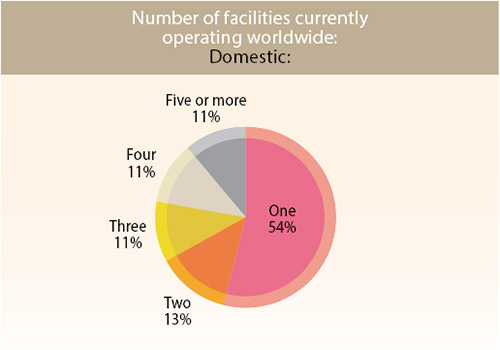

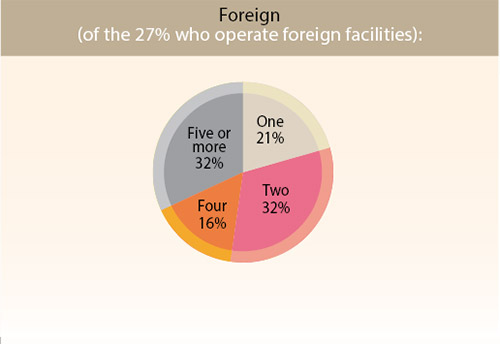

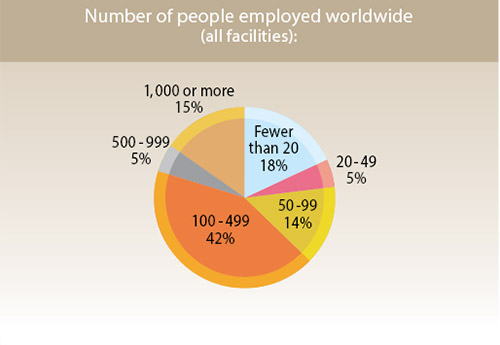

More than half of the Corporate Survey respondents operate only one domestic facility. Slightly more than a quarter operate foreign facilities as well. Of those, a third operate two foreign facilities and a fifth have just one. More than 40 percent of the respondents are with mid-size firms in terms of employment numbers (100–499 employees), with a fifth having fewer than 20 workers and 15 percent employing more than 1,000 people.

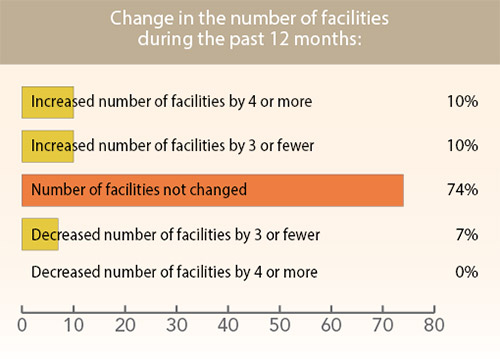

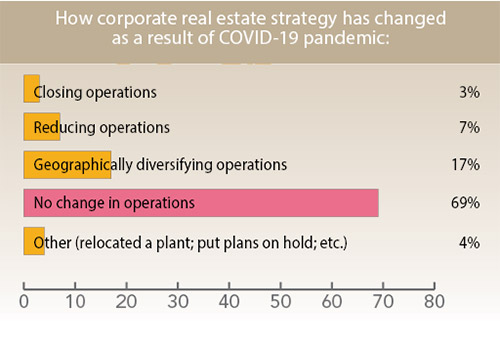

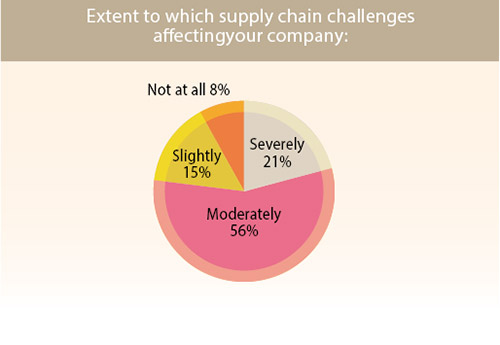

Three quarters of the survey respondents also had no change in their number of facilities over the last 12 months, with nearly 70 percent saying they had not changed their corporate real estate strategies as a result of the COVID-19 pandemic. Interestingly, 20 percent of the Corporate Survey respondents did increase their number of facilities over the last 12 months, with 17 percent saying the pandemic caused them to geographically diversify their operations. This may have been brought about by their desire to be closer to suppliers and/or markets because of supply chain disruptions since more than three quarters of the survey respondents say supply chain disruptions are severely or moderately affecting their companies.

36th Annual Corporate Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

-

Chart 17

-

Chart 18

-

Chart 19

-

Chart 20

-

Chart 21

-

Chart 22

-

Chart 23

-

Chart 24

-

Chart 25

-

Chart 26

-

Chart 27

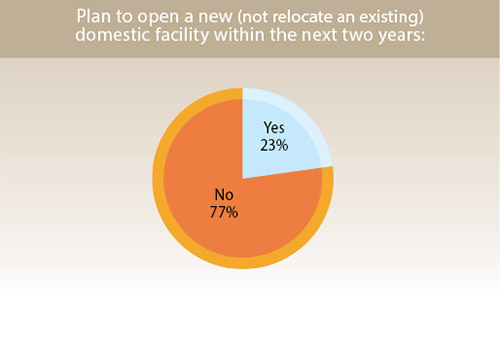

When asked specifically about their facilities plans over the next two years, fewer than one quarter of the Corporate Survey respondents say they have plans to open a new domestic facility.

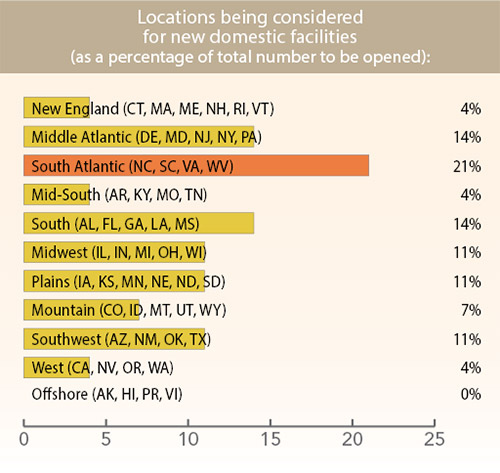

The South Atlantic States will be home to 21 percent of these planned new facilities. The Mid-Atlantic and South will each garner 14 percent of the new facilities, with 11 percent each going to the Midwest, Plains, and Southwest. These percentages are significantly different from those reported by the respondents to Area Development’s prior year survey, when 30 percent of the respondents had plans for new domestic facilities and, of those, the South Atlantic was only to garner 8 percent of the planned new projects and the Plains, only 5 percent.

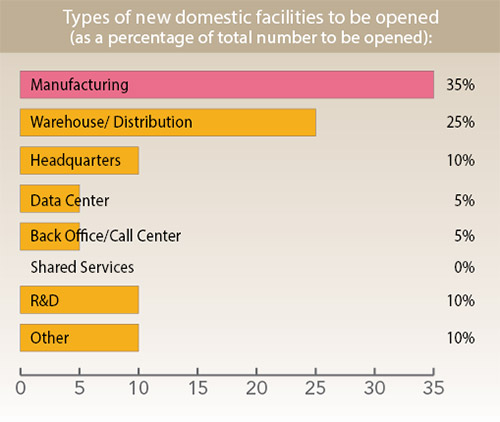

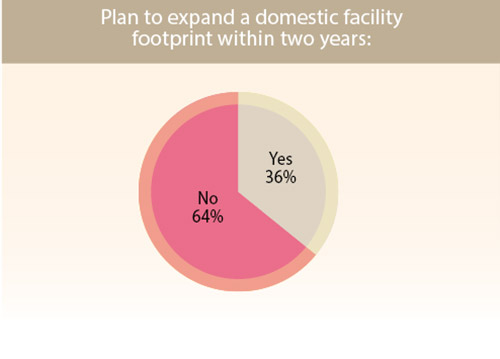

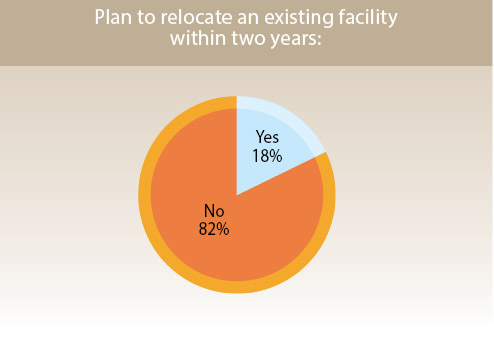

Thirty-five percent of the planned new facilities will house manufacturing operations, according to the current Corporate Survey respondents, with a quarter representing warehouse/distribution operations. Headquarters and R&D operations will each account for 10 percent of the planned new facilities. Those taking the 36th Annual Corporate Survey were also asked about their expansion plans as well as plans to relocate an existing domestic facility over the next two years. Slightly more than a third of the respondents have plans to expand the footprint of a domestic facility, and just 18 percent say they plan to relocate an existing facility during that time period, similar to what was reported by the prior year’s survey respondents.

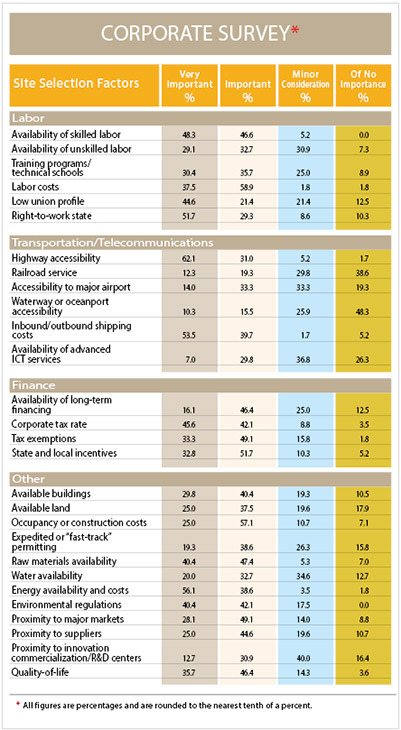

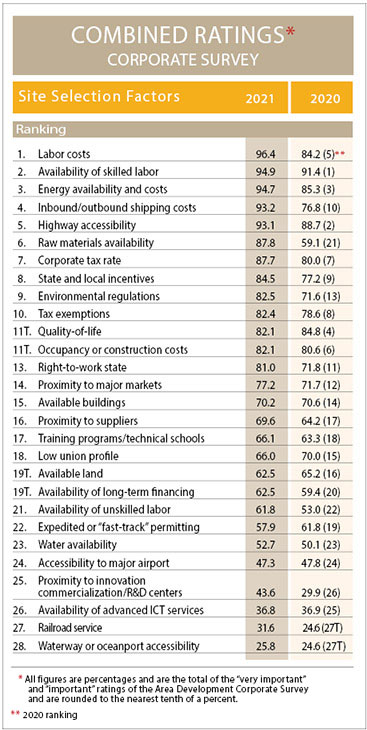

We next asked our Corporate Survey respondents to rate 28 site selection factors as either “very important,” “important,” “minor consideration,” or “of no importance.” By adding the percentages of the “very important” and “important” ratings, we are able to rank the factors in order of importance.

As to be expected, the top-ranked factor is labor costs, considered “very important” or “important” by 96.4 percent of the respondents, moving up 12.2 percentage points from the fifth place spot in the prior year’s survey.

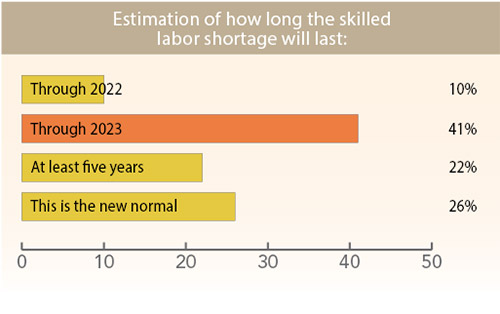

This factor is followed closely by availability of skilled labor, in the #2 spot with a 94.9 percent combined importance rating. With the economy now close to full employment, workers have been able to bargain for higher wages, adding to business costs. And, when asked separately about their predictions for how long the skilled labor shortage will last, about 40 percent of the respondents to our 36th Annual Corporate Survey say it will last through 2023, with nearly 50 percent saying it will last at least five years or “this is the new normal.”

Even availability of unskilled labor is up 8.8 percentage points in the combined ratings, although just 61.8 percent of the Corporate Survey respondents consider it “very important” or “important,” placing the factor toward the bottom of the rankings at #21, similar to the prior year’s survey. However, in response to a related question, about two thirds of the Corporate Survey respondents say they are expanding training initiatives in response to the labor shortage.

The energy availability and costs factor maintained its third-place ranking, but now has a combined importance rating of 94.7 percent, as compared to the 85.3 percent importance rating it received in the year prior survey. It seems the global pandemic also took a toll on energy supply and demand — as with goods — but the demand has increased faster than the energy supply chain can handle it, resulting in rising costs.

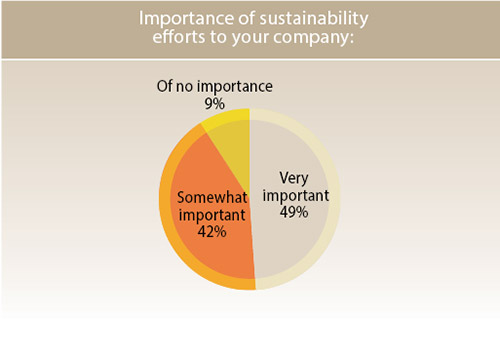

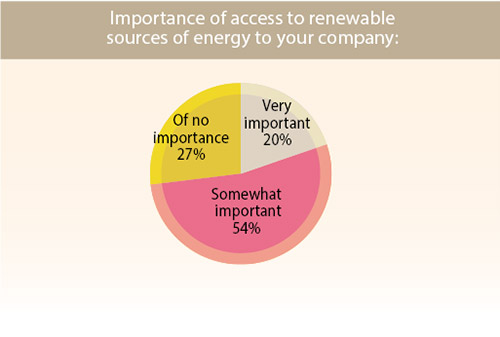

In response to a separate energy-related question, three quarters of the respondents to our Corporate Survey say access to renewable sources of energy are very or somewhat important to their companies. And more than 90 percent of the survey respondents also say sustainability efforts are very or somewhat important to their companies.

With images of containerships waiting to unload clogging the nations ports, it’s no surprise that two supply-chain-related location factors took a tremendous jump in the importance ratings and rankings. Inbound/outbound shipping costs jumped from tenth place in the prior year survey to the #4 spot, increasing 16.4 percentage points, and now considered “very important” or “important” by 93.2 percent of the respondents to our 36th Annual Corporate Survey.

And the largest increase in combined importance rating and ranking goes to raw materials availability. This factor increased an astounding 28.7 percentage points, with a combined importance rating of 87.8 percent, jumping from #21 in the prior year survey to #6 in this year’s rankings. Again, when we think of the shortage of so many goods caused by lack of parts or materials, it’s no surprise that this factor has made an historic leap in importance.

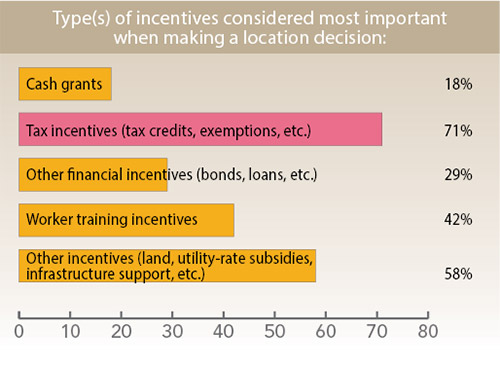

For the most part, the financial-related location factors maintained their rankings in the 36th Annual Corporate Survey over the prior year; however, their combined importance ratings did increase slightly. The corporate tax rate factor is still ranked #7, considered “very important” or “important” by 87.7 percent of the respondents, up 7.7 percentage points over the prior year. State and local incentives follows in the #8 spot, now receiving a combined importance rating by 84.5 percent of the survey respondents, up 7.3 percentage points over the prior year. But the tax exemptions factor fell two spots to the #10 position, despite the fact that its combined importance rating of 82.4 percent was up slightly over the prior year. And in a related question, more than 70 percent of the Corporate Survey respondents say they consider tax incentives the most important incentive when making a location decision.

The increasing focus on getting to net-zero emissions for facilities has bumped the environmental regulations factor up to ninth place in the rankings from #13 the prior year. Its combined important rating jumped 10.9 percentage points; 82.5 percent of the Corporate Survey respondents now consider environmental regulations “very important” or “important” when making a site selection decision.

Interestingly, the quality-of-life factor fell from #4 in the prior year’s survey rankings to #11(tied) this year, although still considered “very important” or “important” by 82.1 percent of the Corporate Survey respondents. Again, other factors are taking precedence. This factor is actually tied for the #11 spot with occupancy or construction costs, which fell from the #6 spot in the prior year’s rankings. With extremely low industrial vacancy rates and delays and rising costs for construction, it was expected that this factor would move up in the rankings, so its middling spot comes as somewhat of a surprise.

Other factors receiving middling or lower rankings did not change much year-over-year, although there are some interesting increases in importance ratings. For example, as mentioned, the pandemic has altered employee demands for increased wages and better working conditions. This development may be responsible for the increase in importance of the right-to-work state factor — more than 80 percent of the respondents to the 36th Annual Corporate Survey rate right-to-work state as “very important” or “important” when making a location decision, up from just over 70 percent in the prior year’s survey.

The proximity to innovation commercialization/R&D centers factor, while remaining toward the bottom of the rankings, actually increased 13.7 percentage points in the combined ratings, with 43.6 percent of the survey respondents deeming it “very important” or “important.” The speed of technology in improving individuals’ health, the health of our planet, and companies’ financial health has resulted in a push for innovation in all industries.

The Year Ahead

As we look to the year ahead, there are many unknowns. It is hoped that we will put the global pandemic in the rearview mirror, although cautionary actions will still be in place for what lies ahead in that regard is unknown. As predicted by our survey respondents, labor shortages may still persist, and consumer habits developed during the pandemic that resulted in a rapid surge in e-commerce are here to stay. All of these disruptions will undoubtedly have a bearing on companies’ location plans and priorities during the course of 2022 and beyond.

Nonetheless, according to J.P. Morgan’s 2022 Business Leaders Outlook, business leaders have stood up to the challenges created by the pandemic over the last two years and are optimistic about the year ahead. Despite tight labor markets, clogged supply chains, and rising costs, nine out of 10 of the mid-size businesses surveyed by the institution expect their businesses to grow and thrive over the next year.