Special Investment Report: Mexico's Labor Costs, Skill Keep Investment Up

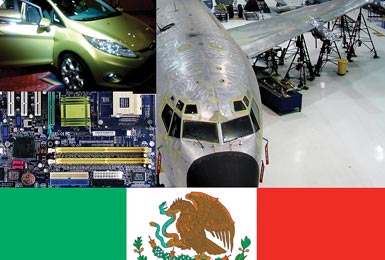

With its low labor costs, skilled manufacturing work force, and proximity to the United States, Mexico is encouraging major companies to plant roots.

November 2010

Despite these favorable appraisals, the World Economic Forum (WEF) says Mexico's economy is not advancing as quickly as emerging countries such as Uruguay, Turkey, and Vietnam, largely due to the deeper toll of the global recession on Mexico and its slow progress on advancing key reforms. Mexico received its best rankings from the WEF for market size and macroeconomic stability. Although its growth is far from torrid, Mexico has made significant progress over the last decade to minimize fiscal deficits, strengthen banks, and bolster foreign reserves.

With an estimated population of 111 million, a $1.14 trillion GDP in 2009, and the benefits of NAFTA, Mexico is well positioned for a solid economic recovery. (That's closely tied to American economic performance, as about 80 percent of Mexico's exports ship to U.S. markets). The industrialized Mexico-U.S. border, where many modern factories (maquiladoras) and light industries are based, will also propel the country forward. Mexico's working-age population is forecast to grow 1.3 percent for the next 10 years. Current unemployment in Mexico is only 6.3 percent, lower than other industrialized countries. And low labor costs remain a business draw.

"Fully fringed labor rates for skilled trades in Mexico are often only 20 to 30 percent of the same salary levels paid in the U.S. and Europe," says Gary G. Swedback, president of NAI Mexico, a network of commercial real estate firms with Mexican assets. "Non-skilled assembly operators can be sourced for $2 to $2.50 per hour with all benefits, as compared with fully loaded rates exceeding $12 to $13 in the U.S."

Major companies are considering expanding in Mexico, including Flextronics, Kimberly-Clark, Honeywell, Hewlett-Packard, Hawker Beechcraft, DHL, and Fisher & Paykel.

"Many companies are creating Mexican production platforms for global export, not just to U.S. markets," Swedback says. "These include truck and auto firms from China, electronics firms from Korea, aerospace firms from France, medical device firms from the U.S., and food processing and logistics firms from North America. Over 100 foreign firms will establish facilities in Mexico during 2010, with investment from Asia and Europe estimated to be $25 billion during the next three years."

Solid Economic Growth

After contracting in the first quarter of 2010, the Mexican economy grew 3.2 percent in the second quarter, driven by a 13.4 percent jump in manufacturing and a 7.4 percent surge in the services sector - the largest increases in over a decade. The Mexican economy, however, will continue to rise and fall according to U.S. economic trends. Overall, most analysts expect Mexico's GDP to grow between 4 percent and 5 percent in 2010, compared to last year's 6.5 percent contraction.

"Mexico has returned to growth at rates close to 1 percent quarterly, supported by the cyclical boost from U.S. demand," says Adolfo Albo, chief economist for BBVA Research in Colonia Xoco, Mexico. "The expansion of exports has been maintained and, in general, among manufacturing activities is linked mostly to the production of durable consumer goods. This boost, which will lead to growth close to 4.5 percent in 2010, has been supported, or at least not hindered by, the cost of the use of capital and financing from the public and private sectors."

Project Announcements

La Colombe Coffee Roasters Expands Norton Shores, Michigan, Operations

02/23/2026

GRVTY Plans Tysons, Virginia, Headquarters Operations

02/23/2026

Hudson Industries Expands Appleton City, Missouri, Operations

02/23/2026

Israel-Based Katz 1899 Plans Dayton, Ohio, Manufacturing Operations

02/23/2026

Chick-fil-A Supply Plans Winter Haven, Florida, Logistics-Distribution Operations

02/17/2026

Annandale Millwork and Allied Systems Plans Newport News, Virginia, Operations

02/17/2026

Most Read

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025

-

Strategic Industries at the Crossroads: Defense, Aerospace, and Maritime Enter 2026

Q1 2026

-

The Skilled Trades Are Ready for a Digital Future

Q4 2025