The Consultants Survey Respondents

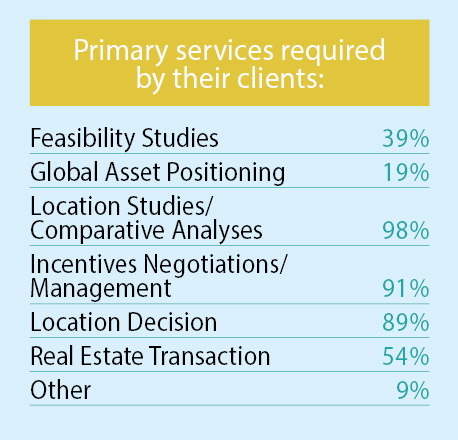

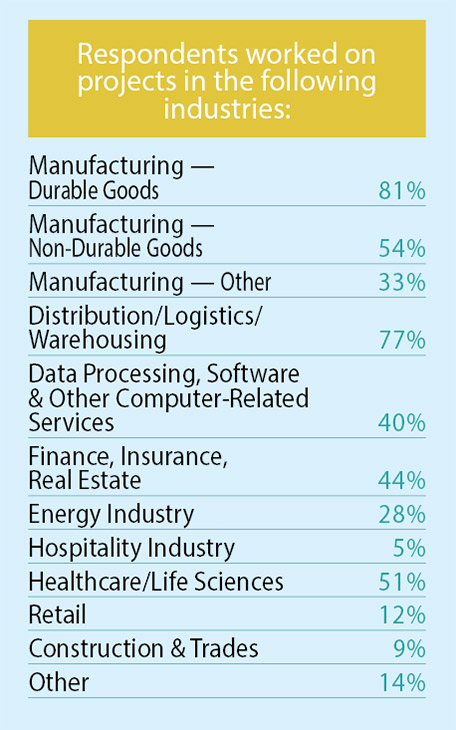

About 80 percent of the consultants responding to our Annual Consultants Survey are working on projects in the durable goods manufacturing sector. More than three quarters are also working on distribution/logistics/warehousing projects, and half on those in the healthcare/life sciences sector. The primary services provided by nearly 100 percent of these consultants to their clients involve location studies and comparative analyses. Around 90 percent of the survey respondents also assist with incentives negotiation and management, and 89 percent claim to actually make the location decision for their clients.

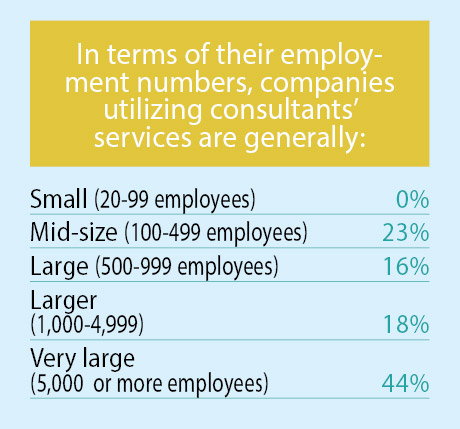

In terms of their employment numbers, the companies utilizing the services of the consultants who responded to our survey are generally large. In fact, more than 40 percent of the responding consultants service companies with 5,000+ employees, with a third serving those having between 500 and 4,999 workers. None of the responding consultants say they service companies with fewer than 100 employees — a category represented by more than a third of those responding to our 36th Annual Corporate Survey.

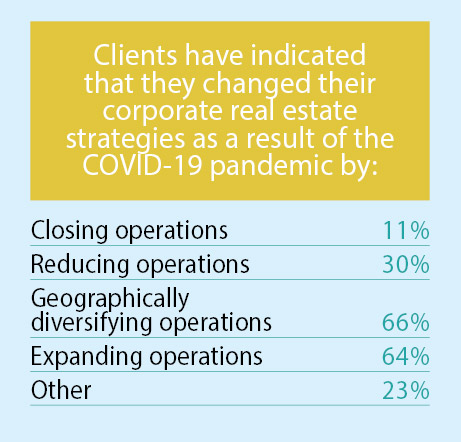

Two thirds of those responding to our 18th Annual Consultants Survey say their clients have geographically diversified their operations and/or expanded operations as a result of the coronavirus pandemic, while 30 percent also say some of their clients reduced operations in response to the pandemic. These responses are in contrast to those received from the Corporate Survey respondents who represent much smaller firms and nearly 70 percent of whom say their firms did not change their corporate real estate strategies as a result of the COVID-19 pandemic.

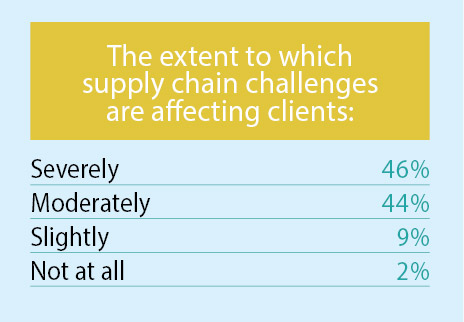

The Corporate Survey and Consultants Survey respondents do agree somewhat on the extent to which supply chain challenges have affected their operations. While three quarters of the corporate respondents say they’ve been severely or moderately affected by these challenges, 90 percent of the respondents to the 18th Annual Corporate Survey say their clients have been similarly affected.

18th Annual Consultants Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

-

Chart 14

-

Chart 15

-

Chart 16

-

Chart 17

-

Chart 18

-

Chart 19

-

Chart 20

-

Chart 21

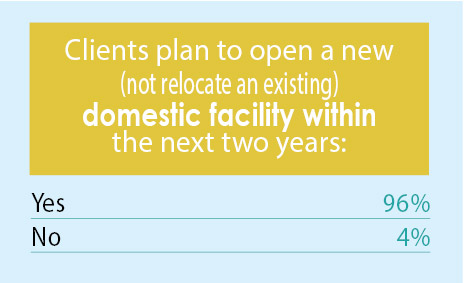

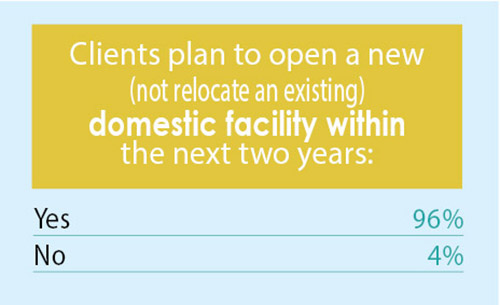

Obviously, consultants work with clients who have plans, as indicated by the fact that 96 percent of the responding consultants say their clients plan to open a new domestic facility within the next two years.

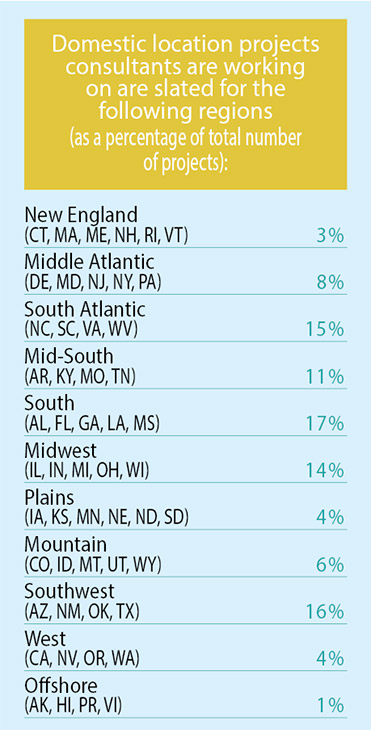

Most of the projects that consultants say they’re working on for their clients will go to southern regions of the U.S. — 17 percent to the South, 16 percent to the Southwest, 15 percent to the South Atlantic, and 11 percent to the Mid-South region. An additional 14 percent of the total projects are slated for the Midwest States. Whereas the Corporate Survey respondents say 11 percent of their new domestic facilities projects will go to the Plains States, only 4 percent of the projects the responding consultants are working on are slated for that region of the country.

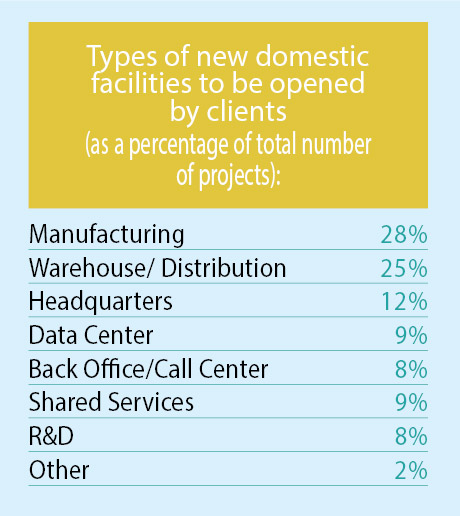

Slightly more than a quarter of the new facility projects being worked on by the respondents to our Consultants Survey will house manufacturing operations, fewer than the 35 percent planned by our Corporate Survey respondents over the next two years. However, similar to the corporate responses, 25 percent of the consultants’ clients’ new facilities will house warehouse/distribution operations.

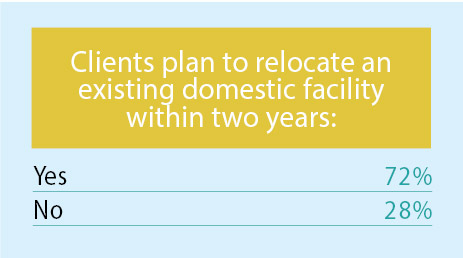

Nearly all of the respondents to our Annual Consultants Survey (95 percent) say their clients plan to expand a domestic facility footprint over the next two years, and more than 70 percent say their clients plan to relocate a facility during that time period. Again, consultants work on active projects, and roughly just a third and a fifth, respectively, of the Corporate Survey respondents have expansion or relocation plans.

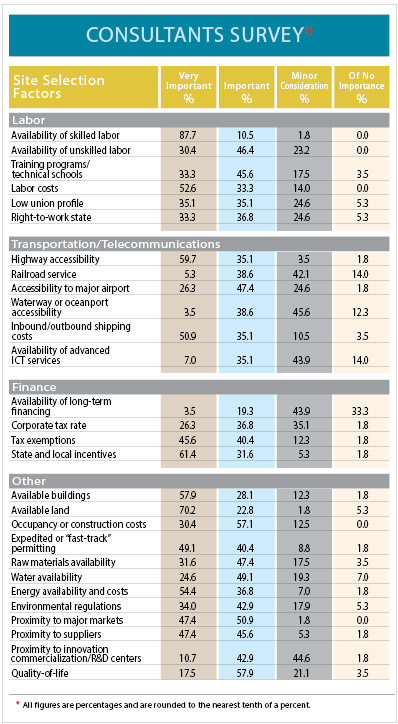

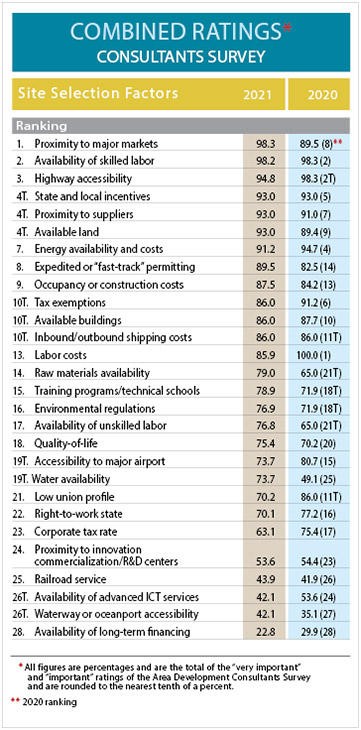

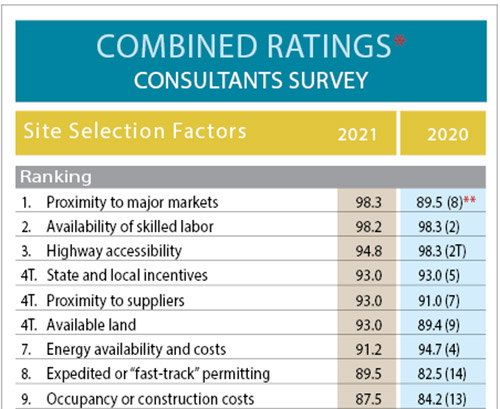

We also asked our Consultants Survey respondents to rate 28 site selection factors as either “very important,” “important,” “minor consideration,” or “of no importance” to their clients. By adding the percentages of the “very important” and “important” ratings, we are again able to rank the factors in order of importance.

The #1 ranked factor in the Consultants Survey is proximity to major markets, with 98.3 percent of the respondents saying this factor is “very important” or “important” to their clients, up 8.8 percentage points and seven positions from the prior year’s rankings. The surge in e-commerce as well as supply chain challenges being experienced by their clients seem to be top of mind in the consultants’ ranking of this factor. Also, the highway accessibility factor — which is vital to last-mile delivery operatons — maintained its high combined importance rating (94.8 percent) and ranked #3 among the site selection factors.

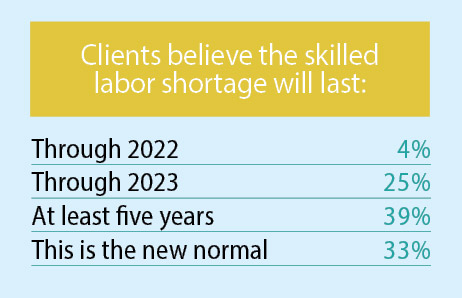

Maintaining its #2 position in the consultants’ rankings is availability of skilled labor, with a 98.2 percent combined importance rating; the Corporate Survey respondents also ranked this factor in second place. Interestingly, even availability of unskilled labor increased in importance, according to the responding consultants, with 76.8 percent considering it “very important” or “important” to their clients (11.8 percentage points higher than last year), while ranking this factor only #17 among the others.

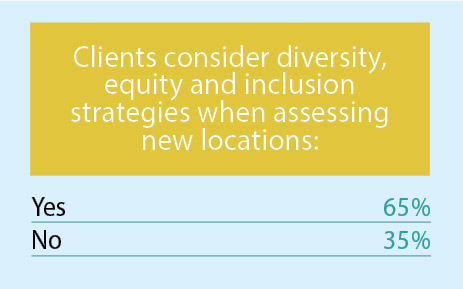

Training programs/technical schools to get these workers up to speed ranked two positions higher at #15, with a combined importance rating of 78.9 percent. It should also be noted that about two thirds of the respondents to our 18th Annual Consultants Survey say their clients consider diversity, equity, and inclusion strategies when assessing new location — up from 57 percent in the prior year’s Consultants Survey and as compared with only a third of this year’s Corporate Survey respondents who consider DEI strategies in their location decision.

Proximity to suppliers also moved up from the #7 spot in the prior year’s survey to #4 (tied) in this year’s rankings by the consultants, with a combined importance rating of 93 percent. A related factor, raw materials availability jumped from the #21 spot in the prior year’s survey to #14 this year, with 79 percent of those responding to our 18th Annual Consultants Survey rating this factor as “very important” or “important,” an increase of 14 percentage points over the prior year’s survey rating. And another related factor — inbound/outbound shipping costs — is considered “very important” or “important” by 86 percent of those responding to our Annual Consultants Survey and is tied with two other factors for a 10th place ranking.

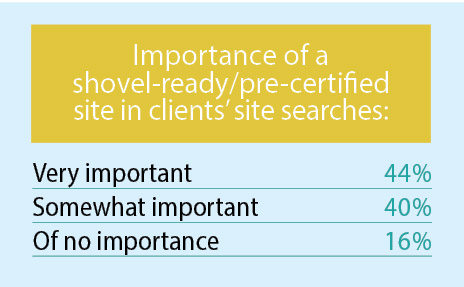

Tied for fourth place in the rankings with a 93 percent combined importance rating is available land. If the responding consultants are working on projects where thousands of people will be employed, it stands to reason that they’re looking at large tracts of land for these mega projects (e.g., projects making headlines of late in the EV sector). In response to a related question, 84 percent of the respondents to our Consultants Survey say the availability of a shovel-ready or pre-certified site is very or somewhat important in their clients’ site searches. Speed to market is always important to industrial projects so expedited or fast-track permitting is ranked #8 by the responding consultants, with an 89.5 percent combined importance rating.

Additionally, the available buildings factor maintained its position in the #10 spot (tied), considered “very important” or “important” by 86 percent of those responding to our Consultants Survey. The e-commerce boom, shifting population densities, and rising transportation costs brought about by the pandemic have all contributed to the strong demand for industrial space. In fact, according CBRE, although industrial development was at a record level in the third quarter of 2021, demand for warehouse space still exceeded supply by 41 million square feet. And as occupancy costs rise in response to low supply, the occupancy and construction costs factor jumps four positions to the #9 spot in the consultants rankings, with an 87.5 combined importance rating.

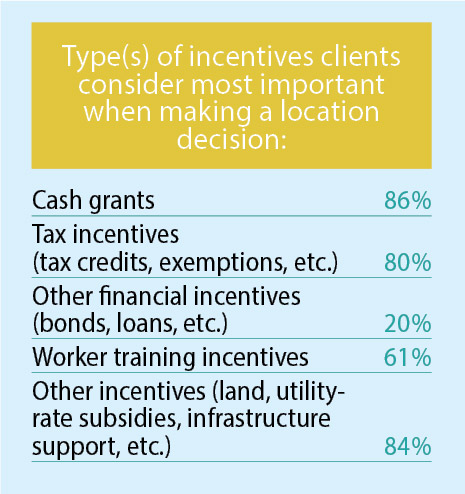

Also tied for the #4 spot in the rankings with a 93 percent combined importance rating is state and local incentives. This high ranking comes as no surprise since 91 percent of the respondents to our Annual Consultants Survey say they provide incentives negotiation and management to their clients. Tax exemptions is tied for the #10 spot with an 86 percent combined importance rating. While 80 percent of the consultants say that tax incentives are among those most important to their clients, 86 percent say cash grants are the most important type of incentive.

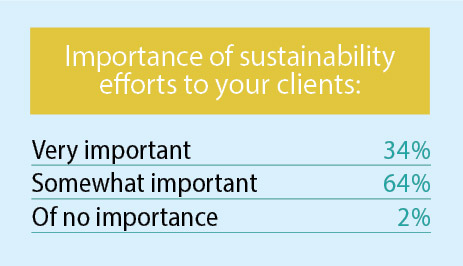

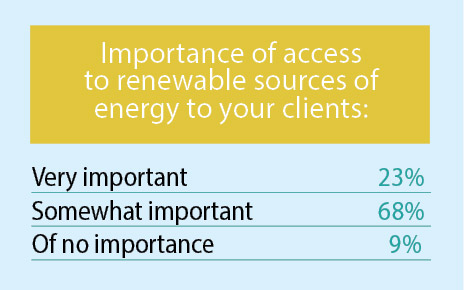

Similar to the Corporate Survey respondents, 91.2 percent of those responding to our 18th Annual Consultants Survey rated energy availability and costs as “very important” or “important,” resulting in a #7 ranking for this factor. In fact, more than 90 percent of the responding consultants say sustainability efforts as well as access to renewable sources of energy are somewhat or very important to their clients.

Several factors saw wide swings in the responding consultants’ importance ratings and rankings over the prior year’s survey and vary considerably from the Corporate Survey responses this year. For example, the labor costs factor actually dropped from the #1 position in the prior year’s consultants’ rankings to #13 this year, rated as “very important” or “important” by 85.9 percent of the respondents to our 18th Annual Consultants Survey. The respondents to our 36th Annual Corporate Survey actually rank labor costs #1 among the site selection factors.

Similarly, the low union profile factor dropped from the #11 spot (tied) in the prior year’s consultants’ rankings to #21 this year, down 15.8 percentage points to a combined importance rating of only 70.2 percent. The only explanation that seems plausible is that the responding consultants realize rising labor costs and increasing unionization drives — in response to an increasing skilled labor shortage and labor’s enhanced bargaining position — while still important now take a backseat to finding available land or buildings in a location that gives a company better access to their markets and suppliers as supply chain challenges persist.

Finally, water availability had the largest jump in the consultants’ combined importance ratings among the site selection factors — 24.6 percentage points. The responding consultants rank this factor #19 (tied) with a combined importance rating of 73.7 percent. The importance of water availability in all phases of the manufacturing process cannot be overstated, directly affecting the location decision, with climate change resulting in some states becoming more parched.

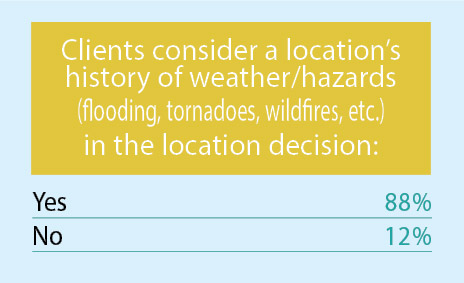

And as the nation experiences more extreme weather — from flooding, tornadoes, and wildfires — 88 percent of the responding consultants say extreme weather is another important consideration in their clients’ site selection decision. On this last point, 70 percent of those responding to our Annual Corporate Survey agree.