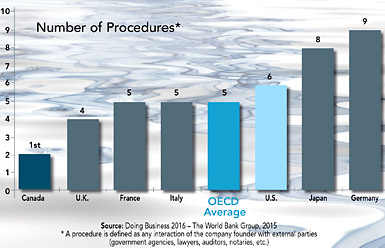

The ease of which a corporation can establish itself in Canada in comparison to the other G-7 members is astonishing. According to the World Bank Group, it requires 1.5 days to establish a business in Canada, while the OECD average entails 8.2 days. This is primarily due to the low level of Canadian procedural requirements — two in Canada versus five as an OECD average.

In addition to the low regulatory processes, Canada possesses the lowest business costs. According to KPMG’s annual “Competitive Alternatives” study, Canada, once again, ranks first with the highest percentage cost advantage relative to its neighbor to the south — the United States. In fact, Canada dominated in the digital, research and development, manufacturing, and corporate services industries. When breaking down the manufacturing industry, Canada encompasses the lowest cost in all the sub-categories in manufacturing: aerospace, agri-food, automotive, chemicals, electronics, green energy, medical devices, metal components, pharmaceuticals, plastics, precision manufacturing, and telecommunications.

Canadian Tax Environment

As in the past, Canada encompasses the lowest total corporate tax rate in the G-7, at 21.1 percent, with the UK and the U.S. following at 32 percent and 43.9 percent, respectively, according to PricewaterhouseCoopers’ “Paying Taxes 2016” report.

SR&ED: One of the primary tax credits is the Scientific Research and Experimental Development (SR&ED) credit. This credit has dual benefits as it allows corporations to deduct the eligible expenditures from income for tax purposes; additionally, it provides an investment tax credit, ITC, which enables a corporation to reduce their income tax payable. If the claimant is a CCPC, Canadian-controlled private corporation, it can obtain 35 percent of the SR&ED expenditures as a 100 percent qualified refundable ITC, up to a maximum of $3 million. If the expenditures are not SR&ED qualified, the rate drops to 15 percent. All other corporations, non-CCPC, can obtain a non-refundable ITC at a rate of 15 percent, which can be utilized to minimize the tax payable.

Regulation 102 New Certification Tax Waiver: Many multinational corporations desire to send employees for work into Canada. However, due to the additional income tax consequences, not all employers are willing to do this. Employment income earned by non-residents in Canada is taxable at the same rate and regulation as that earned by residents employed in Canada.

According to the World Bank Group, it requires 1.5 days to establish a business in Canada, while the OECD average entails 8.2 days. Regulation 102 allows for the exemption of such taxes to be paid by non-residents on the condition of a tax treaty being present between Canada and the non-resident’s country of residence. In the past, the employer had to submit an application for each non-resident employee. However, as of January 2016, the Canada Revenue Agency has created a new certification tax waiver permitting the employer to submit one application for all of its non-resident employees, thus easing the process for foreign companies to send their skilled labor to Canada to work and train at their Canadian subsidiaries.

The limitations to the tax waiver are as follows: U.S. residents who expect to earn no more than $10,000 or residents of a country with a tax treaty with Canada who expect to earn no more than $5,000. Additionally, the employee can only be employed up to 45 days in Canada and can only remain in the country up to 90 days in order to qualify for Regulation 102.

Quebec’s Large Investment Tax Holiday: As the name states, the tax holiday can be granted for large investments projects within the province of Quebec. Such projects consist of $100 million in investment within the industries of manufacturing, wholesale trade, warehousing and storage, and data processing and hosting. The tax holiday lasts throughout 15 years and may not exceed 15 percent of the total eligible investment expenditures. The benefit created by the program permits companies to be exempt on future income taxes generated due to the profits from the investment project.

Additionally, the holiday permits companies to be tax exempt from contributions to the HSF, Health Service Fund, for the portion of employee salaries allocated toward the investment project.

The Canadian federal and provincial governments have always been strongly supportive in the growth of the business community. Whether to expand a local business or attract foreign corporations to establish themselves in Canada, the governments have often provided financial assistance in the form of grants, loans, and tax benefits in order to grow the economy. The largest provinces in Canada by population are Ontario, Quebec, and British Columbia. Naturally, these provinces also attract the greatest proportion of FDI, and they also offer attractive incentives for business growth.

Ontario: In 2015, Ontario launched the Jobs and Prosperity Fund (JPF). The duration of the fund is 10 years and its resource value is $2.7 billion. The JPF encompasses three streams of business: new economy, food and beverage growth, and strategic partnerships.

Canada encompasses the lowest total corporate tax rate in the G-7, at 21.1 percent, with the UK and the U.S. following at 32 percent and 43.9 percent, respectively. PricewaterhouseCoopers’ “Paying Taxes 2016” report The new economy stream concentrates on investment projects valued at a minimum of $10 million in eligible costs within the key sectors of advanced manufacturing, life sciences, forestry, and technologies. The food and beverage growth stream is tailored to companies in food, beverage, and bioproduct production with projects totaling a minimum of $5 million in eligible costs. The third stream, strategic partnerships, concentrates on partnerships within the key sectors listed in the new economy stream with projects totaling a minimum of $10 million. The JPF emphasizes projects that entail the following three criteria: incremental productivity, incremental exports, and innovation.

Furthermore, the 2016 Ontario budget included the Business Growth Initiative, which will commit $400 million over the next five years. The initiative focuses on growing small and medium-sized businesses, while helping them to compete in international markets. It will also be highly driven by innovation and modernizing the regulatory system in order to ease the barriers to growth.

Quebec: In 2015, the Quebec government stated its plan to invest $1.5 billion in the Maritime Strategy Program and $1.3 billion in the Plan Nord Strategy Program. In January 2016, Investissement Quebec, the provincial investment organization, updated the ESSOR program. This program is jointly controlled by Investissement Quebec and the Ministry of Economics, Science and Innovation. The program focuses on capital asset projects with expenditures over $250,000 and can provide an interest-free loan up to 50 percent of the eligible project costs.

The 2016–2019 Quebec Strategic Plan also outlined new, attractive investment incentives. The province plans on providing financing options to companies valued at $967 million, $1.021 billion, and $1.068 billion in years one, two, and three, respectively.

Federal Support

The year 2016 began with a new federal government. As with all new governments, budgets are created and programs are later initiated to carry out the budgetary promises. To date, the budget has a strong stance on innovation and environmental benefits for the economy.

The federal government is investing $2 billion over two years in the Low Carbon Economy Fund to support the reduction of greenhouse gas emissions. It also plans on investing $800 million over four years in support of innovation. No new specific program has been publicized to date; however, it will be interesting to see what programs become available in order to grow Canada’s already favorable FDI position.