Front Line: Job Creation Through Reshoring

Companies are considering reshoring operations for better supply chain management and are creating jobs in the process.

Q1 2021

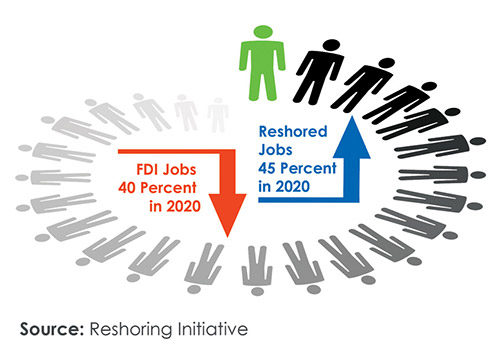

In 2020, reshoring created more U.S. jobs than foreign direct investment (FDI) for the first time in seven years, according to data collected by the Reshoring Initiative. In 2020, U.S. companies reshored nearly 69,000 manufacturing positions, while greenfield investment in the same industries created fewer than 42,000 jobs, according to the Initiative. Reshored jobs were up nearly 45 percent last year, with FDI jobs down 40 percent. The report is based on job announcements and annualized data from the first half of 2020.

Reshoring Initiative founder and President Harry Moser said the Covid-19 pandemic accelerated a trend that had already begun, with the pandemic a motivating factor in 60 percent of cases since March 2020. Medical equipment reshoring cases in the first six months of 2020 were double the full-year 2019 figure. Longer-term, the most active industries in reshoring have been transportation equipment, machinery, electronic products, and appliances.

Moser says China has lost the most reshored U.S. jobs (40 percent of cases) in the past decade. Mexico (23 percent) and Canada (10 percent) followed. Texas and the Midwest have attracted the most reshored jobs since 2010.

In 2020, reshoring created more U.S. jobs than foreign direct investment (FDI) for the first time in seven years. Myriad Reasons for Reshoring

A May/June 2020 Thomas For Industry survey of 750 North American manufacturing firms found 69 percent were “likely” or “extremely likely” to reshore overseas operations.

Why do companies decide to reshore? According to the Reshoring Initiative, increasing wages in hosting countries are one of the reasons most frequently given. Other factors include (non-labor) cost reduction; improved product quality and consistency; protection of intellectual property; shorter supply chains; a more skilled workforce; improved innovation; better responsiveness to customer needs; and total cost of ownership.

One high-profile example of corporate reshoring is Stanley Black & Decker, which moved production of its Craftsman wrenches, ratchets, sockets, and more back to the United States from China. The company built a 425,000-square-foot facility in Fort Worth for that purpose.

Smaller manufacturers are also part of the trend. Hardinge, a Berwyn, Pa.-based maker of CNC turning, milling, and grinding machines, has been doing some of its manufacturing in Taiwan since the early 2000s, according to Global Marketing Director Allan Snider. Late last year, Hardinge decided to bring its manufacturing back to Elmira, N.Y. — where it has manufactured since the 1930s — for several reasons, including better supply chain management.

The COVID-19 pandemic accelerated a reshoring trend that had already begun. Any advice for other manufacturers considering reshoring? “I can’t speak for other companies, but if reshoring allows them to better serve their customers, it is an option they should explore,” Snider told Area Development.

To reshore more jobs, Moser says he would like to see the U.S., Canada, and Mexico collaborate more on trade matters: “The United States trade agreement with Mexico and Canada (USMCA) is a good start; it may bring back 50,000 manufacturing jobs, which is not a lot. We would like to see the U.S., Mexico, and Canada get together and agree to bring back two million manufacturing jobs from Asia.”

The U.S. has a critical need for more qualified, trained workers to increase the country’s capacity to reshore, and needs to continue increasing productivity to be more price-competitive with comparatively low wages overseas, Moser adds.

Project Announcements

Hut 8 Plans West Feliciana, Louisiana, Data Center Operations

12/24/2025

Coley Home Expands Claremont, North Carolina, Manufacturing Operations

12/24/2025

South Korea-Based ALUKO Group Plans Halls, Tennessee, Aluminum Manufacturing Operations

12/24/2025

Hoffman & Hoffman Expands Greensboro, North Carolina, Headquarters Operations

12/24/2025

Fenner Precision Polymers Plans Gaffney, South Carolina, Manufacturing Operations

12/24/2025

Mission Critical Interior Solutions Plans Springfield, South Carolina, Manufacturing Operations

12/24/2025

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Rethinking Local Governments Through Consolidation and Choice

Q3 2025

-

Lead with Facts, Land the Deal

Q3 2025

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

America’s Aerospace Reboot

Q3 2025

-

The Permit Puzzle and the Path to Groundbreaking

Q3 2025