Who cares about energy costs? Everyone, of course, but it’s only likely to be a major location consideration for such big energy users as manufacturing facilities and data centers.

Energy availability and costs have held relatively steady in the location factor rankings generated by Area Development’s Corporate Surveys. The ninth-place ranking takes into account the importance of energy in all varieties of projects, but it tends to understate its influence on manufacturing, says Dean Uminski, partner with Crowe Horwath LLP. “Energy is very relevant to manufacturers,” he says. “I’m surprised it is #9. I’ve done big projects where that was probably a top-three choice.”

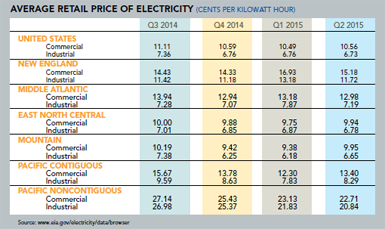

A relatively recent case he cites involves an international company seeking a U.S. location. Six states were in the running for the project, and “three states did not fare well because of their utility rates,” Uminski says.

Special Programs and Green Energy

When wooing projects, states and communities often take aim at these kinds of differences through special energy programs, though Uminski wishes such incentives were volunteered a bit more freely. “There doesn’t seem to be a lot of flexibility with some of the utility customers, and the same kind of creativity you see in other areas. There are things they can do,” he says.

The ability to secure competitively priced energy has been part of the transformative change driving U.S. economic and manufacturing resurgence. It has helped cancel out the factors that had been encouraging the offshoring of manufacturing jobs in the past. This has been a key driver in re-shoring. Mark Sweeney, senior principal with McCallum Sweeney Consulting There are increasing demands from the data center industry to plug into green power. Though there are plenty of examples of green data center power across the country, it’s not easy to obtain enough power from renewable sources to fully drive a data center. It’s not always feasible to locate a data center in places where renewable energy is most readily available.

Google, for example, has made a corporate commitment to using green power, and says it does so for more than a third of its operations now. But the company acknowledges the conflict between that and other location factors. Google literature on the subject notes that “the places with the best renewable power potential are generally not the same places where a data center can most efficiently and reliably serve its users.” Data centers must operate 24/7, Google notes, while renewables don’t often work that way.

The ability to secure competitively priced energy has been part of the “transformative change driving U.S. economic and manufacturing resurgence,” observes Mark Sweeney, senior principal with McCallum Sweeney Consulting. It has helped cancel out the factors that had been encouraging the offshoring of manufacturing jobs in the past, he says. “This has been a key driver in re-shoring. It’s important in the big-picture global economy.”